Bitcoin Surge Above $27,000 May Not Last, Here’s Why

Bitcoin has damaged again above the $27,000 stage in the course of the previous day, but when on-chain information is to go by, this surge might not final for lengthy.

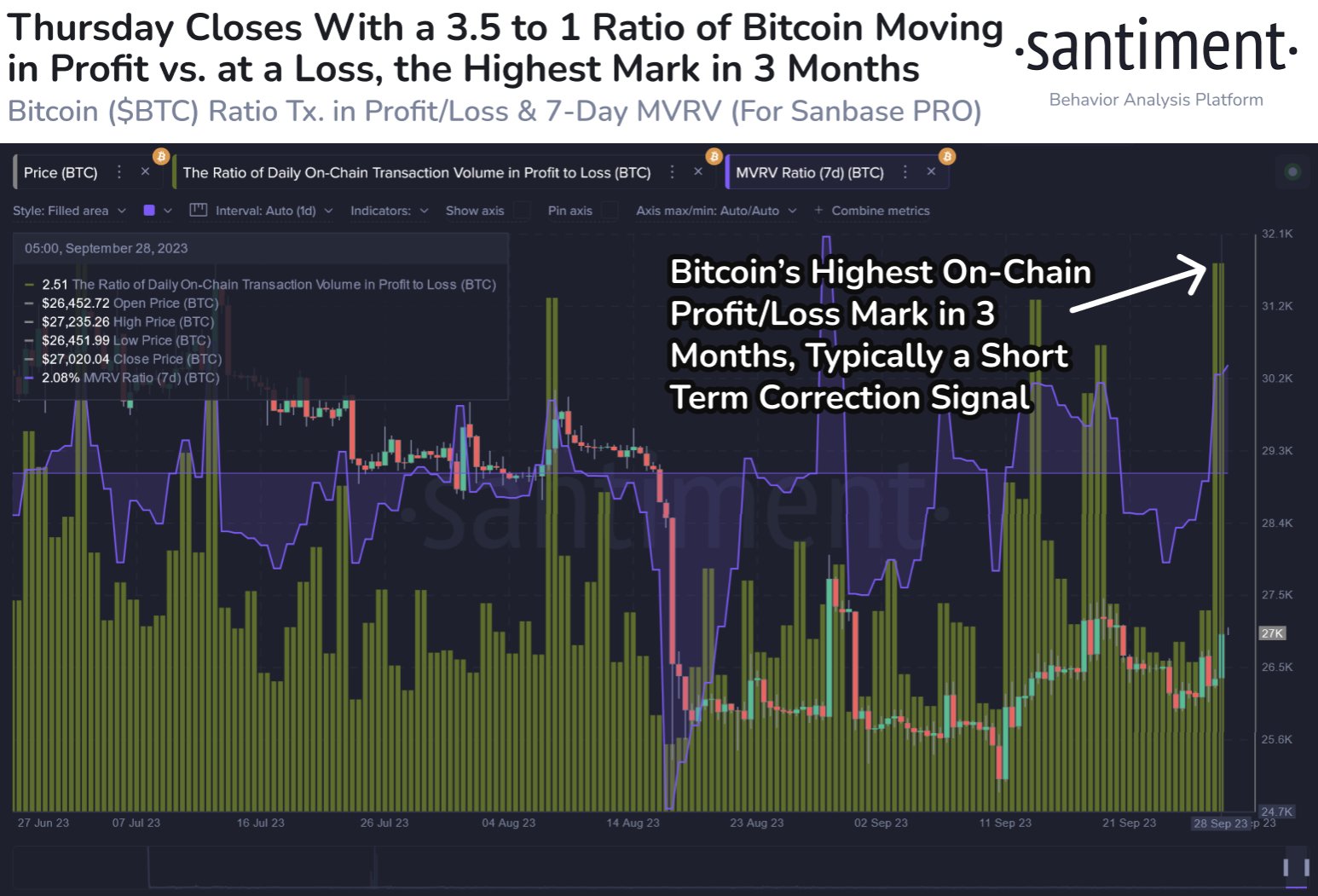

Bitcoin Traders Are Taking Earnings At Highest Charge In 3 Months

In line with information from the on-chain analytics agency Santiment, there’s a likelihood {that a} short-term correction might occur for the cryptocurrency. The related metric right here is the “ratio of every day on-chain transaction quantity in revenue to loss,” which, as its title suggests, tells us about how the profit-taking quantity compares in opposition to the loss-taking quantity on the Bitcoin community proper now.

This indicator works by going via the transaction historical past of every coin being offered/transferred on the blockchain to see what worth it was moved at earlier than. If this earlier promoting worth for any coin was lower than the present spot worth, then that coin is being offered at a revenue proper now.

The sale of all such tokens would contribute towards the Bitcoin profit-taking quantity, whereas cash of the other kind would add in the direction of the loss-taking quantity.

Now, here’s a chart that reveals the pattern on this BTC metric over the previous few months:

The worth of the metric appears to have been fairly excessive in latest days | Supply: Santiment on X

As displayed within the above graph, this Bitcoin indicator has noticed a big spike because the cryptocurrency’s worth itself has seen a surge past the $27,000 mark and has reached a price of two.51.

When the metric has a price larger than zero, it implies that the profit-taking quantity is greater than the loss-taking quantity. However, values underneath this threshold counsel the dominance of loss-taking.

On the present worth of two.51, the profit-taking quantity outweighs the loss-taking one by 3.51 to 1. This disparity between these two volumes is the very best it has been since round three months in the past.

Traditionally, intense profit-taking has often resulted in at the least a short-term high for Bitcoin, so it’s potential that the present values of the metric would additionally lead to a correction for the worth.

Within the chart, Santiment has additionally connected the information for the “Market Worth to Realized Worth (MVRV) ratio,” which retains observe of the distinction between the Bitcoin market cap and realized cap.

The latter of those is principally a measure of the entire quantity of capital that the traders as an entire have put into the cryptocurrency, so this metric tells us how the worth that the holders are carrying presently compares with their whole funding.

From the graph, it’s seen that the 7-day Bitcoin MVRV ratio has turned notably constructive with this rise, which suggests that the traders are carrying income in the meanwhile.

The analytics agency notes that this metric going again under zero can be superb for the subsequent leg up, because the holders being in loss would result in an exhaustion of the profit-sellers.

BTC Value

Thus far, regardless of the aggressive profit-taking occurring out there, Bitcoin has managed to carry above the $27,000 mark.

BTC has noticed a robust surge previously day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.web