Bitcoin Mirroring 1930 Stock Market Crash, Tech Progress From Nearly 100 Years Ago: Bloomberg Analyst

Bloomberg Intelligence’s senior macro strategist Mike McGlone warns that Bitcoin’s (BTC) parabolic ascent over the past decade or so appears eerily just like the 1929 inventory market bubble.

McGlone says that the high-interest charge atmosphere reminds him of the circumstances that led to the collapse of the inventory market in 1930.

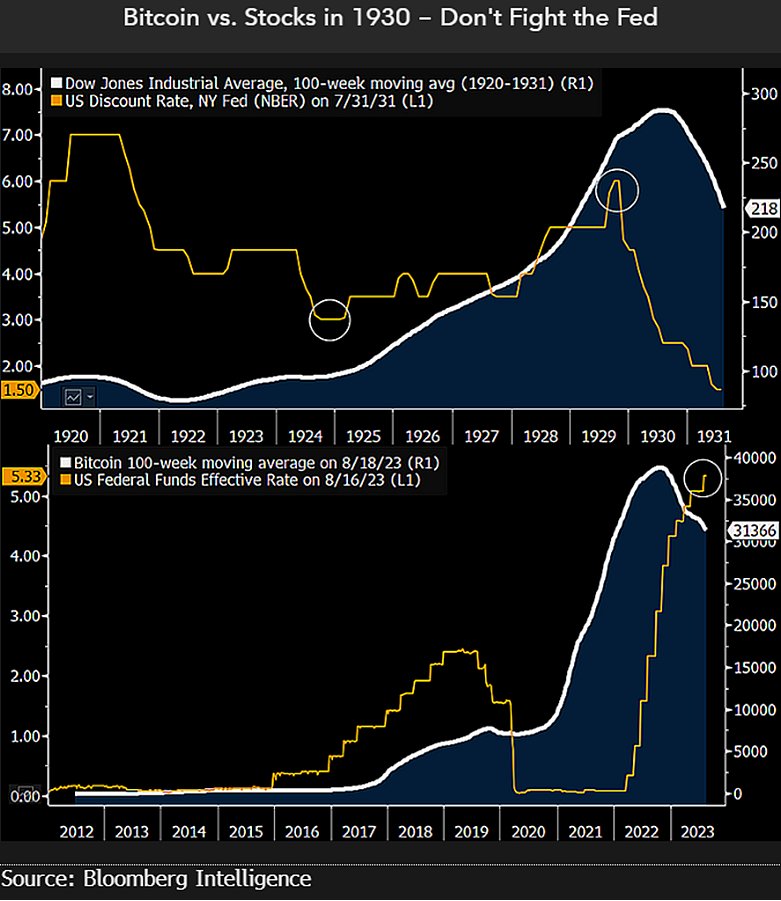

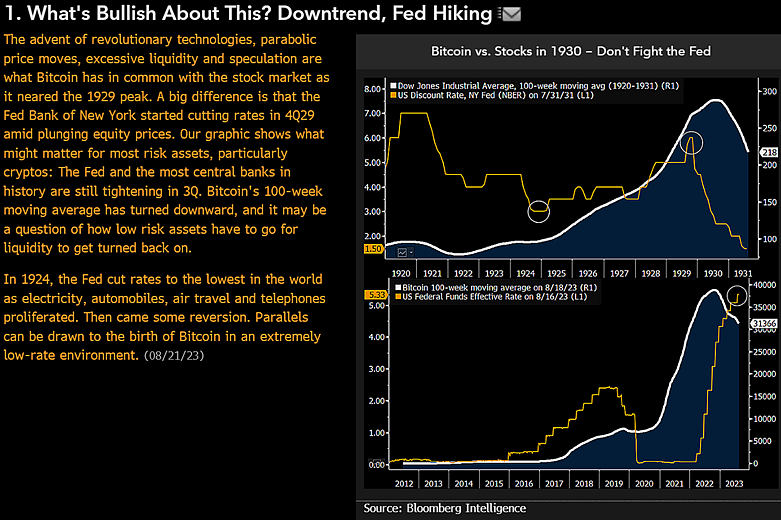

The analyst shares a graphic displaying how the US low cost charge peaked in 1929 simply earlier than the 100-week shifting common of the Dow Jones Industrial Common (DJIA) rolled over.

The US low cost charge is the rate of interest charged to banks on loans collected from the Federal Reserve.

The graphic additionally exhibits the steep rise within the Fed’s rate of interest over the past 12 months or so with Bitcoin’s 100-week shifting common witnessing a downtrend.

“Among the best-performing property in historical past and a number one indicator – Bitcoin – seems just like the inventory market in 1930. Statistician and entrepreneur Roger Babson started warning about elevated fairness costs properly earlier than economist Irving Fisher proclaimed a ‘completely excessive plateau’ in 1929. The Fed tilts our bias towards a stance just like Babson’s.”

McGlone additionally highlights that the start of Bitcoin is harking back to the tech developments about 100 years in the past when electrical energy, automobiles, air journey and telephones proliferated. In accordance with the Bloomberg analyst, the parabolic rise of Bitcoin and the emergence of revolutionary applied sciences within the Twenties each got here at a time when the Federal Reserve stored rates of interest low.

“What’s Bullish About This? Downtrend, Fed Mountaineering…

The appearance of revolutionary applied sciences, parabolic worth strikes, extreme liquidity and hypothesis are what Bitcoin has in widespread with the inventory market because it neared the 1929 peak. An enormous distinction is that the Fed Financial institution of New York began chopping charges in 4Q29 amid plunging fairness costs.”

At time of writing, Bitcoin is buying and selling for $26,020.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney