Bitcoin struggles to breach $86.8k resistance – Will bears stage a comeback?

- Bitcoin has a bearish 1-day construction however confirmed probabilities of a worth bounce towards $88k.

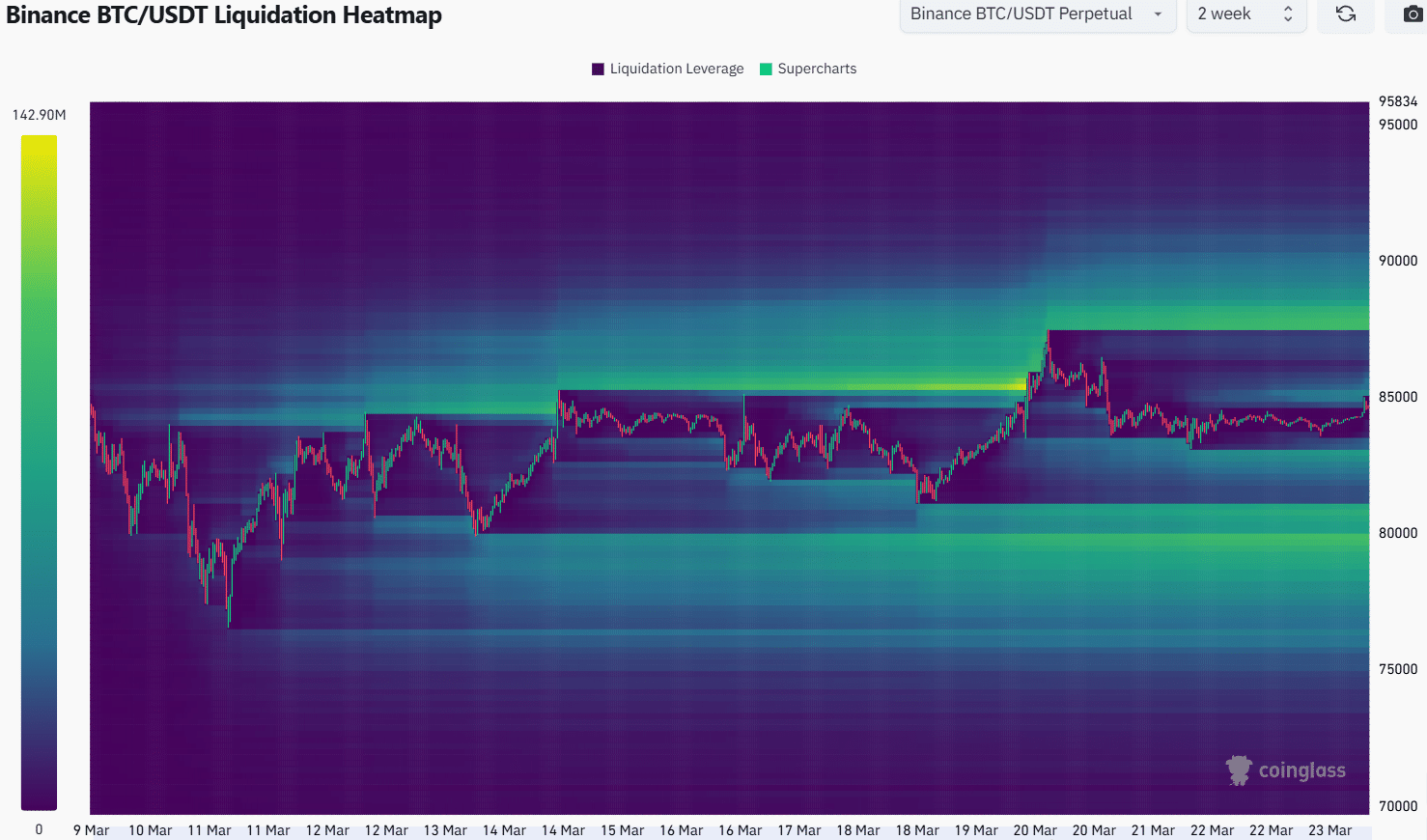

- The liquidation heatmap confirmed that bulls needs to be cautious of taking lengthy positions on BTC.

Bitcoin [BTC] has traded above the $82k assist stage over the previous week, but it surely didn’t have a bullish outlook on the 1-day timeframe.

Decrease timeframes confirmed there was some hope for a bounce, offered the $86.8k resistance was breached.

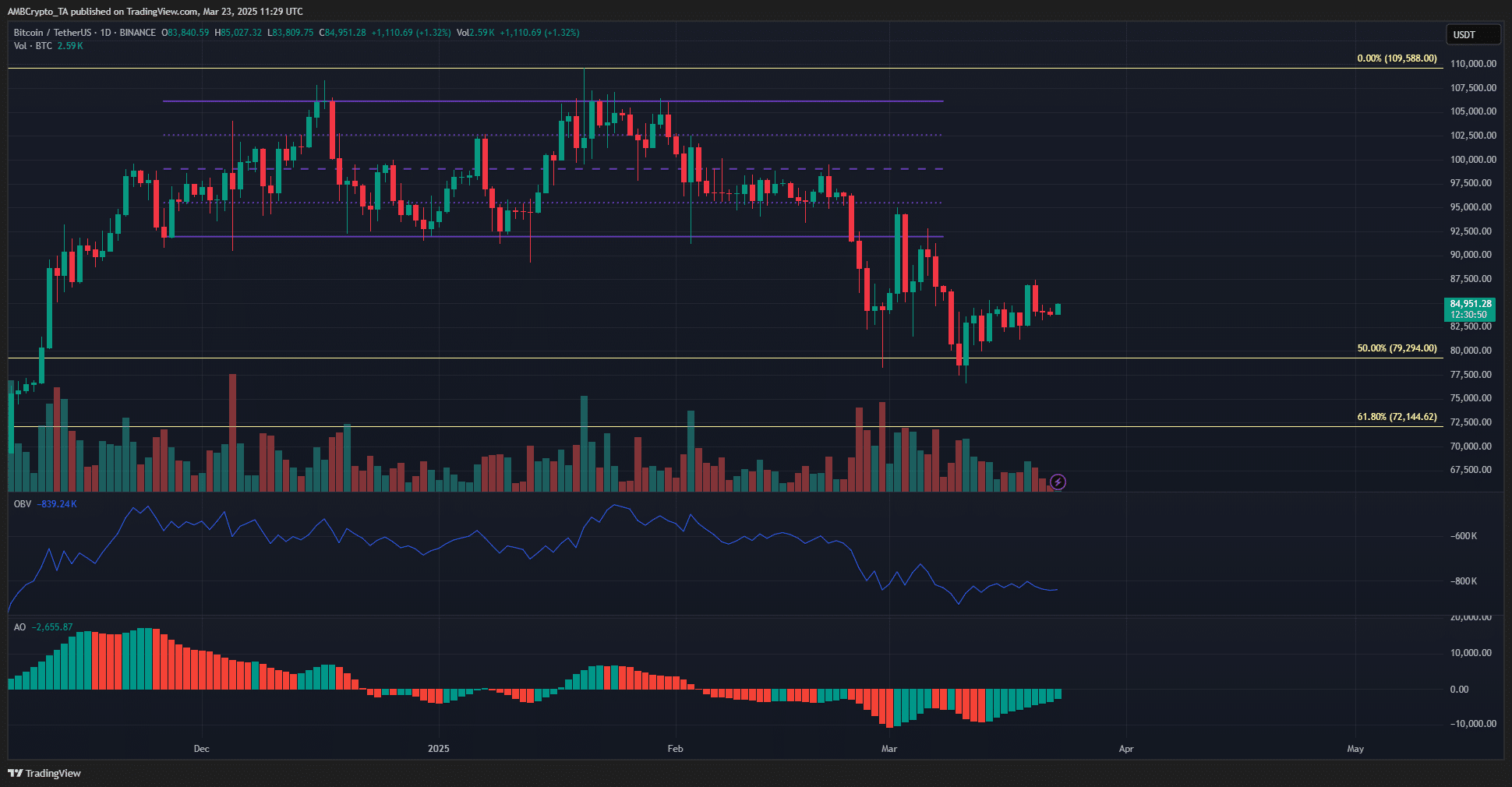

The Fibonacci retracement ranges from the August-December rally confirmed that the $72k assist stage might be the subsequent goal. Nevertheless, on-chain metrics didn’t assist this doom-and-gloom outlook.

Lengthy-term holders most popular to HODL than promote, which means there was some hope for restoration.

Is Bitcoin poised for one more downward transfer?

Supply: BTC/USDT on TradingView

The BTC day by day chart retained its bearish construction. The OBV has additionally been in a downtrend since February, exhibiting promoting strain remained dominant. Collectively, they highlighted the probabilities of additional losses.

The bearish momentum has waned in accordance with the Superior Oscillator however has not flipped bullishly.

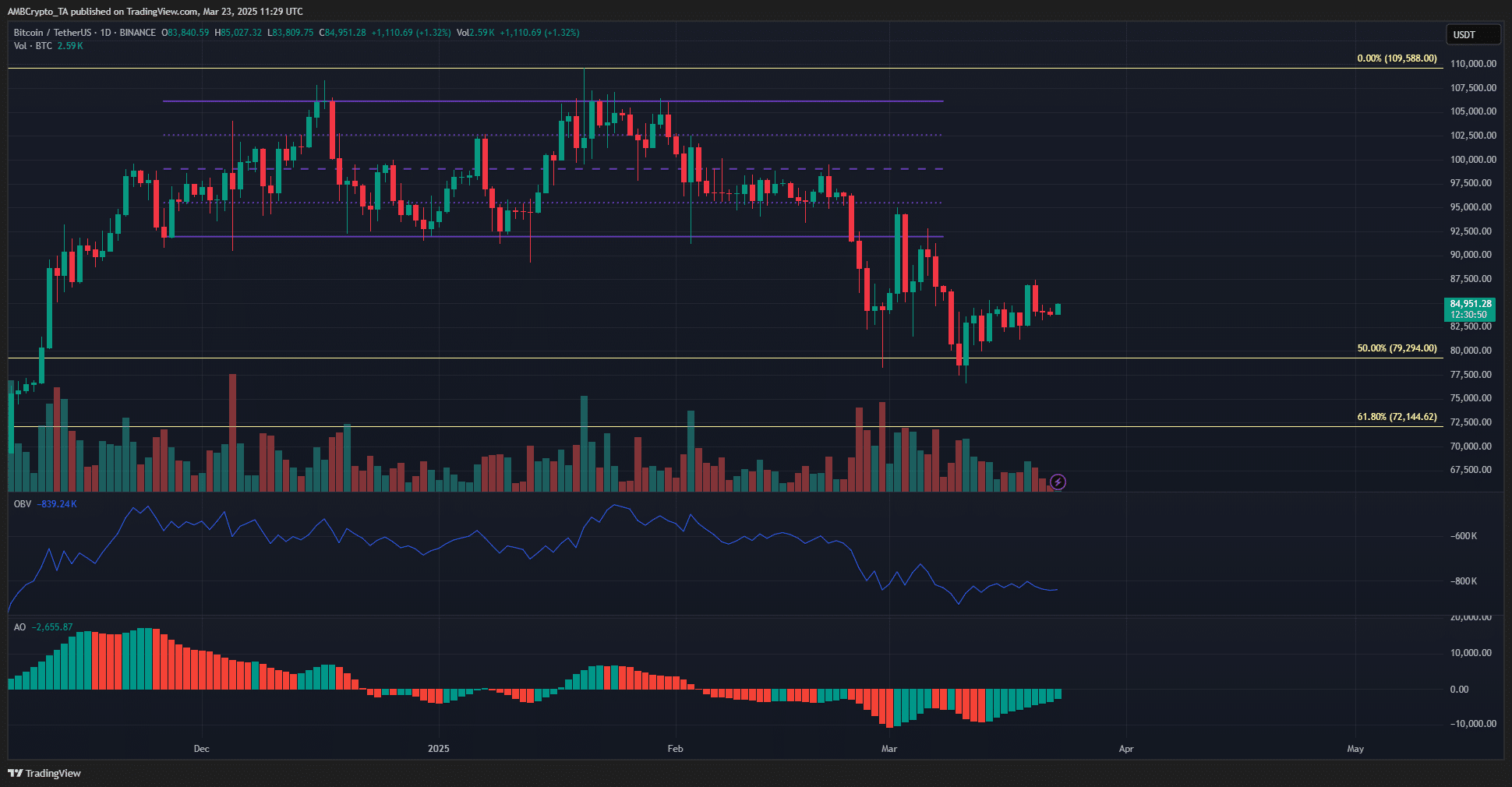

Supply: BTC/USDT on TradingView

After falling under a 3-month-old vary in early March, Bitcoin appeared to have fashioned a brand new vary (white). The mid-range stage at $86.9k has been examined as each assist and resistance previously three weeks.

As issues stand, a transfer under $83k might provoke a bearish pattern, whereas a breakout previous $86.8k might begin an uptrend.

The OBV has been making greater lows over the previous ten days, but it surely was not proof of sturdy shopping for. Neither was it sufficient demand to undo the promoting strain from February.

The two-week liquidation heatmap confirmed that the closest liquidity cluster was at $88k. The magnetic zone at $83k didn’t seem as sturdy because the one at $88k.

Additional down, the $80k was sizeable, however additional away from the worth.

Subsequently, merchants should be ready for the Bitcoin worth to gravitate towards $88k earlier than dealing with a bearish rejection.

Technical evaluation confirmed that if $86.8k had been flipped to assist, it is perhaps secure to go lengthy. The liquidation heatmap confirmed that may not be true. Warning was warranted, particularly for the bulls.

Merchants ought to monitor the response at each resistances rigorously. A rejection might current a possibility to short-sell the asset.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion