Bitcoin: Short-term rally, long-term risk? BTC faces double-top warning

Key Takeaways

Bitcoin’s MVRV ratio alerts a double-top formation. Buyers may even see a short-lived rally earlier than a possible September correction, making warning the wiser guess.

Bitcoin [BTC] has remained in a comparatively bullish part after exceeding $123,000. Nevertheless, it has stagnated over the previous week, displaying solely modest features.

Which will quickly change. AMBCrypto’s evaluation suggests Bitcoin could possibly be getting ready for a contemporary rally, one that will conclude between late August and early September.

Bitcoin rally may finish in September

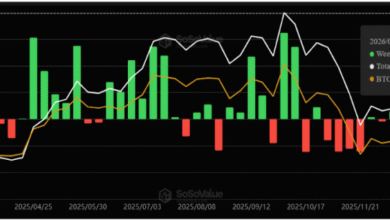

In response to the MVRV 365-Day Shifting Common, Bitcoin could quickly face a major decline.

This projection relies on the Double-High Camel sample, which led to the 2021 bear market. The sample kinds when two peaks happen roughly six months aside.

As of press time, Bitcoin has fashioned the primary peak and is on monitor to kind the second—projected across the tenth of September—which may set off a market cascade.

Supply: CryptoQuant

CryptoQuant analyst Yonsei Dent echoed this sentiment, warning that broader market situations name for warning.

“This timing aligns nicely with broader market narratives, resembling expectations for a attainable Fed charge reduce and shifts in macro sentiment.”

He additionally warned that the decline may start sooner, citing the lagging MVRV 365DMA as a key indicator that late August may mark the beginning of a downtrend.

Accumulation stays regular regardless of threat

Regardless of the looming sample, buyers haven’t stopped accumulating.

The Realized Worth–UTXO Age Band chart reveals that previously month, BTC patrons within the 1W–1M cohort elevated holdings by 3.6%, whereas 1D–1W holders grew by 1.4%.

Supply: CryptoQuant

These cohorts have amassed BTC between $115,252 and $117,762, slightly below the present worth of $118,786.

This conduct implies confidence in a short-term rally, as long-term holders chorus from panic-selling.

Supporting this outlook, Bitcoin’s Trade Reserve declined up to now day, falling to 2.3 million BTC.

A drop in exchange-held Bitcoin usually alerts that buyers are shifting belongings into non-public wallets for long-term holding, with little intent to promote within the close to time period.

Supply: CryptoQuant

Institutional buyers, nonetheless, seem like taking the alternative route.

Institutional publicity drops

Over the previous 4 buying and selling days, institutional buyers have been chopping their publicity to Bitcoin, in line with CoinGlass spot BTC ETF circulate data.

Between the twenty first and twenty third of July, this group offloaded $285.2 million value of BTC, suggesting a shift in sentiment.

Nevertheless, between the twenty fourth and twenty fifth of July, they bought $375.5 million in BTC, including to the bullish case, though briefly, it seems.

Supply: CoinGlass

Nonetheless, that two-day buy was the bottom recorded in latest months, indicating waning curiosity and a attainable readiness for a market reversal.

Bitcoin may nonetheless see extra upside within the coming days.

Nevertheless, the broader knowledge—particularly from the MVRV sample and institutional circulate—factors to a looming threat of main decline, suggesting buyers ought to proceed with warning.