Bitcoin: New holdings spike; good news ahead?

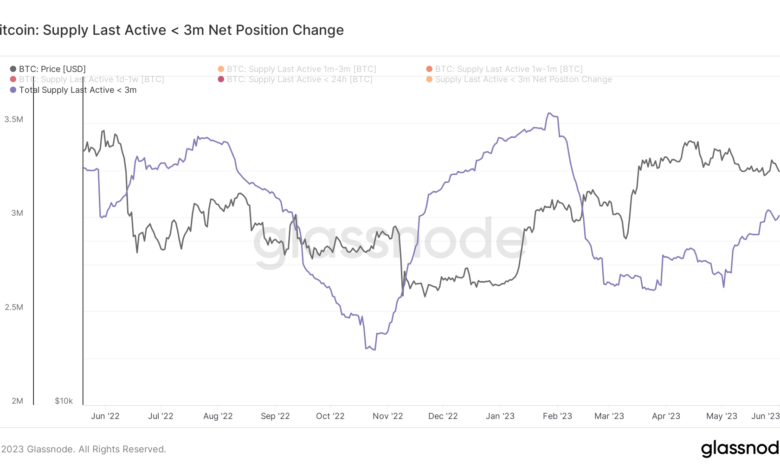

- Bitcoin provide transacted within the final three months elevated from 11.5% to 21.4%.

- The general provide held for lower than six months declined sharply in Might.

A number of analyses centered on Bitcoin [BTC] of late have unanimously agreed that the king coin was in the midst of an accumulation part, with most long-term holders exhibiting a scarcity of need to promote their holdings.

Nonetheless, a latest research by Glassnode revealed that this pattern could be nearing its inflection level. The proportion of Bitcoin provide transacted within the final three months elevated from 11.5% to 21.4% in Might, an exponential enhance of 86%.

This meant that there was a noticeable switch of Bitcoin from longer-term traders to newer members, suggesting bullish market traits.

The 1d-3m #Bitcoin Realized Cap HODL Waves has elevated from the cycle low of 11.5%, to a present worth of 21.4%, an 86% enhance.

This implies that the switch of wealth from skilled holders to newer demand is happening, a phenomena frequent throughout cycle inflection factors. pic.twitter.com/M6ibcjvynb

— glassnode (@glassnode) June 1, 2023

Bitcoin provide that’s lower than three months previous is usually thought of as extremely cellular, liquid, and most certainly to be spent in periods of unstable value swings. Additionally known as “younger cash”, this provide will increase in quantity throughout a bull market part when long-term holders begin to promote and take income. As indicated beneath, the availability swelled up significantly in Might.

Supply: Glassnode

However does that actually imply “diamond fingers” have locked in good points?

As per the graph beneath, BTC’s provide older than six months has grown from a share of 75% at the start of Might to 78% on the time of writing, indicating the shortage of willingness of long-term holders to promote.

Supply: Glassnode

The reply lies right here

In accordance with Glassnode, the rise in cash youthful than three months would happen solely when cash older than three months are spent. As seen earlier, this switch was not pushed by cash older than six months, or the long-term holders of BTC.

This really meant that the cohort that acquired the cash within the final 3-6 months set this off. As evidenced by the graph beneath, the general provide held for lower than six months declined sharply in Might, confirming that capitulation occurred within the 3-6 months age band.

Supply: Glassnode

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Bitcoin: Retail traders drive demand

Curiously, there was a pointy enhance in retail traders for Bitcoin. Information from Santiment confirmed that wallets holding lower than 10 cash mushroomed in Might, most likely pushed by Ordinals and BRC-20 token frenzy.

It might thus be attainable that almost all of those new traders had been a part of the 1D-3m age band, as mentioned earlier.

Supply: Santiment