Bitcoin: Small holders are hoarding; BTC to $70K again?

- Comparatively smaller Bitcoin addresses start to build up BTC as costs surge.

- Profitability remained low, lowering the possibilities of sell-offs anytime quickly.

Ever since Bitcoin[BTC] has handed the $70,000 mark after which witnessed a correction, hypothesis round what’s going to occur subsequent to the coin has flooded the crypto sphere.

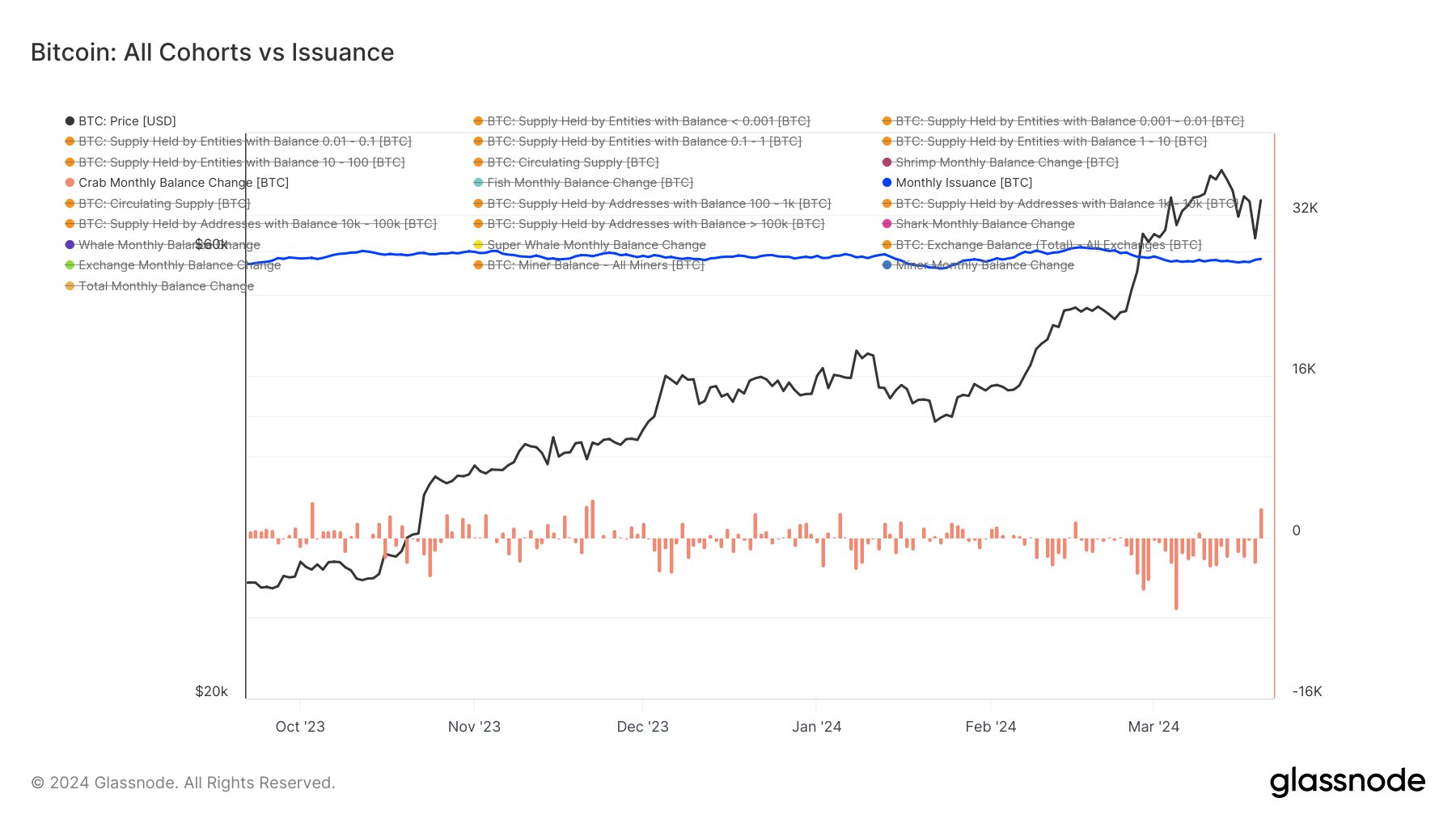

Crabs and Fishes take the pie

The worth of Bitcoin could rally as a result of conduct of two distinct teams of holders often known as “crabs” and “fishes.” These phrases discuss with holders with Bitcoin holdings starting from 1 to 10 BTC for crabs and 10 to 100 BTC for fishes.

Latest observations counsel a possible regime change amongst these holders, transitioning from a section of distribution to accumulation.

Each crabs and fishes have skilled the best degree of accumulation since November 2023. Furthermore, there are indications that even smaller holders, with holdings of 0 to 1 BTC, are becoming a member of this accumulation development, as evidenced by current knowledge.

Whereas this accumulation broadens the investor base, it additionally concentrates holdings amongst these mid-tier traders, which might result in extra centralized management over the market in comparison with a situation with a wider distribution of smaller holdings managed primarily by whales.

Supply: X

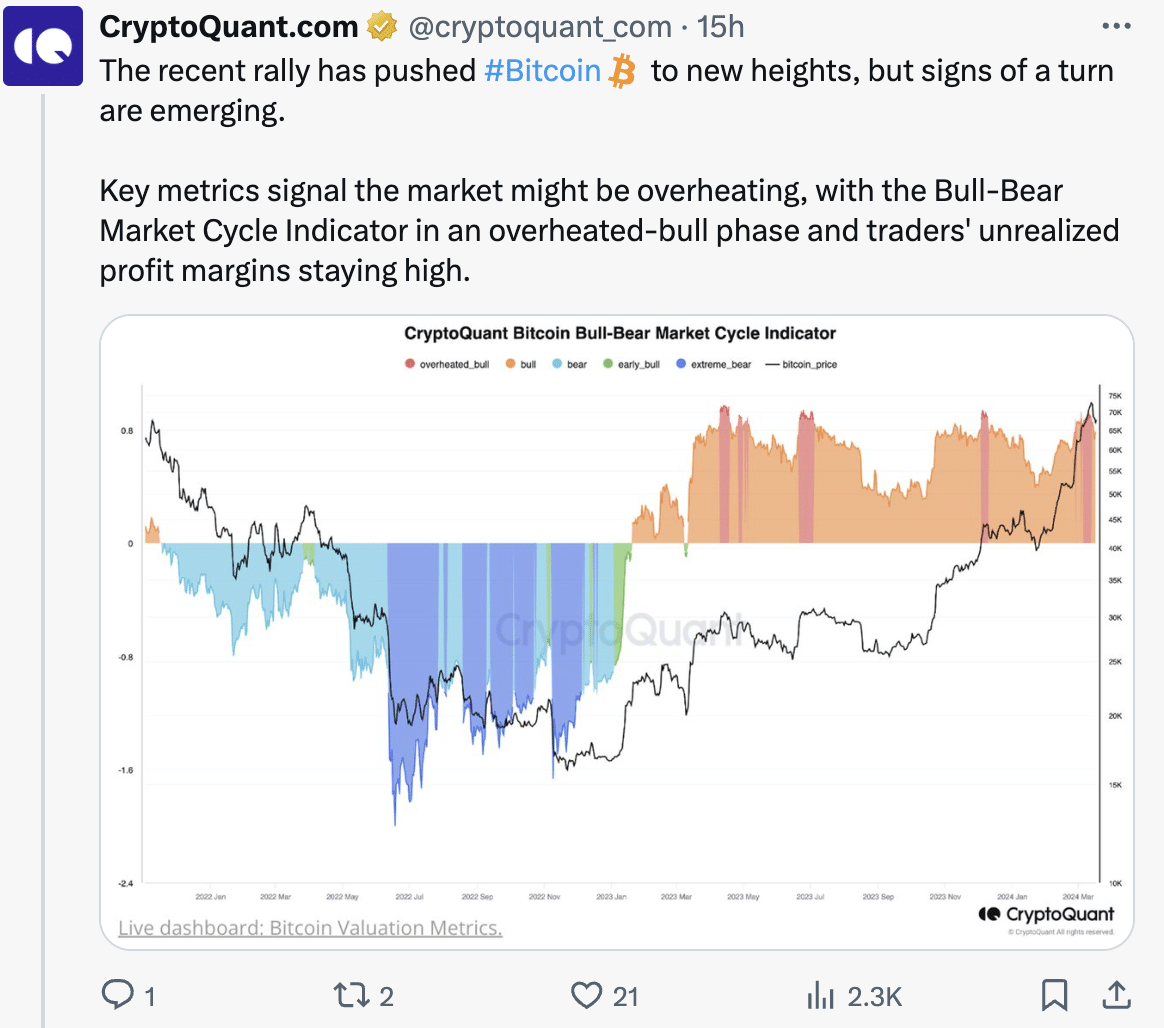

Some challenges forward

Nonetheless, key metrics indicated that the market had probably overheated, as evidenced by the Bull-Bear Market Cycle Indicator. It entered an overheated-bull section and merchants maintained excessive unrealized revenue margins.

After this, promoting amongst BTC merchants commenced, capitalizing on these elevated revenue margins. This scale of promoting hadn’t been noticed since Could 2019.

Moreover, vital Bitcoin holders intensified their promoting actions, whereas miners additionally started offloading their holdings amid the hovering costs.

Supply: X

These components might affect BTC’s journey previous the $70,000 mark negatively. At press time, BTC was buying and selling at $$64,749.87 and its worth had declined by 3.44% within the final 24 hours.

Sensible or not, right here’s BTC’s market cap in ETH phrases

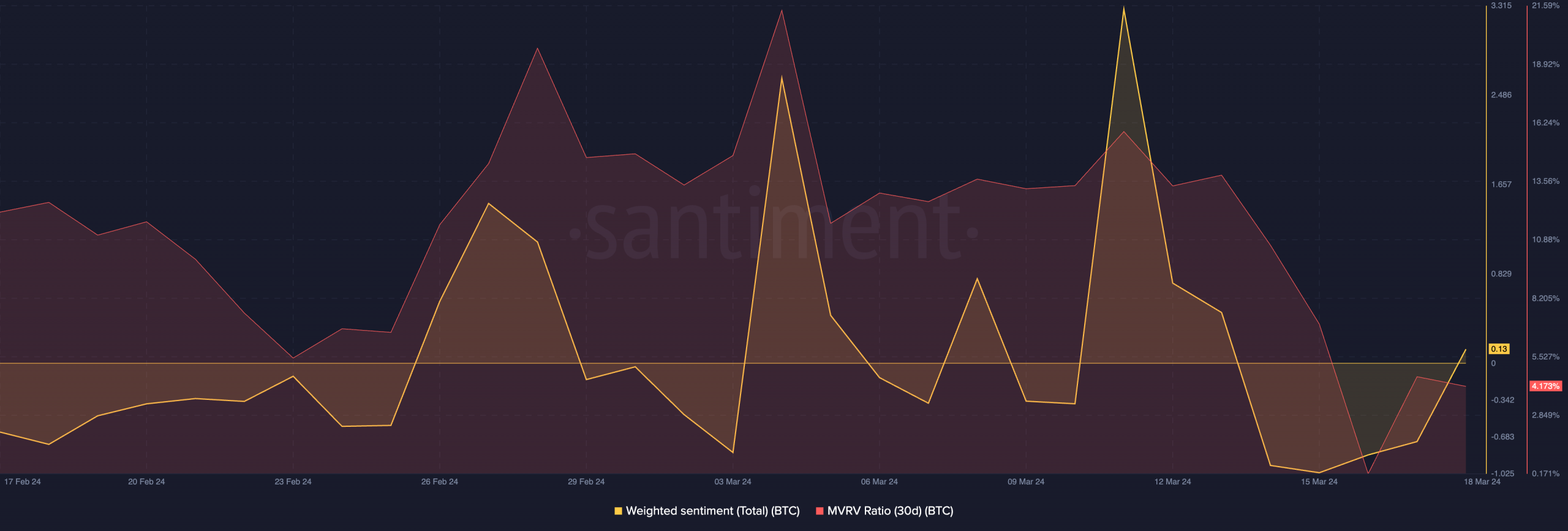

Apparently, the MVRV ratio had remained low, signifying that many holders have been nonetheless not worthwhile. The low MVRV ratio prompt that the present uptick in worth could have been brought on by new entrants who nonetheless haven’t seen income but.

This makes it more likely for BTC to succeed in $70,000 as revenue gained’t be potential at present ranges. Nonetheless, sentiment may shift as costs develop previous $70,000 and the probability of correction would additionally develop.

Supply: Santiment