Top 5 Cross-Chain Bridges In Crypto

The Web3 ecosystem is swiftly evolving right into a cross-chain bridges panorama, characterised by a proliferation of decentralized functions spanning tons of of distinct blockchains and layer-2 options.

Every of those platforms operates with its distinctive method to addressing issues of safety and belief. This development is predicted to persist, pushed by the persistent problem of blockchain scalability, additional amplified by the introduction of latest blockchains, layer-2 and layer-3 options, and self-contained networks like application-specific blockchains. These tailor-made networks cater to the precise technical and financial stipulations of particular person or smaller clusters of decentralized functions.

Nevertheless, an inherent limitation persists: blockchains inherently lack the aptitude to seamlessly talk with each other. Consequently, blockchain interoperability emerges as an crucial necessity to totally harness the potential of the multi-chain ecosystem. On the coronary heart of blockchain interoperability lies the inspiration of cross-chain messaging protocols, which empower sensible contracts to each retrieve and transmit knowledge to and from different blockchains.

As a good portion of financial exercise stays compartmentalized inside remoted networks, the necessity for sturdy cross-chain interoperability options turns into more and more obvious. These options play a pivotal function in facilitating the safe and seamless motion of each knowledge and tokens throughout an interconnected community of blockchains.

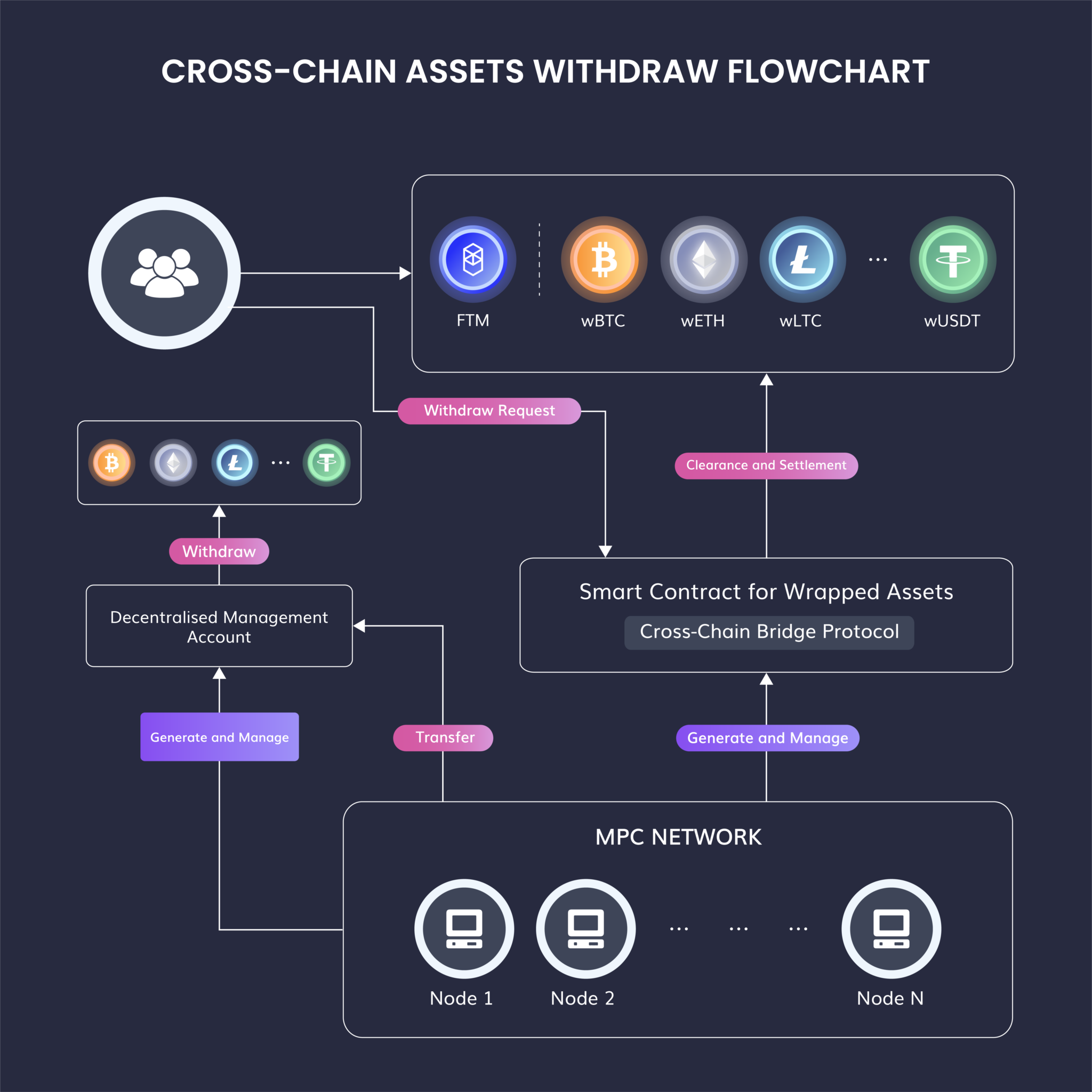

Moreover, a vital element of cross-chain interoperability is the cross-chain bridge, an infrastructure that facilitates the switch of tokens from a supply blockchain to a vacation spot blockchain.

How Do Cross-Chain Bridges Work?

The blockchain universe is getting into a brand new period of interconnectedness, because of the outstanding innovation of cross-chain bridges. These decentralized functions have taken middle stage by enabling the seamless switch of belongings from one blockchain to a different. In doing so, they considerably improve the utility of tokens, forging cross-chain liquidity connections between distinct blockchains. The mechanics of a typical cross-chain bridge contain locking or burning tokens on the supply chain by means of a wise contract and subsequently unlocking or minting tokens by means of one other sensible contract on the vacation spot chain.

Token bridges, usually underpinned by a particular cross-chain messaging protocol, are designed for a single, exact goal: the motion of tokens between completely different blockchains. In essence, a cross-chain bridge represents a narrowly centered software of a cross-chain messaging protocol, steadily serving as an application-specific hyperlink between two blockchains. Nevertheless, the flexibility of those bridges extends past the fundamentals, enabling extra in depth cross-chain performance that goes past mere token switch.

Cross-chain bridges function a cornerstone for an array of functions, every amplifying the utility of blockchain expertise:

- Cross-Chain Decentralized Exchanges (DEXs): By using cross-chain bridges, DEXs are in a position to facilitate the change of belongings between completely different blockchains, considerably increasing the liquidity and buying and selling choices out there to customers.

- Cross-Chain Cash Markets: These bridges empower the creation of cross-chain lending and borrowing platforms, offering customers with an avenue to maximise their belongings’ potential.

- Generalized Cross-Chain Performance: In some cases, cross-chain bridges play a pivotal function in providing extra expansive and generalized cross-chain performance. This consists of the power to facilitate a variety of functions that span a number of blockchains.

Because the crypto panorama matures and the demand for interoperability surges, cross-chain bridges emerge as an important resolution to appreciate the total potential of blockchain expertise. By enabling the fluid switch of belongings throughout blockchains, they gas the expansion of decentralized finance (DeFi) and Web3 ecosystems. Furthermore, cross-chain bridges supply customers enhanced flexibility and alternatives for diversifying their investments.

Varieties of Cross-Chain Bridges

Cross-chain bridges are the spine of the evolving multi-chain ecosystem, serving as conduits for tokens and knowledge to traverse between disparate blockchains. These bridges are powered by three essential mechanisms, every with its distinctive traits:

1. Lock and Mint Mechanism: On this method, a person locks tokens in a wise contract on the supply chain, and wrapped variations of those locked tokens are minted on the vacation spot chain, resembling IOUs. To reverse the method, the wrapped tokens on the vacation spot chain are burned, unlocking the unique cash on the supply chain. This mechanism presents bidirectional token switch with flexibility.

2. Burn and Mint Mechanism: Customers provoke this mechanism by burning tokens on the supply chain, that are then re-issued (minted) on the vacation spot chain as native tokens. It simplifies the method by making certain that tokens are persistently native to the vacation spot chain.

3. Lock and Unlock Mechanism: Right here, customers lock tokens on the supply chain and subsequently unlock the identical native tokens from a liquidity pool on the vacation spot chain. Cross-chain bridges of this kind usually entice liquidity on each ends by means of financial incentives, equivalent to income sharing.

Furthermore, cross-chain bridges can prolong their capabilities to incorporate arbitrary knowledge messaging. This entails the switch of not solely tokens however any type of knowledge between blockchains. These programmable token bridges merge token bridging with arbitrary messaging, executing a wise contract name on the vacation spot chain as soon as tokens arrive at their vacation spot.

Programmable token bridges introduce enhanced cross-chain performance. They allow actions equivalent to swapping, lending, staking, or depositing tokens into a wise contract on the vacation spot chain throughout the identical transaction because the bridging operation. This effectivity opens the door to a mess of subtle use instances within the multi-chain panorama.

One other side of cross-chain bridges worthy of examination is their place on the trust-minimization spectrum. The diploma of trust-minimization corresponds with the extent of computational expense, flexibility, and generalizability. Options positioned additional alongside this spectrum are characterised by stronger trust-minimization ensures, which come at the price of lowered flexibility and generality. These trade-offs are purposefully made to accommodate use instances that demand the utmost trust-minimization assurances, reinforcing the bridge’s reliability and safety.

Why Cross-Chain Bridges Are Obligatory in Web3?

The Web3 ecosystem is flourishing with innovation, brimming with decentralized functions (DApps) unfold throughout an array of various blockchains and layer-2 options. But, an underlying problem persists – these blockchains don’t natively converse with one another. Every chain operates inside its self-contained area, adhering to its distinctive guidelines governing protocol design, foreign money, programming language, governance construction, tradition, and numerous different elements. This individuality leads to a major communication barrier between chains, limiting their capability to work together and coalesce. In essence, the present state of inter-blockchain communication usually resembles remoted economies working independently, with minimal connectivity between them.

The urgent want for cross-chain bridges will be greatest illustrated by means of a easy analogy. Think about these blockchains as separate continents, every endowed with distinct strengths and assets. Continent A boasts bountiful pure assets, Continent B possesses fertile lands for agriculture, whereas Continent C thrives with a booming manufacturing trade and expert artisans.

In a world the place these continents can effectively join and share their strengths, a affluent world neighborhood emerges. Nevertheless, with out the means to bridge their distinct economies by means of transport, bridges, tunnels, or different infrastructure, these areas stay remoted. Continent A lacks entry to meals, Continent B fails to optimize its meals manufacturing, and Continent C stays incapable of producing top-tier merchandise. The result’s a suboptimal state of affairs.

But, think about the choice—a world the place these economies are interconnected, the place every area focuses on its distinctive competency whereas benefiting from the collective wealth and innovation of the whole world by means of commerce. That is exactly the imaginative and prescient of blockchain interoperability, the development of cross-chain bridges, and the creation of interconnected economies throughout the Web3 ecosystem.

The challenges of blockchain interoperability prolong past technological intricacies. They embody the conclusion of a world the place knowledge, worth, and belongings can fluidly traverse the various blockchain networks. The event of safe, environment friendly, and scalable cross-chain messaging protocols and bridges is important to this imaginative and prescient.

To information customers by means of the intricate terrain of cross-chain, we’ve curated a listing of the Prime 5 crypto bridges price exploring. Our choice standards embody elements equivalent to bridge safety, community compatibility, liquidity, charge dynamics, and the general user-centric expertise.

1. LayerZero ($ZRO)

LayerZero is engineered to streamline the event of decentralized functions (dApps) throughout various blockchains, unraveling complexities and facilitating seamless data change whereas upholding paramount safety requirements for each customers and dApps.

A Glimpse into LayerZero’s Key Options:

1. Dex Crosschain: With LayerZero, dApps have the capability to effectively conduct decentralized exchanges (Dex) throughout a number of blockchains. This characteristic opens up a world of alternatives for customers and builders, as belongings will be freely and securely traded throughout numerous blockchain networks.

2. Unlock Liquidity: LayerZero doesn’t simply allow cross-chain transactions; it unlocks liquidity throughout the decentralized panorama. Customers and dApps can seamlessly entry and make the most of liquidity swimming pools from completely different blockchains, bolstering the effectivity and fluidity of the broader DeFi ecosystem.

3. Multichain Lending and Borrowing: Considered one of LayerZero’s standout capabilities is its assist for multichain lending and borrowing. Because of this customers can entry a broad spectrum of lending and borrowing providers throughout numerous blockchains, eliminating the normal boundaries that always prohibit DeFi operations.

4. Derivatives for Each Asset: LayerZero empowers dApps to create derivatives for nearly any asset. This flexibility transcends conventional limitations, making it doable to tokenize and commerce derivatives of a variety of belongings, from cryptocurrencies to real-world commodities.

5. Transaction Optimization: LayerZero’s structure is designed to optimize transactions, minimizing latency and enhancing the effectivity of information transfers throughout blockchains. This ensures that customers expertise easy and swift interactions whereas having fun with the advantages of cross-chain performance.

6. Decide State: Within the multifaceted world of blockchain expertise, figuring out the state of varied belongings and networks is paramount. LayerZero gives dApps with the instruments to effectively monitor and handle the state of belongings and functions throughout a number of blockchains, thereby making certain sturdy safety and seamless operations.

LayerZero’s introduction marks a major leap ahead within the growth of decentralized functions, breaking down boundaries and streamlining the interactions between completely different blockchains. The protocol’s options, starting from Dex Crosschain to transaction optimization, supply customers and builders a complete toolkit for making a extra linked and versatile decentralized ecosystem. By enabling the environment friendly change of data and worth throughout a community of blockchains, LayerZero is ready to usher in a brand new period of DeFi, unleashing untapped prospects and fostering the expansion of the blockchain panorama.

2. Composable Finance ($LAYR)

Composable Finance stands because the foundational layer that acts as a bridge connecting Layer 1 (L1) and Layer 2 (L2) networks. But it surely doesn’t cease there—Composable Finance just isn’t solely increasing Inter-Blockchain Communication (IBC) capabilities to different ecosystems however can be pushing the boundaries of trust-minimized interoperability. This revolutionary platform is abstracting the cross-chain expertise for customers, enabling the seamless, chain-agnostic execution of person intentions.

1. Composable Cross-chain Digital Machine (Composable XCVM): On the coronary heart of Composable Finance’s capabilities is the Composable XCVM, a technological marvel that facilitates trust-minimized cross-chain execution. It empowers customers to work together with numerous blockchains, whether or not they reside in Layer 1 or Layer 2. This breakthrough expertise ensures that person intentions are executed seamlessly, whatever the blockchain’s origin. It transforms the best way customers expertise and work together with the blockchain, eliminating the complexities historically related to cross-chain transactions.

2. Routing Layer: The Routing Layer is an integral element of Composable Finance’s infrastructure, answerable for facilitating the seamless circulation of information and belongings throughout completely different blockchains. It optimizes the routing course of, making certain that cross-chain transactions happen with effectivity and velocity. This characteristic is paramount within the Composable Finance structure, because it lays the inspiration for the platform’s means to summary the complexities of cross-chain execution.

3. Mosaic: Mosaic is an idea intrinsic to Composable Finance, representing the distinctive interaction of interoperability and composable components throughout the platform. Mosaic not solely simplifies the cross-chain expertise for customers but in addition enriches it by enabling the environment friendly mixture of various blockchain assets and providers. This amalgamation of capabilities permits customers to harness the total potential of blockchain applied sciences, breaking down silos and fostering a extra interconnected and versatile ecosystem.

4. Parachain: Parachains are a vital characteristic of Composable Finance, serving because the gateways that allow entry to a big selection of blockchains. Parachains successfully broaden the platform’s attain, connecting it to completely different ecosystems and networks. This extension of functionality opens up a world of prospects for customers and builders, permitting them to discover and profit from the in depth array of providers and assets out there throughout numerous blockchains.

Composable Finance’s relentless pursuit of trust-minimized interoperability is paving the best way for a extra linked and inclusive blockchain ecosystem. Because the platform abstracts the complexities of cross-chain transactions and fosters seamless execution, customers and builders are offered with a world of alternatives to harness the total potential of blockchain applied sciences.

3. Biconomy ($BICO)

Biconomy emerges as a transformative power, providing a multi-chain transaction infrastructure that simplifies and democratizes the Net 3.0 expertise. By means of Biconomy’s intuitive plug & play APIs, it turns into easy for anybody, no matter their cryptocurrency information and experience, to entry decentralized functions (dApps). Biconomy stands as an answer to many blockchain challenges, introducing options like gasless transactions, immediate cross-chain transfers, and versatile gasoline charge fee choices, empowering customers to have interaction with the decentralized world with ease.

- Modular Sensible Accounts: Biconomy’s modular sensible accounts are a game-changer. They facilitate seamless, gas-efficient transactions by permitting customers to create sensible contracts with adjustable parameters. This characteristic opens up a world of prospects for builders and customers alike, making it simpler to customise transactions to swimsuit their distinctive wants.

- Paymasters Service: Biconomy’s Paymasters service introduces a novel method to gasoline charges. Customers can delegate the accountability of paying gasoline charges to a 3rd get together, streamlining the transaction course of and making certain a smoother person expertise. It considerably reduces the friction related to dealing with gasoline prices whereas participating with dApps.

- Bundler Service: The Bundler service is one other pioneering characteristic supplied by Biconomy. It optimizes gasoline consumption by bundling a number of transactions right into a single bundle. This not solely lowers the general gasoline charges but in addition enhances the effectivity of the transaction course of. It’s a win-win for each customers and builders, who can present a cheaper expertise for his or her prospects.

- Gasless SDK (EOA): Biconomy simplifies the method of interacting with decentralized functions by providing a gasless SDK. This permits customers to have interaction with dApps while not having to handle gasoline funds, making the expertise extra user-friendly and interesting to a broader viewers.

Biconomy’s revolutionary method addresses the real-world boundaries which have, at occasions, hindered the adoption of Net 3.0 applied sciences. By providing a user-centric infrastructure with a give attention to accessibility, lowered friction, and cost-effectiveness, Biconomy performs an important function in advancing the Net 3.0 ecosystem. It opens the doorways for a extra inclusive and seamless future in decentralized functions, making certain that anybody, no matter their cryptocurrency background, can take part within the thrilling world of Net 3.0.

4. Celer Community ($CELR)

Celer is a blockchain interoperability protocol enabling a one-click person expertise accessing tokens, DeFi, GameFi, NFTs, governance, and extra throughout a number of chains.

Celer presents itself as a blockchain interoperability protocol that streamlines the person expertise, providing one-click entry to various functionalities spanning throughout chains. It’s a world the place builders can assemble inter-chain-native dApps effortlessly, capitalizing on environment friendly liquidity utilization, coherent software logic, and shared states. In the meantime, customers of Celer-enabled dApps are set to revel within the various, multi-blockchain ecosystem, all throughout the simplicity of a single-transaction person expertise, effortlessly accessible from a single chain.

Celer’s Key Options

- State Guardian Community (SGN): On the core of Celer’s infrastructure lies the State Guardian Community (SGN). This element performs a pivotal function in making certain the safety and reliability of cross-chain transactions. By serving because the guardian of essential states throughout a number of chains, the SGN presents sturdy safety and belief, essential for profitable multi-chain operations.

- Layer2.finance: Celer’s Layer2.finance element is designed to streamline the monetary elements of the multi-chain ecosystem. It optimizes the monetary workflows throughout chains, providing a seamless and environment friendly means for customers to handle and transact with numerous belongings. This revolutionary method considerably enhances the person expertise.

- CelerX: CelerX serves because the gateway to an immersive gaming and leisure expertise. It leverages Celer’s blockchain interoperability to create a unified gaming ecosystem the place customers can entry a big selection of GameFi and NFTs throughout a number of chains. That is an thrilling growth for the gaming and leisure trade, making a seamless and interactive house for customers and builders alike.

- Cbridge: Celer’s Cbridge acts because the bridge that facilitates easy and safe communication between various chains. This bridge performs a pivotal function in making certain that knowledge and belongings circulation effortlessly and safely throughout the multi-chain setting, making it a vital element for the success of Celer’s blockchain interoperability imaginative and prescient.

Celer’s blockchain interoperability protocol is poised to alter the panorama of decentralized applied sciences. It empowers builders to construct and innovate inside a seamless multi-chain setting, offering customers with a unified and user-friendly expertise. As Celer continues to evolve and broaden its attain, it holds the promise of fostering a extra built-in and linked blockchain ecosystem, the place the potential of various chains will be harnessed with ease and effectivity.

5. Throughout Protocol

Throughout is an interoperability resolution powered by intents. Intents is proving to be a profitable resolution within the bridging house as Throughout tends to dominate the routes it helps, as it’s steadily in a position to present the most affordable and quickest bridge choice. Throughout, secured by UMA’s optimistic oracle, units itself other than its opponents with its intents-based infrastructure and by completely transferring canonical or real belongings cross-chain, prioritizing person safety. At the moment, Throughout is main the trade in every day bridge quantity due to its aggressive charges and speeds and a protracted observe file of person security.

The Throughout Benefit: Highest Speeds, Lowest Charges

At its launch in 2021, Throughout devoted itself to optimizing its bridging framework for capital effectivity, theorizing that probably the most capital environment friendly bridge would finally win. Whereas many bridges have adopted messaging or lock and mint designs for his or her cross-chain resolution, Throughout was the primary to pioneer the intents mannequin, which makes use of a third-party filler community to execute bridge transfers. These third-party relayers or fillers ship bridge customers funds on the vacation spot chain, utilizing their very own capital, and wait to get repaid with the person’s authentic funds by way of the chain’s official bridge. This design permits transfers to occur extraordinarily shortly, at a less expensive charge than sending a cross-chain message and rather more securely than lock and mint bridges which ship consultant, artificial belongings to customers on the vacation spot chain.

Key Options of Throughout Protocol

- Throughout Bridge: Throughout is quoted within the prime 2 outcomes on bridge aggregators upwards of 90% of the time, on its supported routes. Its distinctive design makes it the most affordable and quickest bridge in manufacturing, and boasts a zero slippage mannequin.

- Throughout+: Though Throughout is legendary for its bridge, the protocol understands that ultimately bridging must go away, as in, it must be abstracted to the background. Throughout+ is the protocol’s chain abstraction device which permits protocol to bundle bridge + motion(s) into their dapp, permitting them to tug capital cross-chain to their platforms. This product was constructed to assist L2-native protocols with person and capital onboarding by eradicating the bridging hurdle from the equation.

- Throughout Settlement: As our ecosystem continues to disconnect on account of the emergence of 100’s of rollups, liquidity is extra fragmented and cross-chain interoperability turns into extra essential. Throughout Settlement is ready to present greatest execution cross-chain settlement with its modular, intents-based infrastructure. Messages are verified in bundles, and execution occurs optimistically by a third-party set of fillers. These elements lead to sooner, cost-effective cross-chain transfers, take away belief assumptions and supply a Web2-grade UX.

Extra just lately, Throughout teamed up with Uniswap Labs to announce their proposed normal for cross-chain intents, ERC-7683. This normal proposes that intent-based protocols use a unified order system, so {that a} common filler community can be utilized to execute intents. If broadly adopted, this unification would lead to finish customers having fun with decrease bridge prices and an improved UX, to say a couple of. Because the multichain economic system continues to evolve, intents-based settlement is the important thing to fixing interoperability and Throughout is on the core of its execution.

Conclusion

Because the cross-chain ecosystem continues to evolve, the significance of choosing a cheap and reliable bridge can’t be overstated, because it performs a pivotal function in making certain easy asset transfers between various blockchain networks. Our in-depth evaluation highlights the importance of selecting reliable, audited, and user-centric platforms, equivalent to Throughout Protocol, Stargate Finance, and Orbiter Finance, to call a couple of.

These platforms not solely assure safe and economical bridging but in addition contribute to the creation of a extra built-in and environment friendly blockchain infrastructure. Whether or not you might be navigating the realms of Layer 1, Layer 2, or exploring bridging options for each EVM and non-EVM environments, our curated choice of bridges serves as a strong start line for making well-informed selections in your cross-chain journey.

DISCLAIMER: The knowledge on this web site is supplied as common market commentary and doesn’t represent funding recommendation. We encourage you to do your individual analysis earlier than investing.