Bitcoin stalls under $64K, but THIS signals an uptrend: What now?

- Bearish sentiment round BTC was dominant out there.

- Promoting stress on the coin was excessive.

Bitcoin’s [BTC] value motion remained underwhelming, because it has failed to maneuver above $64k in the previous couple of days. Within the meantime, a key BTC metric entered a zone of indecisive path.

Does this imply buyers have to attend longer to see BTC rise once more?

What’s happening with Bitcoin?

CoinMarketCap’s data revealed that BTC was down by greater than 2% within the final seven days.

This pushed BTC’s value below $64k, as at press time it was buying and selling at $63,843.66 with a market capitalization of over $1.26 trillion.

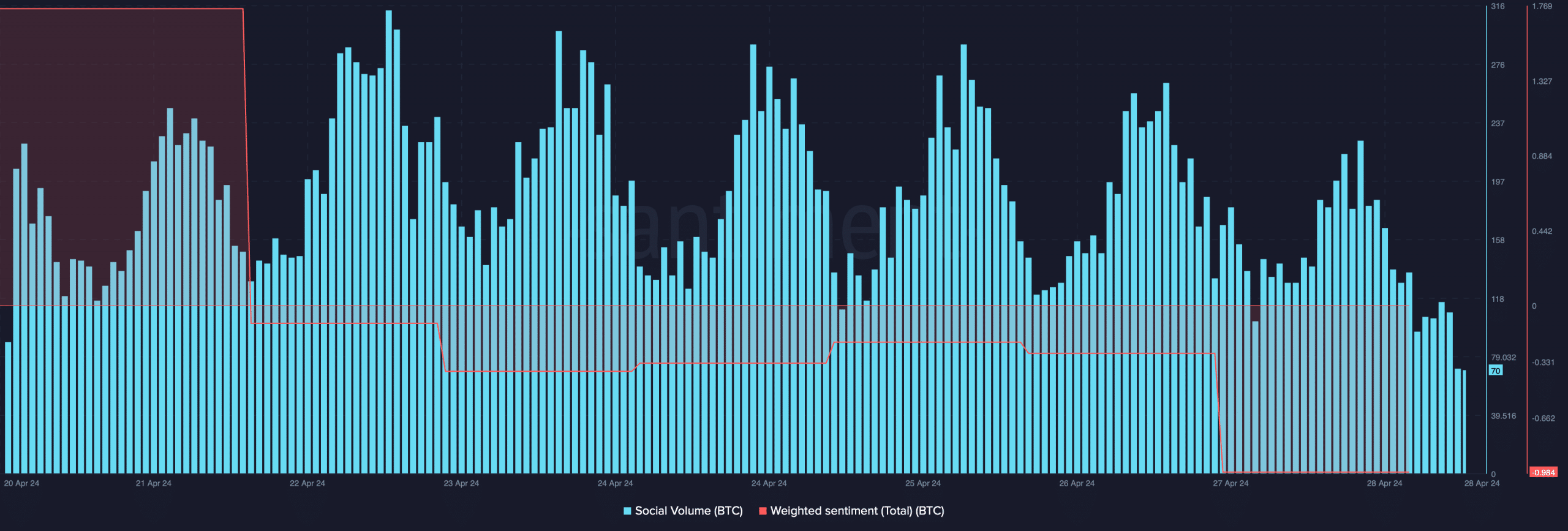

Due to the adverse value motion, Weighted Sentiment across the king of cryptos turned bearish on the twenty seventh of April.

Its Social Quantity additionally dropped barely final week, reflecting a decline in BTC’s recognition within the crypto area.

Supply: Santiment

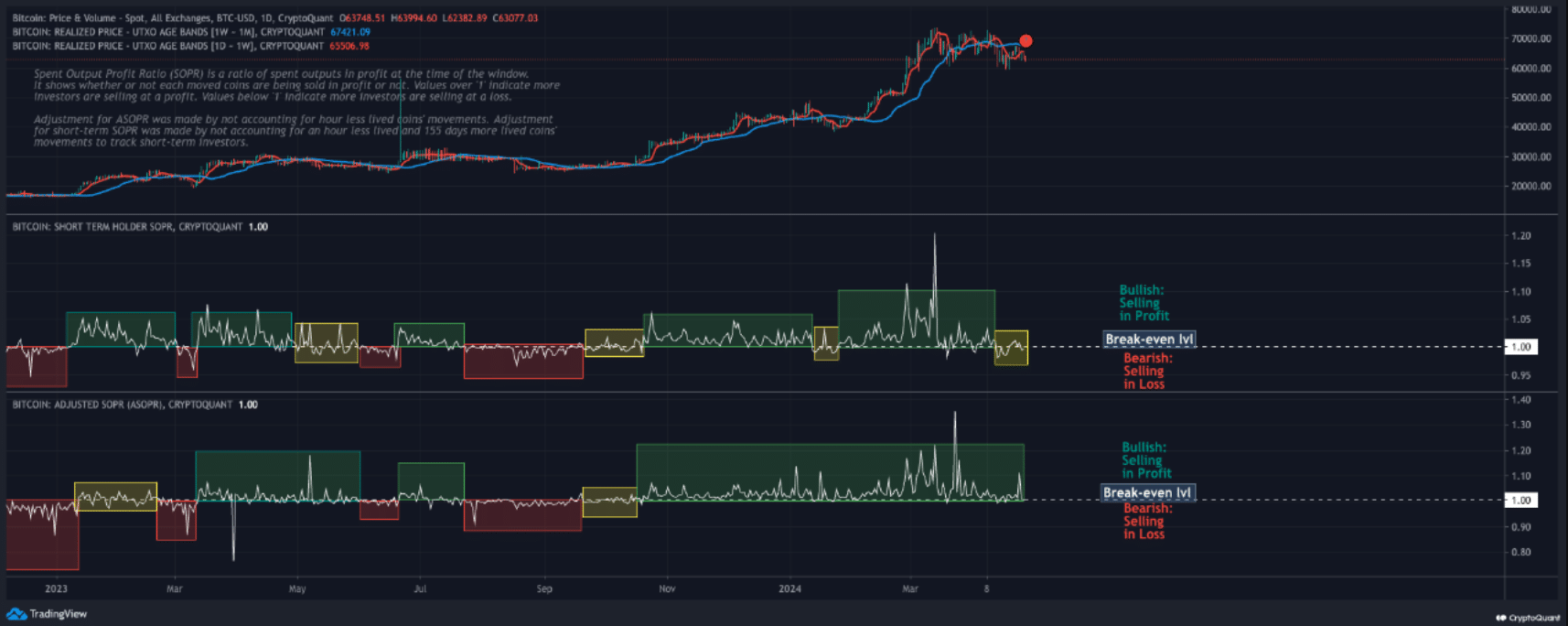

In the meantime, Phi Deltalytics, an writer and analyst at CryptoQuant, posted an analysis utilizing a key BTC metric.

As per the evaluation, the adjusted Spent Output Revenue Ratio (SOPR) of Bitcoin continued to maneuver in a bullish path, whereas the short-term SOPR has entered a zone of uncertainty.

This discrepancy highlighted a fancy atmosphere the place short-term buyers confronted losses.

Supply: CryptoQuant

The evaluation talked about,

“Whereas fluctuations of this nature usually are not unusual, notably during times of value exploration towards new all-time highs, heightened vigilance is warranted.”

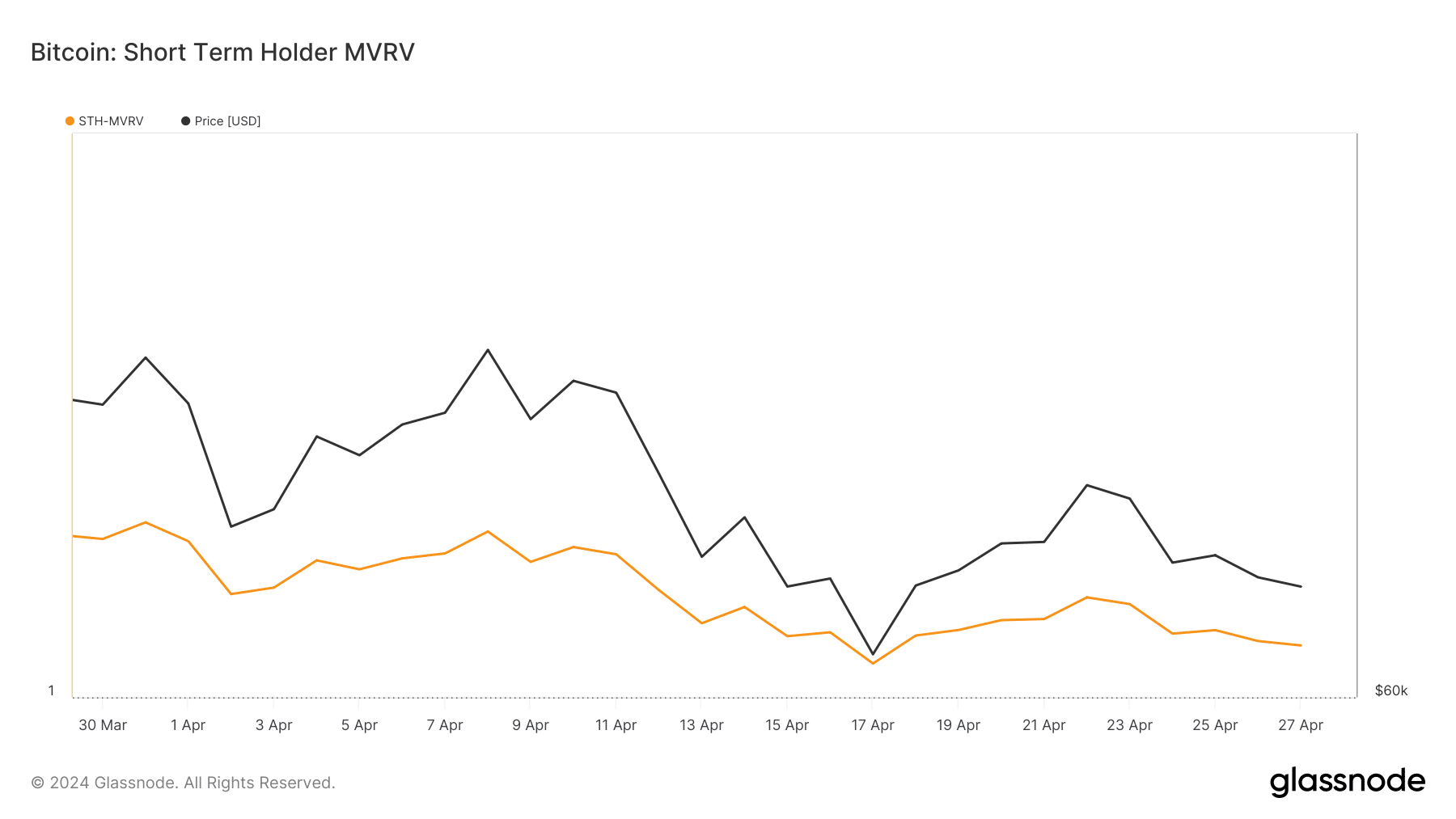

AMBCrypto’s evaluation of Glassnode’s information additionally identified an attention-grabbing growth associated to short-term holders. We discovered that BTC’s STH MVRV dropped over the previous few weeks.

For the uninitiated, a low MVRV means that the present value of Bitcoin is comparatively decrease in comparison with the final transaction costs.

Supply: Glassnode

Does this trace at a value uptick?

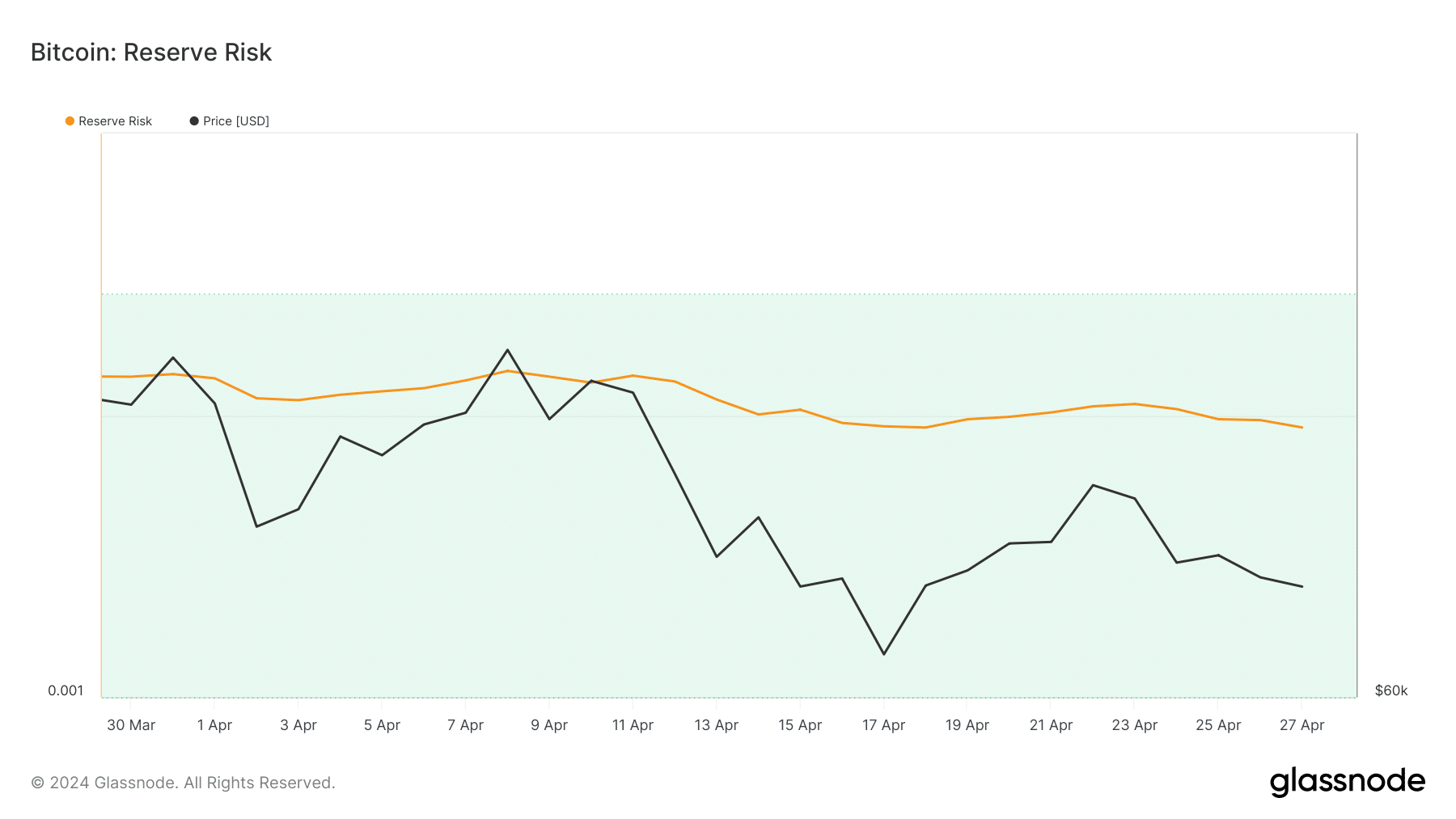

Since BTC gave the impression to be undervalued, AMBCrypto took a more in-depth have a look at its state to higher perceive whether or not a value rise was across the nook. As per our evaluation, BTC’s reserve threat was low.

This metric indicated that confidence in BTC was excessive. Nonetheless, its value lay low at press time, which might be inferred as a bullish sign.

Supply: Glassnode

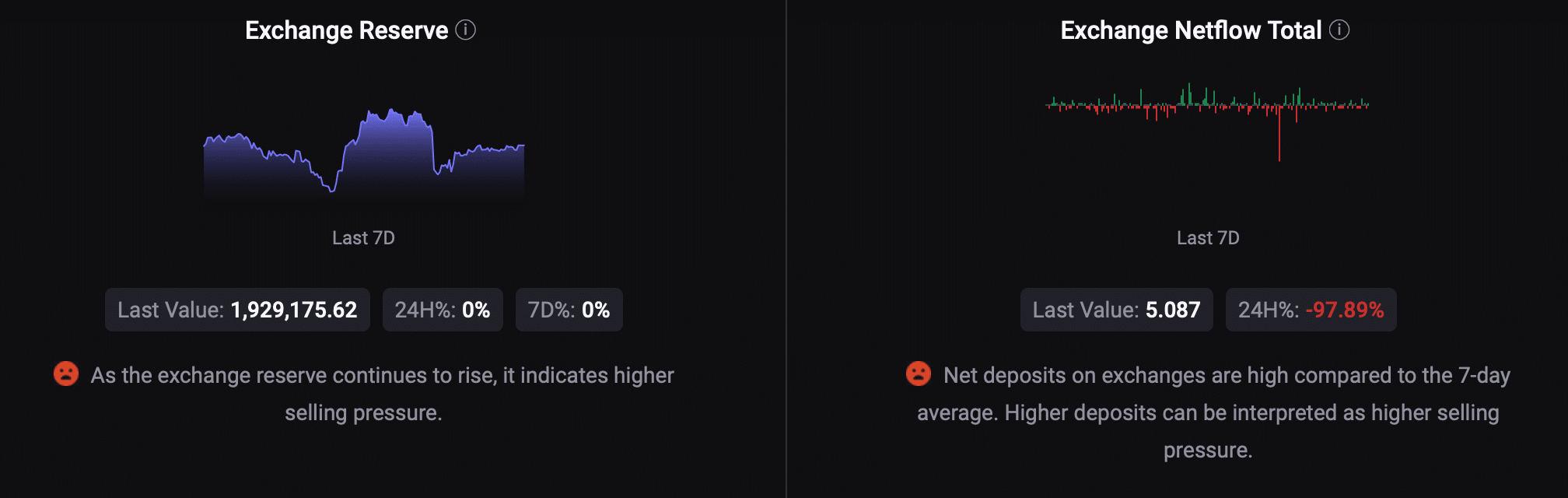

Not every part regarded optimistic for BTC. As an example, AMBCrypto’s have a look at CryptoQuant’s data revealed that promoting stress on BTC was excessive as its alternate reserve was growing.

Its web deposit on exchanges was additionally excessive in comparison with the final seven days’ common.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

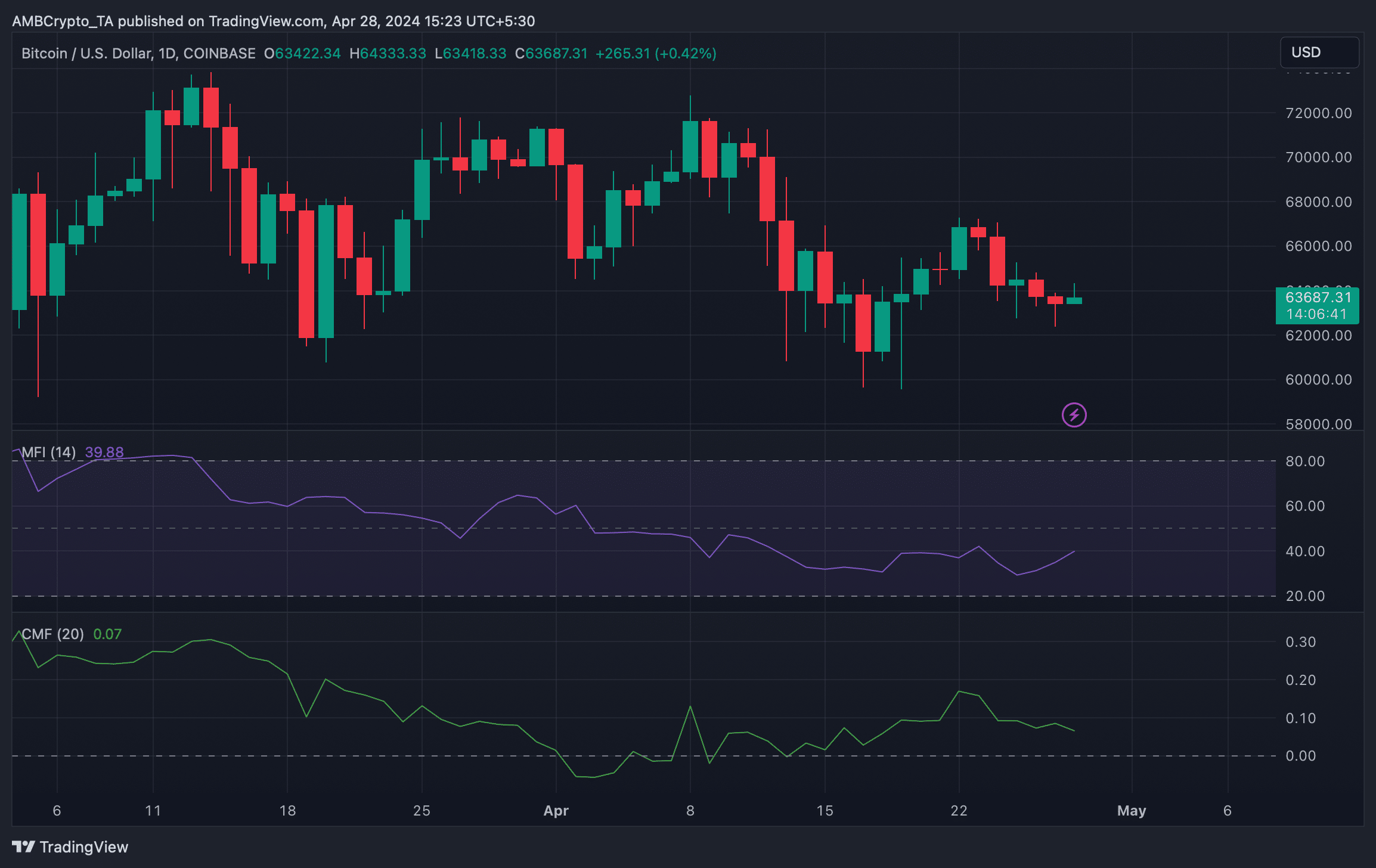

We then took a have a look at BTC’s every day chart to see what market indicators needed to counsel relating to BTC’s upcoming value motion.

As per our evaluation, the Cash Move Index (MFI) hinted at a value uptick because it moved upwards. Nonetheless, the Chaikin Cash Move (CMF) remained bearish.

Supply: TradingView