Bitcoin Price Struggles With Liquidity Blocks From $86,000 To $104,000, Analyst Reveals The Logical Thing To Do

Este artículo también está disponible en español.

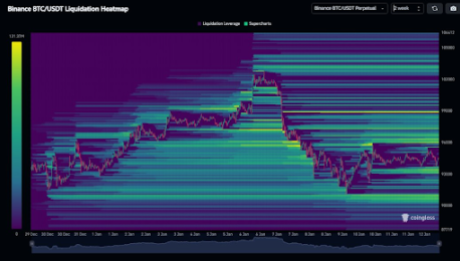

The Bitcoin worth has spent the vast majority of the previous seven days consolidating across the $94,000 mark with indicators of a break to both facet. In line with a crypto analyst, Bitcoin’s current worth actions have led to the creation of liquidity blocks noticed between the $86,000 to $104,000 vary, which raises an equal probability of a bounce in the direction of $104,000 or a draw back break to $86,000 from the present worth.

Huge Liquidity Blocks In Each Instructions

Bitcoin’s current worth consolidation has given little to no concept of what to anticipate from right here, with the liquidation heatmap additionally relaying the identical pattern. As highlighted by crypto analyst Kevin (@Kev_Capital_TA), Bitcoin’s liquidation heatmap relays huge liquidation blocks from $86,000 to $90,000, all the best way to $104,000.

Associated Studying

In line with the analyst, these huge liquidation blocks increase the likelihood that the Bitcoin worth would proceed to brush between these ranges and create an up-and-down motion between $86,000 up till $104,000 until the top of the month. Nonetheless, a break to $86,000 might have a devastating impact on the Bitcoin worth. The Bitcoin UTXO Realized Value Distribution (URPD) ATH-Partitioned exhibits a $12,000 assist void under this worth level. Due to this fact, a decline to $86,000 opens up the potential for an additional crash to $75,000.

BItcoin’s worth motion is prone to proceed shifting within the $86,000 up till $104,000 buying and selling vary and a bullish case will solely emerge if Bitcoin ultimately breaks above $108,000. This stage is essential as a result of it serves as Bitcoin’s present worth peak. A breakout past $108,000 would translate to new all-time highs for the main cryptocurrency and will pave the best way for a extra sustained bullish pattern.

The analyst additionally emphasizes the significance of monitoring USDT dominance, which at present stands at 3.7%. Kevin argues {that a} clear breakdown of USDT dominance is a mandatory sign for a extra secure and bullish market surroundings. A consequence of the much less USDT dominance is that buyers are changing their stablecoins into Bitcoin and different cryptocurrencies.

Logical Strategy To The Liquidation Blocks

Kevin famous that the logical method could be to keep watch over the market throughout these predicted up-and-down uneven actions. This method is much more sensible for merchants who’re extra concerned in current trades and present worth motion.

Associated Studying

Alternatively, merchants who’ve been holding because the bear market lows might discover it simpler to climate the present volatility, on condition that the broader bullish outlook tasks additional worth will increase all through 2025.

On the time of writing, Bitcoin is buying and selling at $94,050 and is down by 0.5% and 5.46%, respectively, previously 24 hours.

Featured picture created with Dall.E, chart from Tradingview.com