Bitcoin: How will Jerome Powell’s ‘not in a hurry’ Fed rate cut outlook impact BTC?

- BTC stalled at $98K and plunged after Powell’s gradual Fed price minimize outlook.

- Demand for BTC has barely dropped amid macro uncertainty.

Bitcoin’s [BTC] early week restoration stalled at $98K and dumped to $95K following Fed’s chair Jerome Powell’s hawkish outlook on rate of interest cuts.

Throughout his semi-annual financial report back to the U.S. Congress on the twelfth of February, Powell bolstered that the company was not ‘in a rush to vary its coverage stance.’ He said,

‘Our coverage stance is now much less restrictively than it had been, and the financial system stays robust. We don’t must be in a rush to regulate our coverage stance.’

For context, a decrease rate of interest means cheaper capital, which is bullish for risk-on belongings like Bitcoin and shares.

Nevertheless, after a hawkish maintain in final month’s FOMC assembly, the gradual Fed price minimize outlook and Trump’s tariffs have heightened bearish sentiment.

Will the January CPI report sway BTC?

U.S. labor markets and inflation standing decide the Fed price cuts. Consequently, the markets will shift focus to key inflation knowledge, the January CPI (Shopper Worth Index) report scheduled for the twelfth of February.

Based on knowledge tracked by Foreign exchange Manufacturing facility, the forecasted goal for month-to-month change for final month’s CPI is 0.3%.

If the precise CPI is larger, it may very well be thought-about bearish as it could immediate the Fed to maintain the rate of interest unchanged for longer. Nevertheless, a decrease CPI print may barely increase the market and odds of a price minimize.

That mentioned, curiosity merchants had been pricing a 95% probability of one other price pause, like in January, through the subsequent FOMC assembly in mid-March.

Supply: CME FedWatch Software

Whether or not the CPI print will change the market pricing stays to be seen.

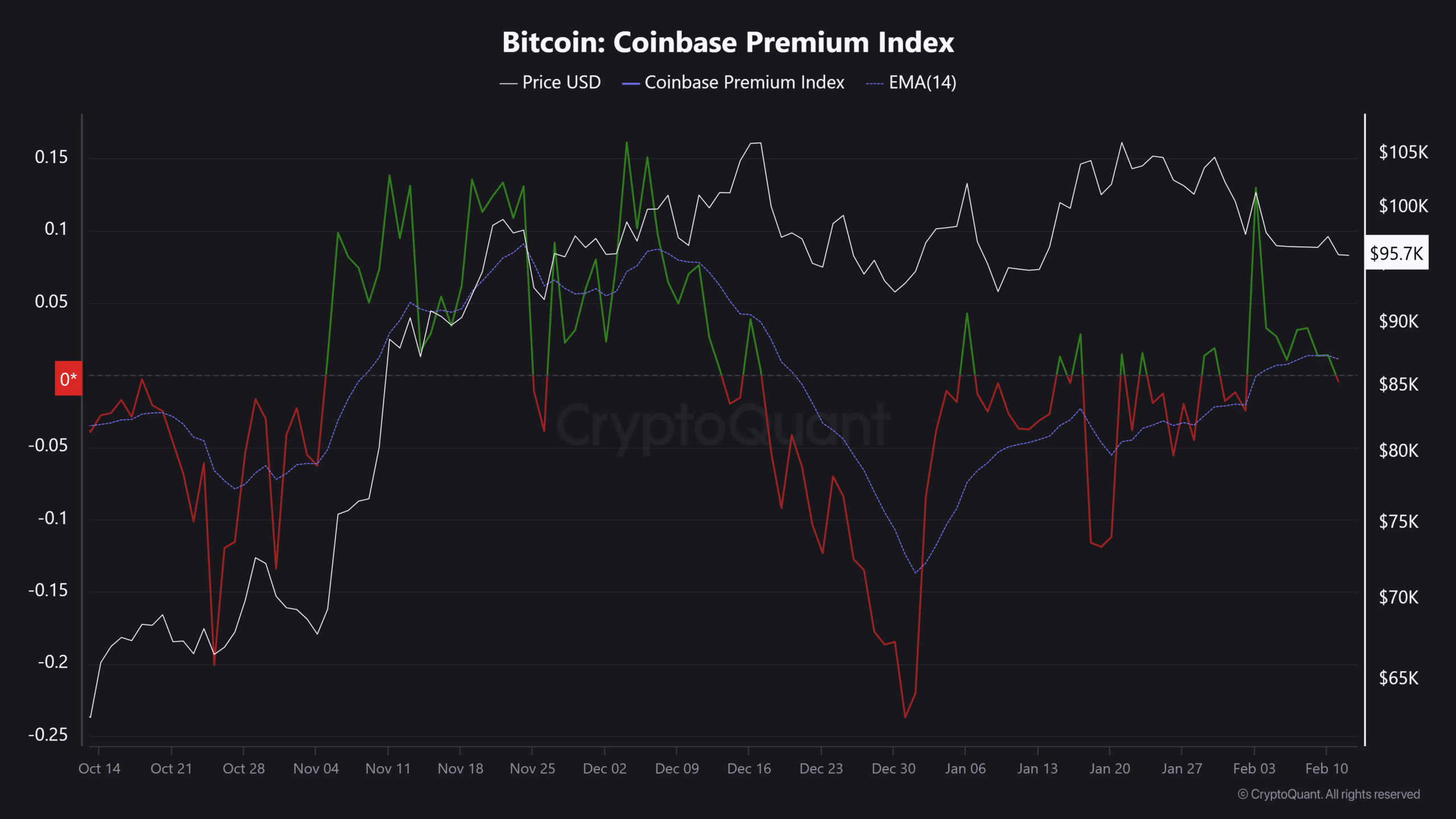

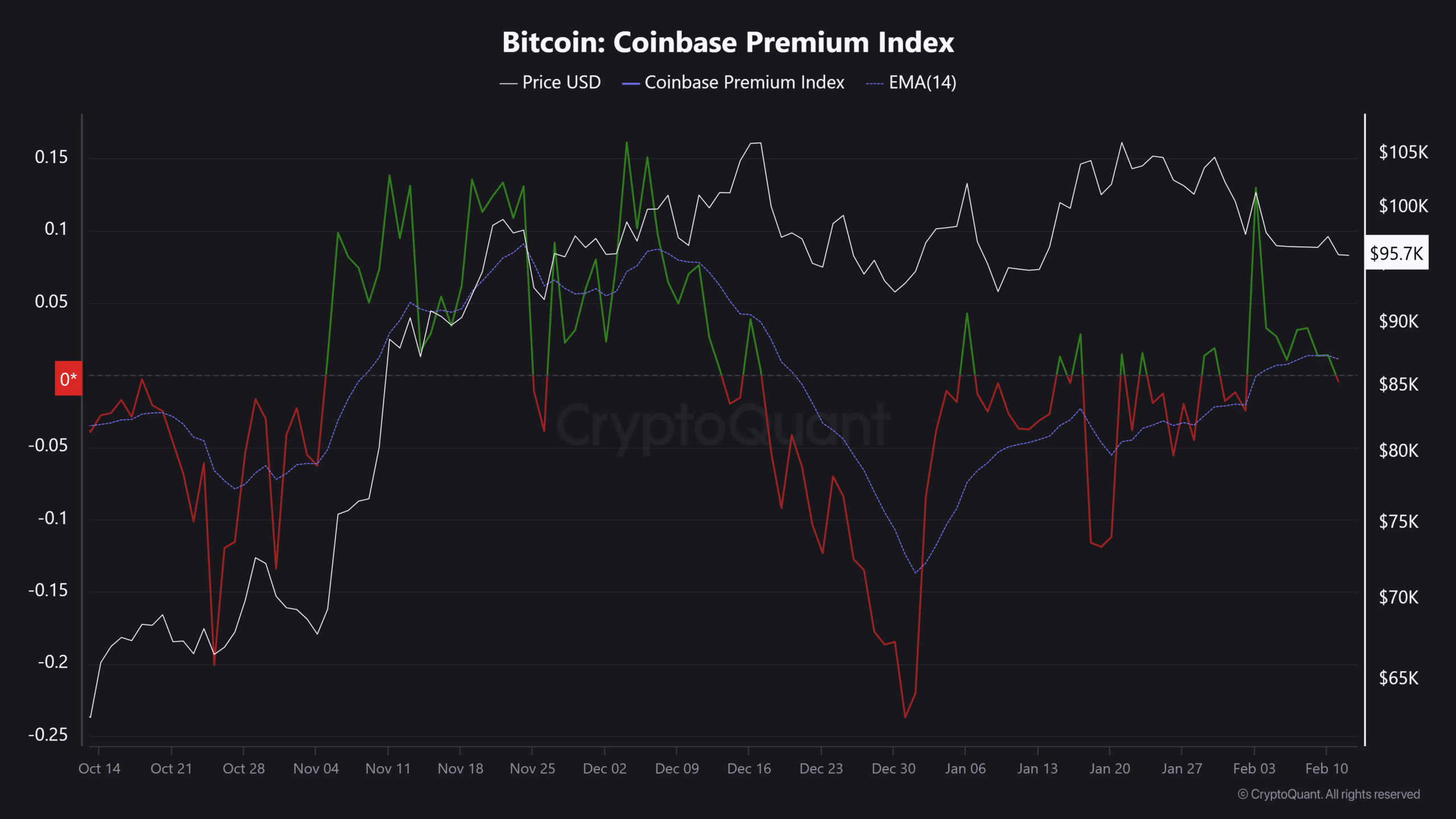

Word, nevertheless, that the above headline threat has stored general demand muted, per Coinbase Premium Index. The indicator tracks U.S. traders’ urge for food for the king coin and positively correlates with BTC value motion.

Supply: CryptoQuant

After a surge in early February, the indicator has returned to a impartial stage. Equally, BTC retraced from $101K to $95K over the identical interval.

Any additional dip within the Coinbase Premium Index to adverse territory may restrict BTC’s short-term rebound, regardless of the pending provide shock because the OTC steadiness shrinks.

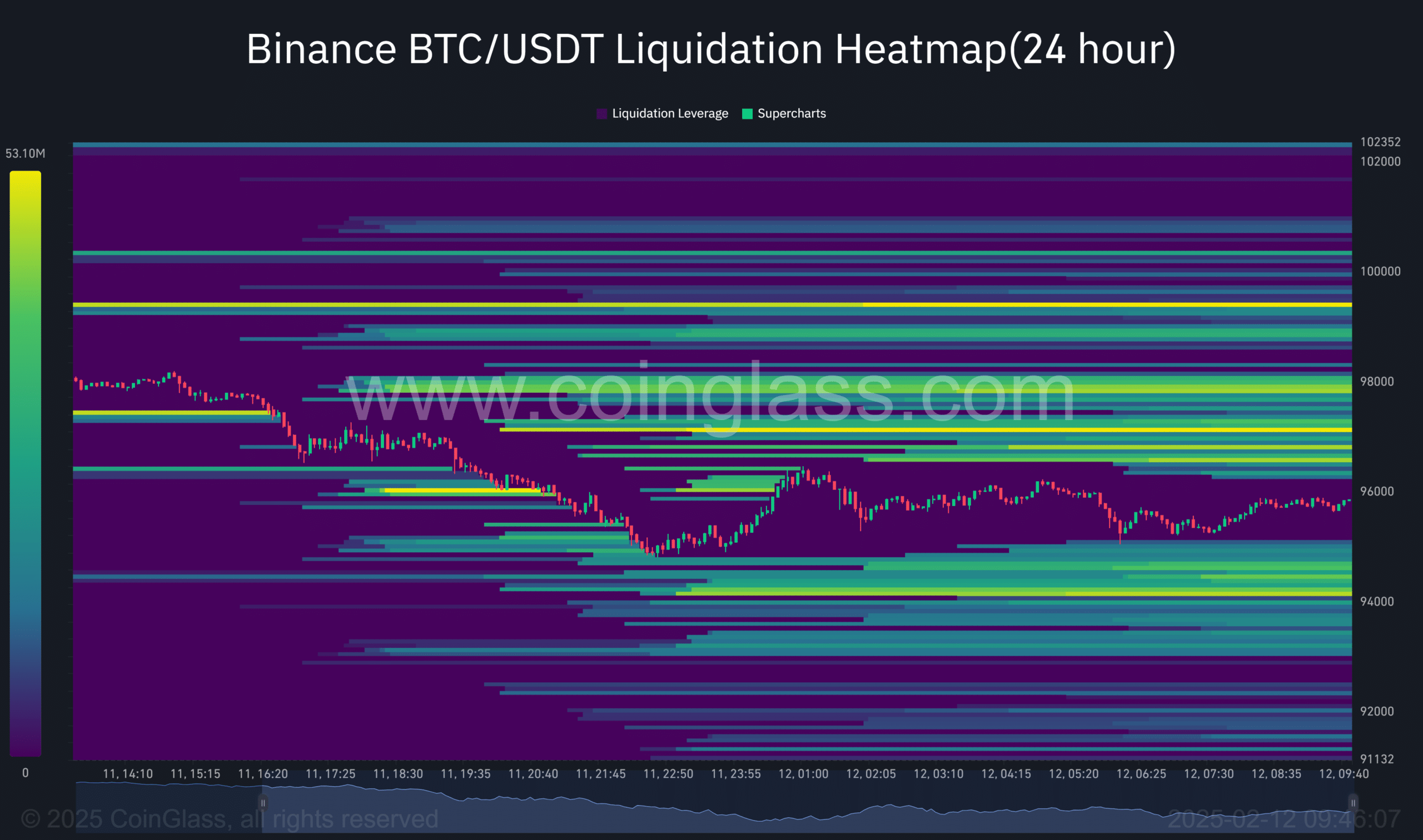

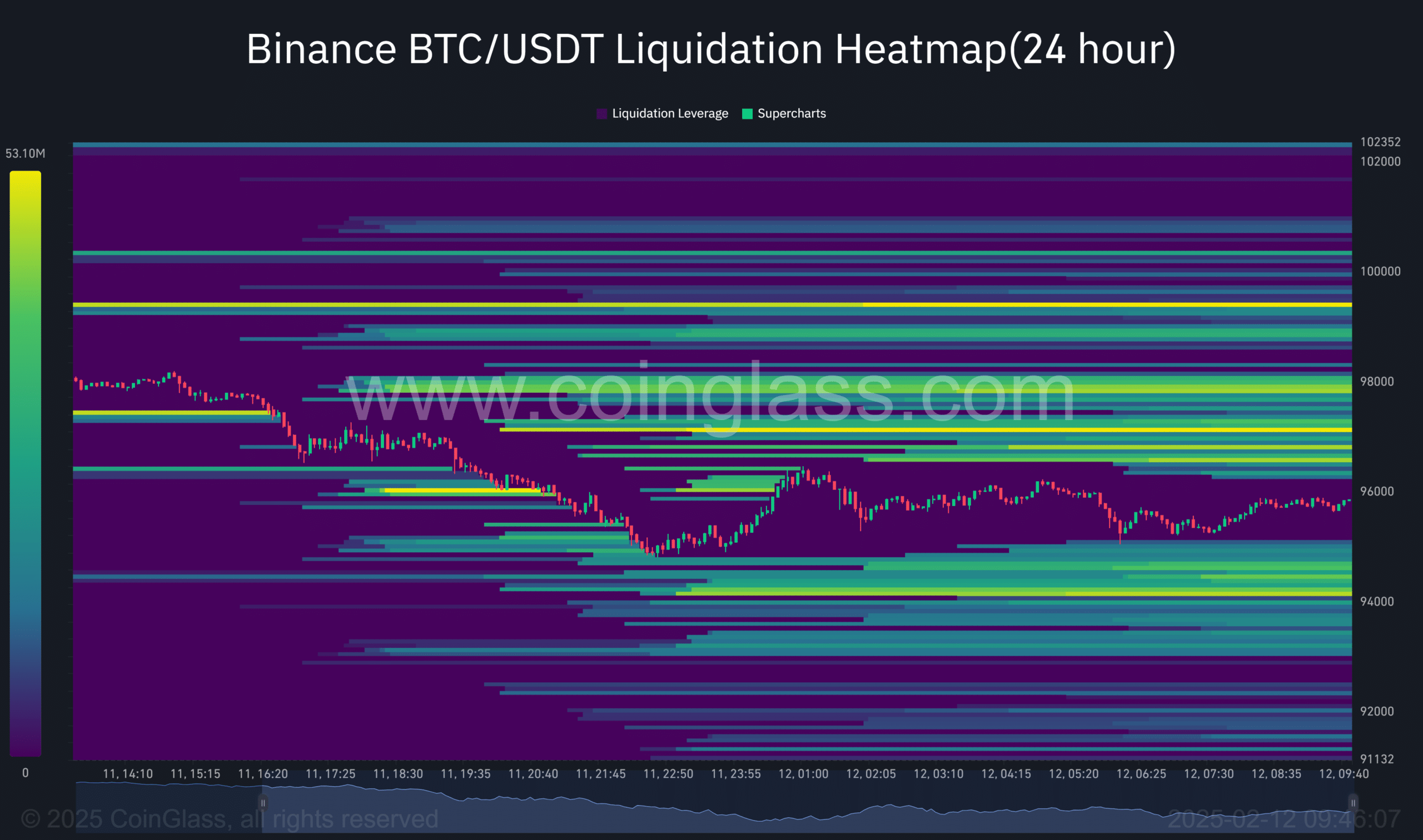

Within the meantime, the cryptocurrency’s uneven market may persist in line with the Coinglass liquidation heatmap. Pockets of liquidity (vibrant ranges) are on both facet of value motion.

Merely put, BTC may proceed fluctuating between $94K and $100K within the brief time period.

Supply: Coinglass