Bitcoin surges above $100K again – Bull run returns or correction ahead?

- Bitcoin’s bull run was pushed by Spot Bitcoin ETFs and rising U.S. investor confidence.

- MicroStrategy’s ongoing Bitcoin purchases and Trump’s crypto stance added gas to the rally.

Bitcoin [BTC] has hit the $100k mark as soon as extra — a dramatic restoration that has reignited curiosity within the coin. As BTC begins a bull run, one issue stands out; the rising function of U.S. buyers.

This surge in shopping for exercise has been spurred partly by the approval of Spot Bitcoin ETFs, which haven’t solely legitimized Bitcoin within the eyes of institutional gamers but in addition amplified the bullish sentiment amongst retail buyers.

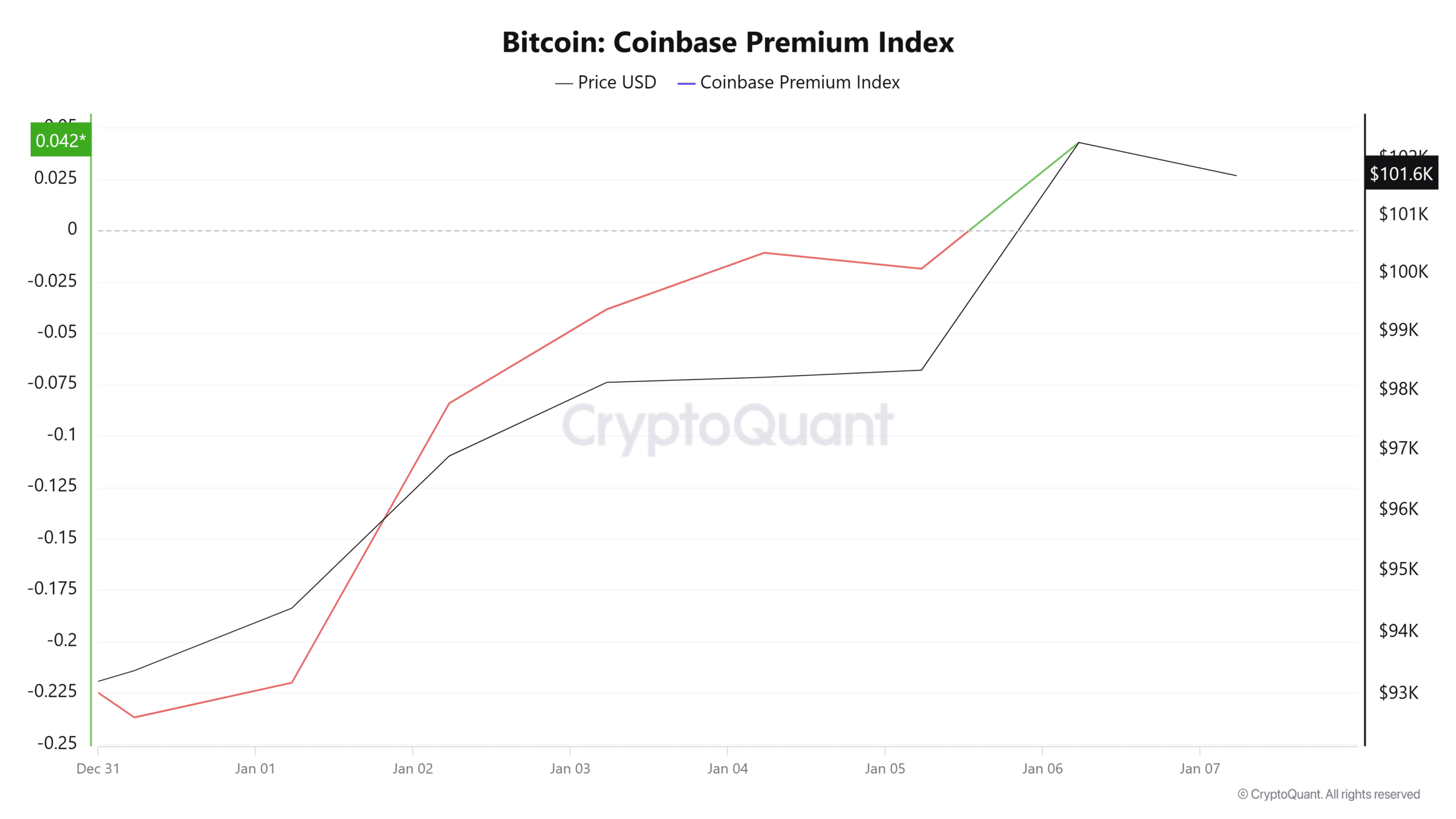

Alongside these developments, key indicators just like the Coinbase Premium Index and huge Bitcoin outflows from exchanges sign a rising dominance of U.S. market members.

Bitcoin: A comeback to $100k

MicroStrategy has been a significant participant in Bitcoin’s latest surge, having bought extra BTC for the ninth consecutive week. The corporate now holds a staggering 447,470 Bitcoin, valued at $27.97 billion.

This strategic shopping for has undoubtedly contributed to Bitcoin’s rise above the $100k mark.

Moreover, with Donald Trump set to be inaugurated as U.S. President on the twentieth of January, there’s rising optimism a few favorable crypto atmosphere below his management.

Trump himself has steered the potential of a Bitcoin fund for the U.S., additional fueling enthusiasm.

This mix of institutional assist and political developments has helped Bitcoin break by way of important value obstacles, signaling a optimistic outlook.

U.S. buyers and the optimistic Coinbase Premium Index

The Coinbase Premium Index, which lately flipped optimistic, highlights the crucial function of U.S. buyers in driving Bitcoin’s upward momentum.

A optimistic CPI displays heightened demand for Bitcoin on U.S.-based exchanges like Coinbase in comparison with their international counterparts, indicating stronger shopping for strain from U.S. market members.

Supply: Cryptoquant

This shift follows the launch of spot Bitcoin ETFs, which has amplified institutional and retail enthusiasm alike.

As Bitcoin surged previous the $100k milestone, U.S. buyers seem like spearheading the rally, leveraging newfound confidence within the asset’s long-term potential.

4,012 BTC outflow from Coinbase

A single block outflow of 4,012 Bitcoin from Coinbase despatched ripples by way of the market, exhibiting sturdy accumulation exercise.

Such substantial outflows are sometimes related to massive institutional gamers or high-net-worth buyers securing their belongings in chilly storage.

This aligns with the Bitcoin bull run $100k, as strategic strikes by whales reinforce the narrative of sustained bullish momentum.

Notably, these outflows coincide with rising U.S. investor dominance and the CPI’s optimistic flip. As Bitcoin provide on exchanges declines, it intensifies the shortage impact, additional propelling costs upward.

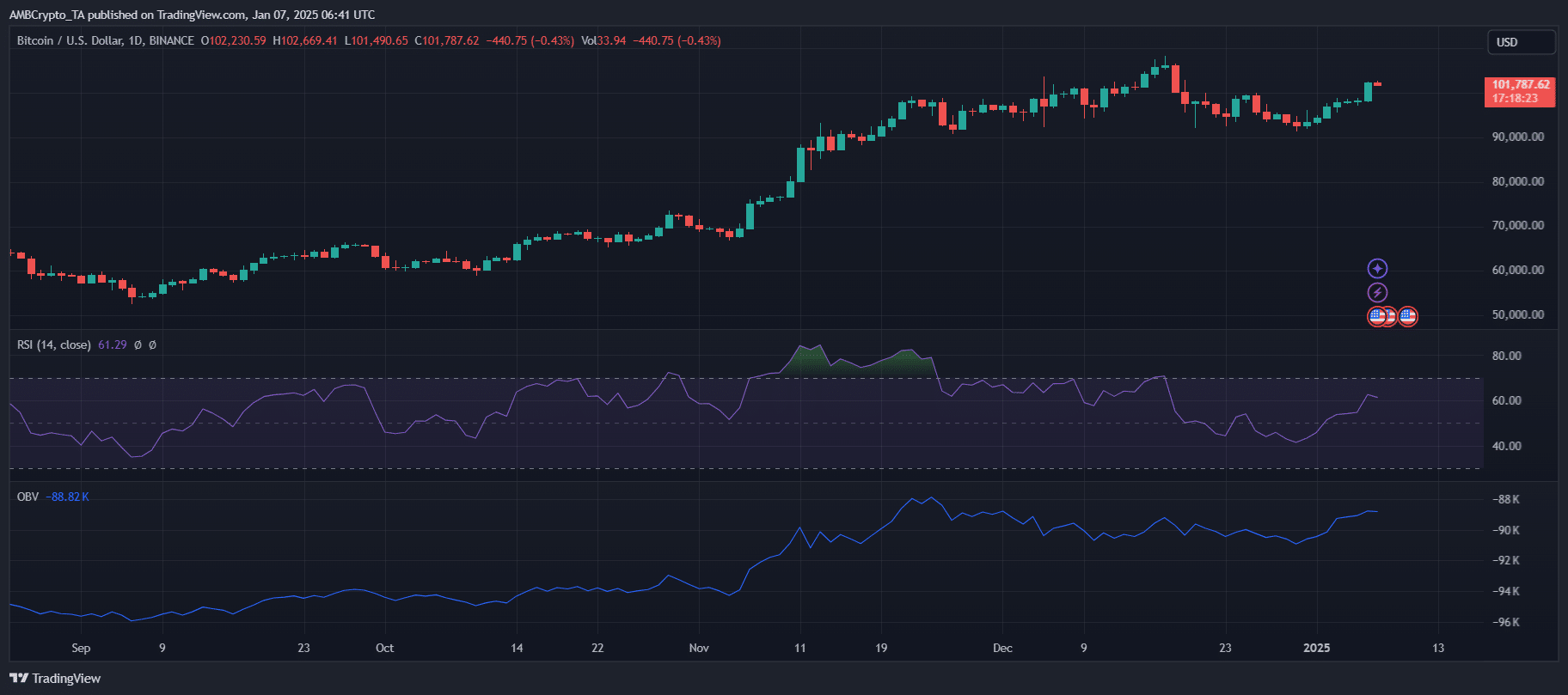

Breaking resistance or retesting key ranges?

As Bitcoin consolidates above $100k, its subsequent transfer is determined by breaking crucial resistance close to $105k.

The press time RSI indicated average bullish momentum with room for additional upside earlier than coming into overbought territory.

In the meantime, the OBV steered that accumulation was ongoing, pushed by institutional curiosity and declining change reserves.

Supply: TradingView

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

A decisive breakout above $105k may goal $120k, supported by psychological shopping for triggers. Nevertheless, failure to maintain present ranges could lead to a retest of $95k, a key assist zone.

With volatility possible, buyers ought to watch whale exercise and macroeconomic cues carefully for directional readability.