Bitcoin rainbow chart predicts the next cycle top, here’s how

- Bitcoin’s rainbow chart was mixed with a technical evaluation of the weekly BTC value chart.

- The primary half of 2025 may see Bitcoin set up the cycle’s high-water mark.

Bitcoin [BTC] costs have climbed increased because the twelfth of September. The uptrend had many pullbacks and halts, however the development was clear on the upper timeframe value charts.

Regardless of the numerous rumblings and failures contained in the crypto trade in 2022, the king stood sturdy.

The tip of 2023 is close to, and the subsequent Bitcoin halving is estimated to happen in April 2024. Wanting into the longer term is not possible, however that doesn’t imply we are able to’t plan for it. So what is going to 2024 and 2025 yield within the BTC markets?

What new highs may we see? One sturdy contender for the crystal ball standing is the Bitcoin rainbow chart.

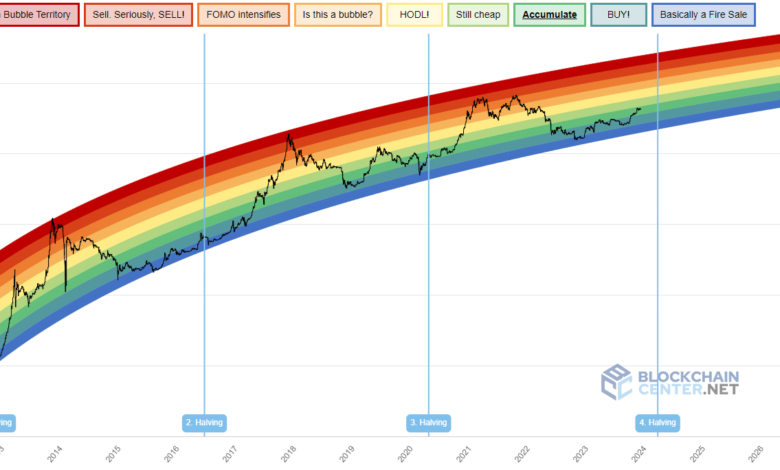

It’s a great time to purchase BTC, in accordance with the rainbow chart

Supply: BlockchainCenter.net

The Bitcoin rainbow chart is a fun-looking, colourful chart that outlines the place BTC is at. Every coloration band has a that means, a message for traders, though it’s not monetary recommendation after all. At press time, BTC is buying and selling throughout the “Accumulate” zone.

The halving occasions are marked as properly, and the interpretation is fairly easy. Purchase Bitcoin when it’s under yellow and promote when it reaches the orange or purple zones.

That is particularly helpful for long-term traders who don’t have the time or inclination to trace BTC costs day by day or to observe a number of on-chain metrics.

Prior to now, the bull run has come round a yr or later after the halving. Assuming the identical for the subsequent halving, we’re more likely to attain the highest of this cycle in 2025. However when, and what would these costs be?

Technical evaluation may assist reply the query of “the place”

The Fibonacci retracement and extension ranges are a widely known and broadly used technical evaluation software.

They carry out remarkably properly throughout completely different timeframes however rely on the judgment of the person in deciding the start and ending factors.

In our case, we might be utilizing a rally’s high and backside, in order that subjectivity might be dominated out. There was a powerful rally from $3135 to $13.8k a yr earlier than Bitcoin’s 2020 halving. This transfer was used to plot the Fibonacci extension ranges (white).

Supply: BTC/USD on TradingView

The rally reached the five hundred% extension stage 868 days after the preliminary transfer, or roughly 2.5 years later. That is info that may be precious for an additional evaluation.

Identical to the earlier time, BTC has rallied strongly within the yr previous its halving occasion.

We’re nonetheless not but on the native high. Bitcoin has a powerful bullish development and the market construction on the one-day chart continued to favor the patrons.

But, we are able to equally plot the Fibonacci extension ranges to search out out the place the five hundred% extension stage could be.

Supply: BTC/USD on TradingView

Assuming the $45k mark that the value reached on the fifth of December is that this run’s high, the five hundred% extension stage comes out to $192.7k.

Given the present bullish outlook for BTC on the one-day chart, $45k won’t be the native high.

Going again to the rainbow chart, we see that the earlier cycle noticed BTC attain the decrease purple band within the bubble zone. Therefore, we are able to assume that $192k could be roughly in the identical band in 2025.

That is projected to be February 2025 on the rainbow chart.

So there you’ve it, a neat Bitcoin value prediction for the subsequent cycle. For readers who wish to assess some on-chain metrics, the NUPL chart could possibly be attention-grabbing.

Extra on-chain metrics to control

The Bitcoin Web Unrealized Revenue/Loss metric measures the general revenue or lack of BTC traders. Values over ‘0’ point out holders are in revenue, and the rising development of the previous few months highlighted that an increasing number of traders are in revenue.

Supply: CryptoQuant

The earlier cycle noticed this metric contact 0.748 on 21 February. Curiously, the 2019 rally to $13.8k noticed the NUPL attain 0.61.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

The metric was at 0.49 on the twenty seventh of December, however a studying of 0.5 or above would imply the present transfer is probably going nearing its finish.

As soon as once more, these inferences are made assuming that historical past would repeat itself. Typically, as a substitute of repeating, it merely rhymes. Subsequently, traders and merchants should be vigilant and able to incorporate new info into their plans.