Bitcoin Price Hits Crash Line, But This Time Is Not Random

In response to a brand new technical evaluation, the Bitcoin value has returned to its “Crash Line,” fueling speak of a doable bullish turnaround. The professional behind this evaluation has instructed that this isn’t a random occasion, however a deliberate transfer that might sign the start of Bitcoin’s subsequent upward transfer.

Bitcoin Value Revisits Acquainted Crash Line

In a latest publish on X, market analyst Crypto Tice announced that Bitcoin has simply hit the Crash Line, a stage that has repeatedly acted as a important reload level throughout the present bull cycle. The analyst indicated that this trendline has traditionally led to robust value rallies for BTC. He noticed that all through the bull market, Bitcoin has persistently adopted the identical sequence every time the worth returns to the Crash Line.

Associated Studying

The method begins with momentum overheating, that means consumers push costs up too shortly, creating unsustainable upward stress. As this momentum builds, extreme leverage accumulates available in the market, adopted by a pointy correction. This value decline usually brings Bitcoin again to the Crash Line. From this level, BTC often begins gearing up for its subsequent enlargement section.

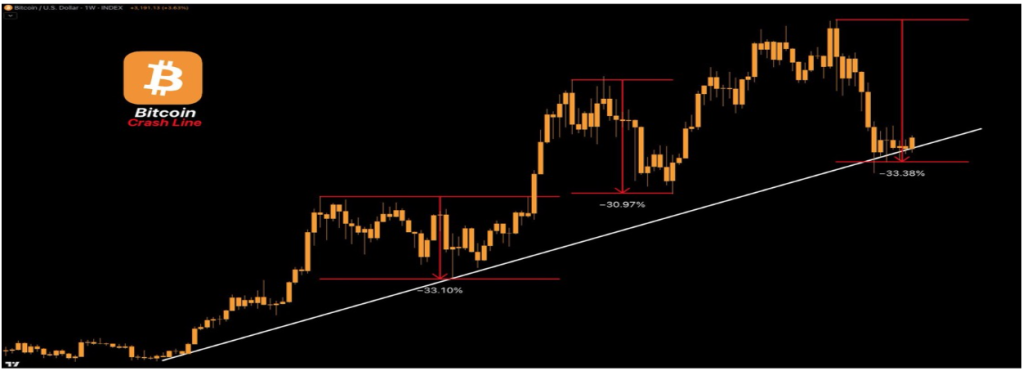

Crypto Tice shared a weekly chart illustrating this sample. Every time Bitcoin approached the Crash Line, its value corrected by about 33.10% and 30.97% earlier than shortly surging larger. Now that Bitcoin has returned to the Crash Line after a latest 33.38% drop, the analyst instructed it might comply with the identical historic pattern and launch a significant rally.

Crypto Tice additionally famous that the Crash Line has persistently marked leverage flushes, selling-pressure exhaustion, and pattern continuation zones for Bitcoin. Quite than signaling structural weak point, the analyst mentioned this trendline has acted as a transition level. He famous that if the broader construction stays intact, the Crash Line might mark the world the place Bitcoin’s upside reloads.

Analyst Predicts Subsequent Doable Strikes For Bitcoin

In a separate X publish, market professional Crypto King said that Bitcoin is at the moment “caught in a no buying and selling zone,” that means that the market nonetheless lacks a transparent path regardless of its latest rebound above $90,000. The analyst added that BTC’s liquidity and market participation are drying up, significantly as value strikes sideways and the danger of getting caught in false strikes will increase.

In consequence, Crypto King has outlined two doable eventualities for Bitcoin. If the cryptocurrency can push above $92,000 and maintain that stage, he expects it to flip from resistance into assist.

Associated Studying

Alternatively, if value fails to reclaim $92,000, the analyst predicts Bitcoin might decline once more, this time testing the Chicago Mercantile Trade (CME) hole at $88,000. The analyst has highlighted two potential demand zones on the chart: one round the CME hole and one other extending decrease between $60,000 and $50,000.

Featured picture from Unsplash, chart from TradingView