Bitcoin long-term holders refuse to sell – What it means for BTC

- BTC is 14.4% down over the previous month.

- Bitcoin’s long-term holders refuse to promote, however short-term holders really feel totally different as losses rise.

Since hitting $109k, Bitcoin [BTC] has struggled to keep up an upward momentum. Over this era, volatility has surged, as BTC costs proceed to fluctuate.

Regardless of this heightened fluctuation, Bitcoin’s long-term holders refuse to shut their positions, as per CryptoQuant.

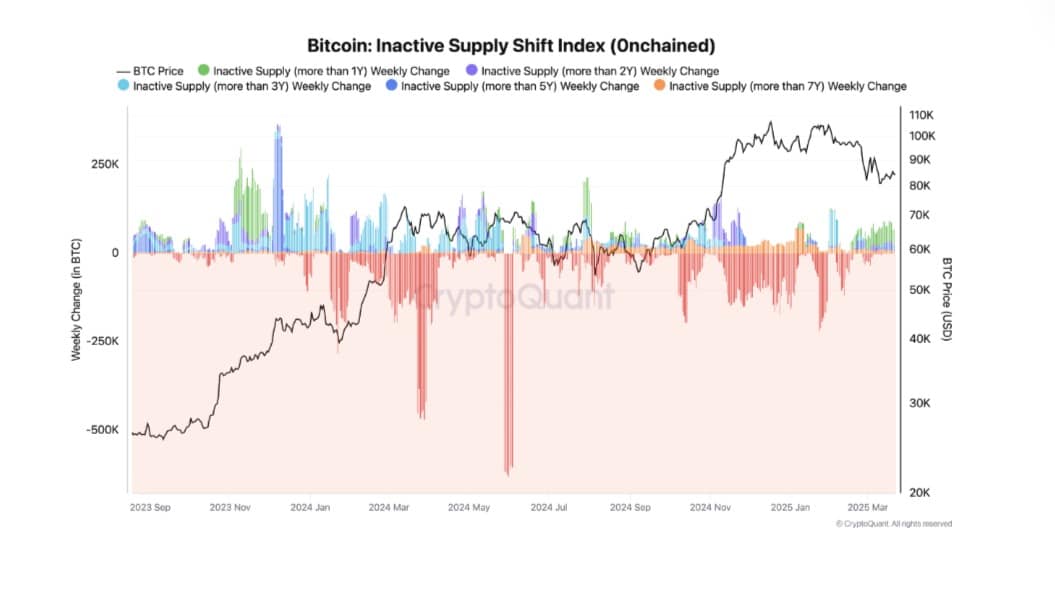

Supply: CryptoQuant

Bitcoin’s long-term holders stay steadfast and their cash should not shifting. Trying on the Inactive Provide Shift Index (ISSI), it means that there’s no vital promoting strain from long-term holders.

Thus, there’s a structural demand outpacing provide. Good cash isn’t exiting, however strategically positioning for the subsequent Bitcoin’s trajectory.

Traditionally, when LTHs maintain their commerce, it displays sturdy conviction which regularly precedes main value expansions. Conversely, once they start to distribute, it sometimes aligns with market tops.

Subsequently, if the LTHs should not promoting, it suggests market confidence amongst this cohort. Nonetheless, though LTHs are optimistic, short-term holders should not.

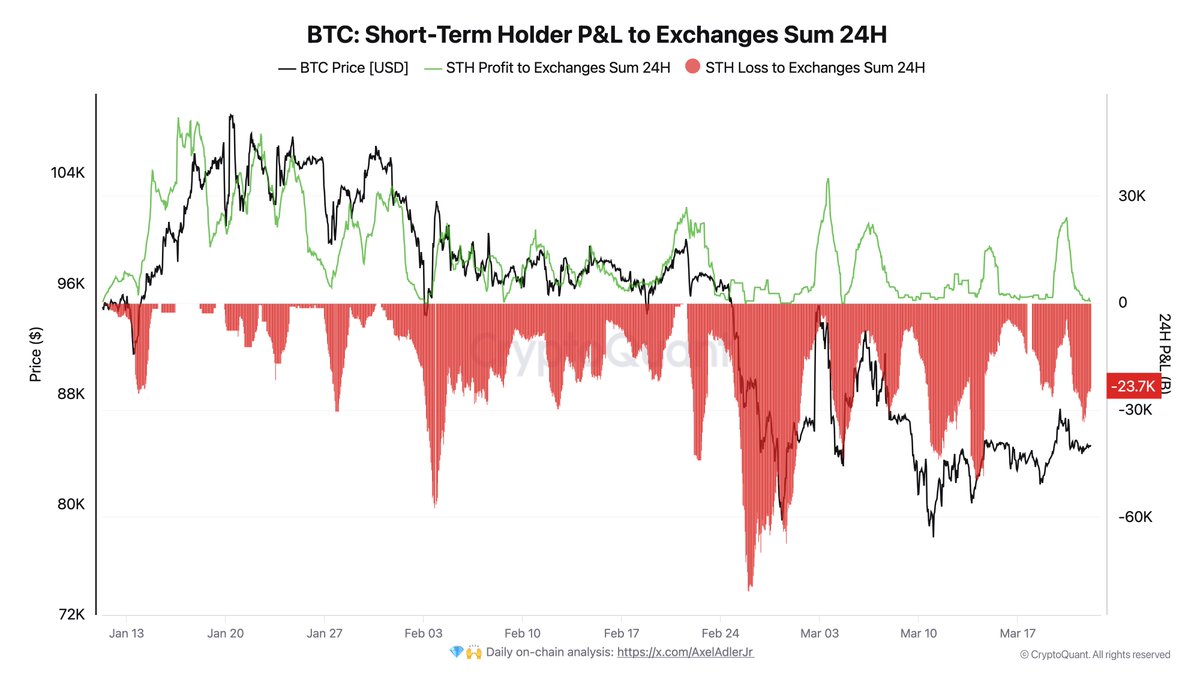

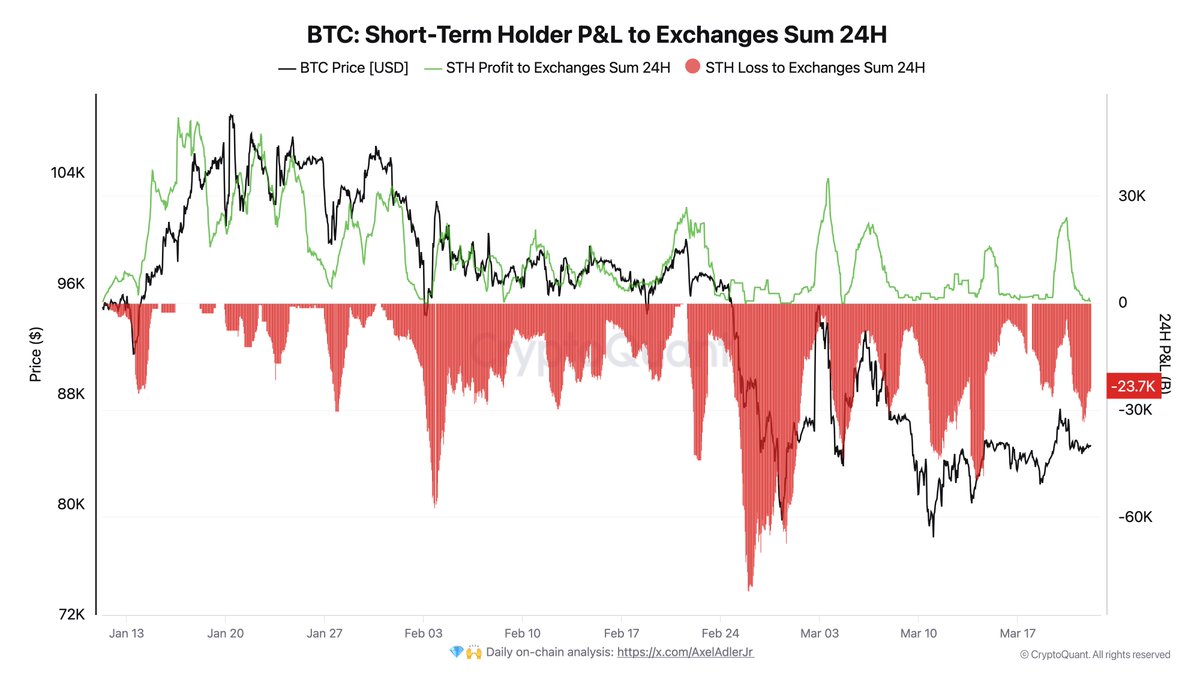

As such, the STH realized value is ready round $92K, placing this cohort at a loss for the reason that sixth of March.

Supply: CryptoQuant

Durations of uncertainty are normally tough for weaker palms, typically forcing them to capitulate. This implies that there’s totally different market conduct from LTHs and STHs.

What BTC charts recommend

Primarily based on the evaluation supplied by CryptoQuant, there’s no vital promoting strain from long-term holders.

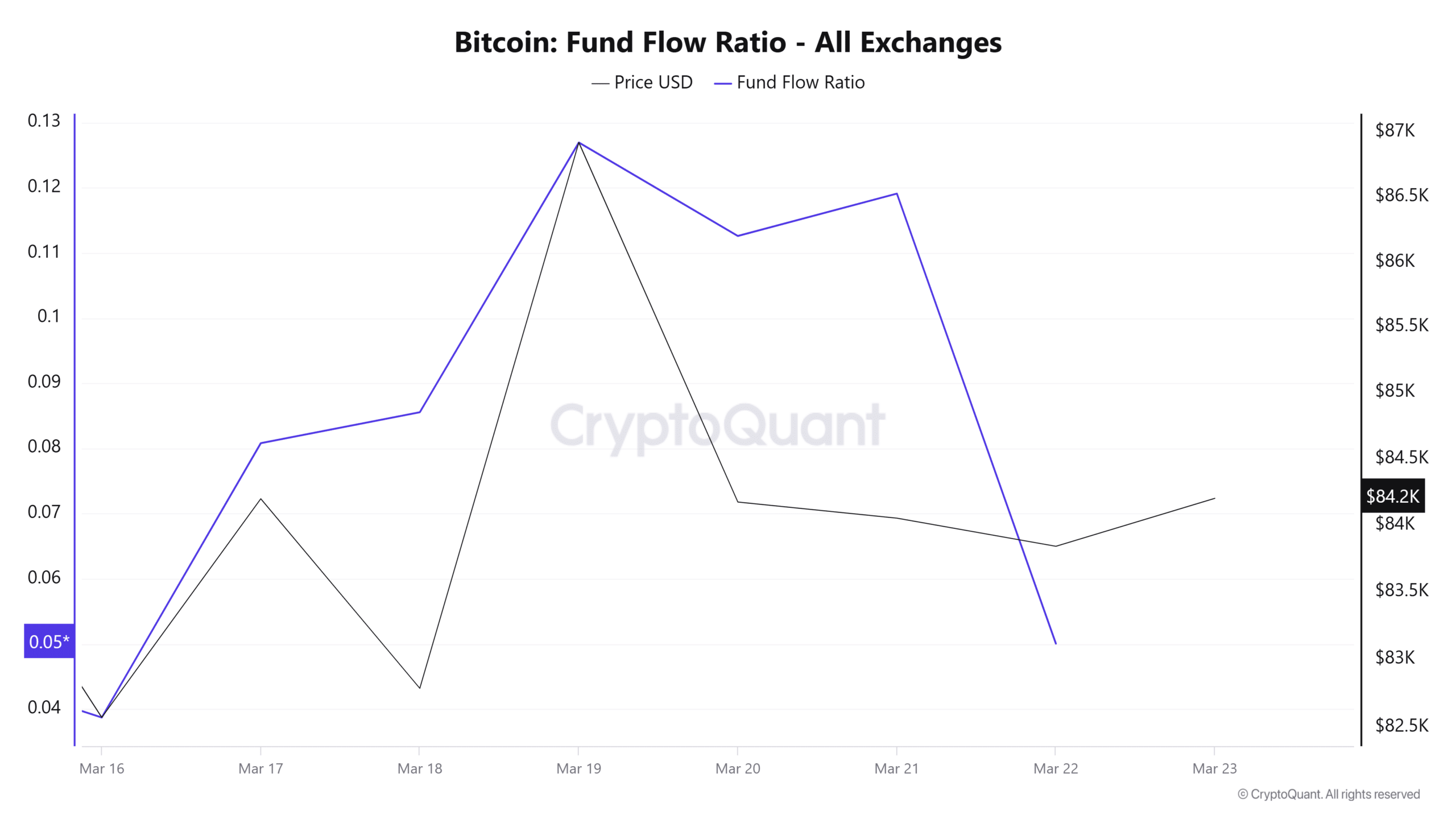

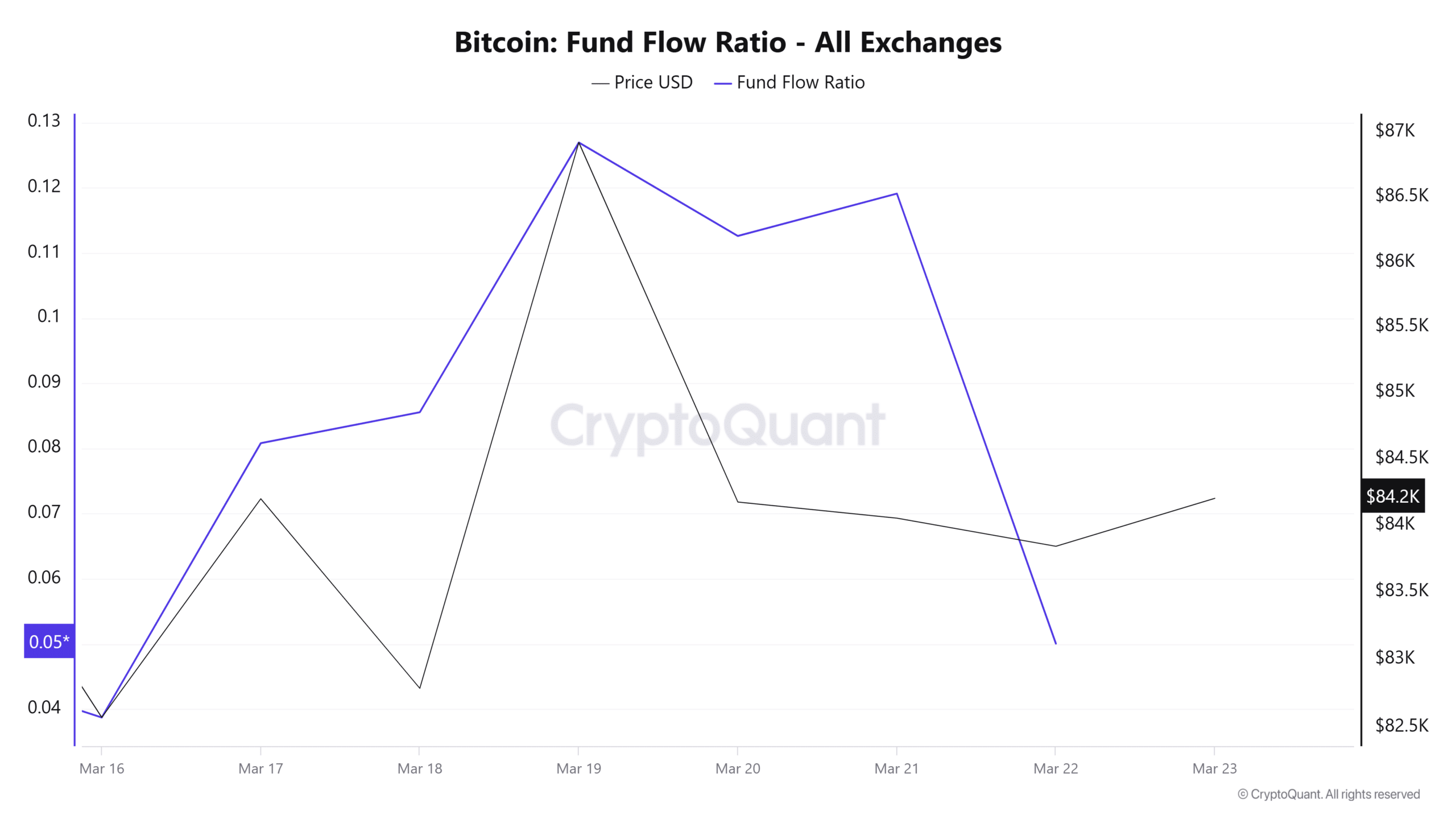

In response to AMBCrypto’s evaluation, actions on the promote aspect have drastically declined. We are able to see this shift as Bitcoin’s Fund Stream Ratio has declined from 0.12 to 0.05.

This drop means that fewer funds are flowing into exchanges, thus there may be much less speedy promote strain from holders. As such, LTHs is likely to be accumulating or holding, which reduces the probability of a big sell-off.

Supply: CryptoQuant

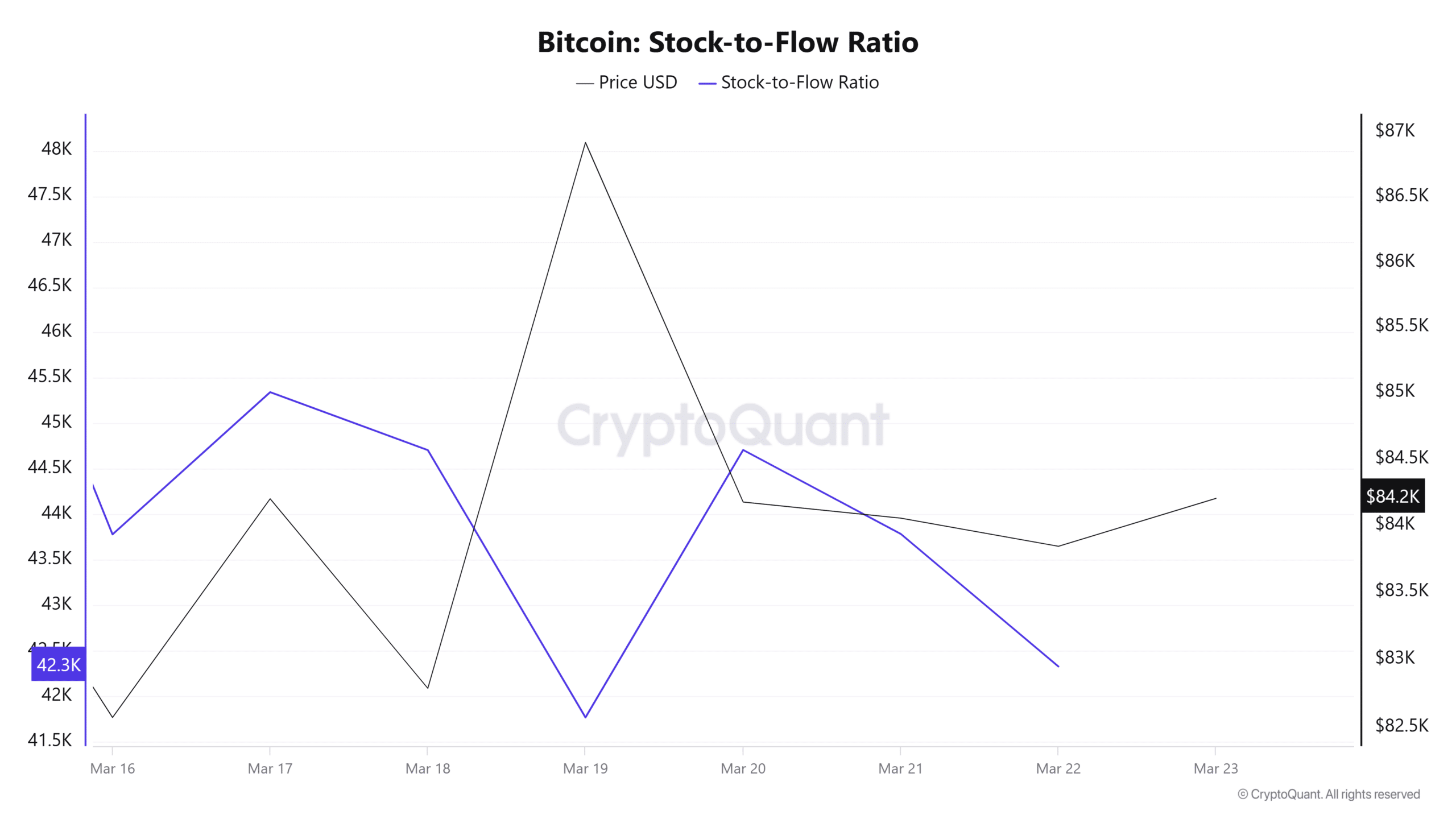

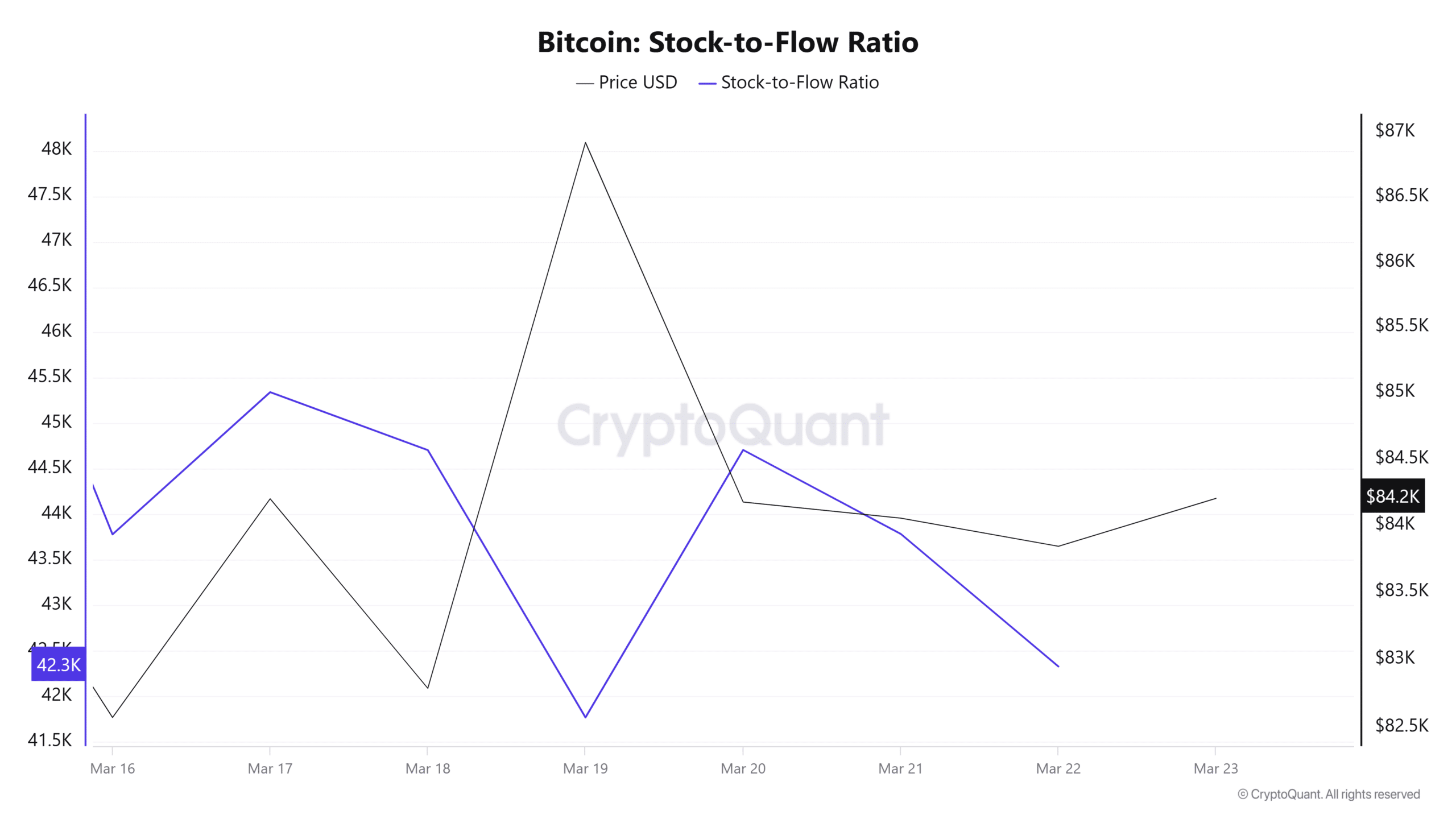

This decreased promoting strain is additional evidenced by the declining stock-to-flow ratio. Bitcoin’s SFR has dropped from 43k to 42k over the previous week.

When provide declines whereas demand stays fixed or rises, costs are prone to rise.

Supply: CryptoQuant

Subsequently, the present market situations present that though there’s promoting exercise, the demand aspect is steadily absorbing it.

With LTHs refusing to promote whereas STH is capitulating, it suggests a continued consolidation.

If sellers and consumers proceed to battle, we may see Bitcoin proceed to commerce between $82k and $87k. Nonetheless, a breakout above this vary may push the king crypto in the direction of $92k, which is STH’s realized value.