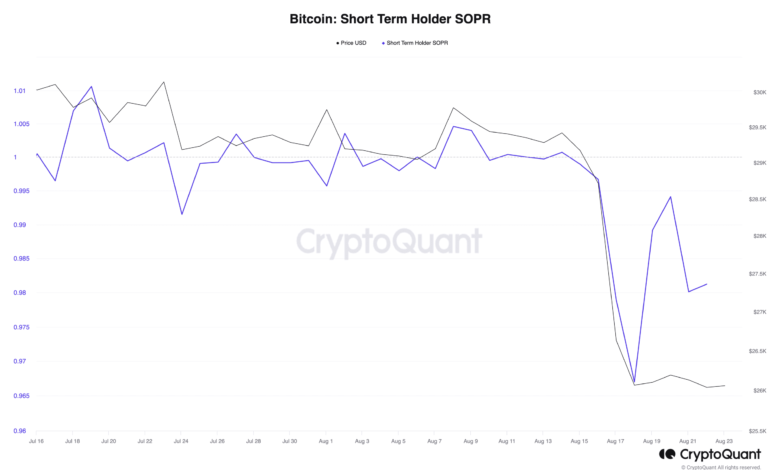

Bitcoin: Short-term holders remain underwater

- Bitcoin’s SOPR for its short-term holders fell beneath 1 following final week’s value decline.

- This meant that these buyers have since traded at a loss.

Bitcoin’s [BTC] short-term holders continued to distribute their holdings at a loss because the Spent Output Revenue Ratio for this cohort of buyers trailed downward at press time.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Brief-Time period Holder Spent Output Revenue Ratio (STH-SOPR) is a metric used to gauge the profitability of short-term holders of a specific crypto asset. It typically affords insights into whether or not buyers who’ve held a specific asset for 3 to 6 months are in a worthwhile or unprofitable place.

If the STH-SOPR is above 1, it signifies that short-term holders, on common, are promoting their cash at a revenue. Conversely, if the STH-SOPR is beneath 1, it means that these holders are promoting at a loss.

Commenting on the influence of final week’s deleveraging occasion on BTC’s short-term holders, pseudonymous CryptoQuant analyst Onchained famous that the STH-SOPR fell to 0.96.

In accordance with Onchained, This STH-SOPR stage was just like a earlier value correction in March 2023, when BTC’s value declined from $25,000 to $19,800, and the STH-SOPR additionally dropped to 0.96.

This metric was 0.98 at press time, in accordance with knowledge obtained from CryptoQuant. With BTC exchanging fingers above $26,000, “short-term holders are nonetheless promoting at a loss, however the losses are much less vital.”

Supply: CryptoQuant

Document lows in BTC distribution

An evaluation of BTC’s value actions on a each day chart revealed that its key momentum indicators have dropped to lows final seen in 2020.

Bitcoin each day RSI is essentially the most oversold that it has been because the March 2020 covid crash pic.twitter.com/MPUfmQagcu

— Will Clemente (@WClementeIII) August 22, 2023

BTC’s Relative Power Index (RSI) was pegged at 20.90, whereas its Cash Circulation had plummeted to six.79 on the time of writing. The positions of those indicators confirmed the excessive quantity of BTC sell-offs amongst each day merchants, most of which occurred after final week’s sudden value decline.

Since 17 August, BTC bears have been accountable for the market. A have a look at the Directional Motion Index (DMI) confirmed the optimistic directional index (inexperienced) at 10.32, lingering beneath the unfavourable directional index (purple), which was 35.86.

In conditions similar to this, the downward actions are extra pronounced than the upward actions, which factors to a value downtrend.

Additionally signaling a waning shopping for stress, BTC’s Superior Oscillator has been marked by downward-facing purple histogram bars since final week.

Supply: BTC/USDT on Buying and selling View

Is your portfolio inexperienced? Test the BTC Revenue Calculator

Regardless of elevated coin distribution amongst each day merchants, gamers within the futures market have adopted a unique method. After just a few days of shorting the main coin, funding charges throughout crypto exchanges have turned optimistic.

This confirmed that buyers have begun to occupy buying and selling positions with bets positioned in assist of a rally in BTC’s value.

Supply: Coinglass