Bitcoin: Should you expect more volatility ahead of the halving?

- Bitcoin’s Implied Volatility noticed a surge final weekend.

- Bearish sentiments overrun the market because the halving nears.

The implied volatility for Bitcoin [BTC] choices contracts expiring in April elevated considerably from 62% to 75% over the weekend, Kaiko famous in a latest publish on X (formerly Twitter).

Implied Volatility measures the anticipated future swings in a coin’s value.

Such a pointy rise in an asset’s Implied Volatility over a brief interval suggests a notable shift in market sentiment concerning the place the asset’s value could also be headed within the brief time period.

The surge in BTC’s implied volatility means that market members count on elevated value fluctuations or “turbulence” within the brief time period.

BTC within the spot market

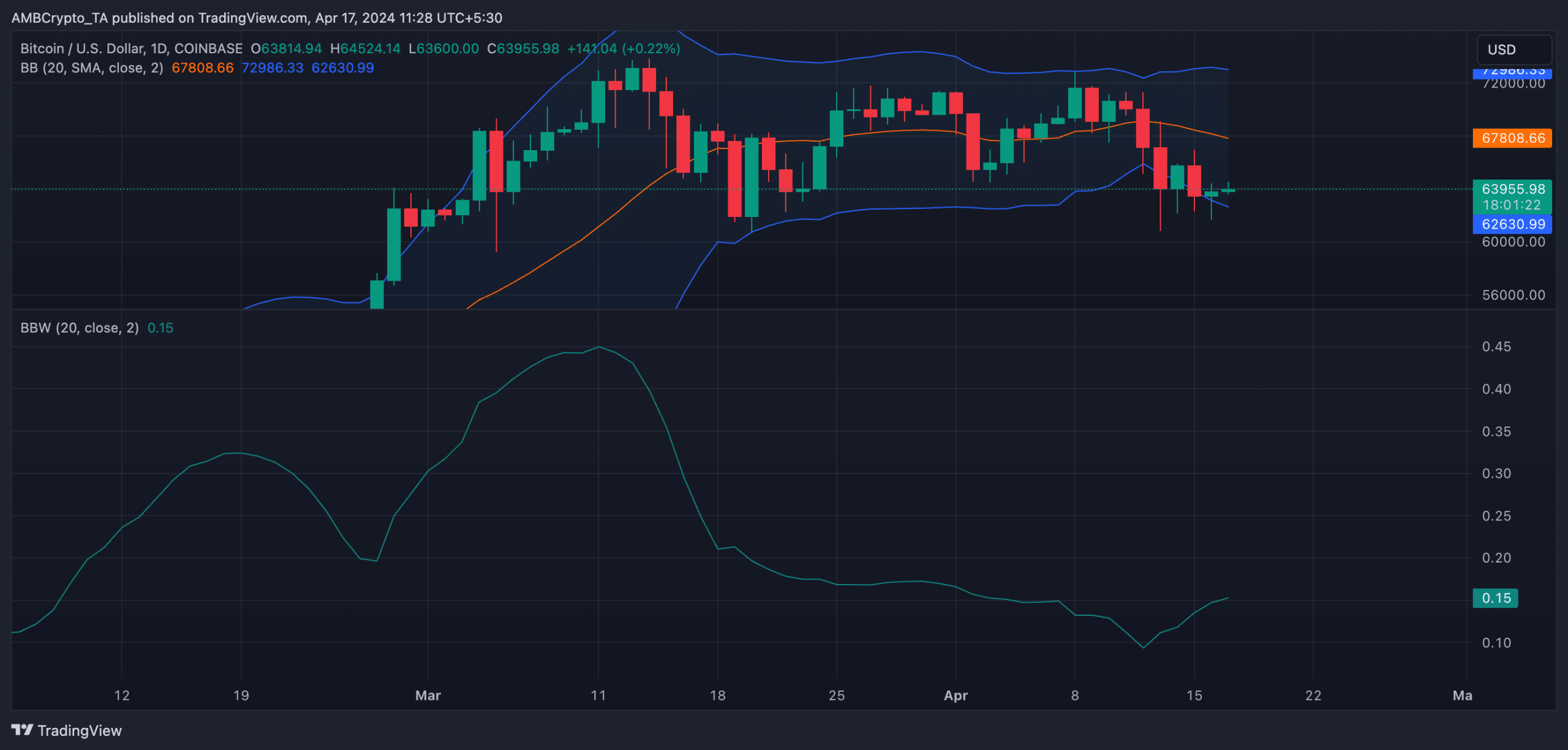

An evaluation of key volatility markers on BTC’s every day chart confirmed that the coin stays vulnerable to important value swings in both path.

For instance, the hole between the higher and decrease bands of the coin’s Bollinger Bands (BB) indicator has widened. This indicator assesses market volatility and an asset’s potential value actions.

When the hole between its higher and decrease bands widens, the asset’s value turns into extra risky and will get away in an uptrend or a downtrend.

Confirming the rising volatility, BTC’s Bollinger Bandwidth was in an uptrend as of this writing. At 0.15, the indicator’s worth has risen by 67% prior to now 4 days.

This indicator measures the width of the Bollinger Bands relative to one another. When it rises (as in BTC’s case), it confirms an increase in market volatility.

Supply: BTC/USDT on TradingView

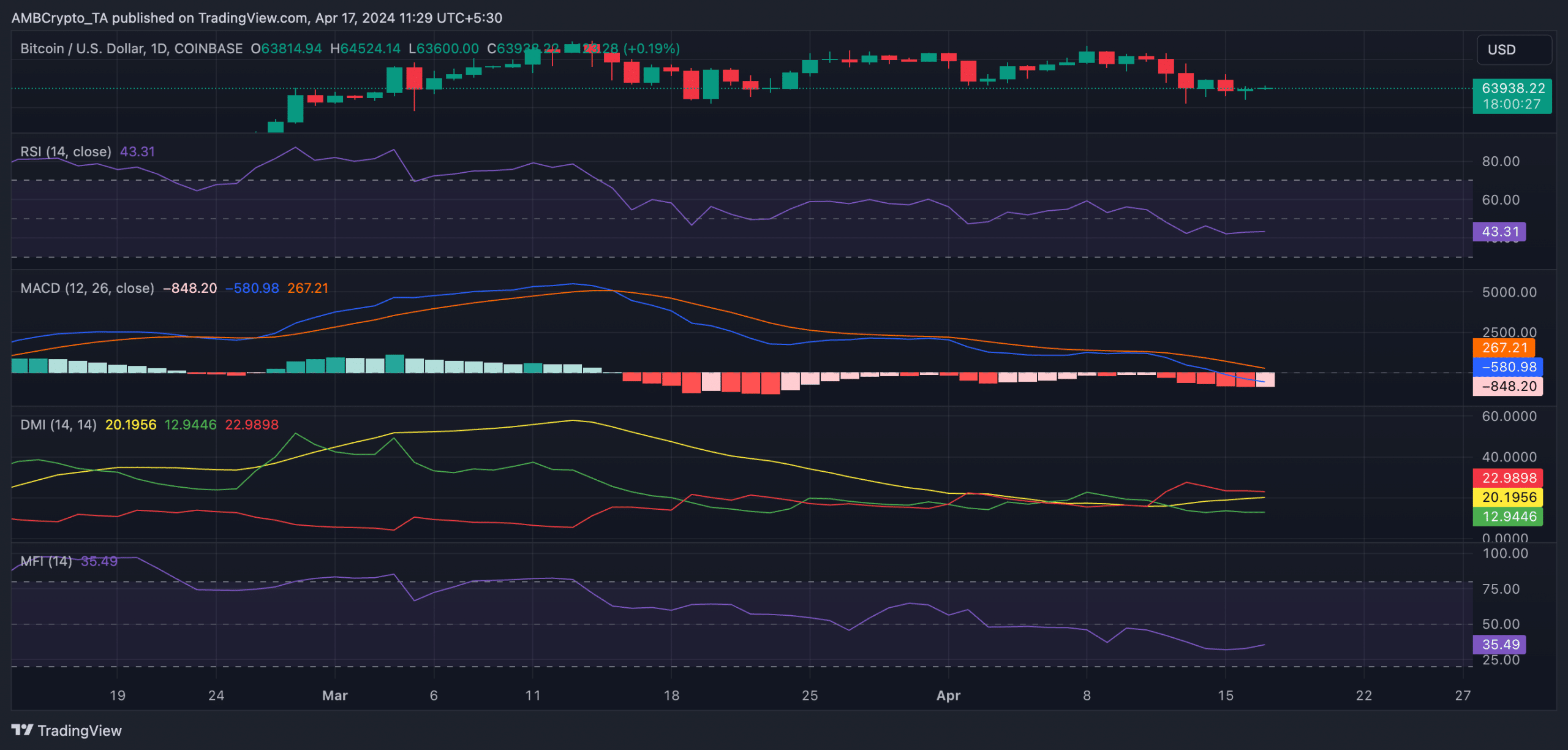

Amid rising volatility and the upcoming halving occasion on the twentieth of April, bearish sentiments remained important within the BTC market.

Readings from the coin’s Shifting Common Convergence Divergence (MACD) indicator confirmed its MACD line resting beneath its sign and 0 traces.

These traces have been so positioned for the reason that fifteenth of March, when the coin fell from its all-time excessive of $73,750.

This indicated that BTC’s short-term shifting common is beneath its longer-term shifting common. That is usually interpreted as a bearish sign.

Additionally, its constructive directional index (inexperienced) was pegged beneath its destructive index (crimson). This confirmed that the coin’s bear energy considerably outpaced its bull energy.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

At press time, BTC’s Relative Power Index (RSI) and Cash Circulate Index (MFI) had been 43.29 and 35.45, respectively, suggesting a decline in every day demand.

Supply: BTC/USDT on TradingView

These values confirmed that market members most popular to promote their cash slightly than accumulate extra.