Bitcoin Reverses Losses—Analysts Say $100K Is On The Horizon

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin costs have jumped to $85,020 within the final 24 hours, marking a 1.2% enhance that reverses a number of the latest downward momentum. The cryptocurrency is now testing a key resistance stage that dates again to its January peak of $110,000, in response to market analysts.

Associated Studying

Indicators Of A Rebound Rising

Whereas Bitcoin nonetheless exhibits a 3.4% drop over the previous week and a 9.5% decline over the past month, indicators of restoration are rising. Technical analysts have noticed a robust one-day value candle that has fully erased the losses from the earlier three days.

The Relative Power Index (RSI), a preferred momentum indicator, has bounced off its help line. This technical sign usually suggests constructing momentum for an upward value motion.

In response to stories from TradingView analysts, Bitcoin faces its most vital problem on the falling pattern line that started on January 20. This resistance coincides with the 50-day shifting common, and Bitcoin has already examined this stage 4 occasions beforehand.

$100,000 Goal Inside Attain If Resistance Breaks

Market watchers eye a goal just under $100,000 if Bitcoin can break its present wall. This purpose sits close to the highest of February’s barrier zone and matches the two.0 Fibonacci extension stage, a key mark utilized by merchants.

A breakthrough may sign a transfer towards a long-term bullish pattern for the cryptocurrency, which has confronted large hurdles in latest weeks.

The fifth take a look at of this resistance stage may show decisive for Bitcoin’s near-term value course. Merchants are watching carefully to see if this try shall be profitable the place earlier ones have failed.

Giant Holders Present Rising Confidence In Bitcoin

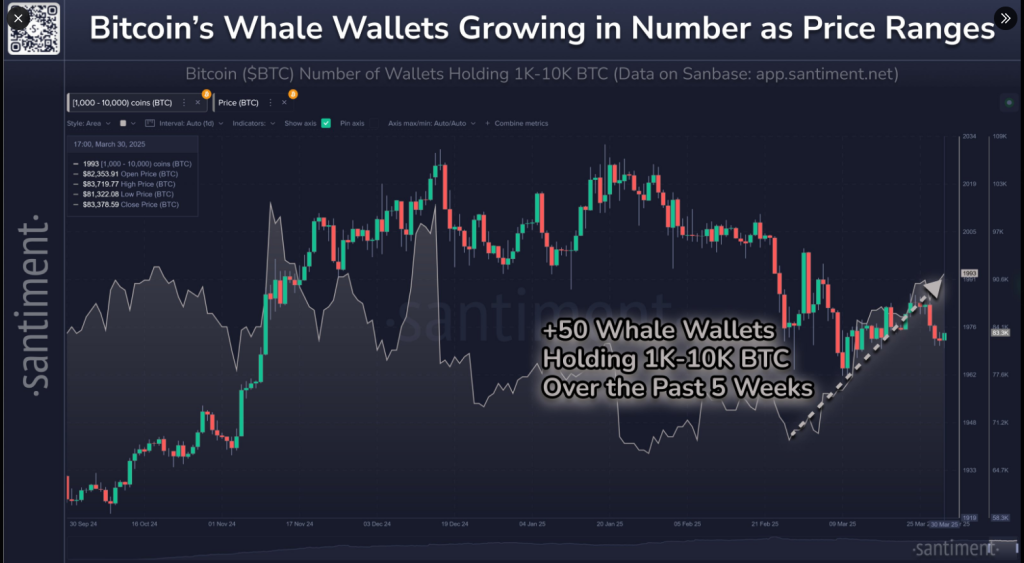

In response to figures equipped by Santiment, the wallets holding between 1,000 and 10,000 Bitcoins elevated to 1,993 by March 31. It’s the greatest since December of 2024 and an increase by 2.5% inside a five-week interval when 50 giant wallets joined the market.

🐳 Bitcoin’s market worth has fluctuated between $81K to $84K Monday. And whereas costs proceed ranging as March attracts to an in depth, whale wallets (particularly 1K-10K $BTC holders) proceed rising in quantity.

There at the moment are 1,993 #Bitcoin wallets of this measurement, which is the best… pic.twitter.com/iVYj9XdxAj

— Santiment (@santimentfeed) March 31, 2025

This accumulation sample by giant holders tends to lower the availability of Bitcoin in circulation. When demand stays fixed or will increase whereas provide decreases, costs are likely to go up.

Associated Studying

Trade Outflows Sign Quick-Time period Bullish Outlook

The exercise of those “whale” wallets is a main gauge of market sentiment as a result of these giant holders are typically privy to stylish analysis and market evaluation that information their funding decisions.

In the meantime, Bitcoin’s motion to and from exchanges exhibits a 38% decline in internet flows over the previous 24 hours. In response to IntoTheBlock analytics, this means merchants are shifting their Bitcoin off exchanges reasonably than making ready to promote.

Featured picture from Gemini Imagen, chart from TradingView