Bitcoin remains stagnant even as spot ETFs bring in $418M

- Inflows into new ETFs negated outflows from GBTC.

- Bitcoin nonetheless encountered promoting strain from long-term holders.

In a exceptional turnaround, Bitcoin [BTC] spot exchange-traded funds (ETFs) within the U.S. attracted substantial inflows on Tuesday, following a disappointing efficiency final week.

A robust web constructive day

In line with AMBCrypto’s evaluation of SoSo Value information, about 6,000 BTCs, price $418 million, flew into these funding avenues on a web foundation, marking the strongest wave of inflows for the reason that 14th of March.

With the most recent inflow, the entire worth of Bitcoins backing the spot ETFs hit $57.2 billion, constituting 4.20% of the crypto’s whole market cap.

Supply: SoSo Worth

Constancy’s spot ETF (FBTC) led the inflows chart, amassing $279.10 million price of Bitcoins, adopted by BlackRock’s IBIT fund with inflows of $162 million.

The full inflows from the 9 newly-launched ETFs helped in negating $212 million in outflows from incumbent issuer Grayscale Bitcoin Trust (GBTC).

Final week, Grayscale outflows had exceeded inflows, leading to 5 straight web detrimental days.

On an interesting notice, the accrued quantity by new ETFs included all newly mined Bitcoins on the day, the equal of Grayscale’s outflows, and a further 5,092 cash from different sellers, enterprise capital agency HODL15Capital noted.

Bitcoin fails to carry

Regardless of a powerful wave of inflows, Bitcoin stayed rooted across the $70,000 degree, in accordance with CoinMarketCap, implying that appreciable promoting was nonetheless happening.

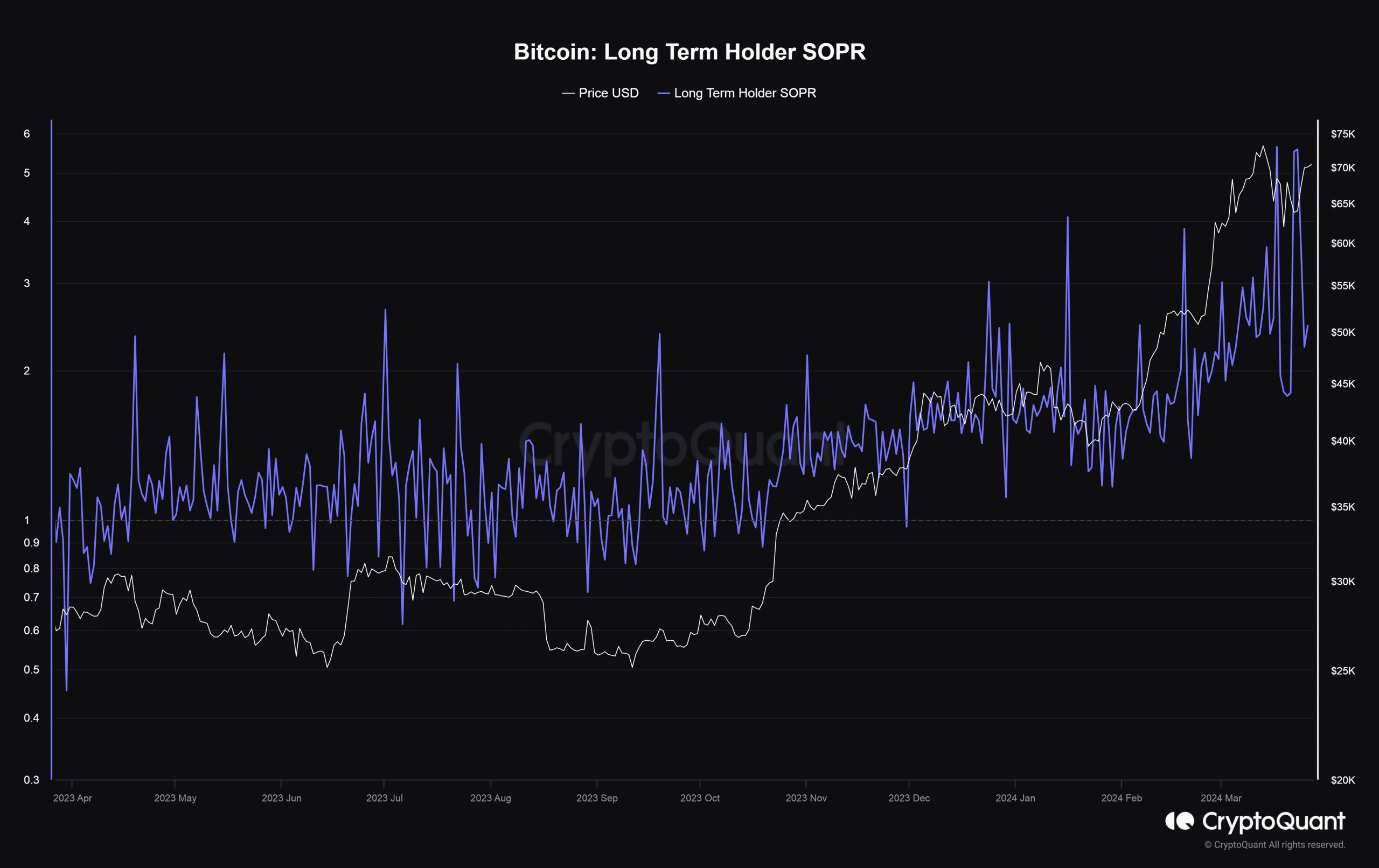

A number of these sell-offs might be attributed to long-term holders of the coin. As per AMBCrypto’s scrutiny of CryptoQuant information, this cohort has been more and more promoting their holdings for revenue recently.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Whereas occasions like this stem the asset’s rise, they convey beforehand inactive cash into the liquid provide. This might probably result in extra demand and volatility.

A sentiment of “excessive greed” prevailed out there, as per the most recent replace from Bitcoin’s Fear and Greed Index. This might result in sustained shopping for strain within the coming days, inflicting Bitcoin to go additional north.