Bitcoin NFTs fall by 60% after December boom

- 2024 has seen a lower in NFT exercise on the Bitcoin community.

- On account of low exercise, there was a decline in demand for blockspace by Inscriptions.

Month-to-month NFT gross sales quantity on the Bitcoin [BTC] community plummeted by over 60% in January following December’s record-breaking highs, information from CryptoSlam confirmed.

Knowledge from the NFT analytics platform confirmed that the Bitcoin community outpaced Ethereum [ETH] because the blockchain with the best NFT gross sales quantity in December 2023.

Whereas NFT gross sales quantity on the previous totaled $881 million, the latter recorded a gross sales quantity of $353 million.

In November of the identical yr, NFT gross sales on the Ethereum community fell behind that of the Bitcoin community by virtually 10%.

This marked the primary time in historical past that the latter would report the next month-to-month gross sales quantity than the previous.

Nevertheless, with a decline in NFT buying and selling exercise on the Bitcoin community this month, its gross sales quantity has fallen behind Ethereum.

In line with information from CryptoSlam, with two days until the tip of January, NFT gross sales transactions price $314.2 million have been performed on Bitcoin.

Alternatively, Ethereum has registered a gross sales quantity of $328.4 million within the final 28 days.

Goodbye Ordinals?

AMBCrypto reported earlier that the surge in NFT exercise on the Bitcoin community in November and December 2023 was primarily pushed by the final improve in curiosity in inscriptions and Ordinals on the blockchain.

This manifested within the excessive charges customers paid to mint inscriptions on the blockchain.

For instance, on the tenth of December 2023, the chain recorded a single-day excessive charge of $10 million as complete transaction charges paid to mint inscriptions on the community.

Nevertheless, with the yr thus far marked by a decline in curiosity on this digital asset class, there was a corresponding dip within the charges spent each day to mint inscriptions.

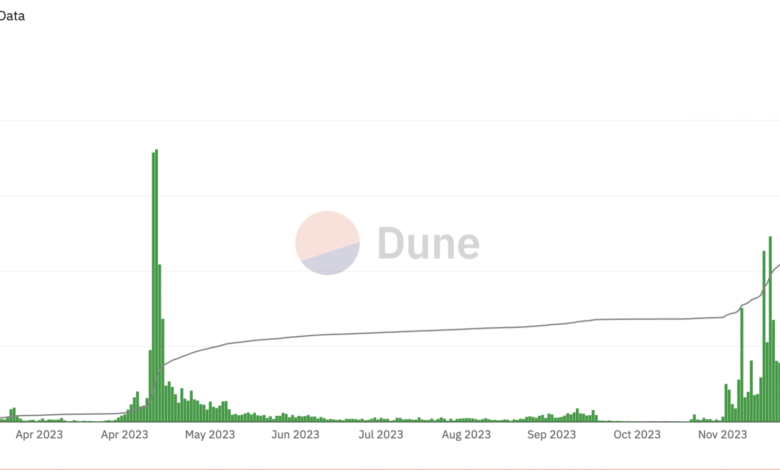

In line with information from a Dune Analytics dashboard by Data Always, minting charges peaked at $5 million on the 14th of January and have since declined by 83%.

As of the twenty eighth of January, inscription minting charges totaled $848,000.

Supply: Dune Analytics

As Inscription exercise craters on the Bitcoin community, there was a decline within the demand for blockspace for non-traditional transactions.

AMBCrypto’s examination of Dune Analytics’ dashboard confirmed that weekly demand for blockspace for Inscriptions on the blockchain has dropped by 33% because the yr started.

Supply: Dune Analytics