Bitcoin spot ETFs’ ‘Zero flow’ days – All you need to know

- Bitcoin spot ETF sees zero netflow.

- GBTC holdings proceed to say no.

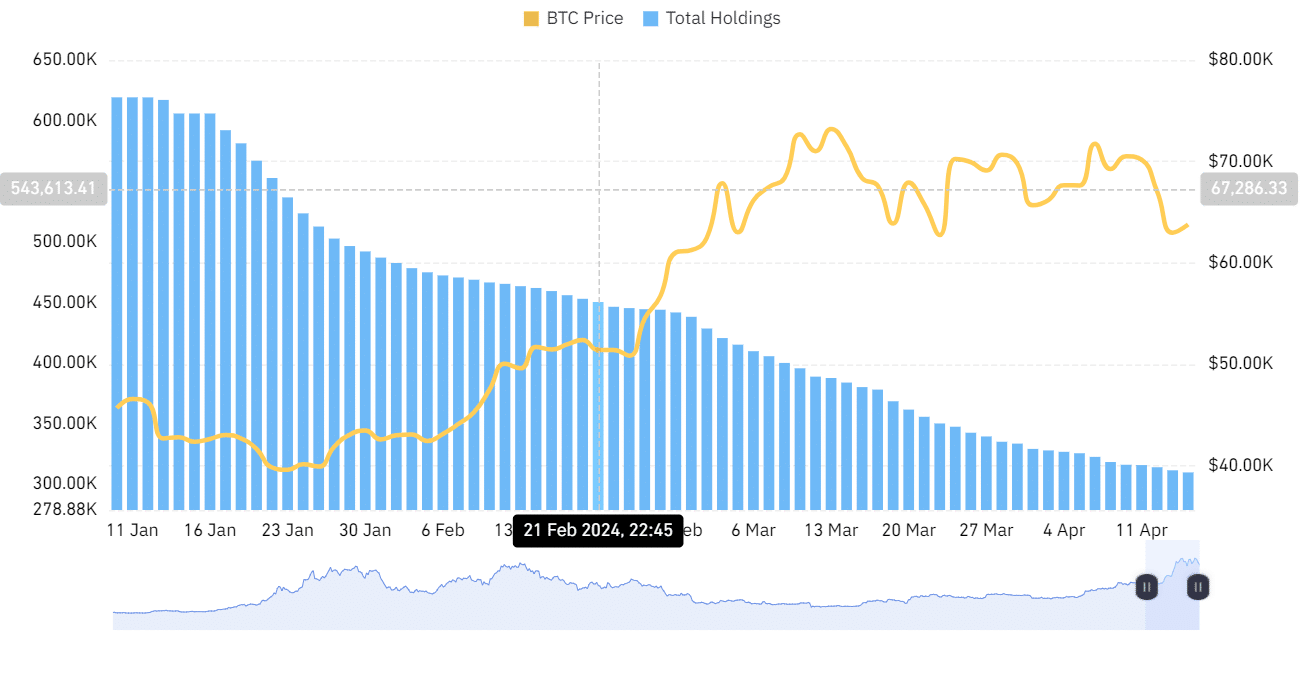

Following the approval and launch of the spot Bitcoin [BTC] ETF, Grayscale’s Bitcoin holdings have skilled a decline. After the ETF’s launch, most platforms have witnessed zero flows for the primary time.

Grayscale’s Bitcoin holdings halves

An examination of establishments that lately obtained spot Bitcoin ETF approvals revealed that Grayscale held the best BTC market capitalization.

Nonetheless, a deeper dive into the information revealed a decline within the quantity of BTC held by Grayscale over current months.

Coinglass knowledge indicated that as of January, Grayscale held over 619,000 BTC. But, as of press time, their complete holdings stood at round 310,000 BTC.

Supply: Coinglass

Grayscale’s pre-existing Bitcoin Belief, GBTC, transitioned into an ETF relatively than launching afresh.

Regardless of the lower in Grayscale’s holdings, it has continued to expertise vital quantity in ETF flows. Nonetheless, sure spot ETF platforms have lately recorded zero flows.

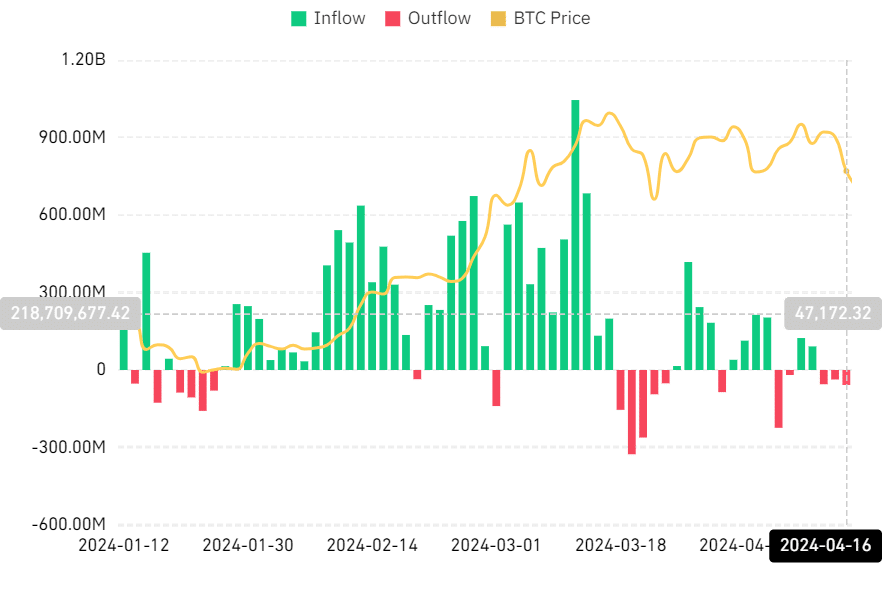

Spot Bitcoin ETFs see consecutive outflows

An evaluation of the Bitcoin spot ETF netflow on Coinglass signifies consecutive outflows over the previous few days. On the fifteenth and sixteenth of April, outflows amounted to $26.7 million and $58 million, respectively.

This isn’t the primary prevalence of consecutive unfavorable flows, with the best quantity noticed in March. In March, knowledge revealed consecutive outflows for 5 days.

Notably, BlackRock’s IBIT and Grayscale’s GBTC are the one U.S. spot BTC ETFs to file any flows for the reason that starting of the week.

Supply: Coinglass

Zero flows dominate ETF flows

Additional evaluation of the Bitcoin spot ETF circulate revealed that on the fifteenth of April, GBTC skilled an outflow of $157.50 million, adopted by one other outflow of $109 million on the sixteenth of April, persevering with the development of consecutive outflows.

In distinction, IBIT noticed a special circulate sample, with an influx of $76.23 million on 15 April and almost $26 million on 16 April.

Notably, there have been no flows from different platforms. Nonetheless, James Seyffart famous that this doesn’t point out the failure of the product.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In his submit, he defined that on most days, the overwhelming majority of all United States ETFs submit zero inflows, which is taken into account regular for any ETF in a given sector.

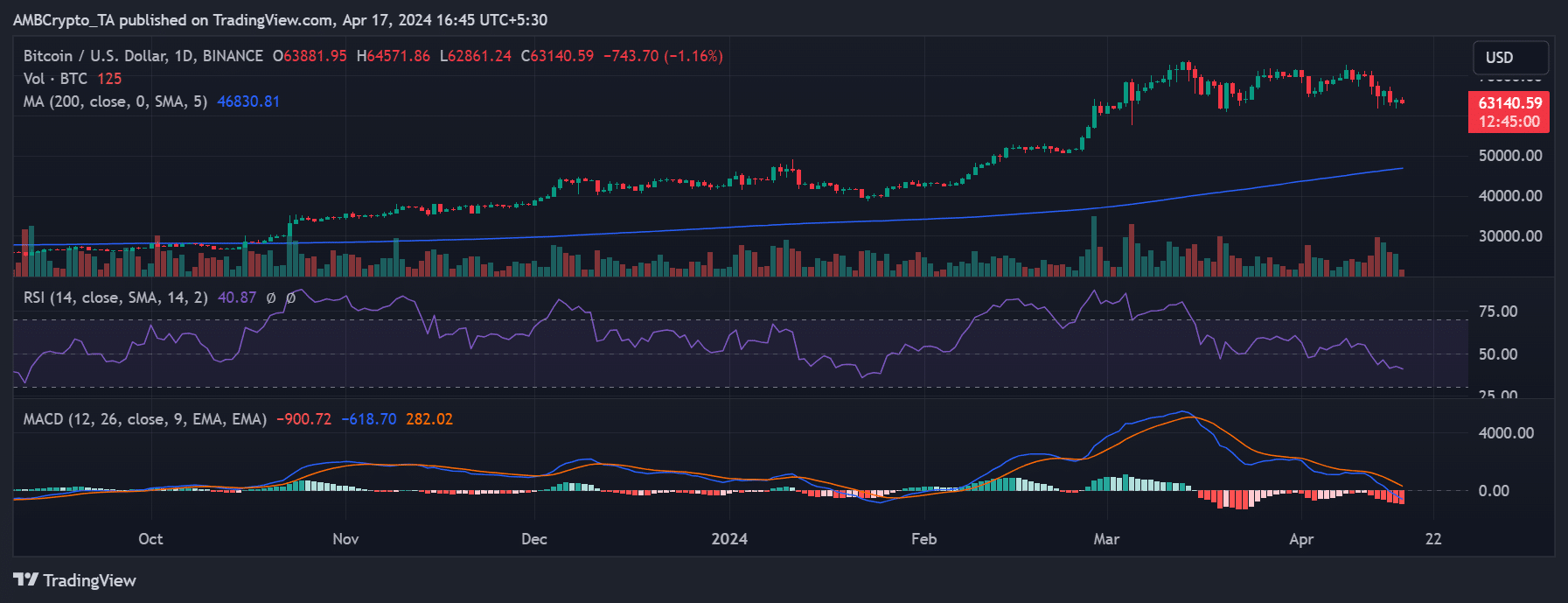

As of this writing, Bitcoin was buying and selling at round $63,170, representing a decline of over 1%.

Supply: TradingView