Bitcoin Price Eclipses $72,000: 5 Major Factors

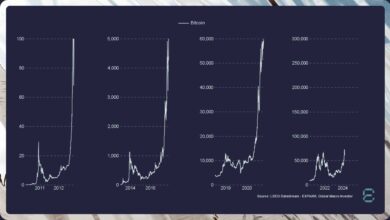

Within the early US hours of Monday, Bitcoin witnessed a major surge, with its worth climbing above the $72,000 mark. The ascent, marked by a greater than 4.5% improve inside a mere five-hour window from beneath $69,500 to an intra-day excessive of $72,579, could be attributed to a confluence of things which have stirred the crypto market.

#1 Robust Bitcoin Spot Demand

The rally seems to be fueled by sturdy demand within the Bitcoin spot market, hinting on the potential sustainability of the transfer. Crypto analyst Daan Crypto Trades (@DaanCrypto) noted the wholesome market dynamics, stating on X, “Funding charges nonetheless wanting strong. Wholesome reset, worth slowly grinding up. That’s what we would like and the way we need to hold it. If longs begin aping once more whereas spot bid stops, then that may find yourself in one other flush sooner or later. For now, all good.”

In tandem with the rising spot costs, data from Coinglass reveals that $40.7 million in BTC shorts have been liquidated right now, additional propelling the value upwards.

#2 BTC Halving

The imminence of the subsequent Bitcoin halving, slated to happen roughly 12 days any longer April 20, has additionally in all probability performed a pivotal function. Traditionally, Bitcoin has skilled a pre-halving worth retraction adopted by a major rally main into the occasion.

The halving will scale back the Bitcoin reward from roughly 900 cash per day to 450 cash. Skybridge Capital’s Anthony Scaramucci shared his insights with CNBC not too long ago, highlighting the unpriced nature of the upcoming halving and its potential to additional drive Bitcoin’s worth.

“They’re now saying that the halving is priced in. I don’t consider that. I believe Bitcoin has much more to go right here,” he said. At present costs, roughly $65 million in Bitcoin ETF inflows per day are wanted to purchase up the day by day mined provide. In 2.5 weeks, that’s solely $32.5 million.

#3 BTC Follows Gold

The correlation between Bitcoin and gold, each thought of safe-haven property, is one other issue contributing to Bitcoin’s worth motion. Gold’s sturdy opening this week, reaching a brand new all-time excessive of $2.253, has been mirrored by Bitcoin’s worth trajectory. Gold fanatic Peter Schiff and crypto analyst Michaël van de Poppe have each remarked on the optimistic correlation between the 2 property, suggesting a shared momentum amid financial uncertainties.

Gold bug Peter Schiff commented by way of X: “It’s been a risky Sunday night time for gold. After an early $27 unload, it rallied over $45, hitting a brand new report excessive above $2,348. That is an early stage of a significant repricing of gold to mirror a lot larger future inflation. It’s a warning that financial coverage is just too free.”

Crypto analyst Michaël van de Poppe remarked: “There we go. Gold opening up with a giant new upwards candle and Bitcoin is again to $71,000. Given the power on commodities and the present worth motion of Bitcoin, I believe we’ll see a check of the all-time excessive developing.”

#4 Robust Weekly Shut

The importance of Bitcoin’s weekly candle shut was highlighted by CRG, a famend analyst, who pointed to it as a contributor to the rally. The flexibility of Bitcoin’s worth to shut sustainably above its 2021 excessive for the second consecutive week alerts a robust bullish sentiment out there.

Nice weekly shut

Recent all time highs this week

Supply: my plums pic.twitter.com/wyxwomdDjZ

— CRG (@MacroCRG) April 8, 2024

#5 Hong Kong Readies For Spot ETF Launch

Lastly, the anticipation of the launch of spot Bitcoin ETFs in Hong Kong could have injected optimism into the market. Reports point out that main Chinese language asset managers, equivalent to Harvest Fund and Southern Fund, managing property value over $230 billion and $280 billion, respectively, are positioning themselves by Hong Kong subsidiaries to enter the Bitcoin ETF market, awaiting regulatory approval.

#6 Further: The “Ethena-Impact”

Ethena Labs has began buying BTC as a part of a cash-and-carry commerce to be able to create a “safer” USDe artificial greenback product for customers. The transfer is being critically noticed by the crypto neighborhood.

Ethena now holds greater than half a billion in BTC hedged throughout Binance, OKX and Deribit

Prepared for the halvening ₿ pic.twitter.com/auquK59DfY

— Seraphim (@MacroMate8) April 8, 2024

At press time, BTC traded at $72,103.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal danger.