Bitcoin: Miner fees decline as bears take this next step

- BTC correction affected miners financially as charges collected fell.

- Establishments strategically accrued BTC amid market complexities.

Bitcoin [BTC] witnessed a large correction in the previous few days. The worth of BTC fell previous the $42,000 assist stage, inflicting FUD amidst the general market.

Miners see purple

The current correction within the BTC despatched shockwaves not solely via the neighborhood of holders, but in addition considerably impacted Bitcoin miners.

Over the previous 24 hours, BTC miners have discovered themselves grappling with monetary pressure as transaction charges hit their lowest ranges since June 2022.

This introduces a brand new layer of complexity, as miners face the problem of sustaining profitability amidst diminishing compensation.

Bitcoin miners feeling the ache from decrease costs and costs.

Proper now they’re extraordinarily underpaid (lowest since June 2022). pic.twitter.com/VxE170jCNP

— Julio Moreno (@jjcmoreno) January 22, 2024

The monetary strain on miners has broader implications for the BTC panorama.

The lowered rewards for miners can create promoting strain, because the miners are compelled to navigate between sustaining profitability and managing their holdings.

This miner-driven promoting might probably contribute to downward strain on Bitcoin’s worth, including extra momentum to the continuing market correction.

Institutional curiosity stays excessive

In distinction to the miner challenges, institutional gamers have been strategically accumulating BTC.

Excluding Grayscale, Bitcoin ETF issuers amassed a substantial 86,320 BTC at a mean worth of $42,000, reflecting a considerable funding totaling $3.63 billion.

This strategic accumulation by establishments underscores a long-term perspective, suggesting sustained confidence in Bitcoin’s future worth.

Nonetheless, it additionally introduces extra centralization of BTC, with potential short-term impacts on the BTC market.

Excluding @Grayscale, all #Bitcoin ETF issuers have collectively acquired over 86,320 $BTC at a mean worth of $42,000 – totaling a large $3.63 billion funding.

Do you suppose these seasoned establishments actually purchased on the prime? This stage of institutional funding… pic.twitter.com/kwB2BIPZ8e

— Ali (@ali_charts) January 22, 2024

As of press time, Bitcoin was buying and selling at $41,084.39, reflecting a 1.27% decline up to now 24 hours.

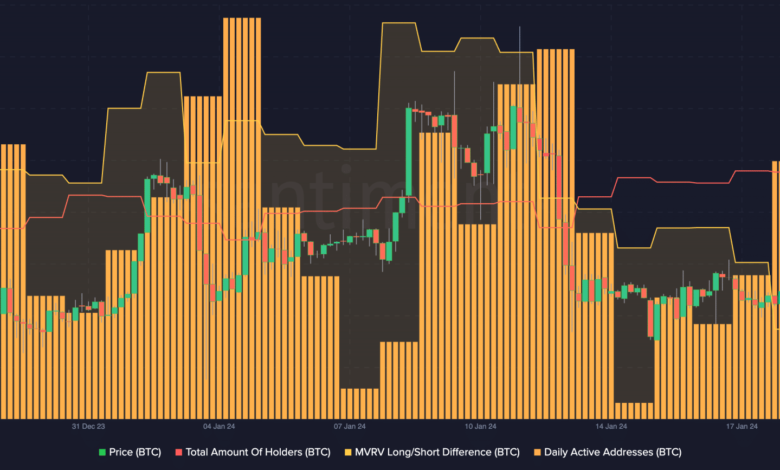

There was a discount within the complete variety of addresses holding BTC, hinting at a possible contraction in total market participation.

Moreover, the decline within the lengthy/brief distinction indicated that new addresses outnumbered outdated ones, suggesting a possible shift in market sentiment.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Amidst these developments, a silver lining emerged with a surge in each day lively addresses on the Bitcoin community.

This uptick in community exercise served as a counterbalancing drive, injecting a level of stability and probably mitigating the influence of different adverse components.

Supply: Santiment