Bitcoin price alert: Could BTC plunge to $68K if $80K support crumbles?

- Quick-term holders are retreating, displaying decreased speculative urge for food and weak near-term conviction.

- Liquidation clusters construct close to $80K, growing danger of cascading sell-offs.

Bitcoin’s [BTC] value was hovering simply above $83K as of the 4th of April.

In reality, your entire crypto market is on edge, with indicators pointing to a doable drop beneath $80K. If that occurs, technical fashions counsel a slide towards the $68K zone might comply with.

A Bitcoin rally that couldn’t final

In case of BTC, the asset surged to $88,580 after President Donald Trump introduced sweeping tariffs. However the rally was short-lived.

Costs fell sharply as merchants weighed the dangers tied to world commerce uncertainty.

To not point out, markets reacted quick. The S&P 500 dropped 4%—its greatest each day loss because the pandemic lockdowns. Roughly $3 trillion in worth was worn out throughout U.S. shares.

In fact, crypto didn’t escape the panic as Bitcoin fell to $82,220 that very same day and has struggled to reclaim increased floor since.

Is $80k the brand new Maginot line?

Current knowledge exhibits patrons defending the $80K zone. However technical indicators just like the dying cross are flashing warning.

Supply: Glassnode

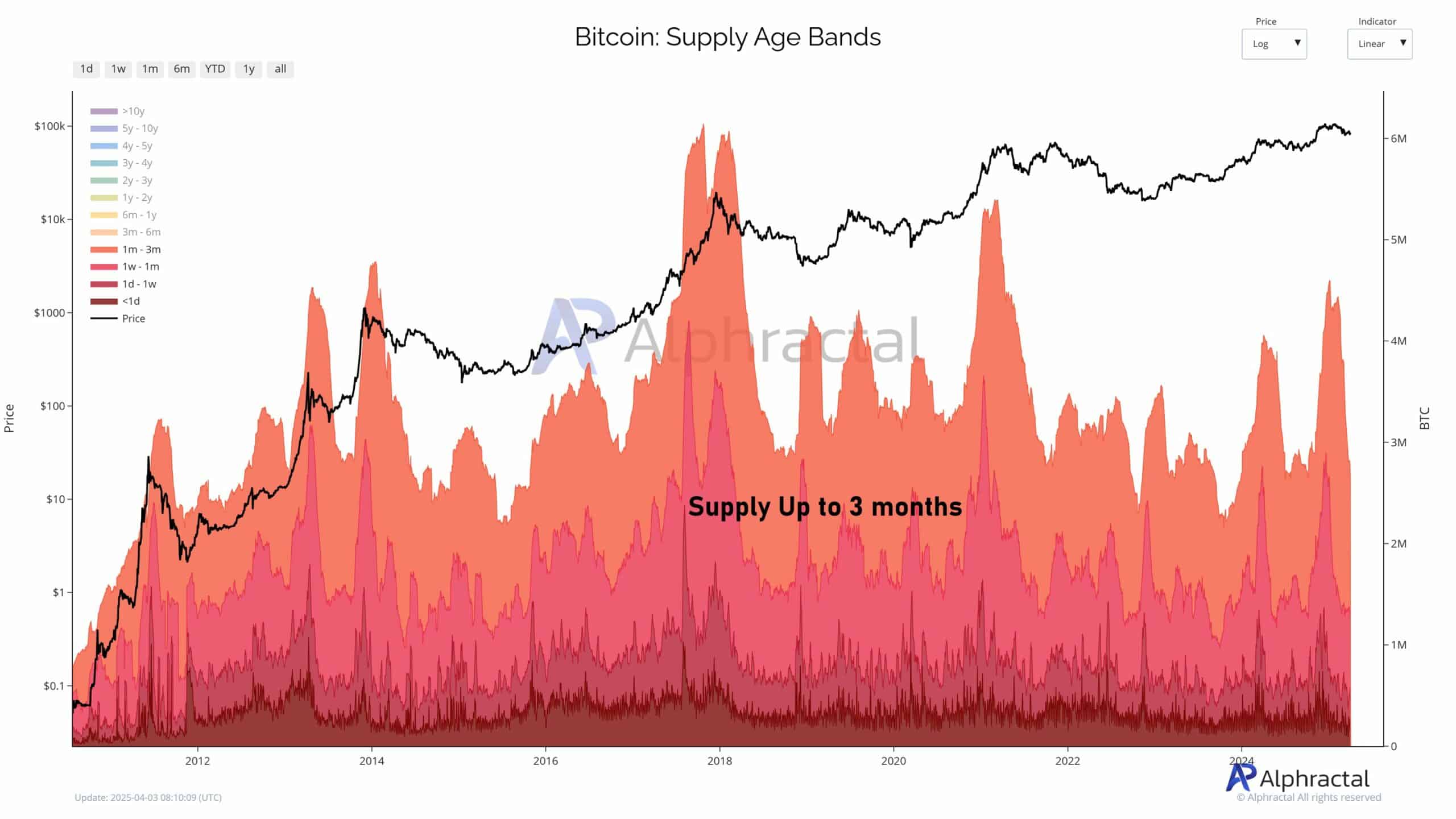

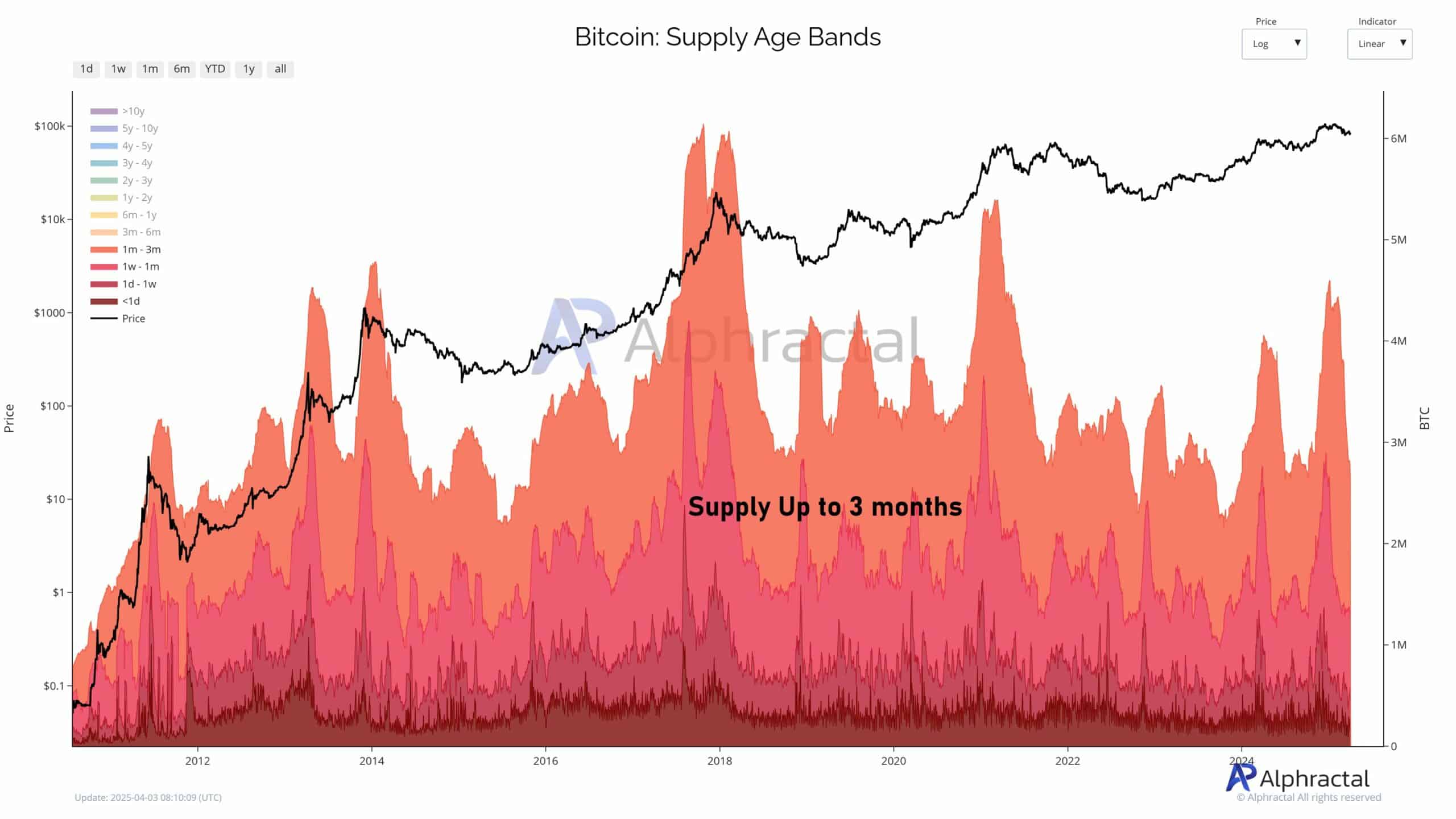

One other concern comes from realized value knowledge.

There’s a steep drop in cash held for lower than three months. These short-term holders are traditionally tied to bullish phases. But proper now, their accumulation is fading.

Up to now, spikes in short-term holder provide led Bitcoin’s greatest bull runs.

On the time of writing, that determine had dropped beneath 15%. The decline suggests decreased speculative curiosity and displays a broader market cool-down.

Supply: Alphractal

BTC Open Curiosity sinks, and so does hope

Furthermore, Open Curiosity has dropped 37.5%, falling from over $80B to beneath $50B since late 2024—mirroring Bitcoin’s slide from $106K to $84K.

With out leverage, value swings are likely to shrink—however when liquidation clusters construct, sharp strikes can nonetheless happen.

Liquidation heatmaps present the place leveraged trades might unwind. A current 7-day heatmap exhibits a heavy build-up of lengthy liquidations slightly below $80K.

Supply: Alphractal

If Bitcoin loses $80K with quantity, a cascade towards $68K is probably going, per analyst Joao Wedson.

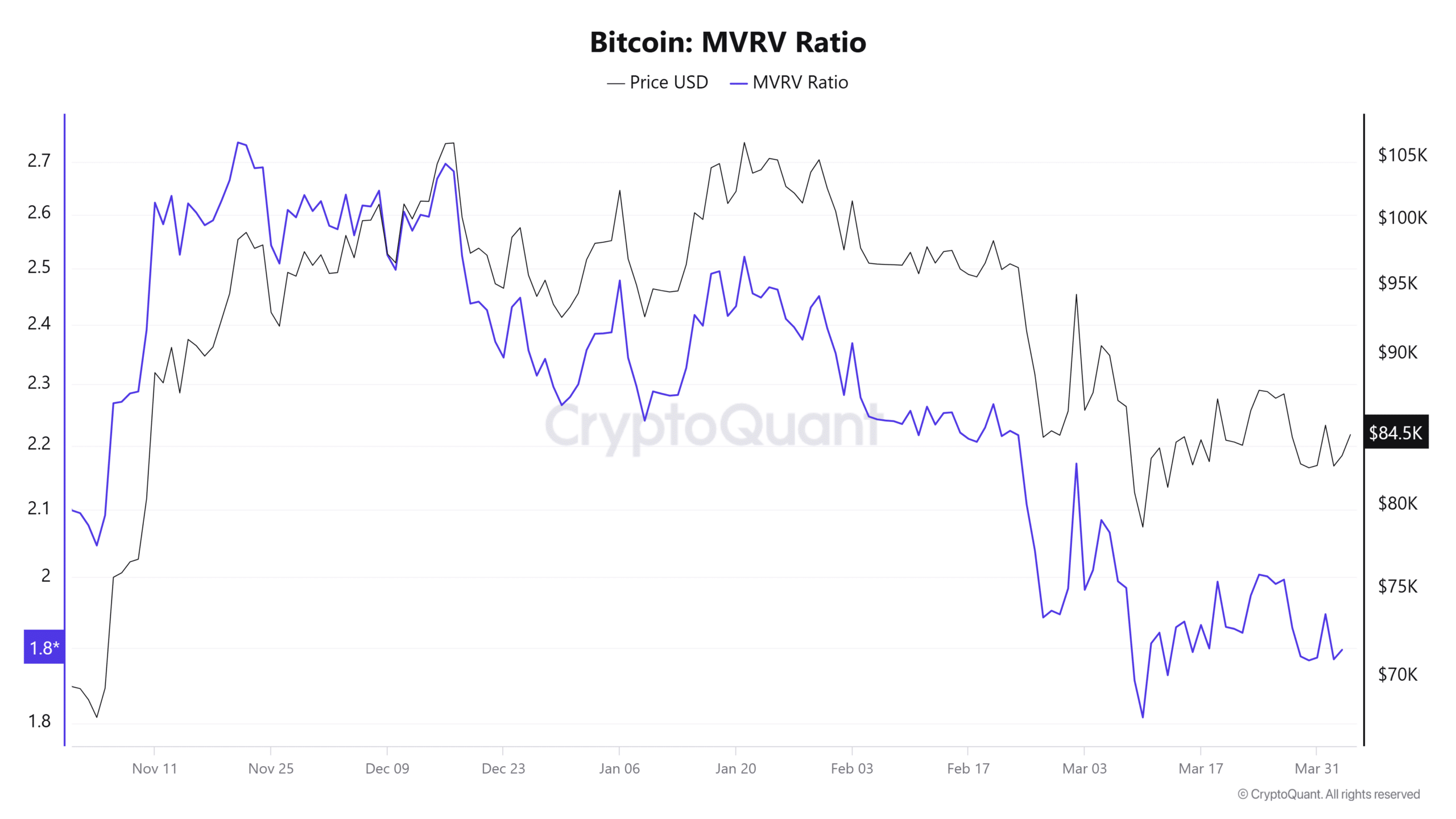

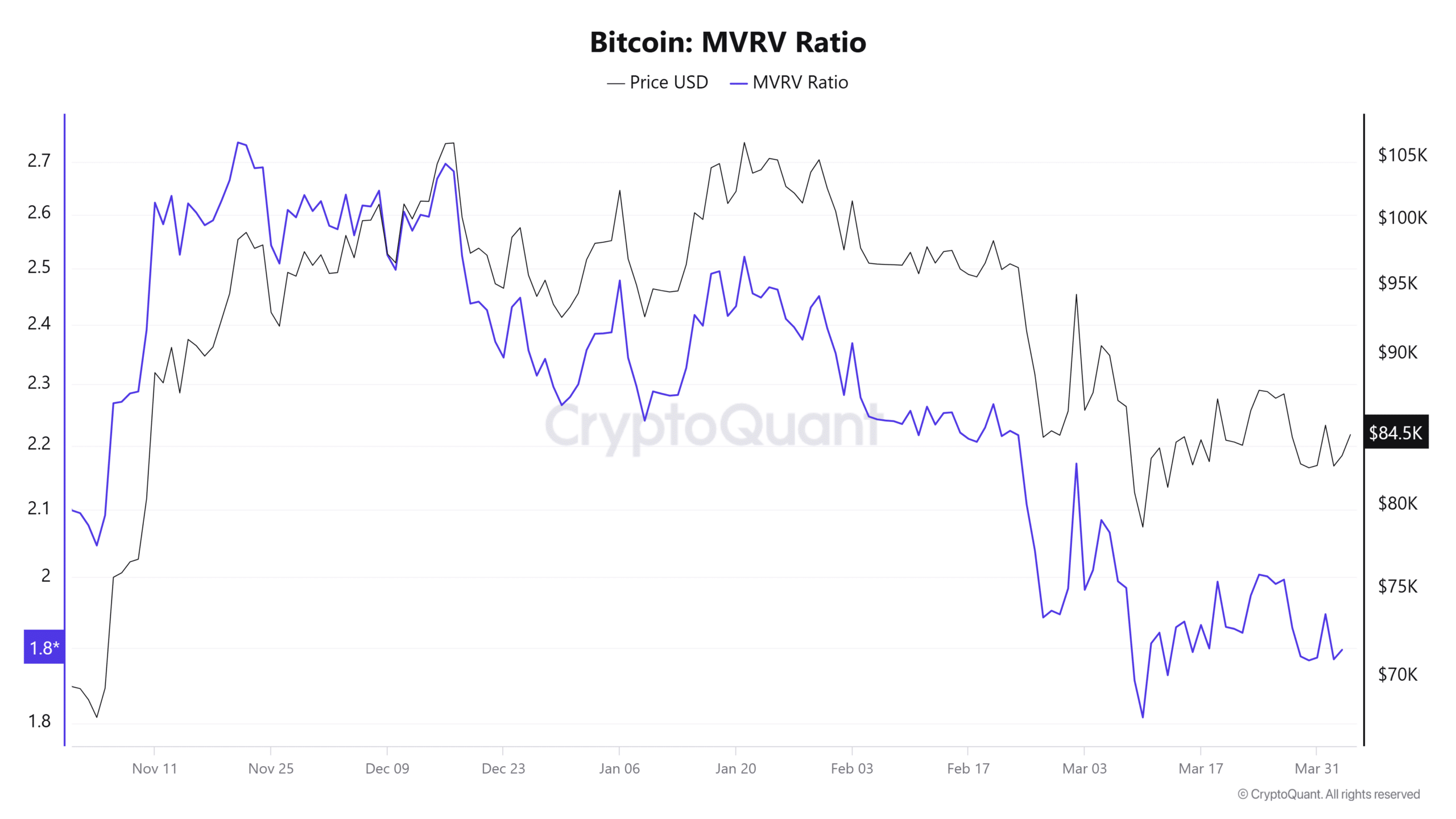

The MVRV wake-up name

One other crimson flag is the MVRV Ratio. It has fallen from 2.74 in November to beneath 2.0 in April, signaling fading hypothesis and a shift towards long-term holding.

Supply: CryptoQuant

In reality, trade netflows inform an analogous story. Outflows are extraordinarily dominating, and that, indicators that traders are shifting cash to chilly storage, not making ready to promote.

For instance, on the third of February alone, over 60,000 BTC exited exchanges. That’s one of many largest single-day outflows recorded in months.

Supply: CryptoQuant

The takeaway? Sellers usually are not essentially dashing to exit. However new patrons aren’t stepping in both.

Bitcoin’s place above $80K is fragile. If that degree breaks, a transfer to $68K might comply with as bearish indicators align.

With leverage fading and macro dangers rising post-tariff, the subsequent few days might resolve whether or not it is a short-term dip or the beginning of deeper consolidation.