Bitcoin plummets, loss cut of 40 billion yen, major alts also fall in reaction

Macroeconomics and monetary markets

On the US New York inventory market on the eighth of final week, the Dow Jones Industrial Common closed 130.4 factors (0.36%) increased than the day past, and the Nasdaq Index closed 63.9 factors (0.45%) increased.

On the twelfth of this week, the US Shopper Value Index (CPI), which influences the financial coverage selections of the Federal Reserve System, will probably be introduced, and at 4:00pm on the 14th, the FOMC (Federal Open Market Committee) and Chairman Powell will probably be introduced. will chorus from holding a press convention.

Within the futures market, 98.4% predict that rates of interest will probably be left unchanged, however the market may even be paying shut consideration to the post-FOMC rate of interest forecast distribution map (dot plot) that predicts the longer term end result. Whereas the market temper is enhancing with the suspension of rate of interest hikes factored in, if there’s any trace of additional rate of interest hikes sooner or later, this might result in a sudden change in market costs.

connection:Expectations for an early rate of interest reduce are barely set again on account of robust U.S. employment statistics. Cryptocurrency-related shares rise considerably as Bitcoin rebounds | eighth Monetary Tankan

connection:10 main digital foreign money shares within the Japanese and US inventory markets

Digital foreign money market circumstances

Within the crypto asset (digital foreign money) market, the Bitcoin value fell 3.48% from the day past to 1 BTC = $42,049.

BTC/USD day by day

At one level, the value plummeted to $40,300.

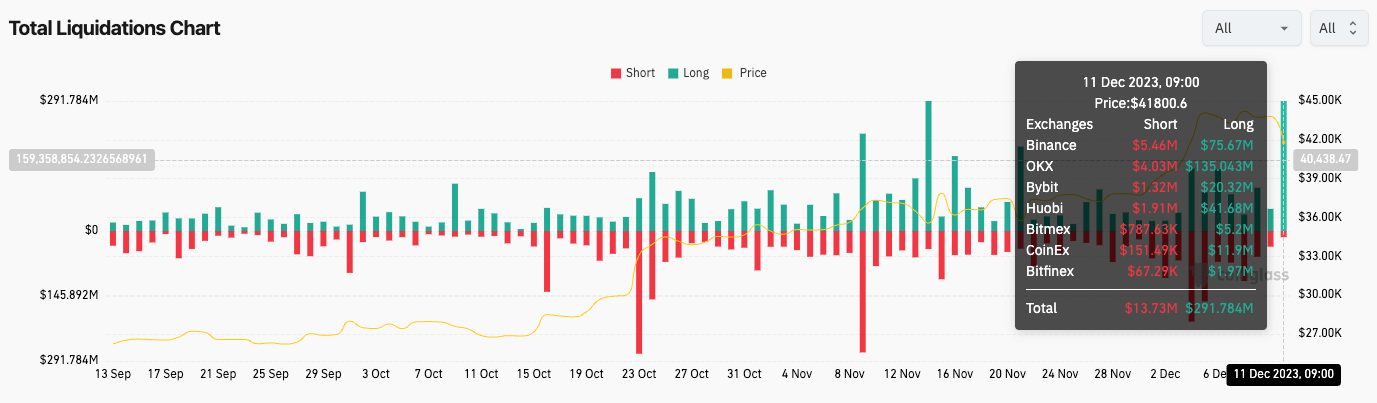

Within the derivatives market, lengthy positions price $290 million (42.3 billion yen) have been pressured to be liquidated.

coin glass

The present liquidation quantity is on the identical degree as on the 14th of final month, making it the most important quantity prior to now three months.

Among the many main alts, Ethereum (ETH) fell 4.5%, XRP fell 6.3%, and Solana (SOL) fell 3.2%. Among the many main alts, Polkadot (DOT) is down 7.3%, and Chainlink (LINK) is down 8.8%, with the best fee of decline. In the interim, there’s a threat that volatility (value fluctuation) will enhance and market uncertainty will enhance.

Bitbank analyst Hasegawa wrote in an article for CoinPost over the weekend, “The day by day Relative Energy Index (RSI) is at an overbought degree, making it straightforward for profit-taking to happen, and the U.S. Treasury yields are quickly rising. “If it rebounds, it may put downward strain on the BTC value.” He was of the view that “the present upward pattern in market costs is not going to proceed for lengthy.”

connection:Bitcoin soared to six.5 million yen this week, however be cautious of value vary adjustment threat | Contributed by bitbank analyst

On-chain analyst Willy Woo identified the opening within the day by day candlesticks of CME (Chicago Mercantile Trade) Bitcoin futures. He hints at a potential correction to 1BTC = $39,700.

The #Bitcoin CME Hole at 39.7k…

By my depend 28 out of 30 gaps have been crammed on CME day by day candles (93%). The opposite unfilled hole is pictured within the decrease left of this chart additionally. pic.twitter.com/EyccaJTTkr

— Willy Woo (@woonomic) December 7, 2023

connection:Find out about Bitcoin ETFs from the start: Explaining the benefits and drawbacks of investing and tips on how to purchase US shares

altcoin market

Through the capital influx part into the alt market final weekend, Solana (SOL), which attracted curiosity because of the airdrop of the staking pool’s governance token “JTO” and its new itemizing, continued to rise to the $77 degree at one level. On the eleventh, the value fell by 2.3% in comparison with the day past because of the sharp fall in BTC.

connection:Coinbase newly lists Jito’s governance token “JTO” on the primary day of airdrop

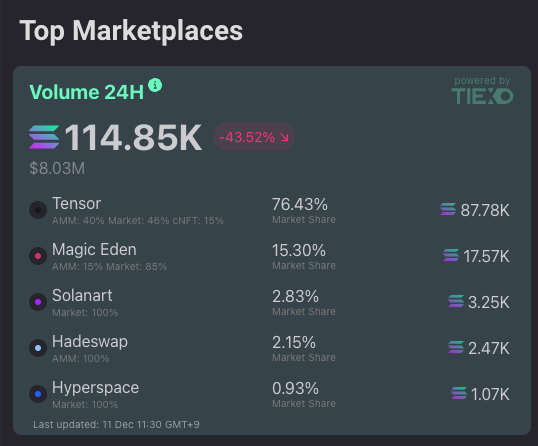

Within the Solana-based NFT market, “Tensor”, which is seen as Solana’s model of “Blur”, has emerged, surpassing the foremost NFT market “Magic Eden” with a month-to-month transaction quantity of $1 million.

Historical past has been made.@solana flips @etherum for NFT gross sales.https://t.co/T9HL2i0hlC pic.twitter.com/oSYbYGXCkC

— ◢ J◎e McCann 🧊 (@joemccann) December 9, 2023

Because of expectations for airdrops, Tensor’s market share continued to develop considerably to 76.4% as of the eleventh, forward of Magic Eden’s 15.3% and Solanart’s 2.83%.

tiexo

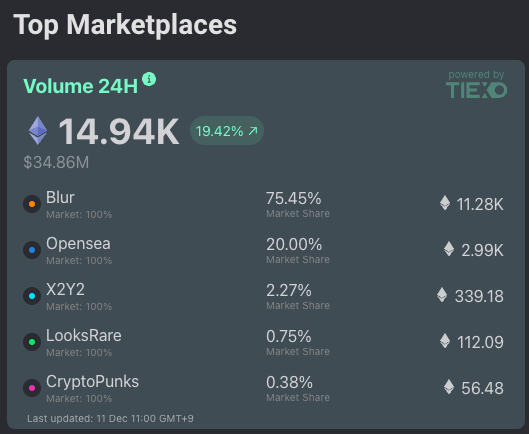

Moreover, within the Ethereum-based NFT market, “Blur” has a 74.5% share, far exceeding “OpneSea”‘s 20.0% share.

On the fifth, the NFT market “MOOAR” operated by Discover Satoshi Lab (FSL), the developer of STEPN, quickly elevated its buying and selling quantity with the introduction of MOOAR Field incentives, taking the lead amongst Solana-based NFT marketplaces. .

FSL is conducting a beta check of Fuel Hero, and the elevated demand for high-value property reminiscent of hero badges can also be seen to have boosted buying and selling quantity.

It’s official! We’ve surpassed TensorSwap & Magic Eden & now reign as #1 in 24-hour buying and selling quantity on Solana! 🚀

Speak about a #MOOAR energy transfer! 🐱#MOOARBox pic.twitter.com/GxVaEqDqOo

— MOOAR | Part 3 loading… (@mooarofficial) December 5, 2023

connection:Discover Satoshi Lab, developed by STEPN, begins closed beta testing of the subsequent work “Fuel Hero”

Bitcoin ETF particular function

As a result of hovering value of Bitcoin, the variety of downloads and MAU of the CoinPost official app is quickly rising.

Along with digital foreign money information, crypto indicators may cowl future supplies. By utilizing the My Coin operate and Crypto Alert, you may rapidly examine for sudden rises and falls in altcoins.■Explanatory article https://t.co/9g8XugH5JJ pic.twitter.com/gYtpheMykj

— CoinPost (digital foreign money media) (@coin_post) December 6, 2023

[Recruitment]CoinPost, Japan’s largest crypto asset media, is at the moment recruiting human sources on account of enterprise growth (potential full-time positions)

Editorial Division: Pupil interns fascinated about web3 and writers acquainted with crypto property

Gross sales division: Those that are good at English dialog and people with gross sales expertise are welcome.

webX administration: Individuals who have robust analysis expertise and are good at English dialog https://t.co/UsJp3v7P39— CoinPost (digital foreign money media) (@coin_post) November 24, 2023

Click on right here for a listing of previous market studies