Bitcoin Realized Losses From Entities Surges To 2022 Levels Following Crash Below $90,000

Bitcoin’s value motion prior to now two weeks has opened a brand new section of stress amongst merchants, with on-chain information displaying realized losses climbing to heights final noticed in 2022.

Glassnode’s newest Week-On-Chain report shows Bitcoin is buying and selling above an essential cost-basis stage however can also be visibly straining below intensified loss realization, fading demand and weakening liquidity, which has positioned short-term traders in a troublesome place.

Realized Losses Return To Deep Territory

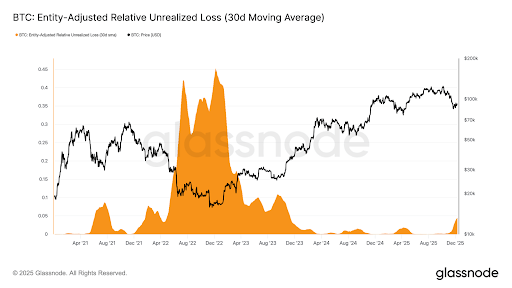

In accordance with Glassnode, realized losses amongst Bitcoin entities have risen massively, and is now nearly on the similar magnitudes recorded through the deep retracements of the 2022 bear market. Notably, the Relative Unrealized Loss (30D-SMA) has climbed to 4.4% after practically two years under 2%.

Associated Studying

The escalation in loss realization displays how the latest drawdown under $90,000 has compelled numerous market members to dump cash at costs under their acquisition value. This, in flip, has disrupted the gradual enchancment in profitability seen earlier within the 12 months.

Bitcoin’s latest bounce from the November 22 low to above $92,000 hasn’t eased the pressure on holders. Glassnode famous that entities are nonetheless locking in losses at an rising tempo, with the 30-day common of realized losses now at round $555 million per day.

These circumstances imply that traders are dropping confidence in short-term upside prospects for Bitcoin and select to scale back publicity, even at unfavorable costs. Due to this fact, the report famous that resolving it should require a renewed wave of liquidity and demand to rebuild confidence.

Glassnode additionally highlights a pointy rise in profit-taking amongst long-term holders, whose realized good points have climbed to roughly $1 billion per day and briefly set a brand new file above $1.3 billion.

Even with this elevated stage of distribution, Bitcoin is at present positioned simply above the True Market Imply, which is a long-standing cost-basis benchmark that serves as some extent of structural help. The latest value downturn under $90,000 has pushed this zone near its limits, however the glimpse of demand mirrored round it means that value may revisit the 0.75 quantile close to $95,000 and probably method the short-term holder value foundation as effectively.

Spot ETF, Futures, And Choices Markets Point out Weak spot

Glassnode’s report factors to persistent softness throughout ETF flows, which have cooled notably after a interval of sturdy inflows earlier within the 12 months. This slowdown represents a discount in one of many largest and most quick sources of buy-side liquidity for Bitcoin.

Associated Studying

Spot market liquidity has additionally light, with order books on main exchanges close to the decrease certain of their 30-day vary. This has created an atmosphere the place buying and selling exercise has weakened by way of November and into December, and fewer liquidity flows can be found to soak up volatility or maintain directional strikes.

Derivatives positioning displays comparable warning, with funding charges pinned close to impartial. Futures open curiosity has additionally been subdued and has did not meaningfully rebuild for the reason that breakdown under $90,000.

Throughout all main venues, the tone is similar: liquidity is lighter, sentiment is softening, and members are leaning defensive quite than pursuing short-term rallies. The eye is now on how Bitcoin will respond in the aftermath of the Federal Reserve’s latest fee lower.

Featured picture from Pixabay, chart from Tradingview.com