Bitcoin Ordinal NFT Sales Nosedive as Broader Market Cools

The thrill surrounding Bitcoin’s leap into the NFT world through Ordinals is likely to be fleeting. A Dappradar examine reveals that buying and selling actions and gross sales figures for Bitcoin Ordinals have plummeted by a staggering 97% since their Might 2023 zenith. This downturn mirrors a wider slowdown within the NFT sector. Nevertheless, the stoop in Bitcoin Ordinals is much extra pronounced than in established networks equivalent to Ethereum.

Bitcoin NFTs Face Crossroads: Ordinal Gross sales Decline Highlights Market Volatility and the Quest for Tangible Utility

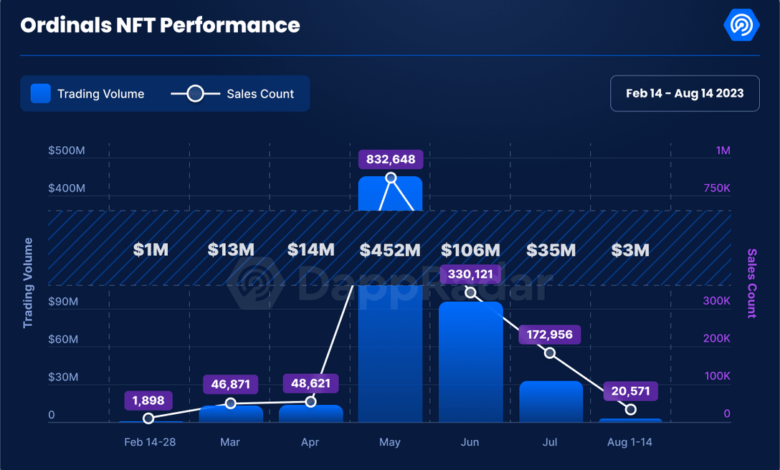

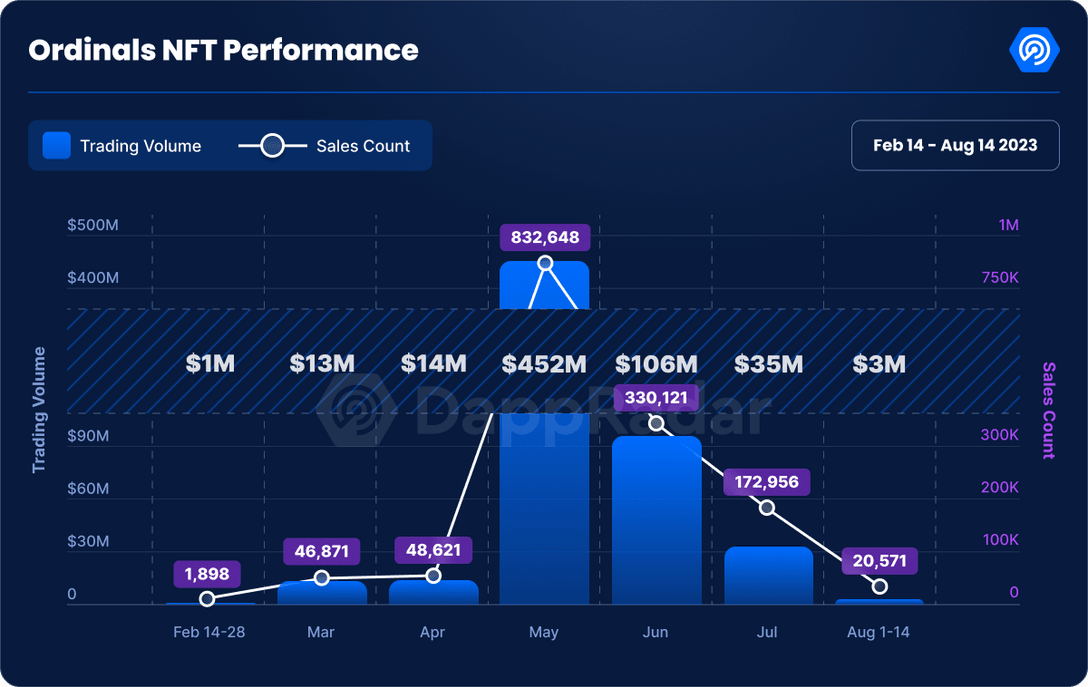

After hovering to report ranges this spring, the nascent marketplace for Bitcoin-centric NFTs has hit a snag. By June and July, Bitcoin Ordinals reported a pointy drop in each gross sales and transactions, diving 97% and 98% from their Might pinnacle. Dappradar’s evaluation signifies that Ordinals buying and selling dwindled from $452 million in Might to a mere $3 million in early August.

There’s additionally been a pointy downturn in lively contributors within the Bitcoin NFT area. The variety of distinctive lively Bitcoin pockets addresses plunged 90% from February to mid-August, dwindling from 79,261 to a scant 6,708. Whereas Ethereum and Polygon have witnessed declines in lively merchants, their 22% and 60% reductions throughout the identical timeframe appear trivial in comparison with Bitcoin’s dramatic downturn.

Chart through Dappradar’s newest report on Bitcoin Ordinals.

Dappradar posits that this retraction might sign waning pleasure and belief in Bitcoin NFTs’ prospects. Not like their counterparts in Ethereum and Polygon, Bitcoin’s NFT sphere is predominantly dominated by profile image collections, which usually provide restricted utility. Given the broader and extra assorted choices of Ethereum and Polygon, Bitcoin’s slender NFT specialization is likely to be accelerating its descent.

“As you’ll be able to see utilizing Dappradar’s NFT Assortment Rating, a lot of the collections on Bitcoin are nonetheless within the early levels and nonetheless lack the innovation that the NFT house is experiencing – concerning interoperability, dynamism, and utility,” the report states.

Dappradar’s report says the approaching months are set to be defining moments for Bitcoin NFTs. It additional notes how there’s a debate throughout the neighborhood: some advocate for Bitcoin to take care of its “digital gold” persona, suggesting Ethereum performs the “digital oil” function, powering Web3 improvements.

The waning exercise in Ordinals buying and selling means that the Bitcoin neighborhood won’t be as captivated with NFTs as initially thought. Nevertheless, Dapprader notes that it could be untimely to dismiss Bitcoin’s potential function within the dynamic NFT area.

The researchers additional conclude by saying the meteoric rise and subsequent fall of Bitcoin Ordinals highlight the capricious nature of the NFT market. For these enticed to trip the wave of the most recent pattern, the dip in Ordinals serves as a stark reminder of how fleeting speculative pleasure could be.

Though Bitcoin NFTs harbor nice theoretical potential, sheer hype won’t be sufficient to maintain market frenzies alive. Dappradar researchers recommend to make sure the Ordinals setback is considered as a lesson relatively than a terminal blow, it’s crucial for builders to zero in on fostering tangible utility, enabling Bitcoin NFTs to really understand their promise.

Dappradar’s report could be learn in its entirety right here.