Bitcoin’s market mood shifts – Is BTC heading for a breakout or fakeout?

- Bitcoin CMI rebound to 0.6 suggests early upside as sentiment and valuation metrics enhance.

- Extreme quick positioning may gas volatility if accumulation positive aspects momentum.

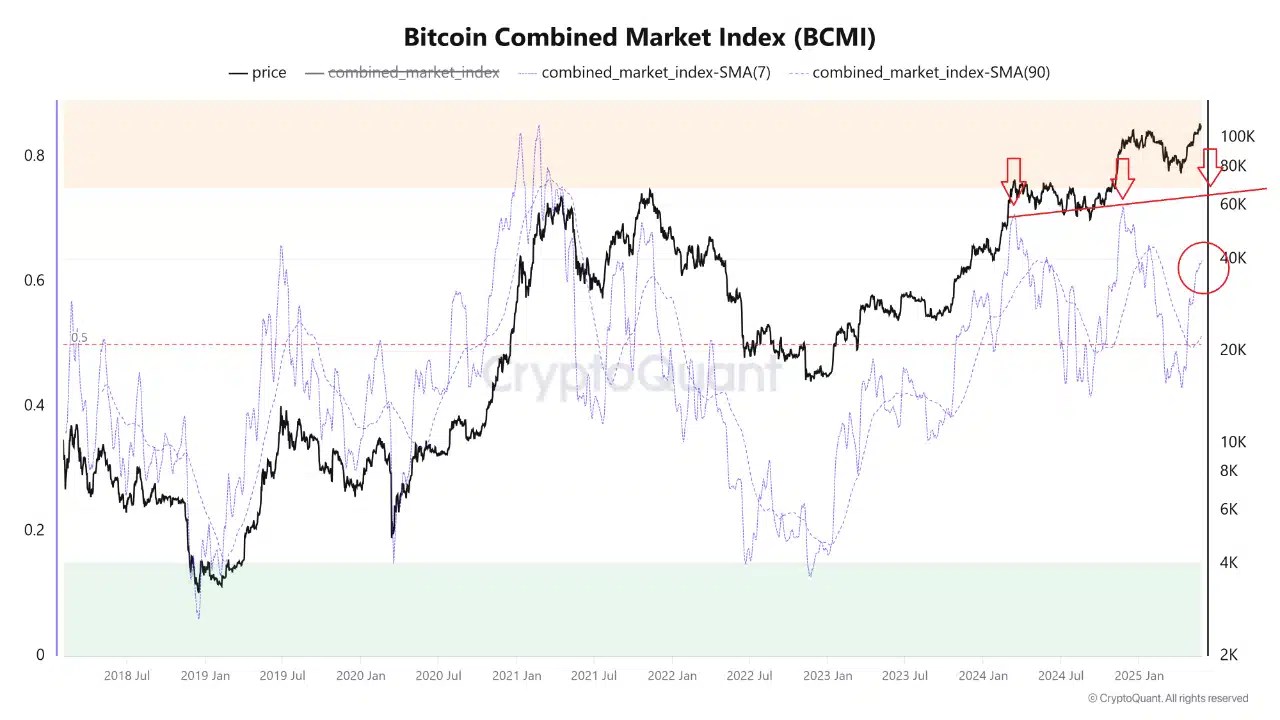

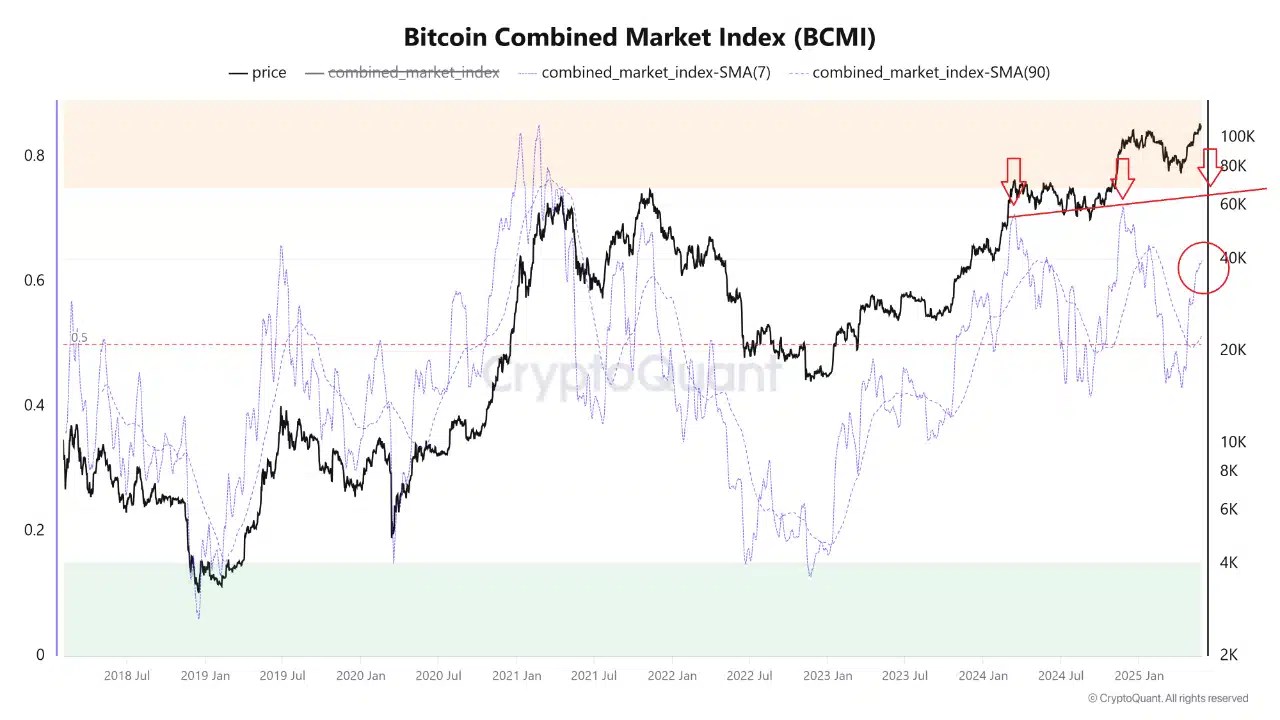

Bitcoin’s [BTC] Mixed Market Index (BCMI) has rebounded sharply, with its 7-day SMA rising to ~0.6—an early sign that market sentiment could also be shifting towards cautious optimism.

This recovery comes as profit-taking slows and core on-chain metrics enhance. After all, the long-term image regarded extra restrained.

The 90-day SMA held regular close to 0.45, indicating the market stays in a impartial state, removed from the overheated zone.

Now, with profit-taking slowing and on-chain fundamentals stabilizing, the query is whether or not this bounce has legs—or is simply one other fakeout.

Supply: CryptoQuant

Bitcoin sharp drop in NVT metrics displays valuation reset

The NVT Golden Cross plunged by 78.68% to 0.29, a major shift that signifies the market might have exited a neighborhood high.

On the identical time, the usual NVT Ratio fell by 13.1% to 27.37, pointing to stronger transaction quantity relative to market cap.

These declines reinforce the concept of a valuation reset and trace at bettering natural community exercise. Subsequently, whereas costs stay subdued, the underlying worth proposition is strengthening.

That makes the BCMI’s uptrend really feel much less synthetic and extra grounded in bettering fundamentals.

Supply: CryptoQuant

Alternate Reserves present mild accumulation amid low conviction

Bitcoin’s complete Alternate Reserve dropped by 1.36% to $263.45 billion, indicating slight outflows. Traditionally, reducing reserves indicate accumulation, as cash transfer off exchanges into long-term storage.

Nevertheless, the size of outflows stays modest, suggesting market conviction remains to be low. That, as soon as once more, matched the muted tone of the 90-day BCMI SMA.

So, whereas accumulation could also be beginning, it’s occurring cautiously. Extra pronounced reserve drops can be wanted to substantiate a stronger restoration part underway.

Supply: CryptoQuant

Bitcoin quick dominance may set off volatility if sentiment shifts

As of the twenty ninth of Might, the Lengthy/Quick Ratio decreased to 0.886, with quick positions comprising 53.01% of the overall. This means that merchants are nonetheless leaning bearish regardless of bettering sentiment indicators.

When shorts dominate in such situations, it raises the danger of a brief squeeze if the value unexpectedly strikes greater.

Subsequently, whereas the BCMI rebound displays higher sentiment, this short-heavy positioning may amplify volatility in both route.

If consumers regain management, the ensuing squeeze may push Bitcoin past $110K quickly.

Supply: CoinGlass

Is the BCMI rebound the start of an actual restoration?

Presumably.

The BCMI’s sharp 7-day rebound, paired with improved NVT ratios and modest reserve outflows, factors towards early accumulation.

Nevertheless, steady long-term metrics and prevailing quick positions counsel the market stays cautious.

A sustainable restoration could also be forming, however the sign nonetheless requires affirmation from stronger accumulation and worth momentum.