Bitcoin nears $93K again as short-liquidation clusters build — is a squeeze coming?

Bitcoin is pushing towards the $93K area for the second time in lower than per week, and new derivatives information suggests the market could also be coming into a high-volatility part.

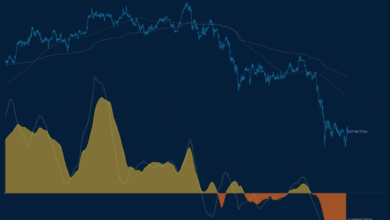

A contemporary studying from Glassnode’s liquidation heatmap exhibits giant short-liquidation clusters forming between $92.5K and $94K, hinting at a possible squeeze if value continues greater.

The cluster buildup is important as a result of value was sharply rejected at this similar degree final week. The return to the zone alerts that merchants are more and more positioning in opposition to the transfer.

Supply: Glassnode

This creates situations the place any sustained uptick might set off a cascade of brief liquidations.

Brief-liquidation pockets act as “gasoline” throughout upside strikes. When value enters these zones, over-leveraged merchants are pressured to purchase again Bitcoin. This accelerates momentum with out requiring new natural demand.

This dynamic has pushed a number of of Bitcoin’s most aggressive strikes in earlier cycles.

Bitcoin technical situations now assist the transfer

A complementary view from the every day Bollinger Bands chart reinforces this setup. BTC has reclaimed the 20-day SMA at round $90.5K, a degree it has struggled to shut above throughout the previous two weeks.

Breaking by this midline usually alerts a short-term development reversal.

Volatility can also be increasing, with the bands widening after a number of days of compression.

This setup often precedes giant directional strikes, and with the higher band sitting close to $97.9K, Bitcoin has room to push greater if the squeeze accelerates.

Supply: TradingView

Right now’s sturdy bullish candle, which engulfed the earlier multi-day vary, provides momentum to the upside case.

The rebound from the decrease Bollinger Band round $83K final week was equally notable.

Consumers absorbed the sell-off shortly, a transfer that aligned with the heatmap’s lower-level long-liquidation pockets. That response set the stage for the present push again towards the $90K–93K area.

The vital zone: $92K–$94K

The overlap between high-density short-liquidation clusters, rising volatility, and a reclaim of key technical ranges creates a degree of confluence that merchants usually watch intently.

If BTC breaks decisively above $93K, a fast transfer greater turns into more and more doubtless as pressured patrons enter the market.

Nonetheless, this similar area rejected BTC decisively only a few days in the past. One other rejection right here would point out that sellers nonetheless view this degree as a cycle-defining resistance zone.

Last Ideas

- A break above $93K might unleash a short-squeeze towards the higher Bollinger Band.

- Failure at this degree would reinforce it as a robust resistance zone heading into mid-December.