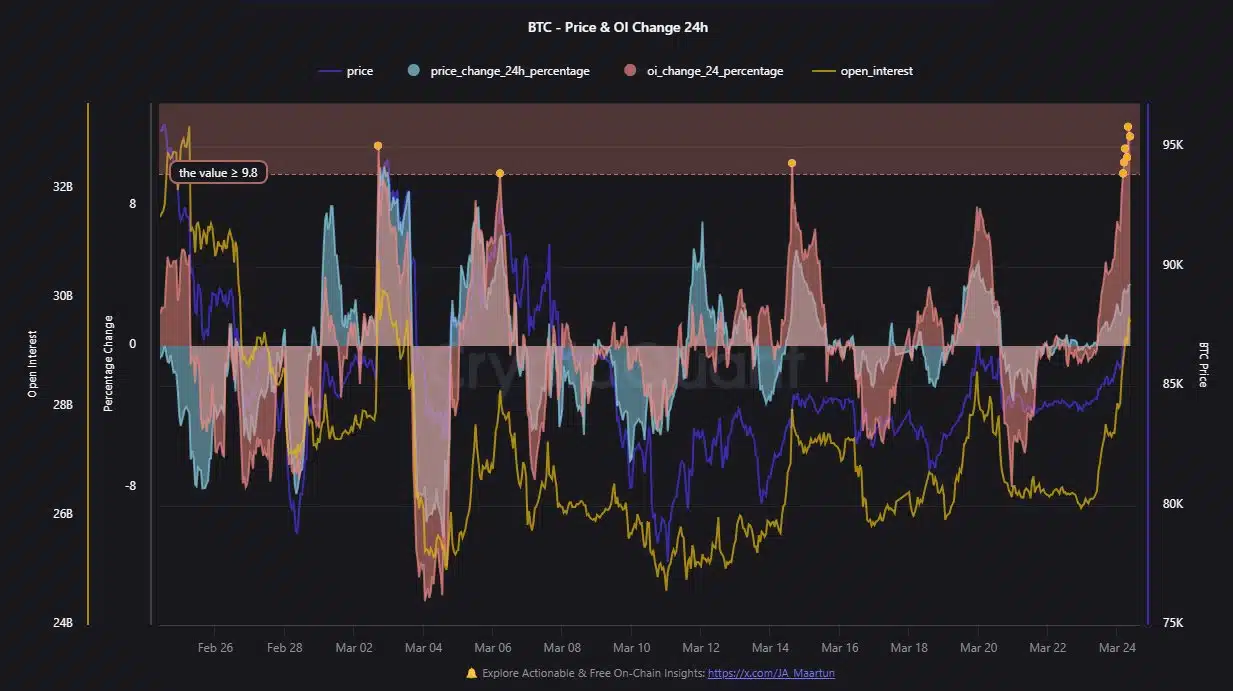

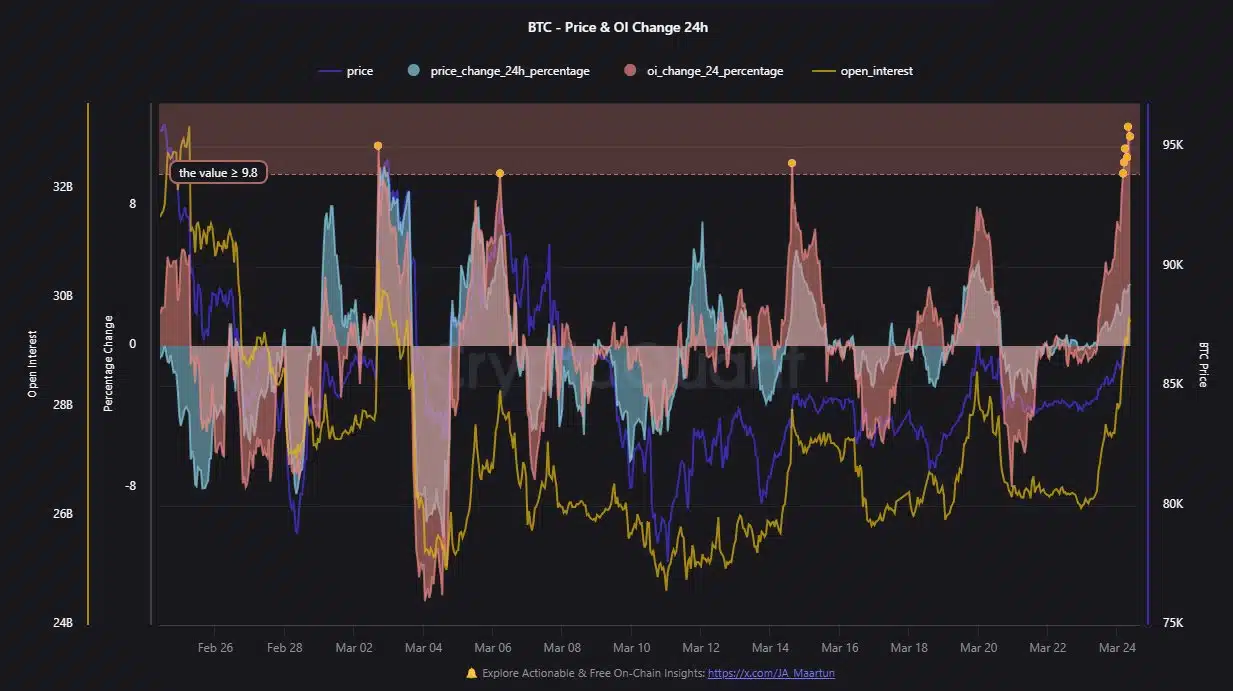

Bitcoin records $32 Billion in Open Interest: Is BTC headed for a crash?

Bitcoin’s worth surged towards $95K, however the 24-hour chart reveals heightened volatility, with OI reaching record levels above $32 billion.

Supply: Cryptoquant

Within the final 24 hours, Bitcoin noticed a major worth enhance, accompanied by notable inflows of leveraged positions. OI trended upward alongside worth, suggesting merchants are betting on additional beneficial properties.

Nonetheless, OI spikes exceeding 9.8% have traditionally been a precursor to sharp corrections. If worth momentum falters, overleveraged positions may unwind, inflicting fast sell-offs.

Bitcoin leverage: Breakout or breakdown?

As OI crosses $32 billion, the rising leverage fuels Bitcoin’s rally. Nonetheless, this inflow of capital creates a fragile setup the place even minor pullbacks may set off liquidations.

A fast worth enhance mixed with extreme leverage heightens the chance of cascading liquidations, creating the potential for amplified worth swings.

If bullish momentum persists, Bitcoin may enter a parabolic section, pushing costs past present highs. Alternatively, if the worth drops instantly, it may spark a wave of liquidations, resulting in a pointy correction.

Monitoring shifts in OI and funding charges will probably be key to assessing market sentiment and figuring out potential development reversals.

FOMO could also be driving Bitcoin larger, however at what value?

Bitcoin’s ascent towards $87.5K has ignited a wave of FOMO, with merchants dashing in to capitalize on the momentum. This heightened hypothesis has additional elevated OI, signaling rising leverage available in the market.

Whereas this emotional shopping for spree may push Bitcoin into uncharted territory, it additionally raises the chance of a pointy correction if sentiment shifts.

Historical past warns that such leverage-driven rallies are sometimes adopted by fast reversals.

If sentiment shifts or leverage unwinds, the identical merchants driving costs up may rapidly discover themselves on the mistaken facet of a fast correction.

Because the rally continues, intently monitoring funding charges and OI shifts will probably be essential for anticipating potential reversals.