Bitcoin Price’s Next Move Could Be Below $80,000 — Here’s Why

The value motion of Bitcoin has been considerably restricted previously few weeks, because the bulls and bears battle for dominance out there. This indecisiveness has had the premier cryptocurrency oscillating between the $89,000 and $93,000 ranges in current weeks.

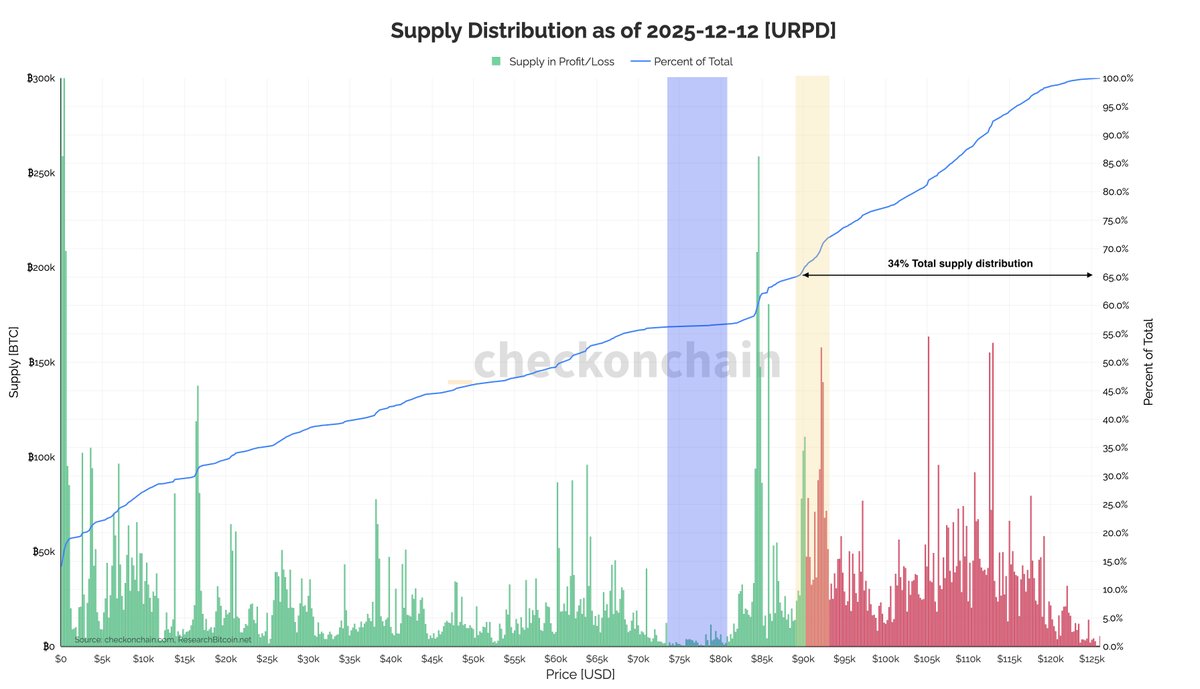

In line with the newest on-chain knowledge, this sideways motion exhibited by the Bitcoin value is related to the uneven distribution of the coin’s complete provide round numerous ranges. This current on-chain analysis has additionally recognized the potential subsequent cease for the market chief’s value.

BTC Worth At Threat Of A 20% Decline?

In a December 13 put up on the X platform, pseudonymous analyst Darkfost explained that the Bitcoin value is locked in a battle between $89,000 and $93,000. This on-chain commentary relies on the distribution of the BTC provide (utilizing the URPD metric) round totally different value ranges.

Associated Studying

The URPD (UTXO Realized Worth Distribution) metric tracks the quantity of a specific cryptocurrency that was traded at a particular value stage. When a considerable amount of cash is traded at a sure value stage, the area tends to function help when the value trades above it and resistance when the value is beneath it.

In line with Darkfost, this explains why the Bitcoin value appears caught throughout the $89,000 – $93,000 area (the yellow space within the highlighted chart). The market analyst famous that the zone has seen important buying and selling exercise, justifying the oscillation of the BTC value throughout the vary.

What’s new is the “distribution hole” (blue space within the chart) within the $74,000 – $80,000 vary, which represents a zone with comparatively low historic buying and selling exercise. Darkfost defined that these low-liquidity areas have a tendency to draw the Bitcoin value in a bid to rebalance provide and demand.

As noticed within the chart above, this distribution hole lies between the $74,000 – $80,000 vary, that means that the value of BTC may witness a correction to this stage earlier than bouncing again to a brand new excessive. A correction to this stage could possibly be equal to a virtually 20% downturn from the present value level.

Moreover, Darkfost famous that 34% of the full BTC provide distribution is now above the psychological $90,000 stage. This development may make $90,000 a structural help stage for the value of Bitcoin over time.

It’s also value noting that whereas a big distribution cluster might be seen round $84,000, it shouldn’t be over-interpreted. Darkfost talked about that the distribution stage is just not as real because it seems, however slightly a results of Coinbase’s recent Bitcoin movement.

Bitcoin Worth At A Look

As of this writing, the value of BTC stands at round $90,150, reflecting no important change previously 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView