Bitcoin – THESE are the signs supporting another ATH for BTC in January!

- Brief-term holders have seen their unrealized earnings develop, reaching new highs whereas concurrently establishing a brand new assist stage

- BTC has continued to observe its historic patterns from the final two bull cycles

After hitting a brand new peak of over $108k in December, Bitcoin has struggled to take care of any momentum on the charts as promoting strain intensified. In reality, on the time of writing, the cryptocurrency was valued at slightly below $94,000.

Nevertheless, market reactions, notably from short-term holders, mixed with historic tendencies, appeared to counsel the asset has robust potential to development greater.

Brief-term holders’ revenue surge units new assist base

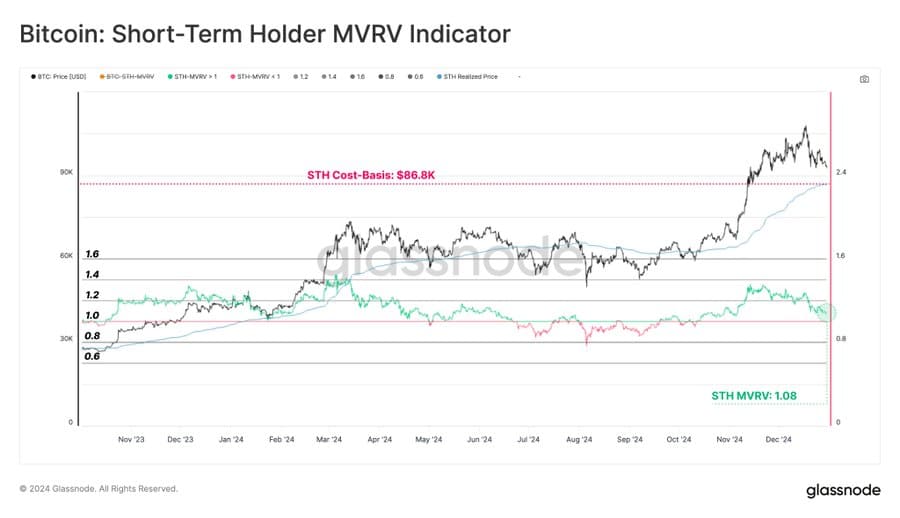

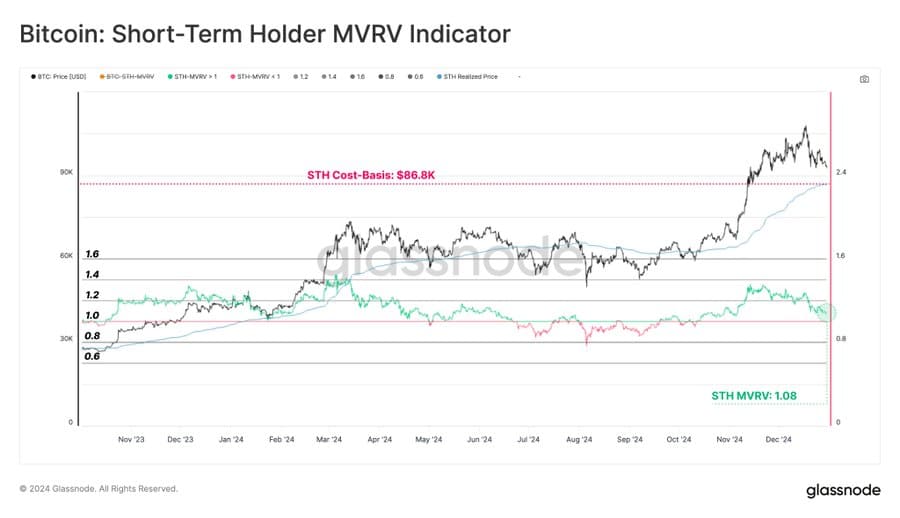

At press time, Glassnode knowledge revealed that there gave the impression to be a notable surge within the unrealized earnings of short-term holders (STH) of Bitcoin (BTC). Right here, short-term holders are outlined as addresses which have held BTC for not more than 155 days, or roughly 5 months.

Sometimes, short-term holders promote for a revenue, however on this case, they’ve chosen to carry, accumulating complete positive factors of over 7.9%. This achieve is set by evaluating the Market Worth to Realized Worth (MVRV) of this cohort.

Supply: X

When unrealized earnings surge, it usually implies that short-term holders are refraining from promoting and like to carry their BTC. This habits is taken into account a bullish sign.

Ought to this development proceed, the common value at which short-term holders acquired their BTC—round $86,600, as indicated by the chart—will probably function a brand new assist stage for the worth to development greater from its press time level.

In different phrases, if Bitcoin falls, this combination cost-basis would act as a big assist stage. This could forestall additional value declines, probably fueling sustained upward momentum.

Historic knowledge reveals BTC might rally greater

In line with analyst James Van Straten, the continuing 15% value drop in Bitcoin follows historic market cycles, which have beforehand recorded comparable, slight declines.

His evaluation additionally famous that there’s potential for BTC to rally additional, though it might see extra drops heading into January.

Supply: X

Nevertheless, a number of key occasions might nonetheless considerably affect Bitcoin’s market trajectory, together with the upcoming presidential inauguration of Donald Trump on 20 January.

Others like analyst TonytheBullBTC discovered that BTC is following a historic sample, one much like one seen earlier in January final yr – A development that led to its rally to a brand new excessive.

In line with him,

“The [current] corrective habits in Bitcoin stays comparable [to that of January], albeit at twice the pace.”

Supply: X

The 2 days timeframe chart on the left illustrated how BTC entered a corrective section earlier than its subsequent rally, which led to a brand new excessive of $73,777 earlier in 2024.

On the appropriate, BTC gave the impression to be following the identical sample, as proven on the every day chart. If this sample absolutely materializes by January 2025, BTC might hit a brand new all-time excessive, as advised by broader market outlooks.

General, BTC stays bullish, with short-term holders and historic knowledge taking part in essential roles in its potential value actions.