Bitcoin On The Brink, Price Soars Above $68,000

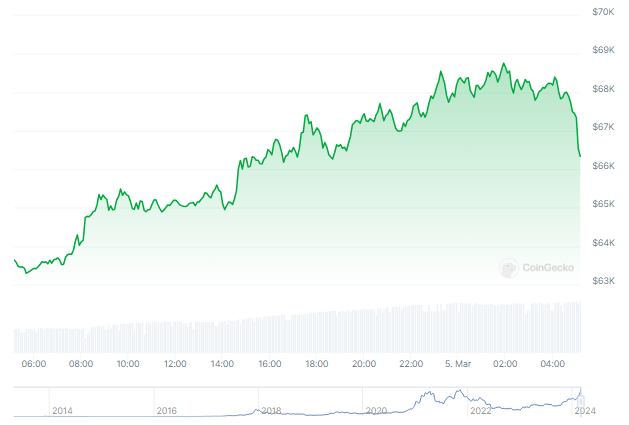

On Monday, a flood of capital introduced Bitcoin inside hanging distance of document values, sending it hovering to a two-year excessive and breaching past $68,000. At its peak, the worth was $68,800.

On the time of writing, Bitcoin was trading at $67,980, up 6.6% and 20.6% within the every day and weekly timeframes, information from Coingecko exhibits.

In latest weeks, as funding in bitcoin funds listed in america has elevated dramatically, the worth of the largest cryptocurrency by market cap has elevated by half this 12 months.

Bitcoin Heating Up

As increasingly more individuals get all for and optimistic concerning the market, Bitcoin’s unbelievable upward trajectory turns into clear in a radical examination of the weekly chart.

The bitcoin value has not too long ago surged, helped alongside partly by the adoption of spot Bitcoin ETFs, and is already approaching the all-time excessive of $69K, which the cryptocurrency attained in November 2021. It has already surpassed quite a few vital resistance ranges.

Bitcoin 24-hour value ascent. Supply: Coingecko

Antoni Trenchev, co-founder of crypto change Nexo, acknowledged that after the launch of those 9 new ETFs, main market actions not happen on weekends however fairly in the course of the common buying and selling week.

Trenchev additionally identified that at the moment’s occasions may very well be a repeat of final week’s, when bitcoin’s worth elevated by $10,000 in a matter of days.

The worth of bitcoin has soared this 12 months, and its market capitalization has already topped $1.3 trillion, making it one of many greatest belongings on this planet.

BTCUSD buying and selling at $66,887 on the 24-hour chart: TradingView.com

Probably the most invaluable cryptocurrency on this planet, Bitcoin, has surpassed Meta Platforms (META), the dad or mum firm of Fb, and is presently approaching silver’s market worth of $1.4 trillion, in accordance with figures supplied by CompaniesMarketCap.

Greater than half of the $2.17 billion internet flows into the highest ten US spot bitcoin funds within the week main as much as March 1 went into BlackRock’s iShares Bitcoin Belief (IBIT.O), opens new tab, in accordance with statistics from LSEG.

Ethereum, a smaller competitor, has capitalised on rumors that it, too, may quickly provide exchange-traded funds that stimulate inflows. It’s up 50% year-to-date and reached two-year highs on Tuesday, rising 2.5% to $3,517.

Bitcoin Leads The Means

Concurrently, Bitcoin boosted many cryptocurrency tokens, notably meme currencies. Dogecoin noticed a 30% enhance, and Shiba Inu had a 90% surge. Individuals who have been sitting on their arms in the course of the present crypto rise are lastly getting again into it, in accordance with analysts. In response to crypto information supply Kaiko, the weekly transaction quantity of meme tokens climbed to its highest stage since late 2021 final week.

#Bitcoin is about to enter value discovery (once more) and individuals are in some way bearish?

couldn’t be me.

— Caleb Franzen (@CalebFranzen) March 4, 2024

In the meantime, Cubic Analytics CEO Caleb Franzen made the statement in a Sunday report that Bitcoin is thrashing the tech-heavy Nasdaq 100 Index (NDX). Breaking over a essential stage connecting the primary quarter and finish quarter of 2021 highs, he characterised bitcoin’s breakout versus NDX as “very encouraging.”

“Bitcoin is about to enter value discovery (once more) and individuals are in some way bearish? Couldn’t be me,” he mentioned in an X submit Monday.

Joel Kruger, a market strategist at digital foreign money change LMAX Group, informed CBS MoneyWatch that traders are seeing the advantages of treating bitcoin as an uncorrelated asset, which makes it very interesting for portfolio diversification.

Featured picture from P2E Crypto Media, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site fully at your individual threat.