Bitcoin: Selling BTC at a loss? Well, here’s the bright side…

- Bitcoin’s worth crossed $67K, hinting at an additional bull rally

- A number of metrics additionally appeared bullish for the cryptocurrency

Whereas Bitcoin’s [BTC] worth remained in a consolidation section, short-term holders bought a considerable quantity of BTC on exchanges at a loss. The sudden sell-off may truly develop into excellent news for BTC although, as it will possibly assist provoke a bull rally within the coming days.

Brief-term holders are promoting Bitcoin

Alex, a well-liked crypto-analyst, just lately shared an fascinating growth relating to short-term holders. As per the tweet, from 19 March to 4 April, STHs bought 106.8K BTCs at a loss on exchanges.

Right here, it’s fascinating to notice that STHs additionally bought BTC at a loss in January. When that occurred, BTC’s worth gained bullish momentum, which ultimately resulted in Bitcoin touching a brand new all-time excessive. Subsequently, this can be a hopeful signal for a worth uptick within the coming days.

Nevertheless, it should even be famous that the quantity of BTCs bought by STHs in January accounted for nearly thrice greater than what they bought in between March and April.

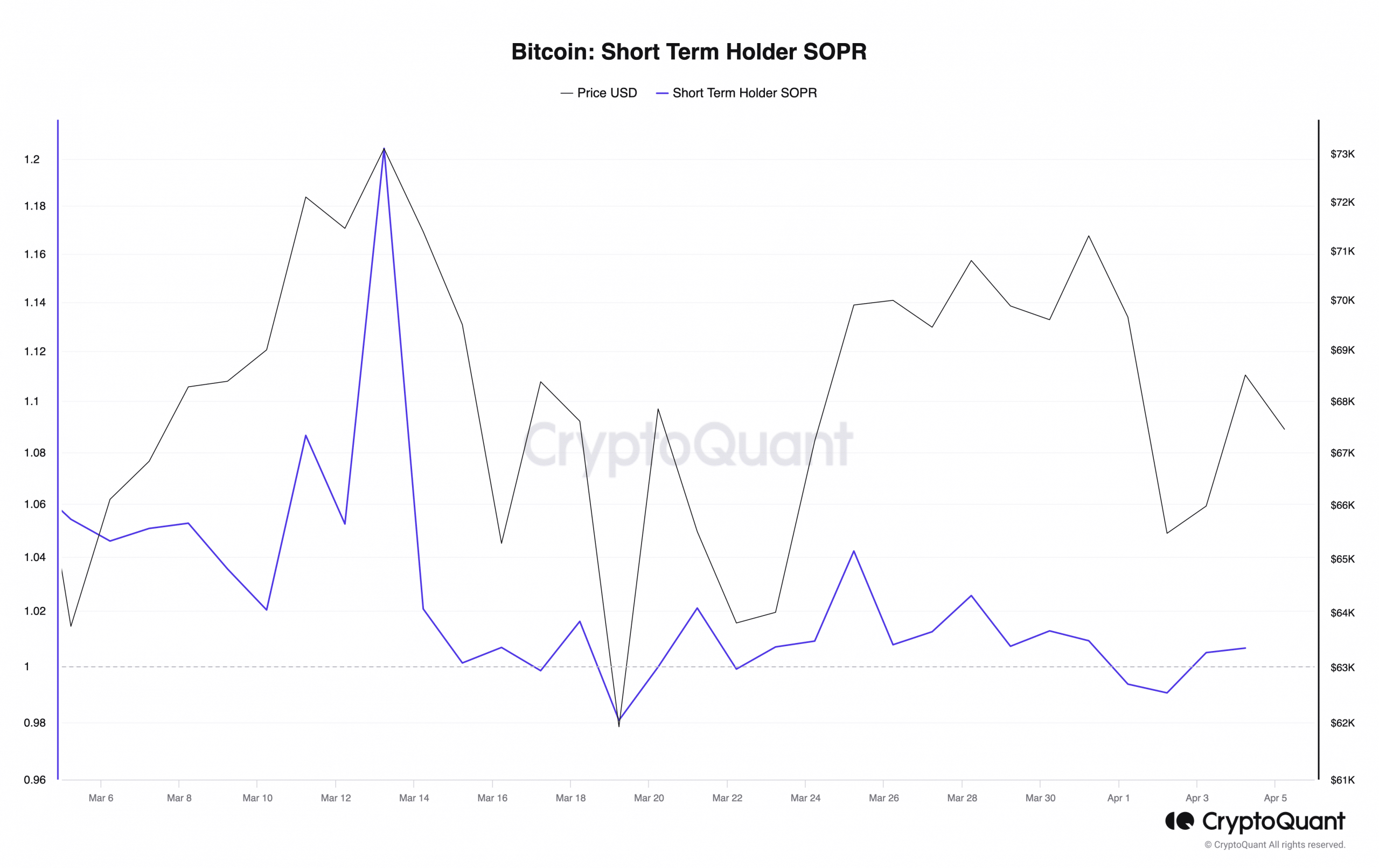

Moreover, AMBCrypto’s take a look at CryptoQuant’s knowledge revealed that Bitcoin’s short-term holder SOPR registered an uptick after declining on 2 April. Historic knowledge means that at any time when these metrics transfer up, BTC’s worth additionally follows an identical pattern of increment.

Supply: CryptoQuant

In actual fact, on the time of writing, BTC’s worth motion was already exhibiting indicators of restoration because it crossed $67k – A psychological resistance degree. Over the past 24 hours alone, it was up by nearly 2% on the charts.

Is there a bull rally across the nook?

AMBCrypto’s evaluation of CryptoQuant’s data revealed that BTC’s change reserve has been dropping too, that means that general promoting strain is low. The coin’s binary CDD was inexperienced, that means that long-term holders’ actions within the final 7 days had been decrease than common.

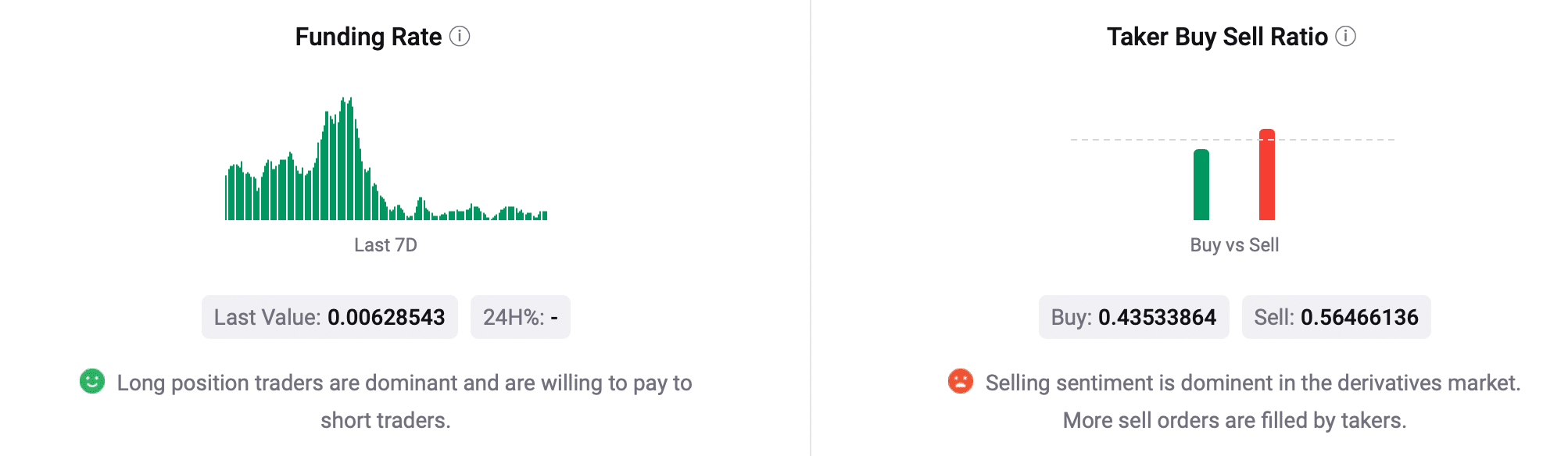

All the pieces on the derivatives aspect seemed optimistic as nicely. BTC’s funding fee was climbing. Nevertheless, Bitcoin’s taker purchase/promote ratio raised a crimson flag because it recommended that promoting sentiment was dominant within the derivatives market.

Supply: CryptoQuant

To higher perceive whether or not a rally is feasible, AMBCrypto analyzed BTC’s each day chart. Our evaluation identified that each BTC’s Chaikin Cash Stream (CMF) and Cash Stream Index (MFI) registered slight upticks, indicating that there have been probabilities of northbound worth motion.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

If a bull rally occurs, it is vital for BTC to cross $71k earlier than it targets its ATH. Nonetheless, the Relative Energy Index (RSI) remained within the sellers’ favor because it went down over the previous few days.

Supply: TradingView