Bitcoin: THIS group starts selling at a loss – What it means for BTC

- Bitcoin short-term holders realized losses, reflecting market uncertainty and potential turning factors.

- A drop in Bitcoin’s STH SOPR steered both the chance of deeper corrections or long-term alternatives.

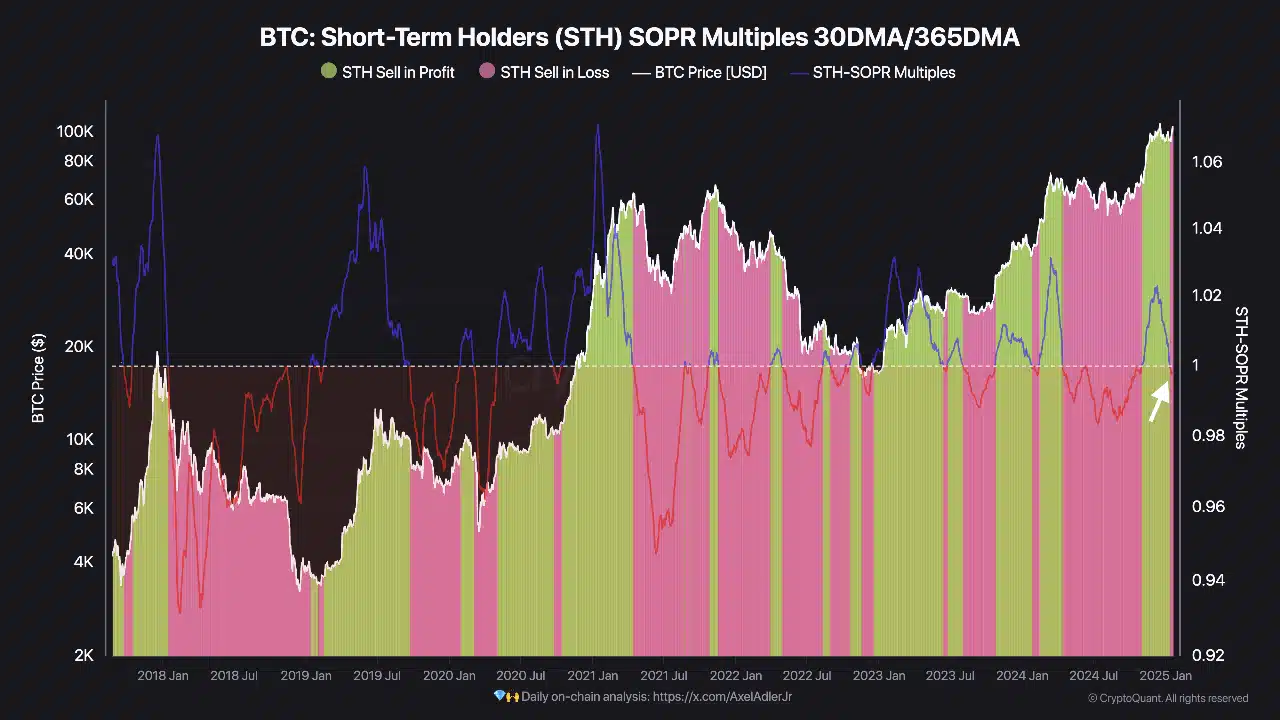

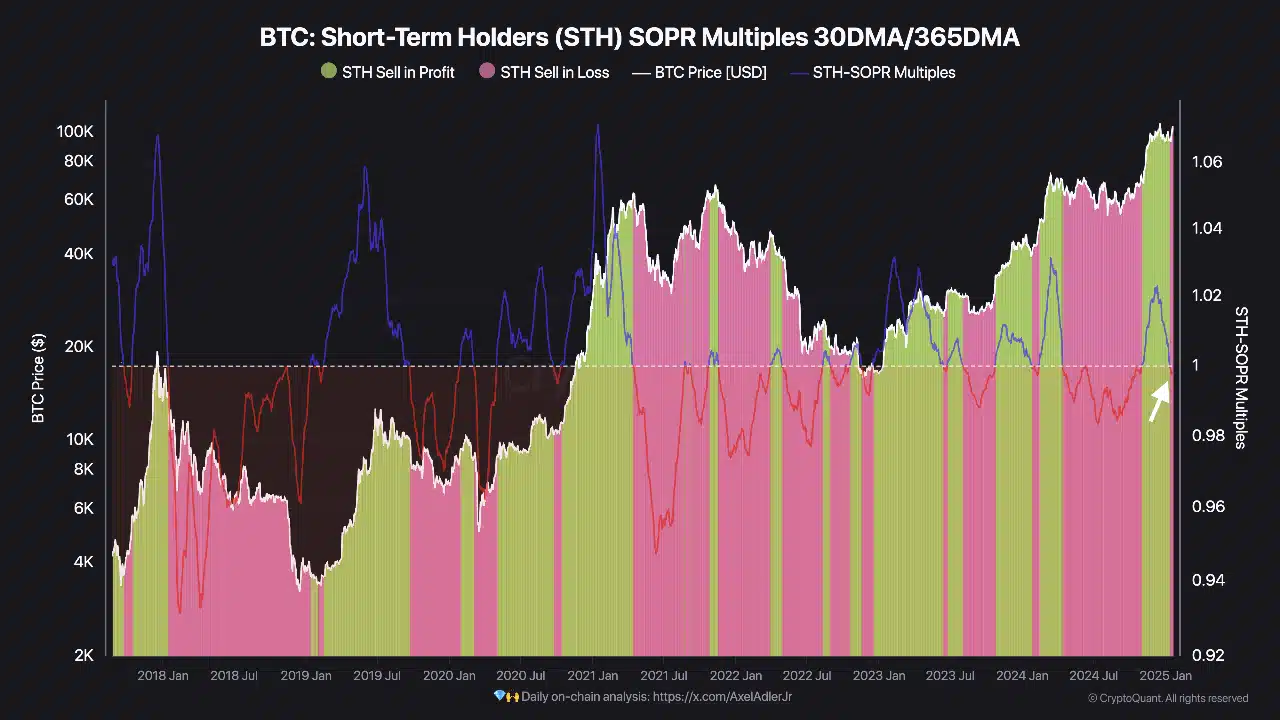

Bitcoin [BTC] short-term holders at the moment are promoting their holdings at a loss, with the Quick-Time period Holder Spent Output Revenue Ratio (STH SOPR) a number of turning unfavourable.

This metric, which compares the 30-day STH SOPR to its 365-day common, highlights a shift in STH profitability traits.

Traditionally, such moments have coincided with vital market turning factors, signaling both enticing long-term entry alternatives or heightened short-term dangers.

What the STH SOPR reveals about BTC

The STH SOPR measures whether or not Bitcoin short-term holders are promoting at a revenue or a loss. By evaluating the 30-day STH SOPR to its 365-day common, this metric supplies a transparent pattern of STH profitability.

Recent data has revealed that the STH SOPR a number of has entered unfavourable territory, indicating that STHs are promoting at a loss.

Traditionally, such dips typically mirror rising market stress however also can current accumulation alternatives for long-term buyers.

Supply: Cryptoquant

The chart highlighted this shift, with the current drop beneath 1.0 signaling waning confidence amongst STHs.

As this pattern unfolds, it raises questions on whether or not STHs will proceed to promote, deepening market corrections, or maintain agency, creating a possible worth ground.

Potential market outcomes amid STH losses

As Bitcoin short-term holders start realizing losses, two attainable situations may form the market trajectory.

Within the first situation, STHs could decide to carry relatively than promote at a loss, permitting their realized worth to behave as a powerful help stage. Such conduct may stabilize Bitcoin’s worth and supply a basis for restoration.

Conversely, a wave of capitulation could happen if STHs proceed to dump their holdings. This might amplify promoting stress and set off a deeper market correction.

Traditionally, such capitulation occasions typically coincide with heightened volatility, however they could additionally sign enticing entry factors for long-term buyers.

The unfolding pattern will rely on broader market sentiment and the conduct of different market individuals.

Historic context and long-term outlook

Traditionally, unfavourable STH SOPR multiples have coincided with important turning factors in Bitcoin’s market.

For example, in the course of the March 2020 COVID-19 market crash, the STH SOPR fell into unfavourable territory, signaling short-term holders capitulating at a loss.

This era later proved to be one of the vital profitable entry factors, as Bitcoin surged from $4,000 to over $60,000 throughout the following 12 months.

Equally, in mid-2018, as Bitcoin retraced from its $20,000 peak, the STH SOPR confirmed sustained unfavourable readings.

Though it indicated capitulation on the time, it marked the buildup section earlier than Bitcoin’s rally to new all-time highs in 2020.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

For long-term buyers, these unfavourable SOPR phases have typically preceded vital recoveries, as promoting stress subsides and accumulation begins.

Whereas the present pattern displays short-term uncertainty, historic patterns recommend potential for bullish outcomes over an prolonged horizon.