XRP vs Bitcoin: Where should you park your crypto in 2025?

- XRP has emerged as a shock winner within the “Trump pump,” making HODLing a wise transfer.

- The crypto area is ever-evolving, and the battle for dominance is way from over.

If there’s one coin that’s actually capitalized on the “Trump pump,” it’s Ripple [XRP]. Lengthy-term HODLers, who endured three years of stagnation and inactivity, are lastly seeing their endurance repay.

Even with the anticipated sell-side stress as stakeholders lock in good points, the bulls have proven spectacular resilience, keeping off two pullbacks in underneath 10 buying and selling days and protecting XRP regular across the $2.50 mark.

Now, with the tables turned, XRP is eyeing its subsequent large 2025 goal. But, the journey forward isn’t with out challenges, notably as Bitcoin [BTC] holds its place because the “grasp card” within the crypto deck.

So, whereas XRP could have stolen the highlight on this cycle, the query stays: Might this be the daybreak of a brand new period for Ripple, or will Bitcoin’s gravitational pull carry it again in line?

Assessing XRP’s long-term potential compared to Bitcoin

The every day chart reveals an thrilling shift: as Bitcoin consolidated, traders redirected funds into XRP, driving every day good points close to 20% and edging it near the $3 mark. However overheated circumstances made a correction inevitable.

Simply three days in the past, XRP tumbled 15%, wiping out a lot of its election-cycle good points and hitting a $2 every day low. But, the rebound was swift and decisive.

Two key takeaways stand out: FOMO is powering bets on a $3 breakout, and people who have been as soon as underwater at the moment are sitting fairly in revenue – heightening the possibility of a short-term pullback.

But, there’s a silver lining. These fluctuations are typical within the crypto market, the place fast entries and exits are frequent.

So, what’s much more vital? XRP’s rising attraction as a “stable various” and a “safe-haven” in opposition to Bitcoin’s high-risk volatility, hinting at a possible shift that warrants deeper exploration.

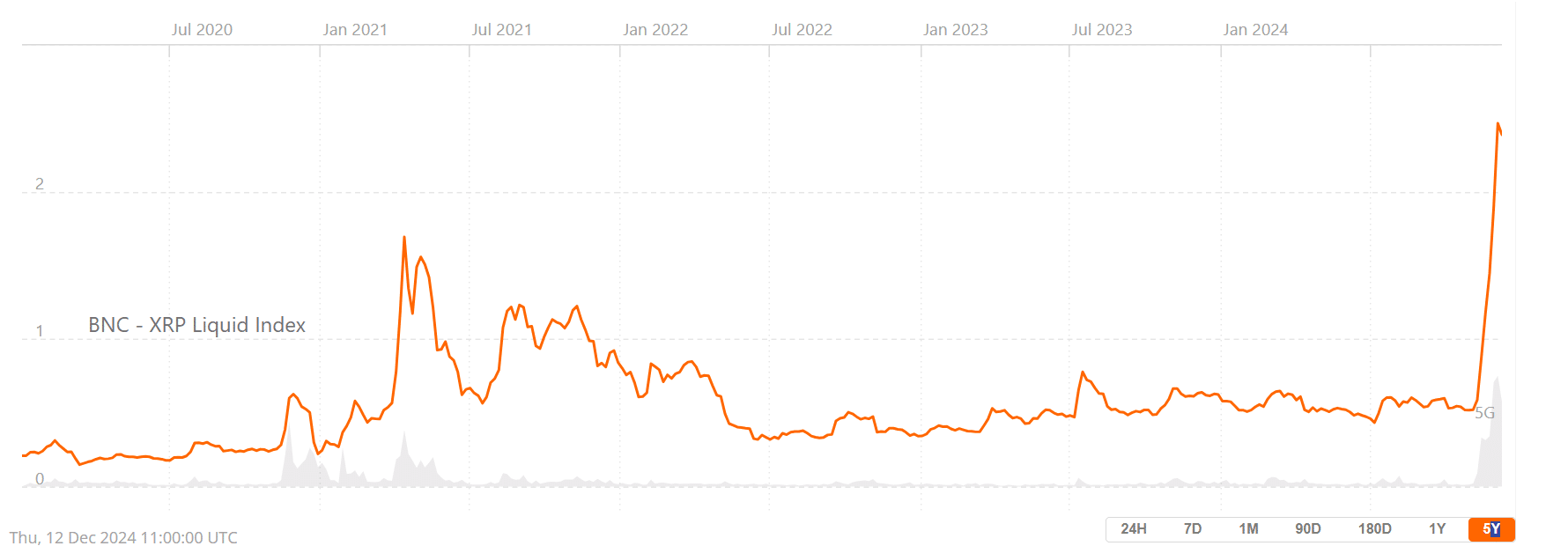

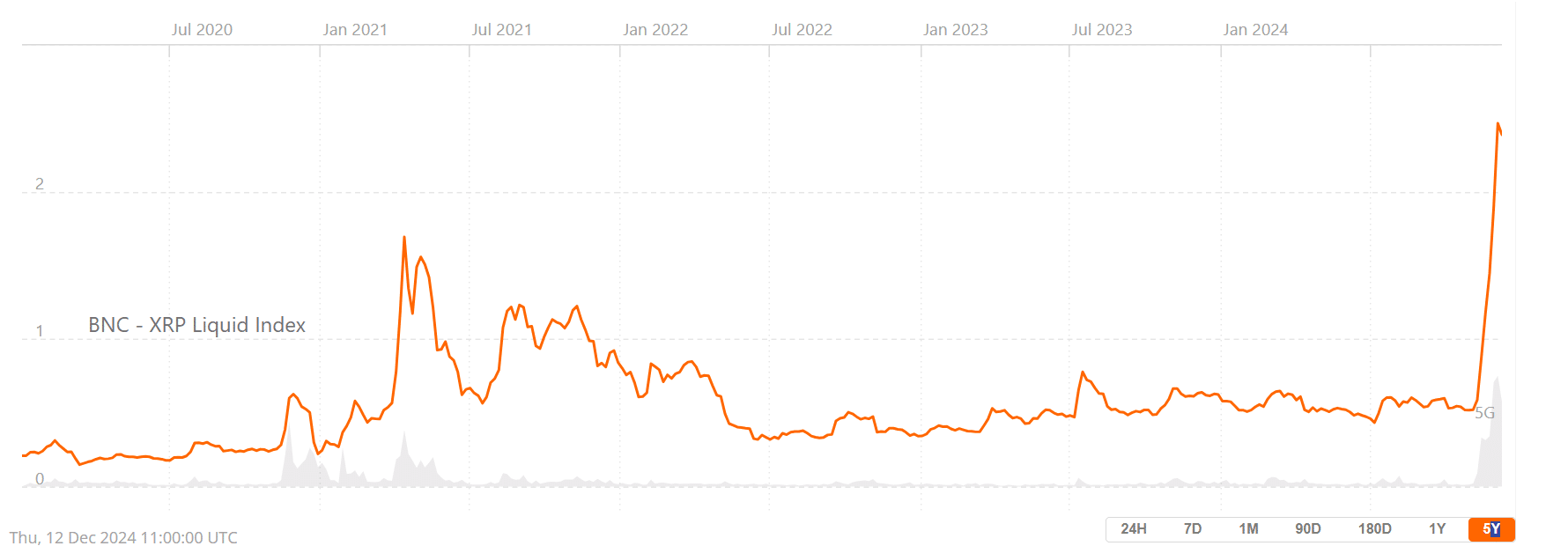

Supply : BraveNewCoin

In a wholesome market, excessive demand drives liquidity, and XRP is demonstrating this. Its liquidity index has soared to a five-year excessive, signaling a surge in demand for the token. This makes HODLing an more and more logical selection for traders.

As extra traders get entangled, 2025 may see much more capital flowing into XRP, particularly as Bitcoin’s standing as a “risk-on funding” is ready to develop.

With market makers speculating on a $200K all-time excessive for Bitcoin, XRP may gain advantage from elevated curiosity as traders search for secure alternate options.

In brief, 2025 may very well be a game-changer. This 12 months would possibly spark a surge in capital allocation and diversification, testing Bitcoin’s dominance and opening new alternatives within the altcoin marketplace for each retail and institutional traders.

However, what are the percentages of Ripple main the cost?

XRP’s breakthrough above the $2 resistance couldn’t have come at a greater time, laying the groundwork for traders to confidently wager on its future potential.

The psychology behind it’s clear—XRP’s spectacular 300% surge in only one month has catapulted it into the highlight, positioning it as a powerful contender within the crypto market.

With this highly effective rally, it’s no marvel that each retail and institutional traders are inserting XRP on the forefront of their portfolios.

Learn Ripple [XRP] Worth Prediction 2024-2025

Nevertheless, the race to say XRP’s high spot is heating up. Whereas Dogecoin [DOGE] briefly took the highlight, its reign was short-lived. Nevertheless, this doesn’t imply the throne stays unclaimed—different rivals are lurking, desperate to take their shot.

So, whereas present circumstances are favorable for Ripple and its fame as a safer wager throughout unstable instances, securing its dominance gained’t be simple.

To remain forward, XRP should preserve breaking key psychological boundaries with each bull run. Within the brief time period, reaching $3 may drive FOMO and keep momentum.

Nevertheless, for XRP to really cement its place as the highest funding in 2025, it wants to interrupt by a lot increased ranges. It must show it’s right here to remain, not simply one other passing pattern.