Bitcoin: Long-term holders in no mood to sell

- Most holders, on common, had been in a state of revenue however had been strongly resisting the urge to promote.

- Lengthy-term holder provide elevated from 75% to 78.62% because the low volatility part kicked in.

The extraordinary stress exerted by U.S. regulators on main crypto entities has fueled substantial FUD amongst market members. Coupled with Could’s prolonged interval of low volatility, there was little to cheer for these gamers currently.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

However regardless of the chances, long-term holders (LTH) proceed to indicate religion available in the market’s potential, particularly in king coin Bitcoin [BTC].

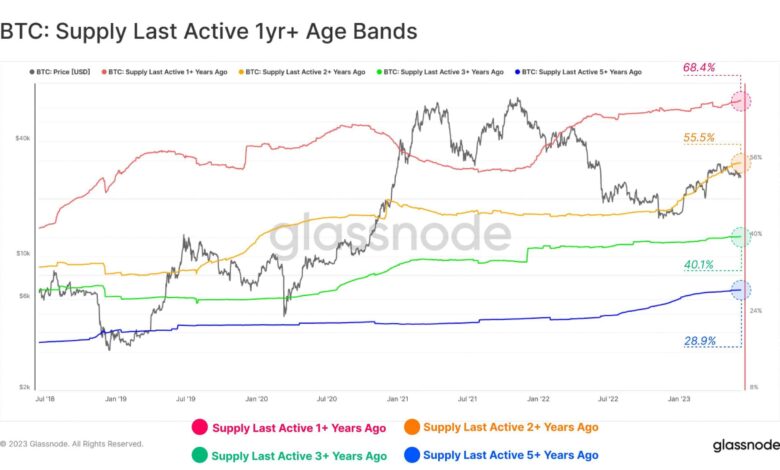

Based on on-chain analytics agency Glassnode, the proportion of provide held for longer than a 12 months climbed to an all-time excessive (ATH) of 68%, revealing buyers’ lack of willingness to promote.

Supply: Glassnode

Resilience on show

Lengthy-term holders are the members who maintain possession of cash for greater than 155 days. Popularly known as “diamond palms”, this cohort is assumed to have a high-risk tolerance and won’t promote regardless of protracted losses.

As indicated within the above graph, BTC’s dormant provide throughout most age bands has elevated considerably because the begin of 2023. Nonetheless, essentially the most placing development was the rising provide within the 2+ years band.

This cohort of buyers introduced the cash doing the Nice Miner Migration of 2021 when mining actions moved out of China after the federal government’s crackdown and BTC crashed. As costs are but to get better, these gamers are holding the cash, anticipating a bullish surge.

Nonetheless, Bitcoin’s Internet Unrealized Revenue/Loss indicator on the time of publication gave a studying of 0.23. This indicated that essentially the most holders, on common, had been in a state of revenue however had been strongly resisting the urge to promote.

Supply: Glassnode

Lengthy-term provide vs short-term provide

One other fascinating development concerning Bitcoin HODLing is the comparability between long-term holders and short-term holders, the members who maintain possession of cash for lower than 155 days.

Because the low-volatility part kicked in, LTH provide elevated from 75% to 78.62% on the time of writing. The STH, or “weak palms,” then again, have offered important quantities of BTC from their portfolios.

Supply: Glassnode

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

On the time of publication, BTC exchanged palms at $26,065.66, as per CoinMarketCap. The market forces had been wanting in direction of the U.S. Federal Reserve’s assembly on 14 June as a set off for vertical worth motion.

The market temper was balanced between greed and anxiousness on the time of writing.

Bitcoin Concern and Greed Index is 45 ~ Impartial

Present worth: $25,899 pic.twitter.com/zuYJ4pjcEy— Bitcoin Concern and Greed Index (@BitcoinFear) June 13, 2023