Ethereum finally breaks above $3K: How ETH was able to regain its highs

- Ethereum has lastly caught a breather within the final 48 hours.

- The worth held regular above the $3,000 worth vary.

Ethereum [ETH] maintained a secure buying and selling vary within the $3,500 zone till it encountered important declines that considerably diminished its worth.

Regardless of this downturn, the movement of Ethereum throughout exchanges has been blended, reflecting diversified sentiments amongst merchants.

Ethereum recovers from declines

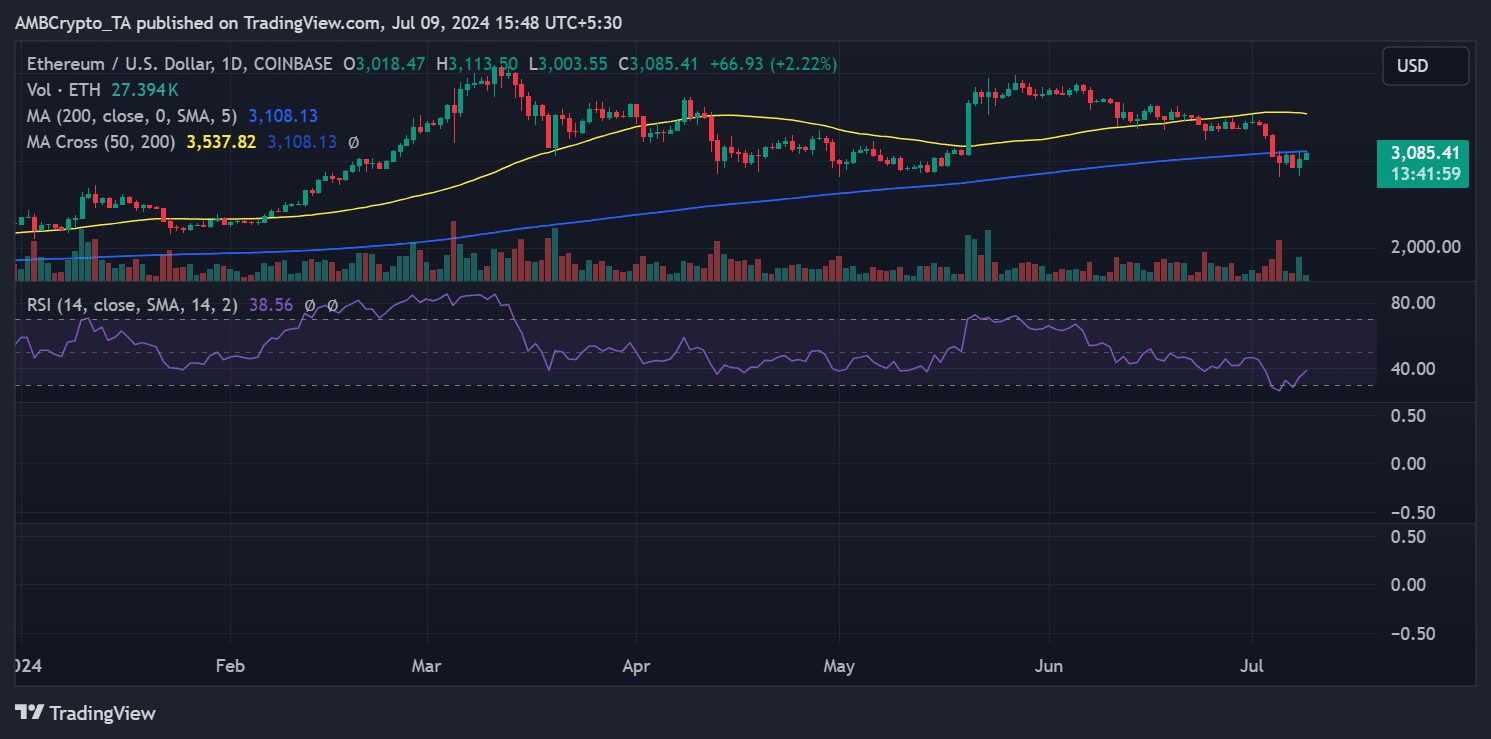

AMBCrypto’s evaluation of Ethereum on a each day time-frame revealed a unstable begin to the month. On the first of July, ETH was buying and selling at roughly $3,430.

The next day, it skilled a slight decline however stayed inside the $3,400 vary.

Nonetheless, the following days introduced extra pronounced decreases, and by fifth July, Ethereum’s worth had dropped to round $2,980.

ETH skilled extra fluctuations after that, oscillating between positive factors and losses. By the eighth of July, there was a noticeable restoration with an almost 3% enhance, bringing its worth to about $3,018.

As of this writing, it was buying and selling with a rise of over 2% at roughly $3,083.

Supply: TradingView

Moreover, the Relative Power Index (RSI) additionally confirmed a slight enhance in tandem with the value.

Regardless of this enchancment, the RSI sat beneath the impartial 50 mark at press time, particularly round 40, indicating that whereas the market sentiment is recovering, it nonetheless remained bearish territory.

Ethereum’s secure sentiments

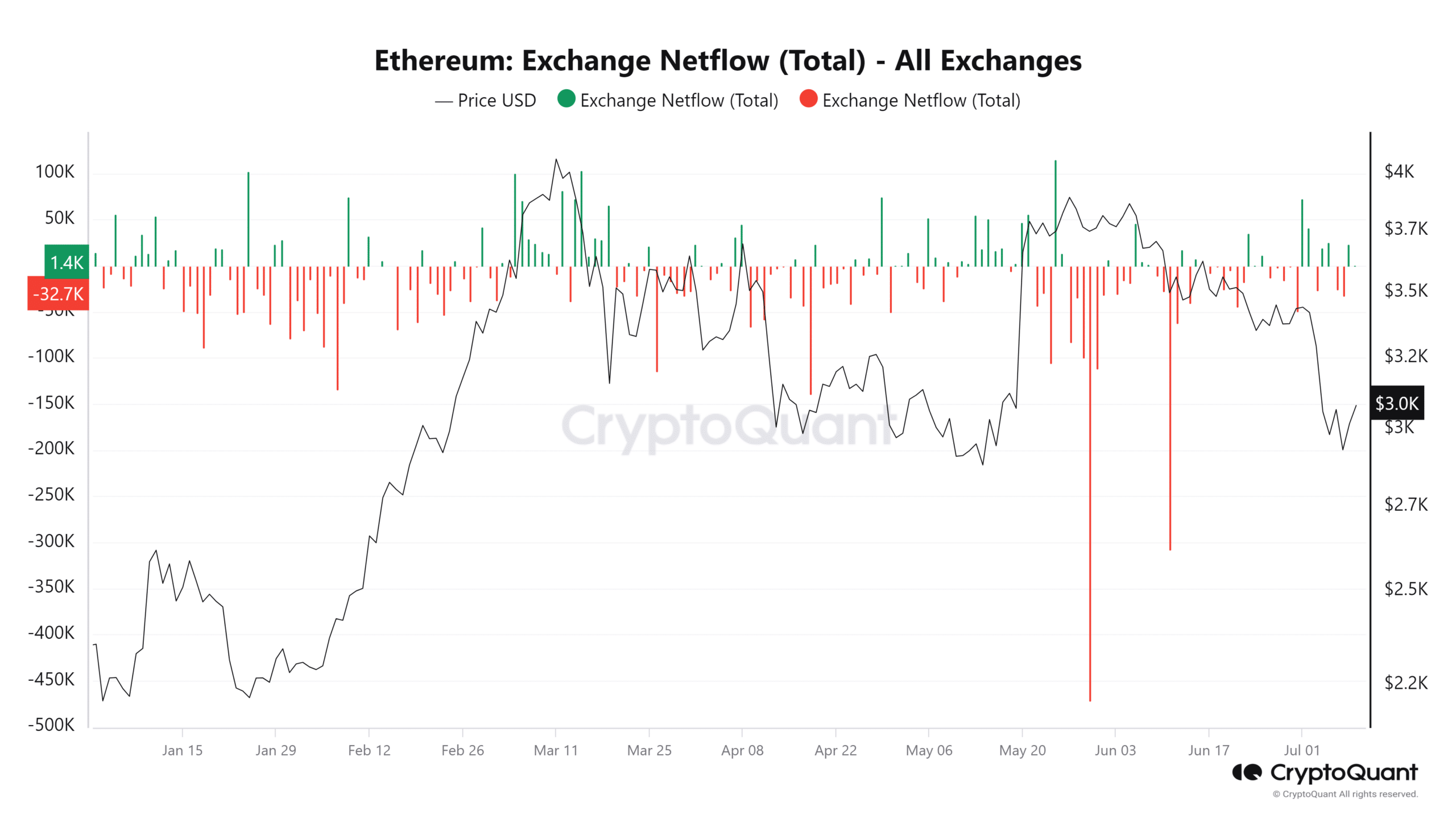

The evaluation of Ethereum’s alternate netflow from CryptoQuant revealed a fluctuating sample between inflows and outflows, indicative of blended dealer sentiment.

Over the previous two days, the netflow has been constructive, that means that extra Ethereum has been deposited into exchanges than withdrawn. This means that merchants are probably getting ready to promote or commerce, anticipating both taking earnings or mitigating losses.

Supply: CryptoQuant

Conversely, within the days main as much as this, the netflow was adverse, indicating that withdrawals of Ethereum from exchanges have been extra prevalent than deposits.

This development is often related to merchants transferring their holdings to non-public wallets for long-term holding or lowering publicity to exchange-related dangers.

The truth that there hasn’t been a major skew in direction of both heavy inflows or outflows means that merchants’ sentiment has remained comparatively unchanged, and regular market dynamics proceed.

Quantity confirms consumers’ dominance

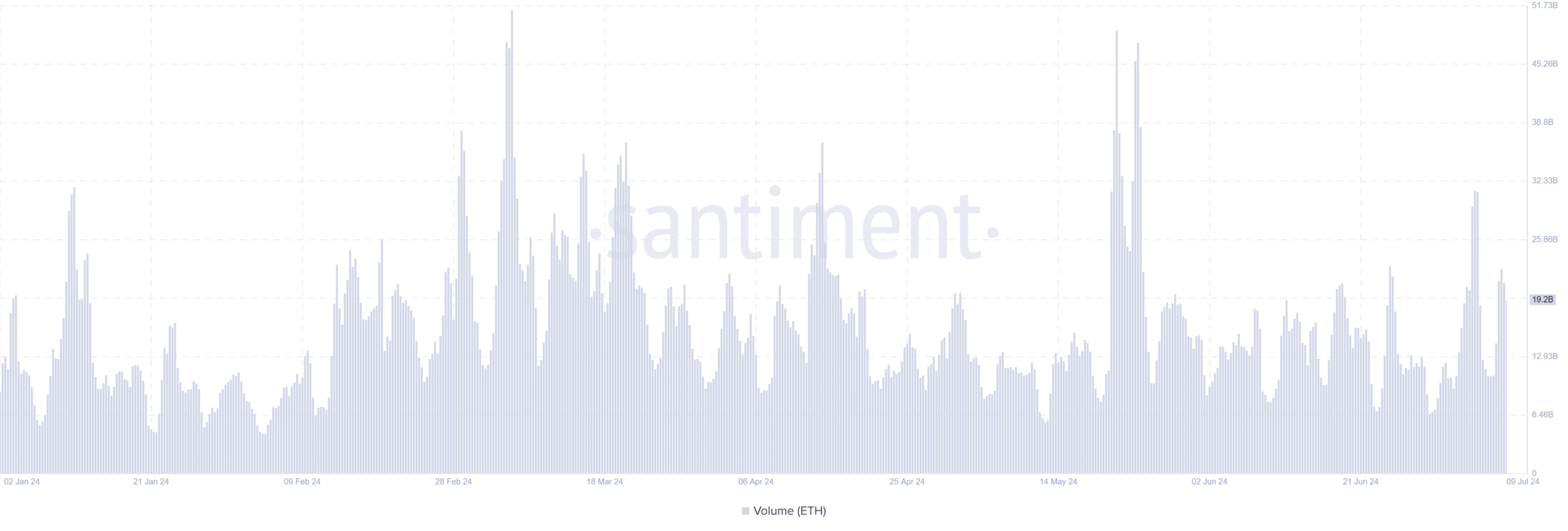

The evaluation of Ethereum’s buying and selling quantity over the previous 48 hours signifies a noticeable enhance, suggesting a revival in market exercise.

In response to information from Santiment, there was a quick dip in buying and selling quantity to round $10 billion on the seventh of July.

Supply: Santiment

Sensible or not, right here’s ETH market cap in BTC’s phrases

Nonetheless, this decline was short-lived, and by the eighth of July, the buying and selling quantity had surged to over $21 billion. As of this writing, the amount remained excessive at over $19 billion.

This enhance in buying and selling quantity, significantly with the present worth development, implies that purchasing exercise has been extra dominant than promoting.