Bitcoin losses mount, traders hit hard! – Is the worst yet to come?

- Bitcoin short-term holders confronted steep losses, surpassing FTX ranges, however with out triggering full panic.

- Quick-term BTC traders had been experiencing extended losses, with market uncertainty fueling warning as a substitute of capitulation.

Since early February, Bitcoin [BTC] merchants have been quietly nursing losses, with the present figures now surpassing even the chaos seen through the FTX crash and the 2024 market correction.

The ache is hitting short-term traders the toughest, notably these holding BTC for simply 1 to three months.

As market uncertainty continues to linger, this development of rising short-term investor losses might point out a deeper shift in sentiment, leaving many questioning if the worst is but to come back or if we’re merely caught ready for a breakout.

Ache, however not capitulation

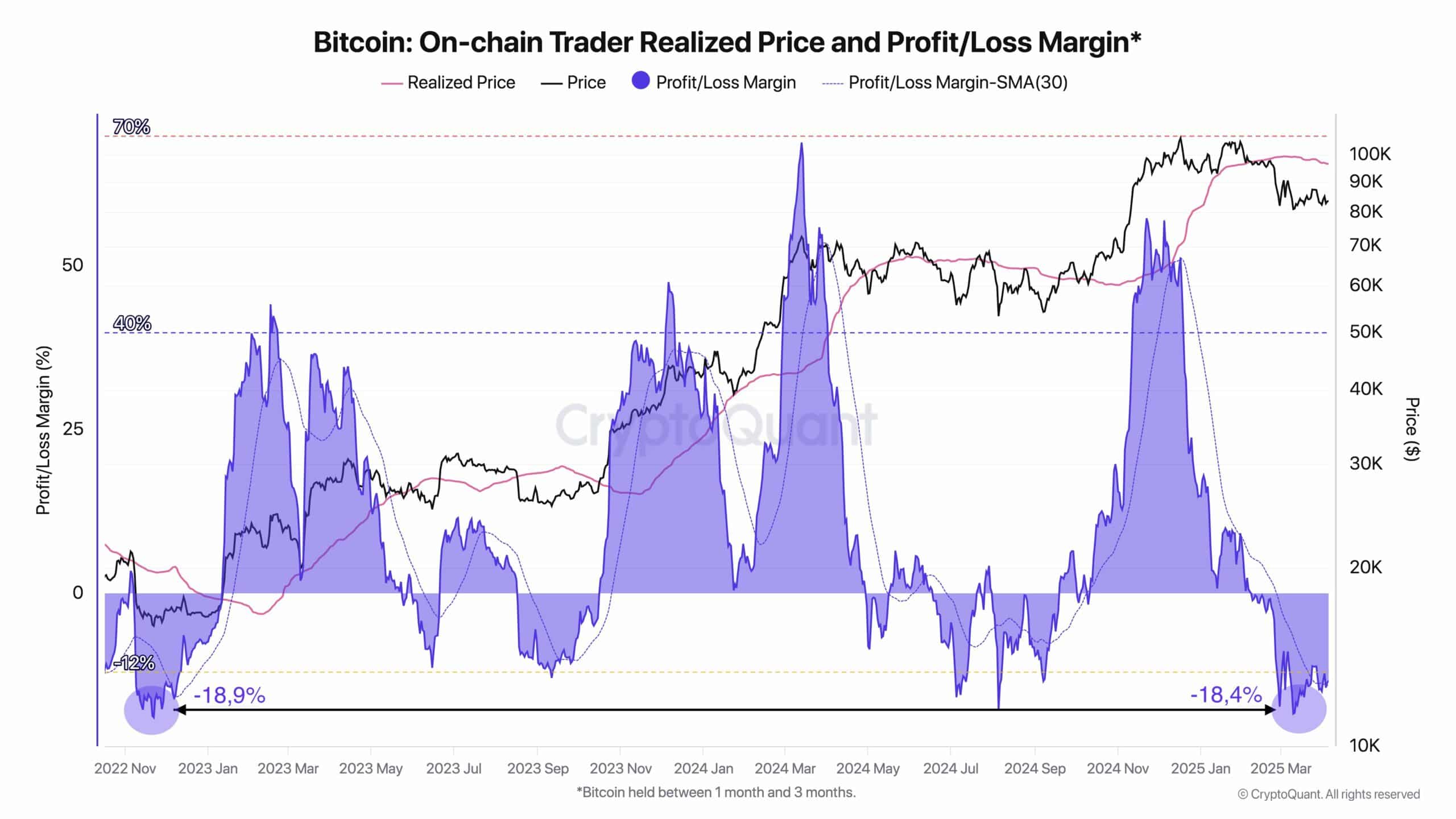

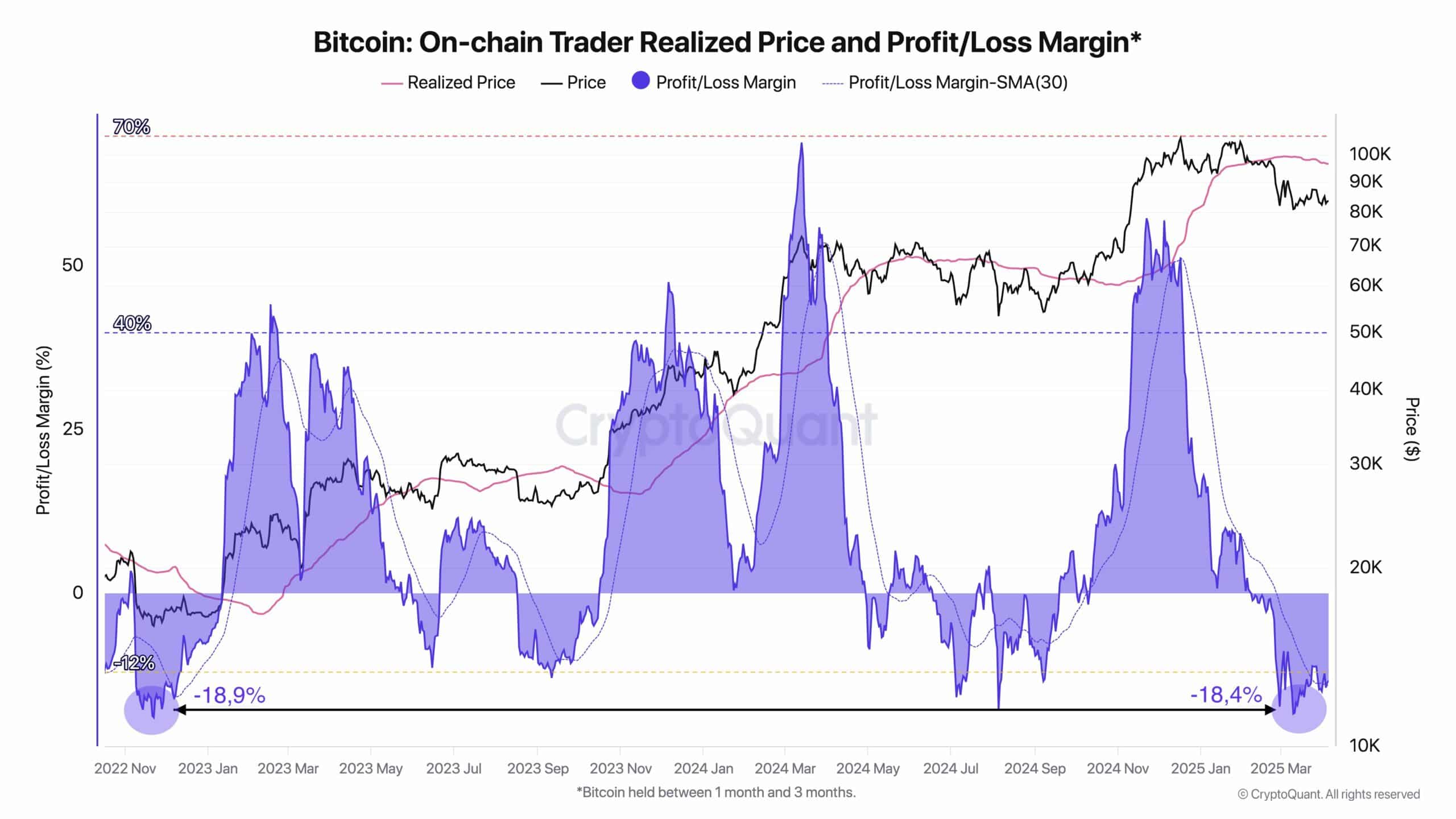

Supply: CryptoQuant

Bitcoin’s short-term holders are deep within the crimson, with them now sitting on realized losses worse than something seen because the FTX implosion.

The chart reveals the profit/loss margin plunging to -18.4%, eerily near the -18.9% ranges of late 2022.

But curiously, this isn’t triggering full-blown panic. Whereas the market’s bleeding, there’s little signal of a mass exodus – simply merchants biting their lips and ready it out.

The temper? Much less “get out now,” extra “this higher be value it.”

Bitcoin: Why this time feels worse for short-term holders

In contrast to long-term hodlers who’ve weathered bear cycles earlier than, STHs are likely to enter close to native tops — proper when hype is peaking.

As BTC flirted with highs round $84K in early March, many of those merchants piled in, solely to be caught in a sluggish bleed moderately than a dramatic crash.

It’s the worst sort of loss: dragged out, confidence-chipping, and murky in course. The information reveals this group is now shouldering the brunt of realized losses – a transparent reminder that FOMO patrons nonetheless be taught the laborious means.

Echoes of FTX

The present drawdown mirrors the FTX crash in magnitude, however not in temper. Again then, the losses had been pushed by panic, contagion, and vanishing liquidity.

Right now, markets are hesitant, liquidity is first rate, and BTC continues to be holding above $80K.

Supply: TradingView

The ache, nevertheless, is actual. Market watchers are observing previous patterns intently, and with loss ranges now breaching 2024’s correction, comparisons to November 2022 have gotten tougher to disregard.

If historical past rhymes, then short-term capitulation might nonetheless be lurking simply across the nook.