Bitcoin price prediction: Assessing BTC’s odds of staying above $100K

- Mapping Bitcoin’s value prediction as BTC consolidated inside $100K-$105K after Trump’s inauguration.

- Choices merchants eyed $90K and $96K as possible ranges for potential drops.

After shaking off the early ‘disappointment’ from the Trump inauguration, Bitcoin [BTC] has defended the $100K stage. Prior to now two days, the king coin has been swinging between $100K and $105K.

With key on-chain metrics suggesting a potential breakout from the general value vary, what’s subsequent for BTC within the brief time period?

BTC extends value vary

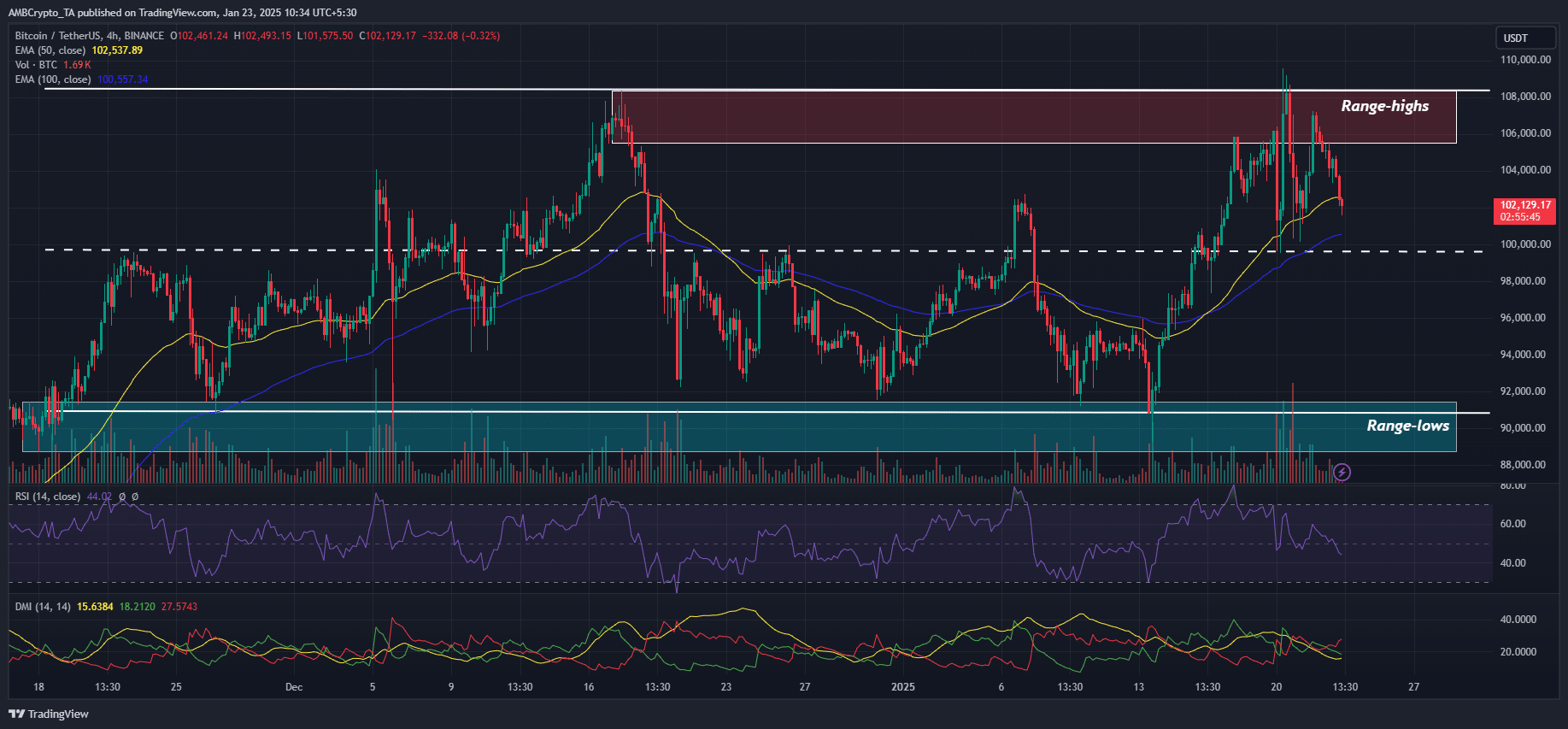

Supply: BTC/USDT, TradingView

The latest value motion was caught within the higher vary of $90K-$108K. Though bulls have beforehand used the 50-EMA (yellow) on the 4-hour chart for short-term re-entry, key chart indicators indicated elevated weakening.

For example, the Directional Motion Index (DMI), confirmed that short-term momentum has eased considerably (crimson line above inexperienced) and will embolden short-sellers.

Equally, the 4-hour RSI slipped under 50 at press time, indicating muted demand, maybe linked to warning post-inauguration.

The above bearish readings may endanger the $100K assist and mid-range. If cracked, BTC may head decrease to $96K or the range-lows at $92K.

Key BTC ranges per liquidity

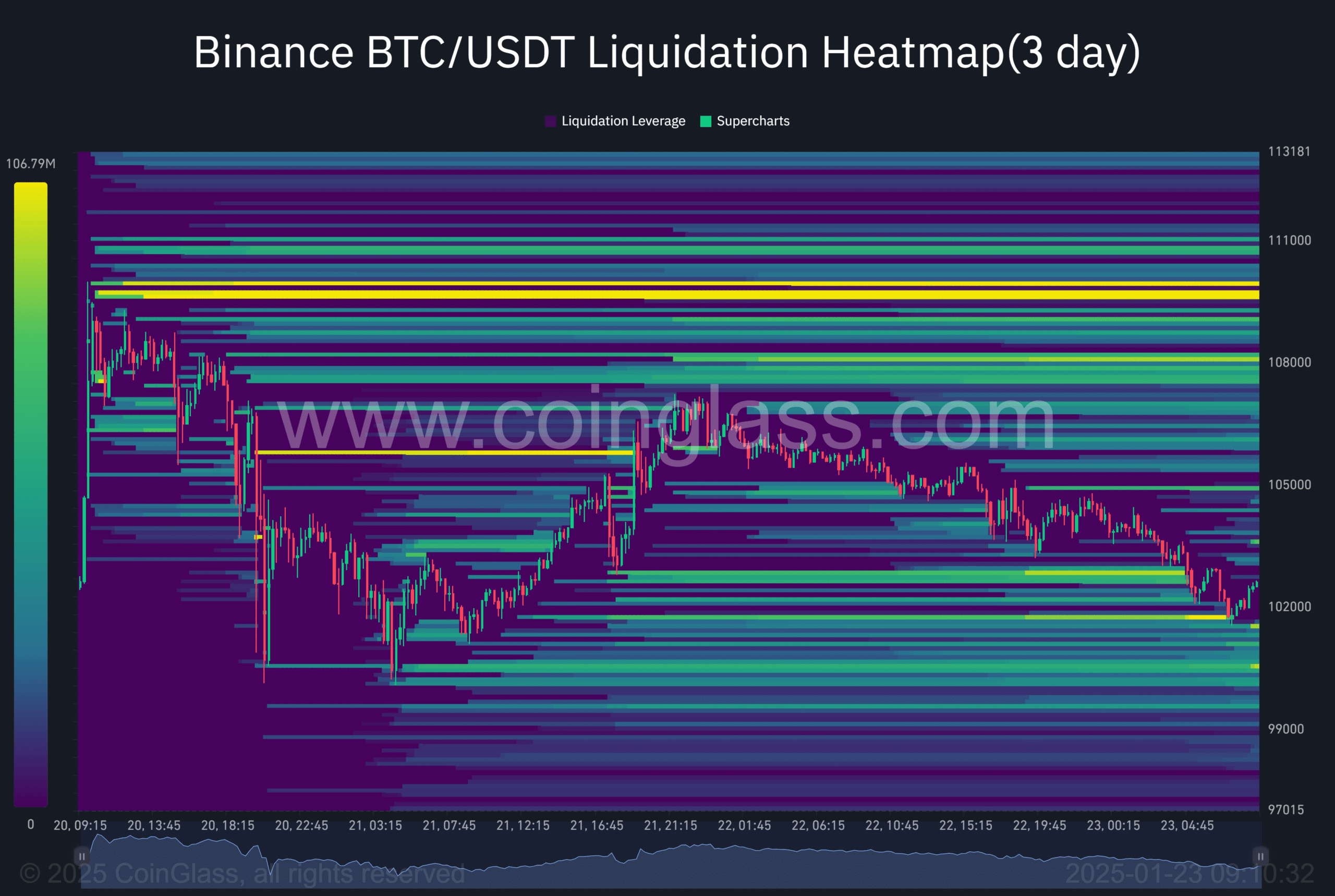

Nevertheless, the liquidation heatmap disagreed with the above outlook. At press time, there was an enormous pocket of liquidity (brilliant yellow) at $109K.

This meant a number of gamers had been shorting the asset on the latest all-time excessive. By extension, the huge liquidity may act as a value magnet and drive costs upward. If that’s the case, then $100K could possibly be defended once more.

Supply: Coinglass

That mentioned, the Futures market remained bullish regardless of cautious sentiment within the spot markets.

In keeping with the Choices buying and selling desk, QCP Capital, there have been extra bullish bets than bearish performs on the Futures facet. It stated,

“In the meantime, BTC futures proceed to development upward, particularly on the entrance finish, as market’s net-long publicity from final week stays stable. Bullish bets presently outpace bearish ones by a ratio of roughly 20:1.”

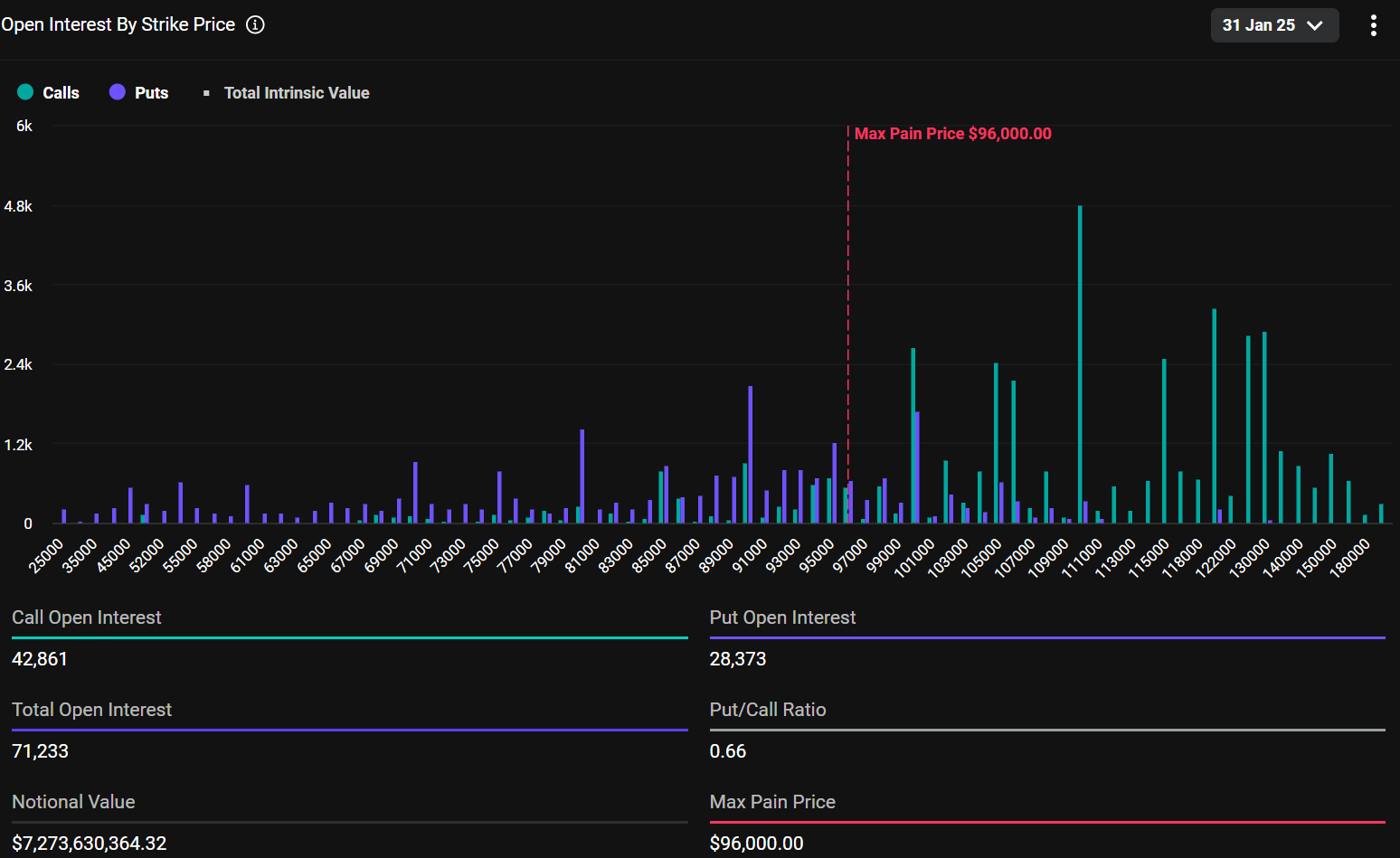

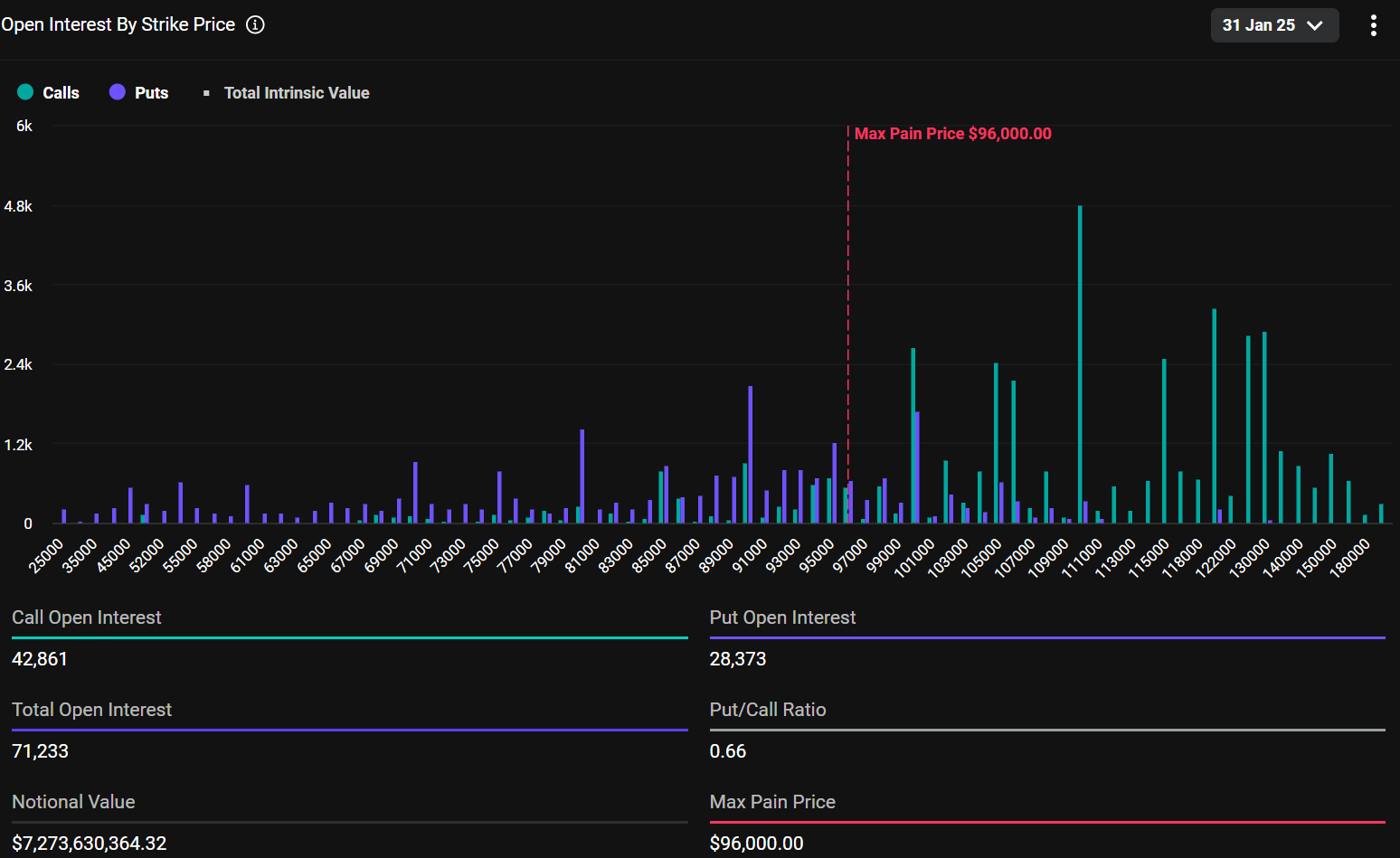

AMBCrypto checked Deribit’s subsequent key Choices’ expiry (thirty first January) for extra insights. The $110K and $120K had the very best Open Interest for calls (bullish bets), marking them as key bullish targets by the top of January.

Supply: Deribit

Learn Bitcoin [BTC] Worth Prediction 2025-2026

On the draw back, $90K (highest places, bearish bets) and the max ache level of $96K had been key ranges anticipated by Choices merchants for potential sharp drops.

Merely put, the market expects value swings inside the $90K-108K vary, with a doable deviation to $110K.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.