Bitcoin miners refuse to sell: A strategy to uphold BTC prices?

- Bitcoin miners proceed to carry on to their BTC regardless of market volatility.

- Curiosity in Bitcoin ETFs plummets.

Regardless of the volatility confronted by Bitcoin [BTC] in the previous few months, some mining corporations have proven resilience within the face of uncertainty.

Miners persist

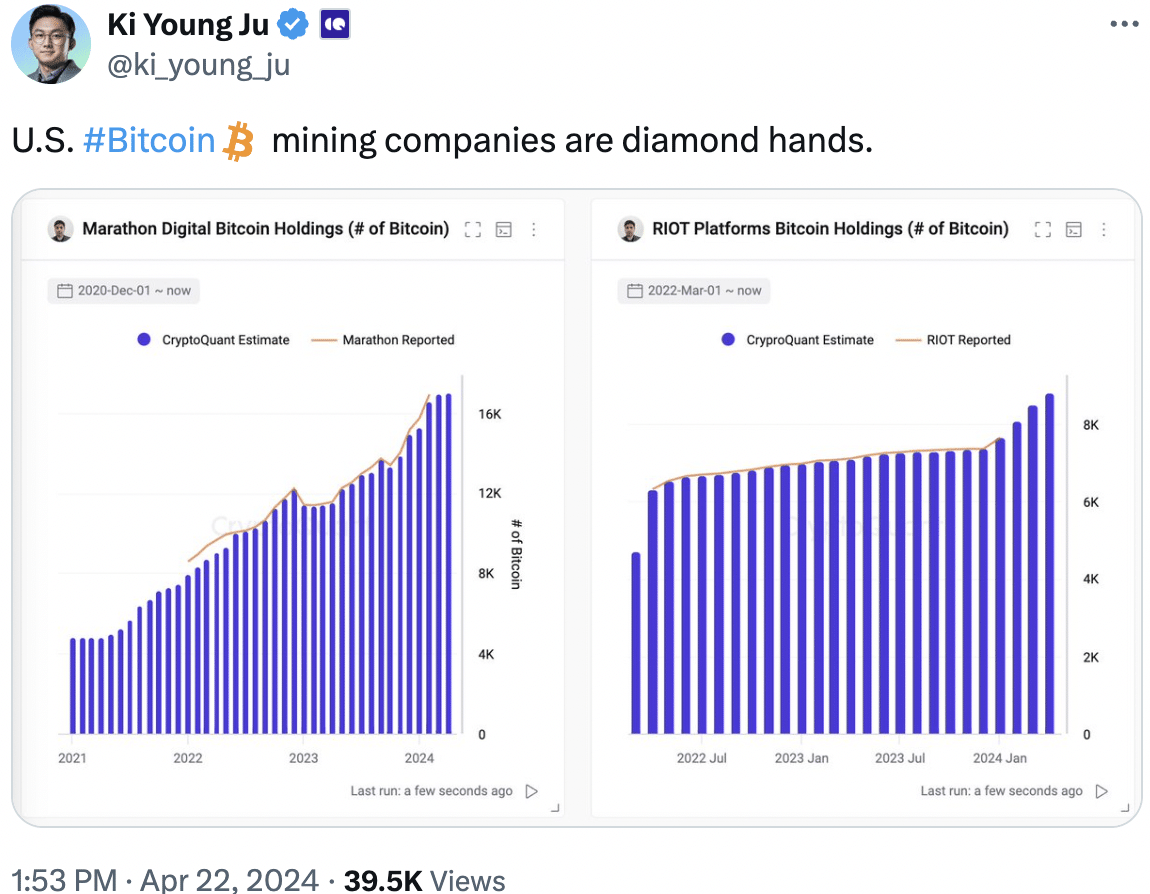

In response to new information, U.S. Bitcoin mining corporations have been diamond arms and refused to promote any of their BTC. This indicated that the sentiment amidst most mining corporations was constructive they usually received’t be promoting their holdings anytime quickly.

This meant the promoting stress on Bitcoin would cut back sooner or later.

Supply: X

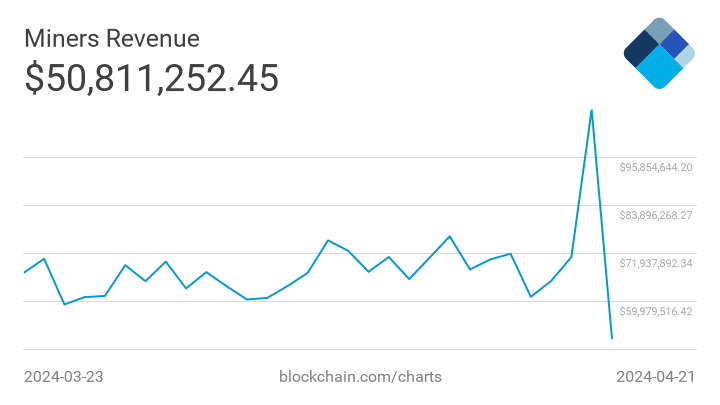

Moreover, the income generated by miners additionally elevated loads throughout this era, attributed to the rising curiosity in Runes. Coupled with that, the hashrate for BTC additionally grew.

A rising hashrate for Bitcoin means the community is safer, but in addition extra aggressive for miners. They’ll want extra highly effective gear and doubtlessly face decrease particular person income.

Supply: Blockchain

Regardless of these constructive elements, there have been some issues that would plague the Bitcoin ecosystem.

ETF hype fades

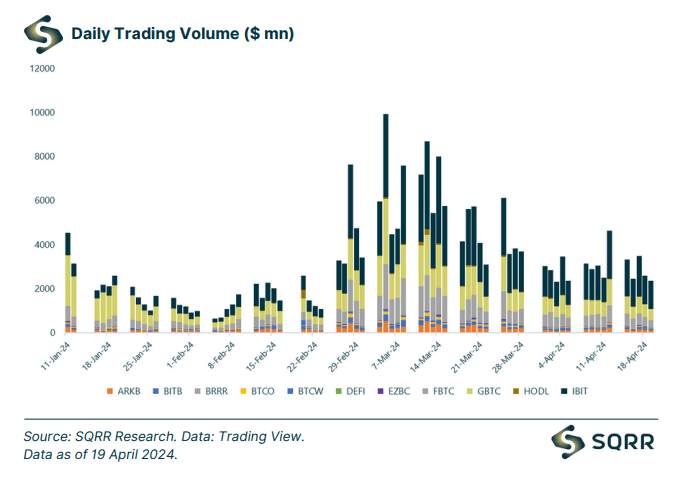

Current information highlighted traits in Bitcoin exchange-traded funds (ETFs) over the previous week. We’ve seen a major shift in the direction of web outflows, with a mixed complete of $319 million exiting all Bitcoin ETFs.

Grayscale’s Bitcoin Funding Belief (GBTC) was a significant driver of this decline.

In distinction, inflows into ETFs had beforehand reached a peak of $12.7 billion, however now seem to have plateaued. This means a possible cooling off in investor sentiment in the direction of BTC ETFs.

Moreover, the info signifies a decline in buying and selling exercise for these funds. Weekly buying and selling volumes have dropped by 12% in comparison with the prior week. This might be an indication of elevated investor warning or a wait-and- see strategy earlier than the upcoming Bitcoin halving occasion.

Lastly, the whole Property Beneath Administration (AUM) for BTC ETFs has additionally dipped.

The present AUM sits at $53 billion, reflecting a ten% lower from the earlier week. This aligns with the development of web outflows and doubtlessly signifies a decline in general investor holdings in Bitcoin via these ETFs.

Supply: SQRR.xyz

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This declining curiosity in BTC ETFs might point out that non crypto native buyers possibly shedding curiosity within the king coin. At press time, BTC was buying and selling at $65,965.95 and its worth had grown by 1.26%.

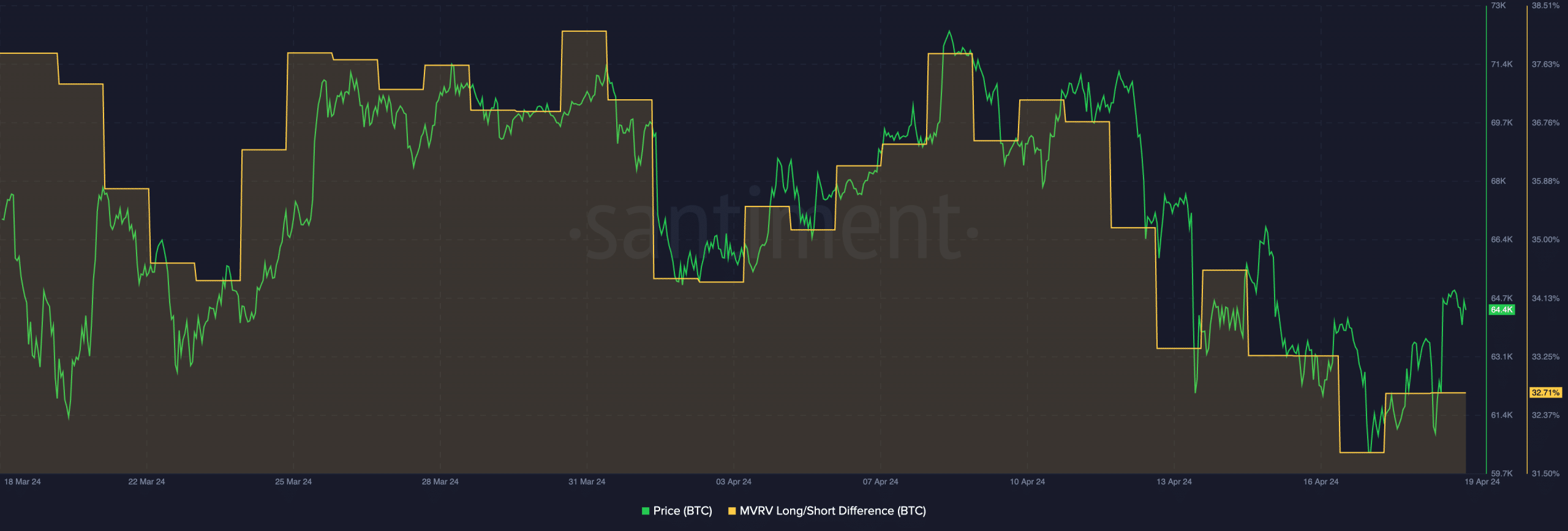

Furthermore, Lengthy/Brief distinction of BTC had declined indicating that the variety of long-term holders holding BTC had fallen.

Supply: Santiment