Bitcoin miners get rid of BTC worth over $430M – Why?

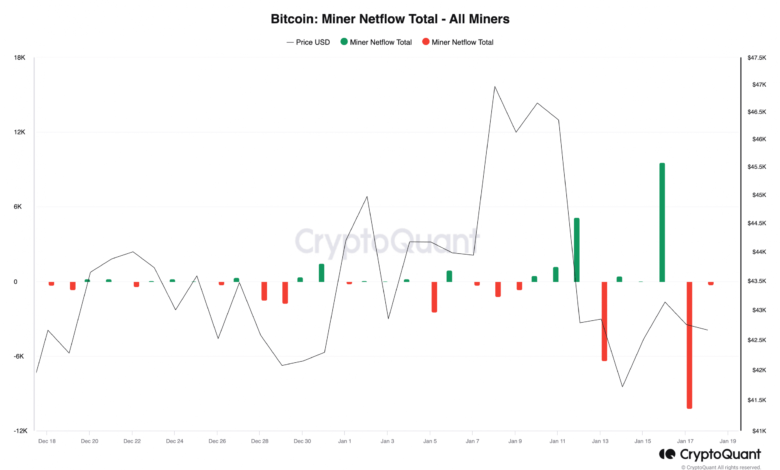

- Bitcoin miner netflow fell to its lowest stage because the yr started on seventeenth January.

- This marked a major decline in BTC miner reserve.

Bitcoin [BTC] Miner Netflow plunged to its lowest stage of the yr on seventeenth January, indicating a major drop in miner reserves, knowledge from CryptoQuant confirmed.

In keeping with the on-chain knowledge supplier, on that day, over 10 thousand BTC value round $436 million on the coin’s press time value had been despatched to exchanges for onward gross sales.

Supply: CryptoQuant

When BTC’s Miner Netflow declines on this method, it leads to a corresponding lower in miner reserves which measures the quantity of cash held in affiliated miners’ wallets throughout the interval below evaluation.

On seventeenth January, BTC’s miner reserve fell by 1%, plummeting to its lowest stage because the yr started. In keeping with knowledge from CryptoQuant, on that day, 1.82 million BTC had been held throughout all current miners’ wallets.

Supply: CryptoQuant

In a latest report, CryptoQuant analyst Woo Minkyu commented on the impression of the decline in BTC’s Miner Netflow and reserves.

“This development may signify miners’ methods for securing long-term operational funds. Promoting Bitcoin in the marketplace to offset mining and operational prices is a typical a part of their enterprise actions. To sum up, such vital sell-offs by miners can affect the market in numerous methods, probably resulting in short-term value fluctuations for Bitcoin.”

Bitcoin within the final week

At press time, BTC exchanged arms at $42,695, logging an 8% value decline within the final week, in keeping with knowledge from CoinMarketCap.

AMBCrypto’s evaluation of the coin’s value actions on a each day chart revealed that the worth fall within the final week represented a direct response to the bearish development, which has dominated the market since twelfth January.

In keeping with readings from BTC’s Shifting common convergence/divergence (MACD), BTC’s MACD line crossed under the development line on that day and has since posted solely purple histogram bars.

The downward crossover of an asset’s MACD line with its development line means that the upward momentum of the market is waning. It additionally suggests {that a} bearish development could be growing.

These accumulating the asset would see it as a warning signal because it suggests a bearish shift in market dynamics.

Confirming the bearish shift in sentiment, at press time, BTC’s optimistic directional index (inexperienced) at 16.90 was pegged under its unfavorable directional index (purple), which returned a worth of 21.26.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Equally, the purple line crossed above the inexperienced line on twelfth January, lending additional credence to the above place.

When a coin experiences the sort of intersection, it connotes that the power of the bears has exceeded that of the bulls, and a value drawdown is to be anticipated.

Supply: TradingView