Bitcoin Long-Term Holder Selloffs Fail To Be Reabsorbed As Demand Weakens

Bitcoin’s worth has struggled to take care of stability above $102,000 in latest days, and knowledge reveals this is because of an obvious imbalance between promoting stress and contemporary demand.

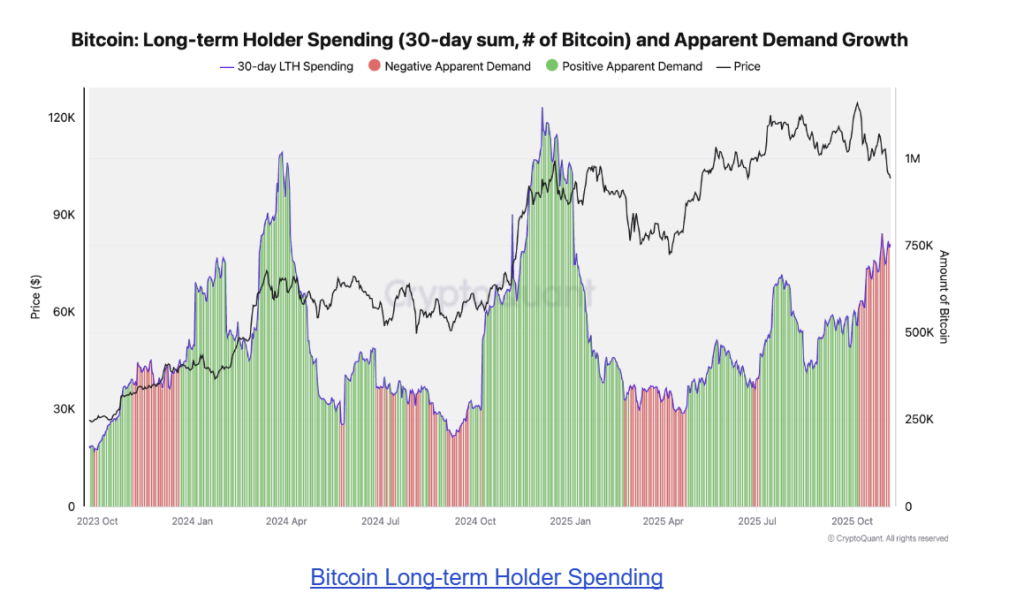

On-chain knowledge from CryptoQuant reveals that whereas long-term holders have been actively taking earnings, the market is exhibiting restricted capability to soak up their sell-offs. It is a distinction to earlier phases of the bull run, the place rising demand was in a position to offset elevated long-term holder exercise.

Associated Studying

Rising Lengthy-Time period Holder Promoting Strain Mirrors Previous Bull Cycles

Information from on-chain analytics platform CryptoQuant, which was initially shared by Julio Moreno, head of analysis at CryptoQuant, reveals an attention-grabbing change in dynamics amongst Bitcoin holder exercise that might form the cryptocurrency’s subsequent transfer.

Julio Moreno defined that long-term holder (LTH) promoting is a standard sample in bull markets as buyers take earnings when Bitcoin approaches or surpasses all-time highs. The CryptoQuant knowledge reveals that the 30-day sum of LTH spending, represented by the purple line within the chart picture under, has been growing since early October.

This habits follows earlier bullish rally phases, reminiscent of these seen in early and late 2024, when profit-taking coincided with increasing demand, and so Bitcoin pushed to new document costs.

The chart accompanying Moreno’s submit reveals inexperienced areas representing intervals of constructive obvious demand progress and pink areas indicating contraction. Throughout January to March 2024 and November to December 2024, LTH selloffs occurred as demand expanded.

Bitcoin Long-term Holder Spending

Since October 2025, nevertheless, that development has reversed. Whilst LTH promoting elevated, demand has entered a pink zone, exhibiting that the market’s skill to soak up this promoting stress has weakened. This has coincided with Bitcoin’s wrestle to maintain its place above $102,000, suggesting that worth progress could be dropping momentum.

Sustained Weak Demand May Delay Subsequent Rally

Moreno famous that the essential issue to look at isn’t simply the amount of long-term holder sell-offs however whether or not demand progress can preserve tempo.

When demand is powerful, the inflow of provide from long-term holders typically drives wholesome consolidation earlier than one other worth surge. In distinction, when demand falls behind, the end result tends to be extended corrections or sideways motion.

A big portion of that demand now comes from Spot Bitcoin ETFs, which have seen a pointy slowdown in inflows. Information from SosoValue reveals that US-based Spot Bitcoin ETFs ended final week with internet outflows of $558.44 million on Friday, November 7, one of many largest single-day outflows in weeks.

Associated Studying

Until Bitcoin’s obvious demand begins to recuperate within the coming weeks and LTH sell-offs proceed, then this would possibly proceed to weigh on worth motion and postpone the subsequent leg of Bitcoin’s rally. On this case, we would proceed to see Bitcoin consolidating between $101,000 and $103,000 for the remainder of November.

On the time of writing, Bitcoin is buying and selling at $101,655, down by 0.6% up to now 24 hours.

Featured picture from Unsplash, chart from TradingView