Bitcoin Rainbow Chart predictions: BTC to $450K by 2025?

- Bitcoin Rainbow Chart reveals BTC alerts accumulation.

- Prediction fashions and analysts forecast a serious BTC rally within the subsequent few months.

Bitcoin [BTC] rallied over 68% in Q1 2024, however Q2 headwinds have eaten a part of the positive aspects. With BTC down 7% in Q2 and caught inside the $60K—$71K value vary, gauging whether or not it’s overvalued or undervalued utilizing the Bitcoin Rainbow Chart is essential.

On a YTD (12 months-to-Date) foundation, BTC has added over $22K, translating to 50.3% positive aspects. Nevertheless, Q2 headwinds, together with curiosity fears and Center East tensions, spooked buyers and partly defined final week’s drawdowns.

Now that Bitcoin is again above $66K, the massive query is: Is it too costly, or is the present worth a discount?

Bitcoin Rainbow Chart sign “accumulate”

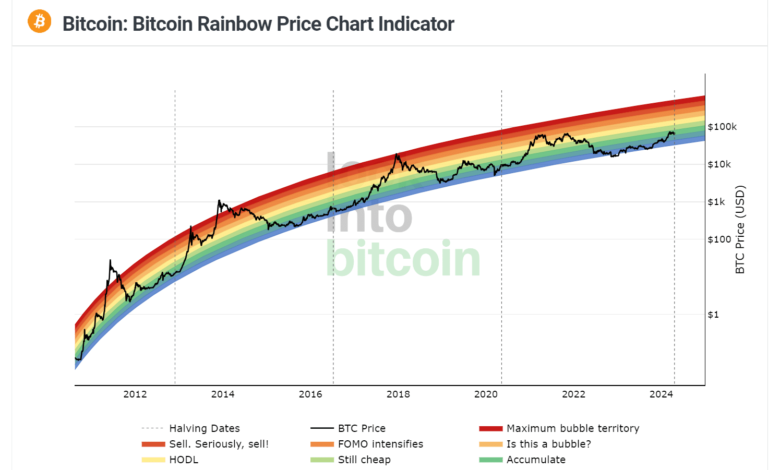

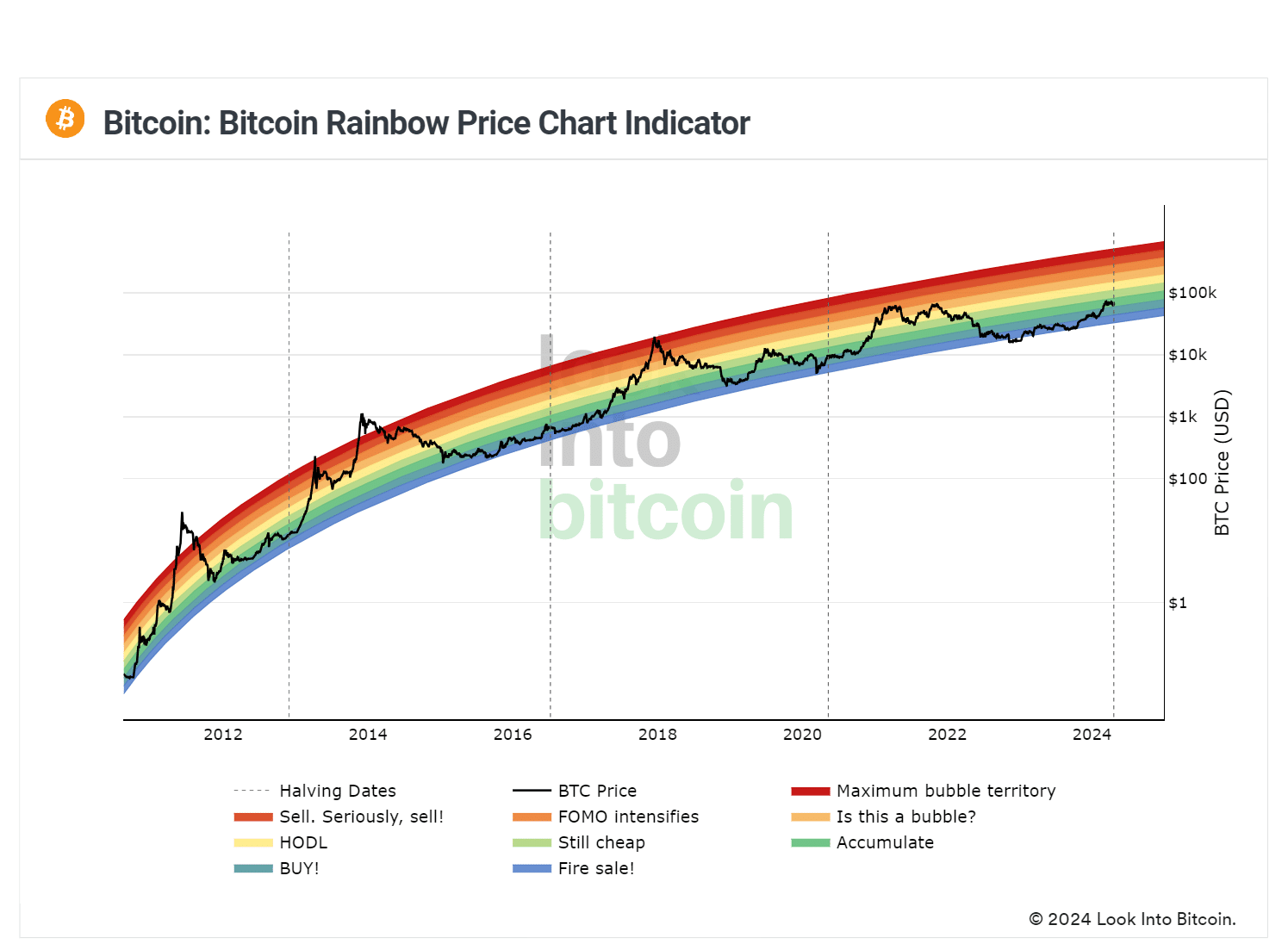

Supply: Supply: Look Into Bitcoin

In line with the Bitcoin Rainbow Chart, BTC’s present value degree was inside a zone referenced as “accumulate.”

The Bitcoin Rainbow Chart visually represents Bitcoin’s valuation primarily based on historic knowledge. Notably, it’s a logarithmic scale that features colour bands exhibiting shopping for (blue, inexperienced) and promoting (orange, yellow) zones.

Up to now three halving cycles, BTC was massively undervalued instantly after the halving. Though the present BTC value degree is barely larger on the dimensions than the final cycles, it’s inside the “accumulate” zone.

So, BTC remains to be undervalued and never overheated, per the Bitcoin Rainbow Chart.

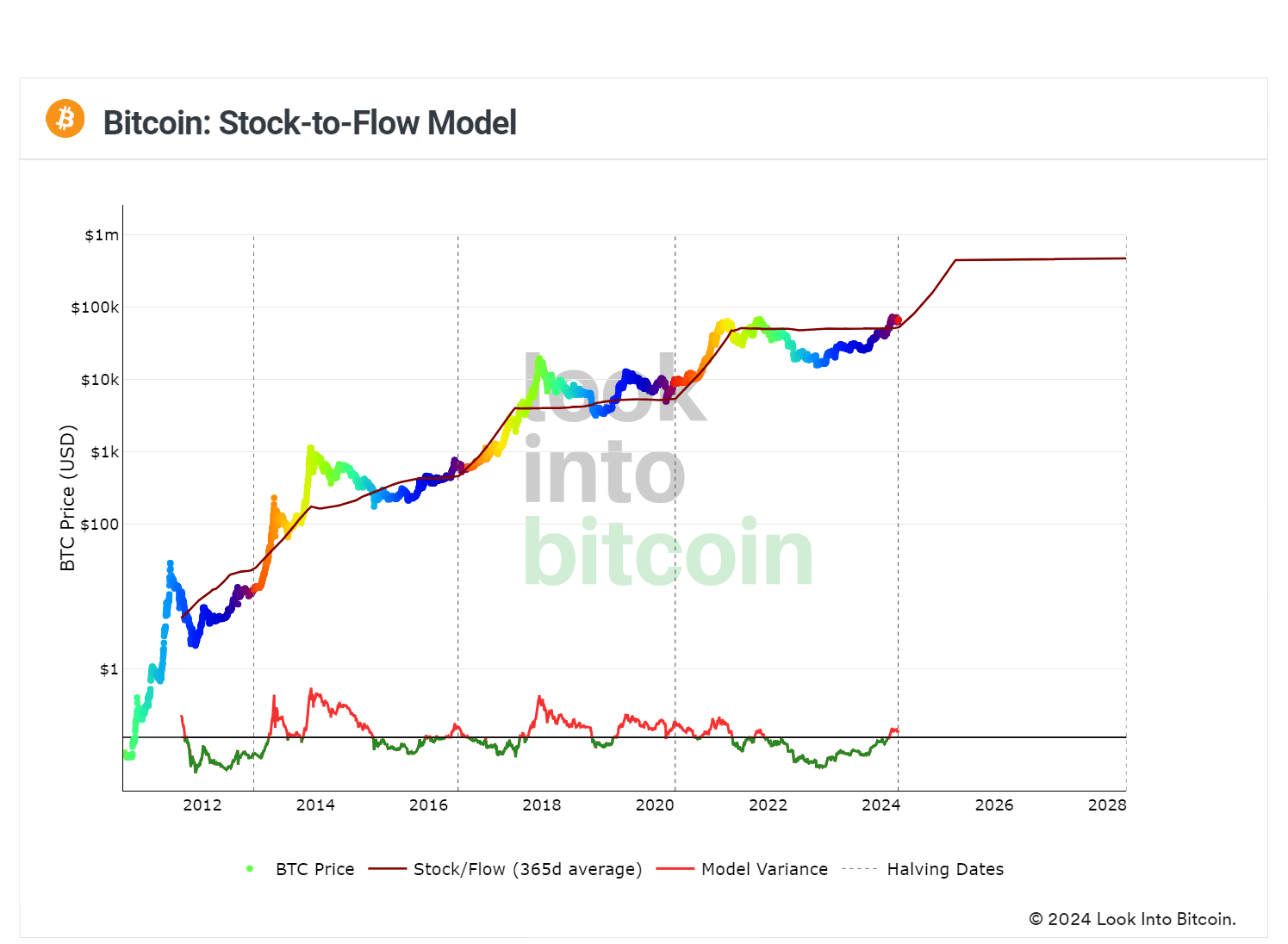

Moreover, the Inventory-to-Movement (S/F) model signifies extra upside potential for Bitcoin’s value. The mannequin evaluates BTC’s future costs by dividing its circulating provide by the annual variety of mined cash.

The mannequin has been capable of predict BTC costs with truthful variance prior to now. It forecasts that BTC will cross $100K in Q3 2024 and hit over $450K on the finish of 2025.

Supply: Look Into Bitcoin

Nevertheless, given the brand new US spot BTC ETF issue and macro pressures, cross-referencing S/F projections with nuanced skilled evaluation also can provide essential insights.

Why analysts assume BTC can hit $200K in 18-24 months

Apparently, Customary Chartered predicts that Bitcoin can hit $200K within the subsequent 18 – 24 months.

In a latest interview, Geoff Kendrick, head of digital belongings analysis at Customary Chartered, noticed spot BTC ETFs maturity as a driving issue;

“I anticipate from the the beginning of this yr to when the ETF market within the US market matures, you’ll get between $50B to $100B in influx. To this point, we now have $12B. That may occur in 18-24 months.”

Correlating BTC ETFs and gold, Kendrick famous that gold’s value went 4.3x when its ETF flows matured. Per Kendrick, if BTC ETF flows maturity follows gold’s path, then,

“that might get us to the $150K – $200K vary.”

Equally, in mid-March, Bernstein analysts revised the BTC value projection from $90K to $150K by mid-2025, citing “more-than-expected” flows from spot BTC ETFs.

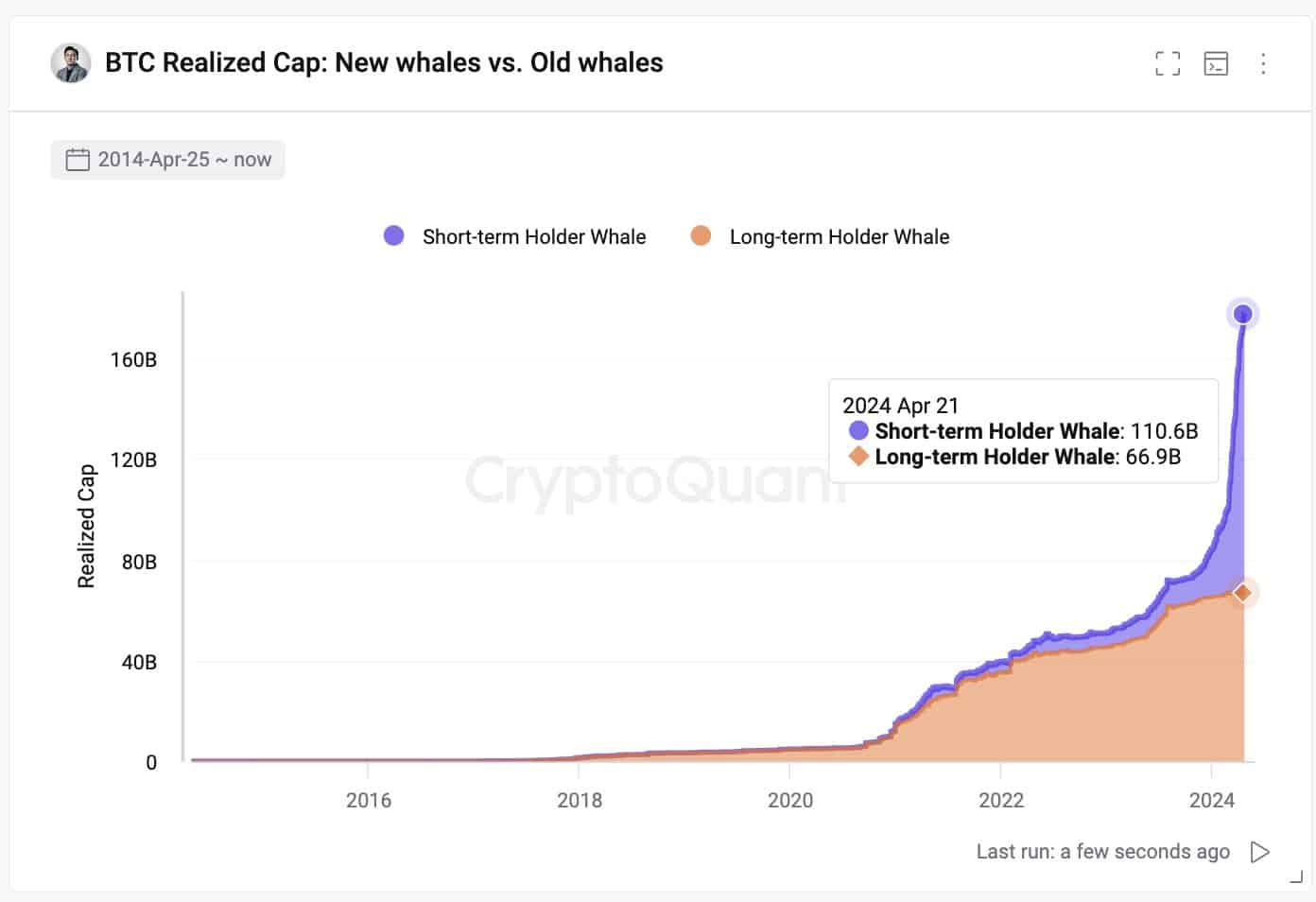

In line with Ki Young Ju, the founding father of CryptoQuant, “new whales” have now doubled their BTC accumulation spree.

“The brand new whales’ preliminary funding in #Bitcoin is sort of twice the previous whales’ cumulative whole.”

Supply: X/Ki Joung Yu

Nevertheless, the large whale demand isn’t the one excellent news for BTC’s future costs. The macro overview is aligned, too.

BitMEX founder and CIO of Maelstrom, Arthur Hayes, foresees a positive summer season for BTC, citing the “sovereign bonds market” points. In a latest weblog dubbed “Left Curve,” the CIO noted;

“Hardly ever in markets do the issues that bought you right here (Bitcoin from zero in 2009 to $70,000 in 2024), get you there (Bitcoin to $1,000,000). Nevertheless, the macro setup that created the fiat liquidity surge that powered Bitcoin’s ascent will solely get extra pronounced because the sovereign debt bubble begins to burst.”

The CIO precisely predicted final week’s huge sell-off, citing the US tax season and Bitcoin’s halving.

Though Center East tensions additionally performed a component in final week’s drawdowns, Hayes’ projections present that the macro overview appears nice for Bitcoin from summer season onwards.

Learn Bitcoin [BTC] value prediction 2024 -2025

That stated, Bitcoin value prediction fashions, together with the Bitcoin Rainbow Chart and analysts, all level to additional upside for BTC within the subsequent few months.

If these predictions are confirmed, then present BTC costs are an enormous discount.