Bitcoin Price Slips Over 5% After Hitting New All-Time High

The Bitcoin value rally cooled off within the final 24 hours, with the value dropping greater than 5% after reaching a brand new all-time excessive of $123,231. This pullback comes as many buyers determined to lock in earnings at file ranges that pushed to $116,700, when writing.

Whereas the market nonetheless seems structurally bullish, current knowledge and insights counsel a short-term consolidation is likely to be underway earlier than persevering with one other leg up.

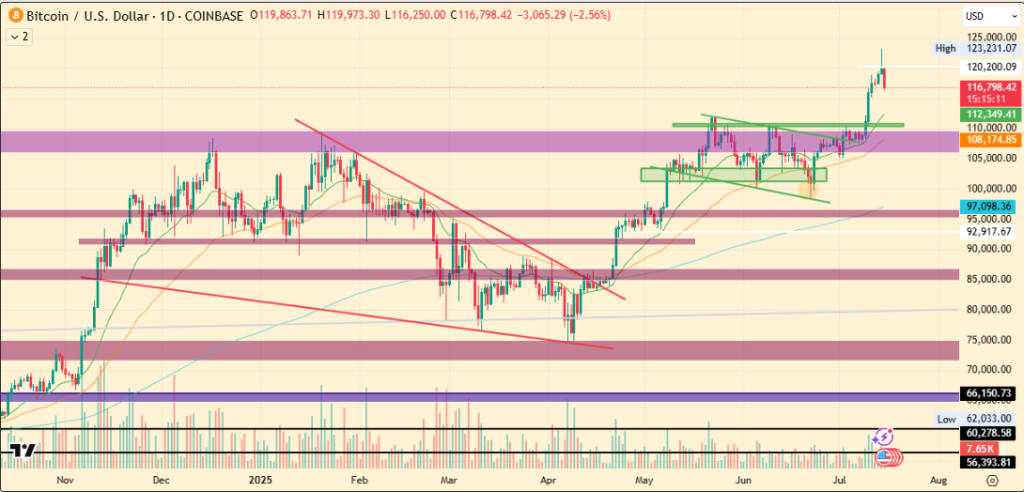

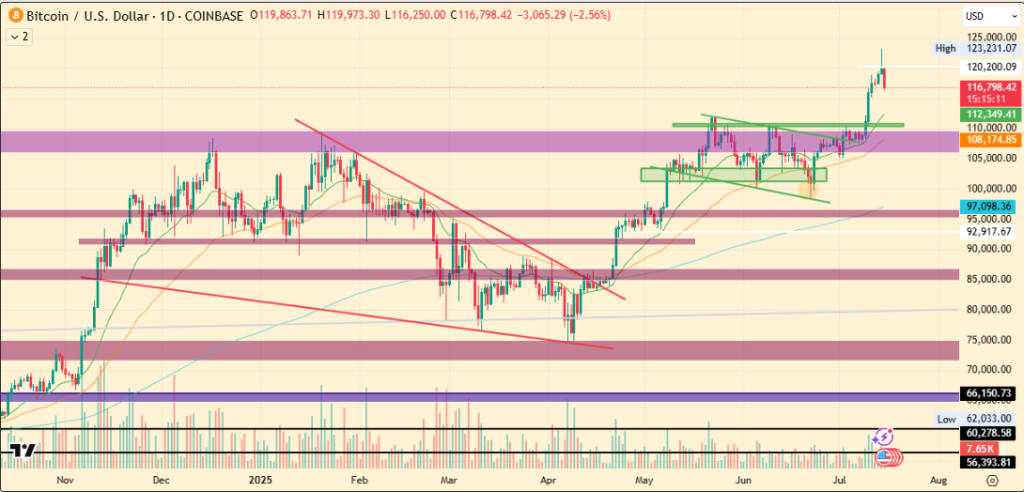

Revenue-Taking Drives Market Pullback In Bitcoin Value Chart

In response to on-chain knowledge from Glassnode, the correction strongly aligns with a major spike within the realized earnings.

In whole, buyers realized over $3.5 billion in earnings. Notably, long-term holders (LTHs) accounted for $1.96 billion, whereas short-term holders (STHs) contributed $1.54 billion.

This degree of revenue realization by LTHs suggests a maturity in market participation as a substitute of a beginner transfer. These sorts of buyers are recognized as these people or establishments who usually accumulate throughout bear phases and selectively offload throughout excessive volatility or market peaks.

The present wave of revenue reserving reveals that many LTHs noticed the $123K milestone as a strategic exit level for partial positive factors.

Key Assist at $110K Could Set off Subsequent Bounce in BTC Value

Regardless of the correction, some analysts stay constructive on Bitcoin crypto’s outlook. In response to Mister Crypto, the current decline could possibly be wholesome within the broader uptrend.

In his view, if Bitcoin value revisits the EMA ribbons, that are aligned close to the $110K degree, which can be June’s earlier excessive, it might create a really perfect bounce situation.

He additionally hinted that in sturdy bullish traits, the EMA ribbons are likely to act as dynamic assist. If Bitcoin assessments this zone and holds, it could rapidly reverse larger, probably focusing on $135K within the subsequent leg up.

Institutional Holdings Mirror Lengthy-Time period Optimism In BTC

Including to the longer-term bullish backdrop, Mister Crypto additionally highlighted that Bitcoin Treasury firms, which embody public corporations holding BTC on their stability sheets, now collectively maintain greater than half the quantity of Bitcoin presently held by all ETFs mixed.

This means that long-term institutional curiosity will not be solely rising however could also be extra influential than Bitcoin ETF flows alone.

Such holdings usually mirror strategic positioning moderately than short-term hypothesis, suggesting that enormous gamers nonetheless view Bitcoin as a viable long-term retailer of worth.