Bitcoin stays above $85K: Will THIS drive BTC to $100K?

- Bitcoin sustains the extent above $85,000, with $95,000 as a major subsequent resistance space.

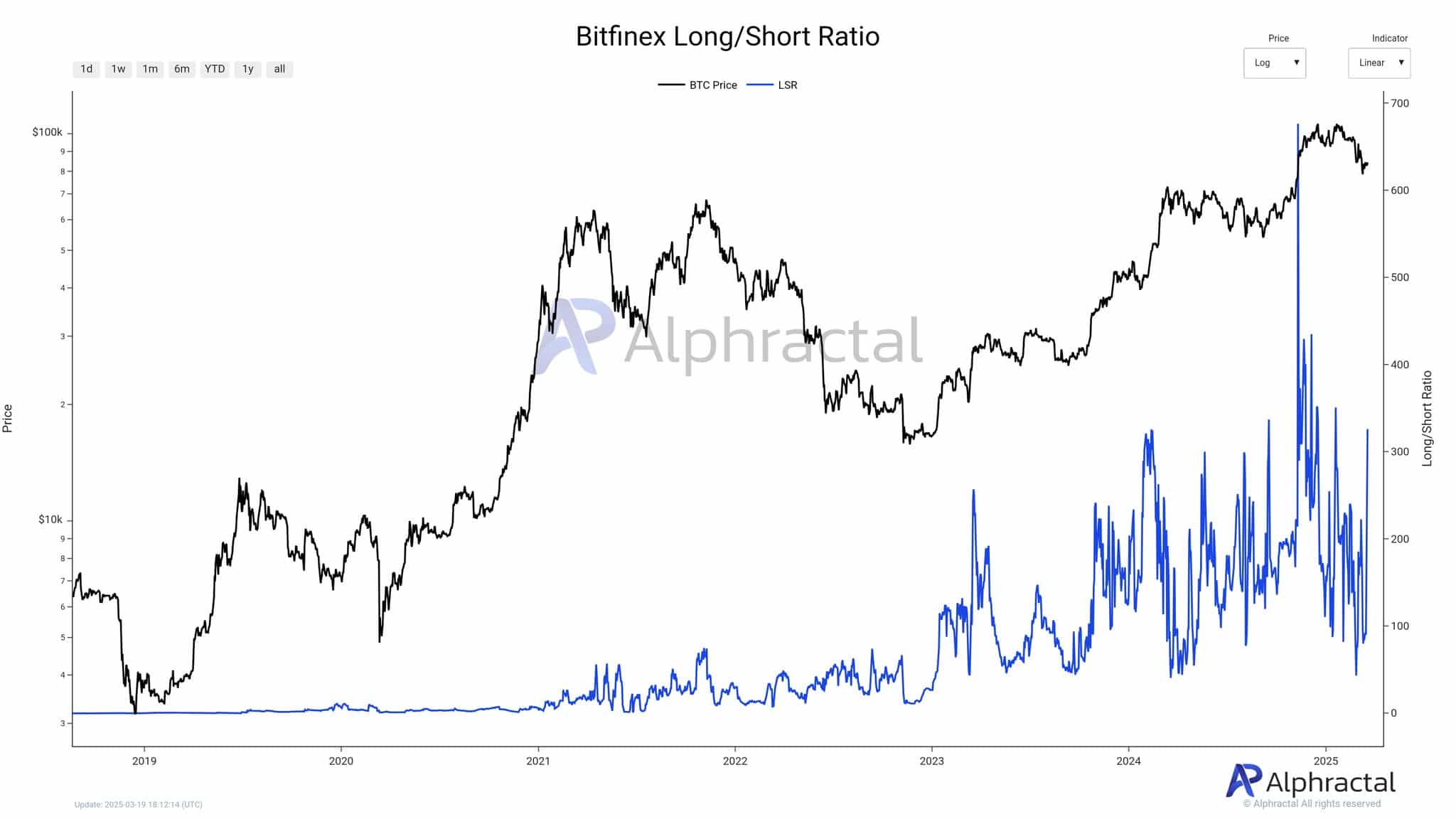

- The Lengthy/Quick Ratio reached 650 in early 2025.

Bitcoin’s [BTC] lengthy positions on Bitfinex skilled important progress, which validated that merchants had constructive market expectations.

The Lengthy/Quick Ratio reached 650 throughout early 2025 at ranges, going far past the important 320 vital threshold.

Supply: Alphractal

A steady choice for lengthy positions amongst its customers materialized via the Lengthy/Quick Ratio reaching numbers exceeding 100 since mid-2023.

The variety of BTC merchants holding lengthy positions reached its most peak of 80,000 at the moment, alongside declining brief place ranges, falling to twenty,000.

The value surge of BTC reached $90,000 as a result of market imbalance that strengthened its upward trajectory.

Moreover, shopping for stress exceeded 320, which demonstrated elevated probabilities for BTC to realize $100,000 worth worth.

Thus, the continued upkeep of a ratio above 320 acted as the important thing issue. This additional enabled a bullish trajectory, but any drift beneath this threshold would possibly trigger it to maneuver towards $85,000.

Bitcoin market sentiment

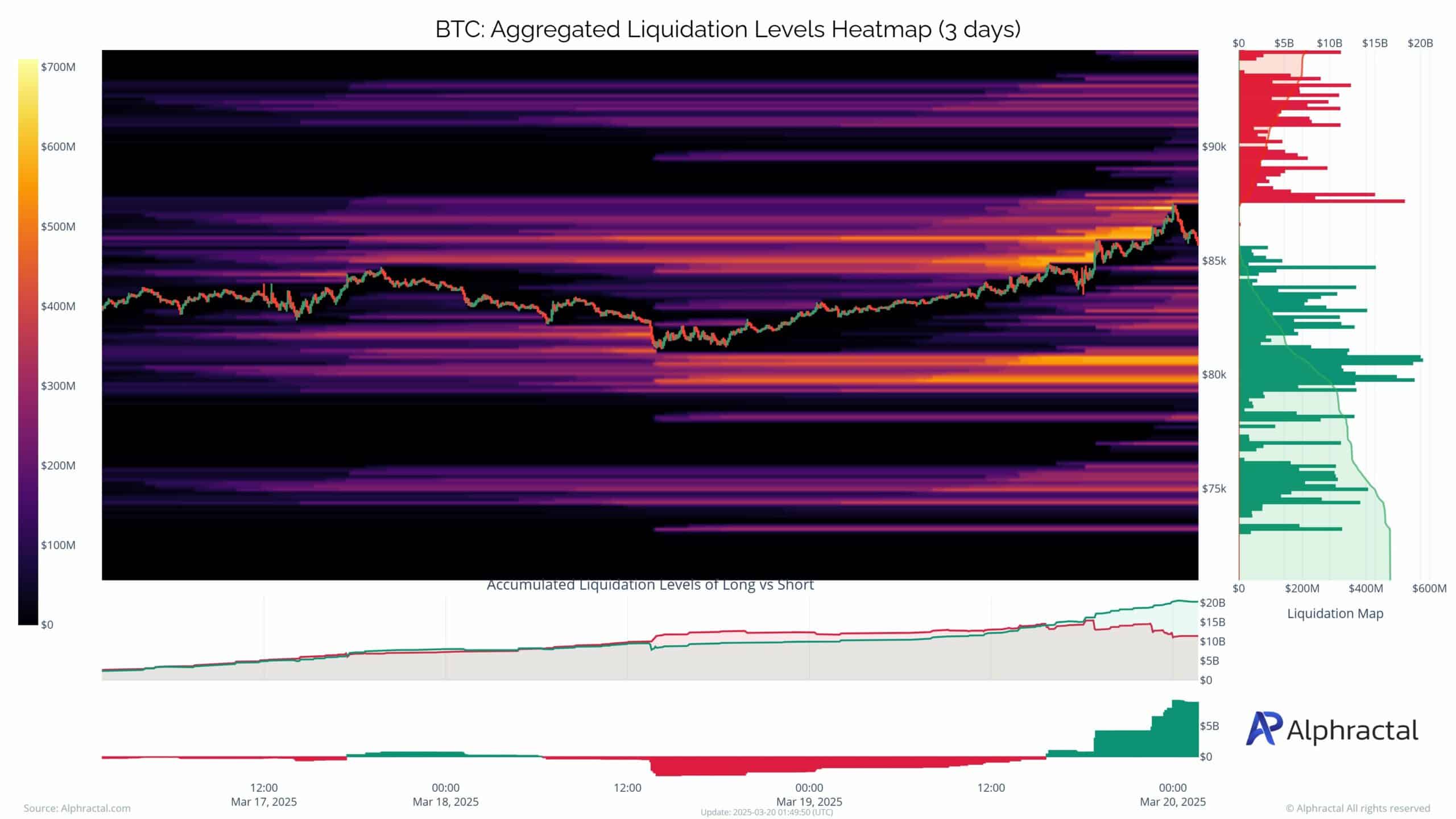

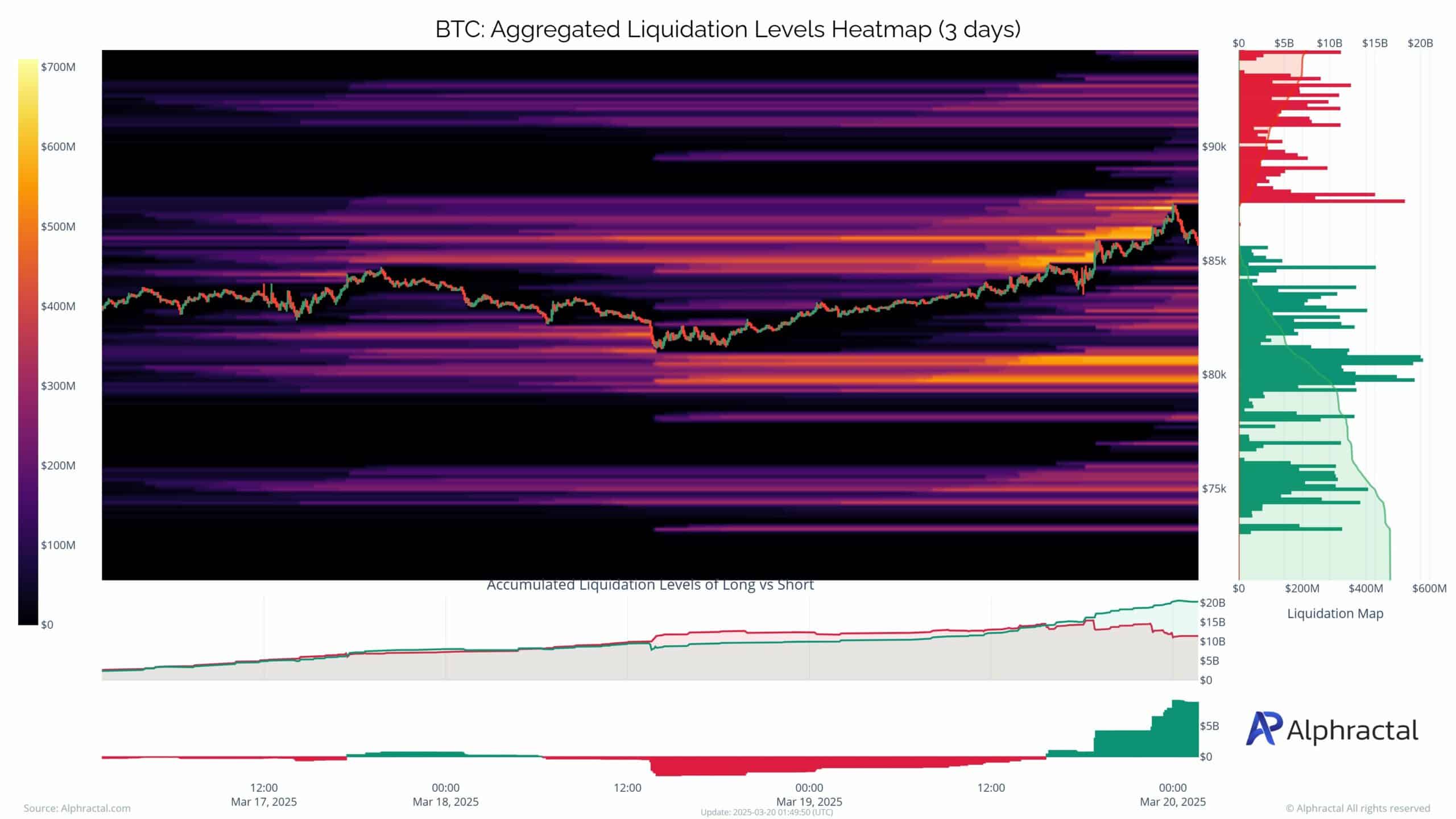

On the time of writing, a mass of shorts suffered liquidation on BTC’s heatmap, which contributed to advancing the bullish market momentum.

A considerable $200 million price of brief positions bought cleared at $85,000 when Bitcoin dropped momentarily earlier than reverting to $90,000.

Supply: Alphractal

Additionally, over $500 million price of brief positions bought robotically liquidated in solely three days inside the value vary of $80,000 via $85,000, thereby amplifying market purchase stress.

Thus, bearish merchants needed to shut their positions, which created extra upward momentum for BTC.

If BTC sustains the extent above $85,000, it could end in a worth goal for $95,000 as a major subsequent resistance space.

Sequentially, BTC exhibited an upward pattern after main whale accumulation occasions, thus elevating the potential for reaching $95,000.

The mixture of whales promoting at elevated worth factors and market promote stress may have pressured costs all the way down to $85,000 ranges.

Due to this fact, whale exercise mixed with Bitfinex’s Lengthy/Quick Ratio tendencies and liquidation information confirmed that the market stays presently optimistic.