Bitcoin: Short-term holders are in panic, should you follow suit?

- Brief-term Bitcoin holders started to promote their holdings.

- Curiosity in Bitcoin ETFs remained excessive regardless of value fluctuations.

Bitcoin’s [BTC] fall from $70,000 has impressed blended reactions from the cryptocurrency market. Many addresses, who weren’t anticipating this sort of volatility, had been noticed to be panicking.

Brief-term holders panic

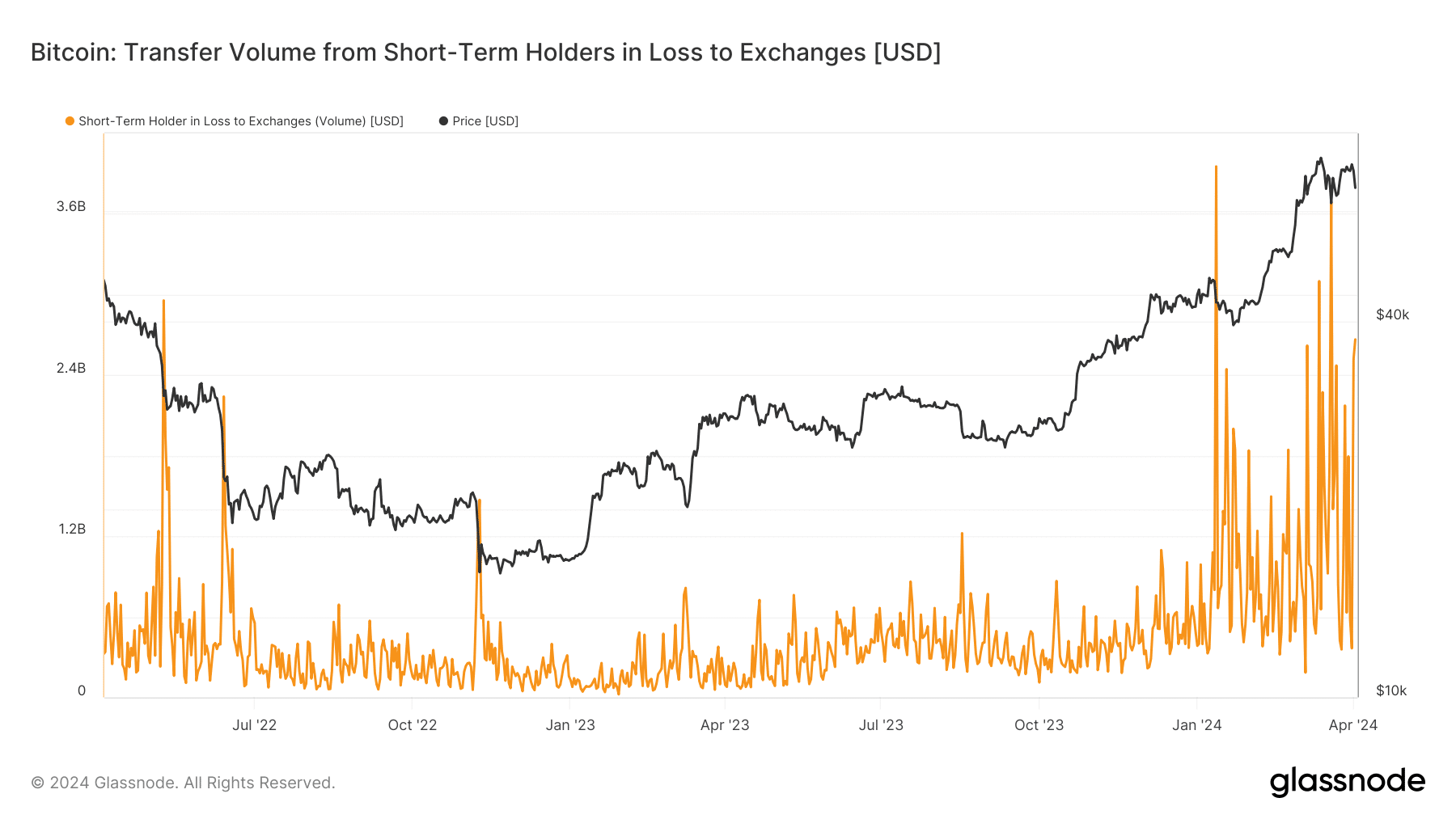

Based mostly on latest information, over the previous forty-eight hours, Brief Time period Holders (STH) despatched $5.2 billion value, equal to 76,000 Bitcoin, to exchanges at a loss. This motion elevated promoting strain on BTC.

The inflow of Bitcoin into exchanges could briefly saturate the market with provide, resulting in downward strain on costs.

This bearish sentiment can unfold all through the market and trigger panic promoting amongst different buyers.

Extended downward strain on costs could impression long-term buyers, who might expertise paper losses or rethink their funding methods.

Supply: glassnode

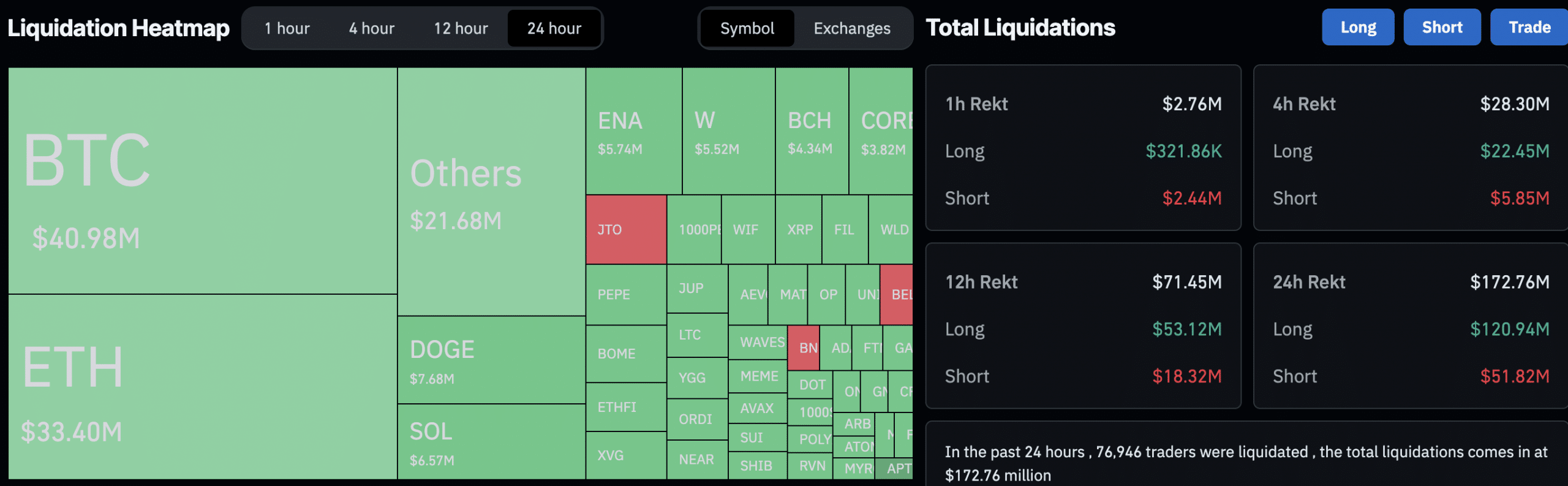

As a result of latest fluctuations of value, liquidations amounting to $40.98 million have occurred. Out of this, $26.6 million had been lengthy positions.

The excessive quantity of lengthy liquidations might impression bullish sentiment round BTC in the long term.

Supply: Coinglass

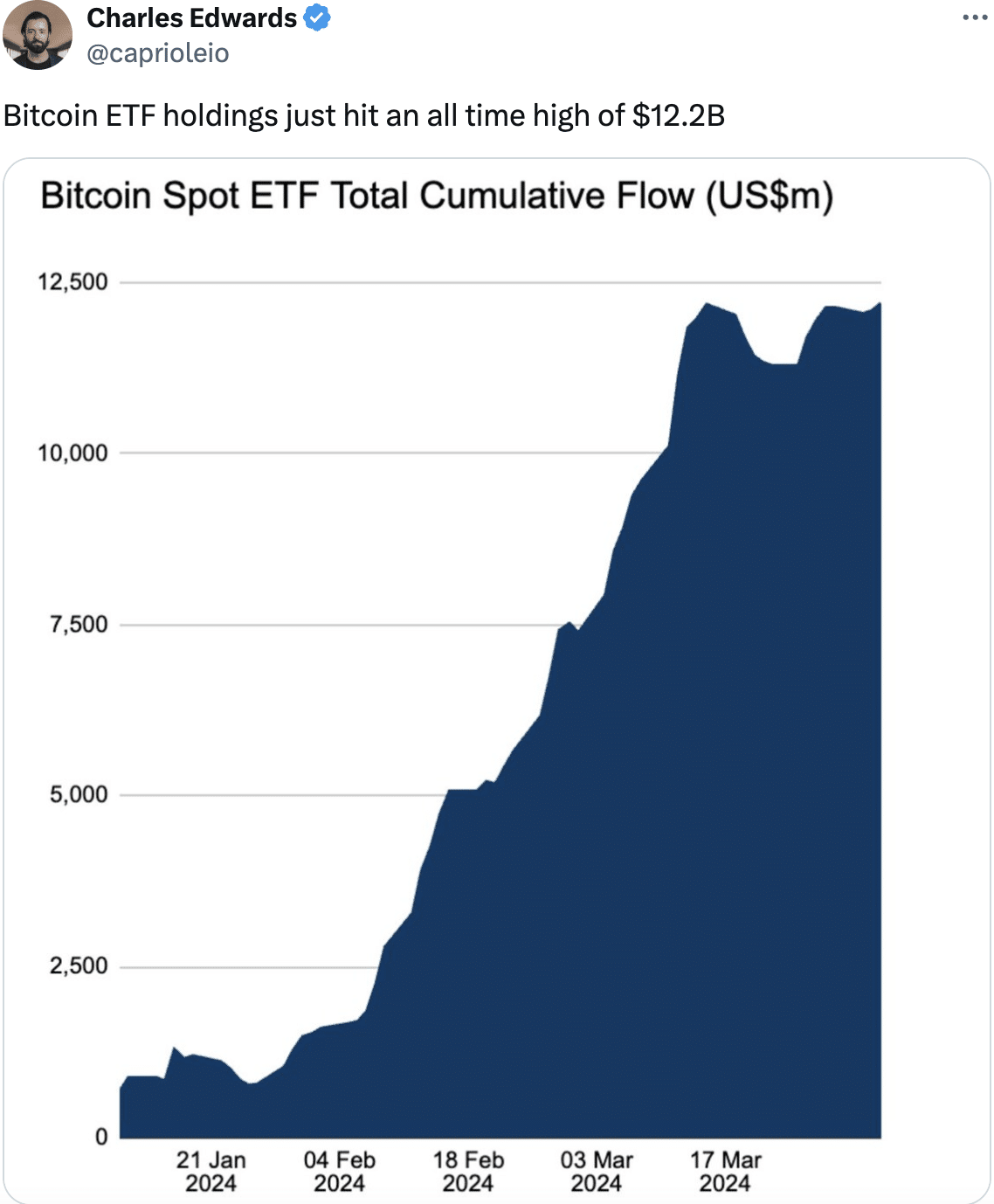

Nevertheless, within the conventional finance markets, BTC was doing comparatively properly. On the time of writing, Bitcoin ETF holdings had simply hit an all-time excessive of $12.2 billion. This signified rising institutional curiosity.

Establishments investing in Bitcoin ETFs typically achieve this as a solution to acquire publicity to the cryptocurrency market with out instantly holding Bitcoin, which might appeal to extra conservative buyers.

Supply: X

With market giants akin to BlackRock advocating for BTC, extra conventional buyers may very well be interested in put money into Bitcoin, regardless of the latest volatility showcased by the king coin.

On the time of writing, BTC was buying and selling at $65,775.97 and its value had fallen by 0.76% within the final 24 hours. Furthermore, the amount at which BTC was buying and selling at had additionally declined by 33.14% throughout this era.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Each day Lively Addresses on the Bitcoin community additionally fell in the previous few weeks.

This steered that the general curiosity in Bitcoin’s ecosystem had fallen in the previous few days, which might additional impression BTC’s future prospects negatively.

Supply: Santiment