Bitcoin reclaims $107K – What’s next as 3 factors align for BTC

- Miners look like getting ready for a Bitcoin rally within the coming buying and selling classes.

- Market habits from whales and derivatives merchants additionally aligns with the continued bullish sentiment.

Bitcoin [BTC] has maintained its upward trajectory, reclaiming the $107,000 area after gaining 1.89%.

This continues its upward momentum from final week, though BTC stays in a broader corrective part, down 2.45% over the identical interval.

Miner exercise signifies a robust risk of additional upside, supported by liquidity from whales and elevated exercise within the derivatives market.

Miner exercise mirrors historic sample

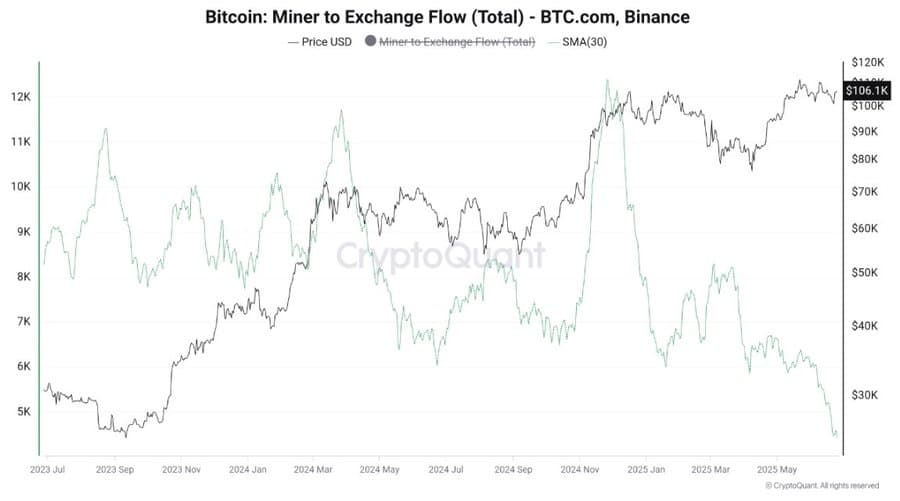

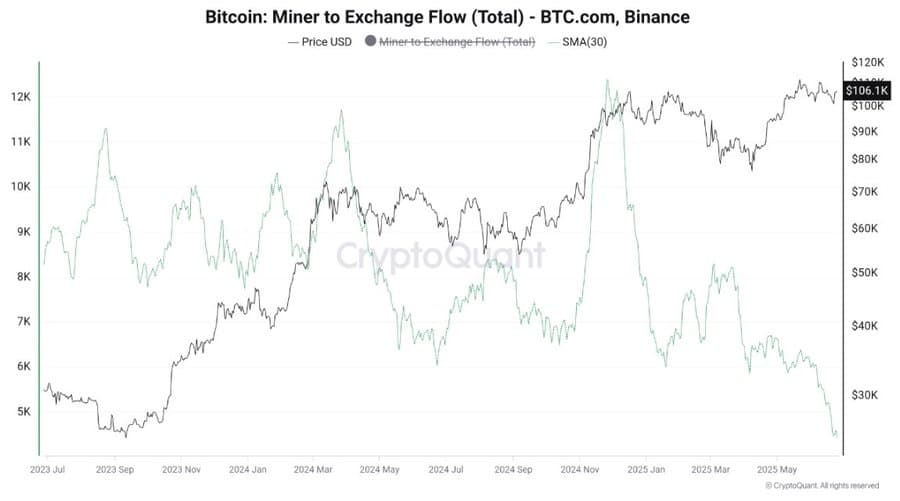

CryptoQuant’s analysis of miner habits revealed a bullish setup forming, suggesting Bitcoin could also be poised for one more rally.

In keeping with the information, BTC.com—a mining pool answerable for 98% of miners’ flows into Binance—has steadily decreased its alternate inflows over the previous month.

Supply: CryptoQuant

Traditionally, a decline in these miner inflows to Binance usually precedes a Bitcoin rally, and vice versa.

As of this writing, these inflows have decreased, indicating that miners want to carry BTC whereas anticipating a rally, solely offloading after they consider the market has peaked.

AMBCrypto additionally analyzed the general Bitcoin Miners’ Reserve and located an analogous sample.

The reserve declined from 574,678 BTC to 1.807 million BTC, suggesting that miners throughout the board are holding with a long-term outlook.

Supply: CryptoQuant

Whales and derivatives merchants in help

Whales and derivatives merchants seem to help the bullish pattern seen in miner exercise.

At press time, whale-controlled liquidity on exchanges has elevated. The Whale Alternate Ratio surged to 0.59—a comparatively excessive degree—suggesting elevated whale presence on exchanges.

Supply: CryptoQuant

Though this isn’t inherently bullish, Bitcoin’s reclaiming of the $107,000 degree implies that whales could also be shopping for.

Within the derivatives market, Funding Charges have turned constructive after two consecutive days of promoting, indicating extra lengthy contracts are open.

This shift in Funding Price is critical, confirming extra lengthy bets have been made on Bitcoin within the pat 24 hours.

Supply: CryptoQuant

If the pattern continues, it may imply derivatives merchants will be a part of whales and miners in positioning for a serious upward value motion.

On-chain exercise confirms rising momentum

Nansen knowledge reveals a surge in on-chain exercise over the previous 24 hours, reinforcing the bullish outlook. Lively addresses have risen by 21.3%, reaching 535,900, confirming elevated utilization of the Bitcoin community.

Supply: Nansen

Transaction-related gasoline charges additionally elevated, indicating increased utility of Bitcoin protocols.

Sustained excessive utilization of Bitcoin on-chain would additional strengthen the asset’s potential to proceed its upward market pattern.