Bitcoin: THIS group starts selling BTC – Troubling times ahead?

- A notable shift is happening amongst BTC holders, signaling potential adjustments in market dynamics.

- Bid-ask imbalances advised that promoting stress prevailed, which may doubtlessly set off a downturn.

Bitcoin’s [BTC] profitability has waned following the current market correction, with its positive factors now diminished. As of the newest knowledge, BTC has posted a 19.86% improve.

Regardless of a modest 0.37% value improve, there may be lingering skepticism about whether or not BTC can maintain these positive factors, as promoting exercise continues to weigh in the marketplace.

Lengthy-term holders start promoting Bitcoin

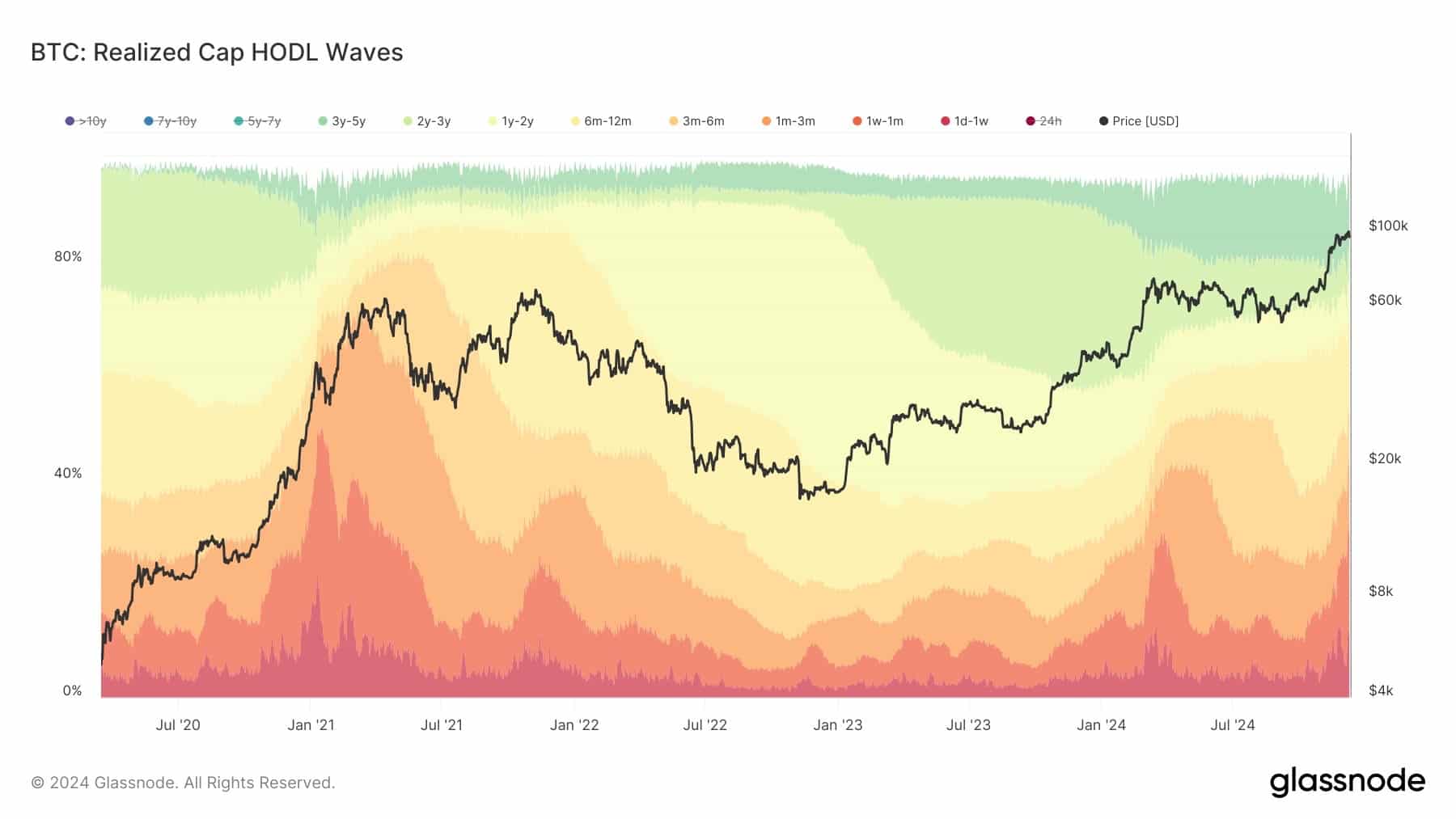

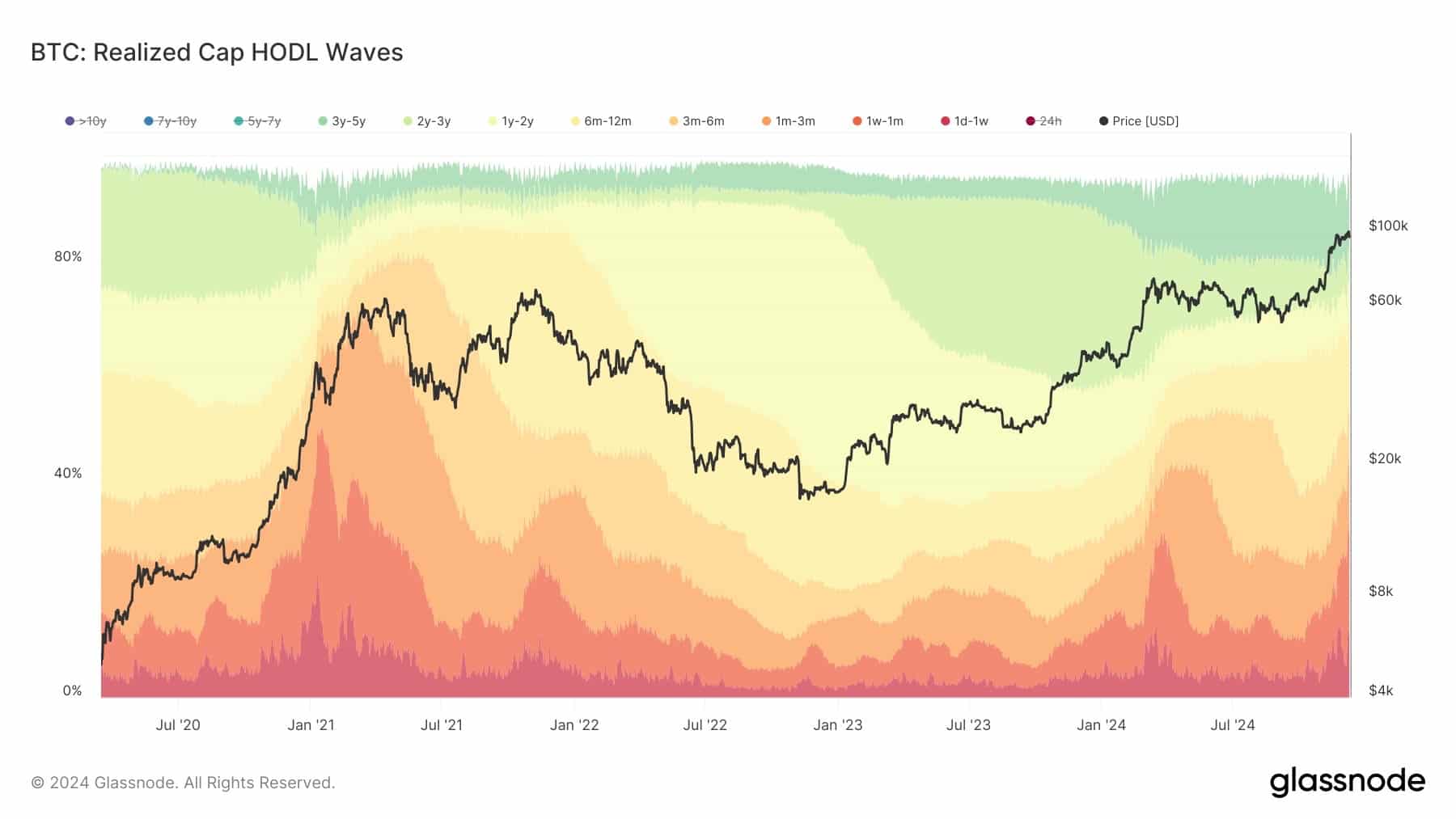

Information from Glassnode revealed that long-term holders of Bitcoin have been partaking in profit-taking actions, besides “Extremely Lengthy-Time period Holders,” who’ve held their BTC for greater than seven years.

Lengthy-term holders are outlined as addresses which have held BTC for over six months (180 days).

As of the newest knowledge, the proportion of BTC held by this cohort has dropped by roughly 10%, reducing from over 60% to round 50%.

The altering distribution of BTC possession is shaping the market’s development. Usually, throughout early levels, long-term and ultra-long-term holders management a big share of BTC.

Nevertheless, as promoting stress will increase, this stability shifts.

Supply: X

This shift is at present empowering short-term holders with higher affect available in the market.

Nevertheless, till short-term holders account for 70-80% of the market, which has not but occurred, the market stays in its early to mid-range section.

Through the peak of the final bull run, the distribution of BTC between short-term and long-term holders was roughly 20% to 80%, respectively.

In distinction, present knowledge from Coinglass exhibits a extra balanced market, with either side holding round 50%.

Lengthy-term holders dropping curiosity in BTC

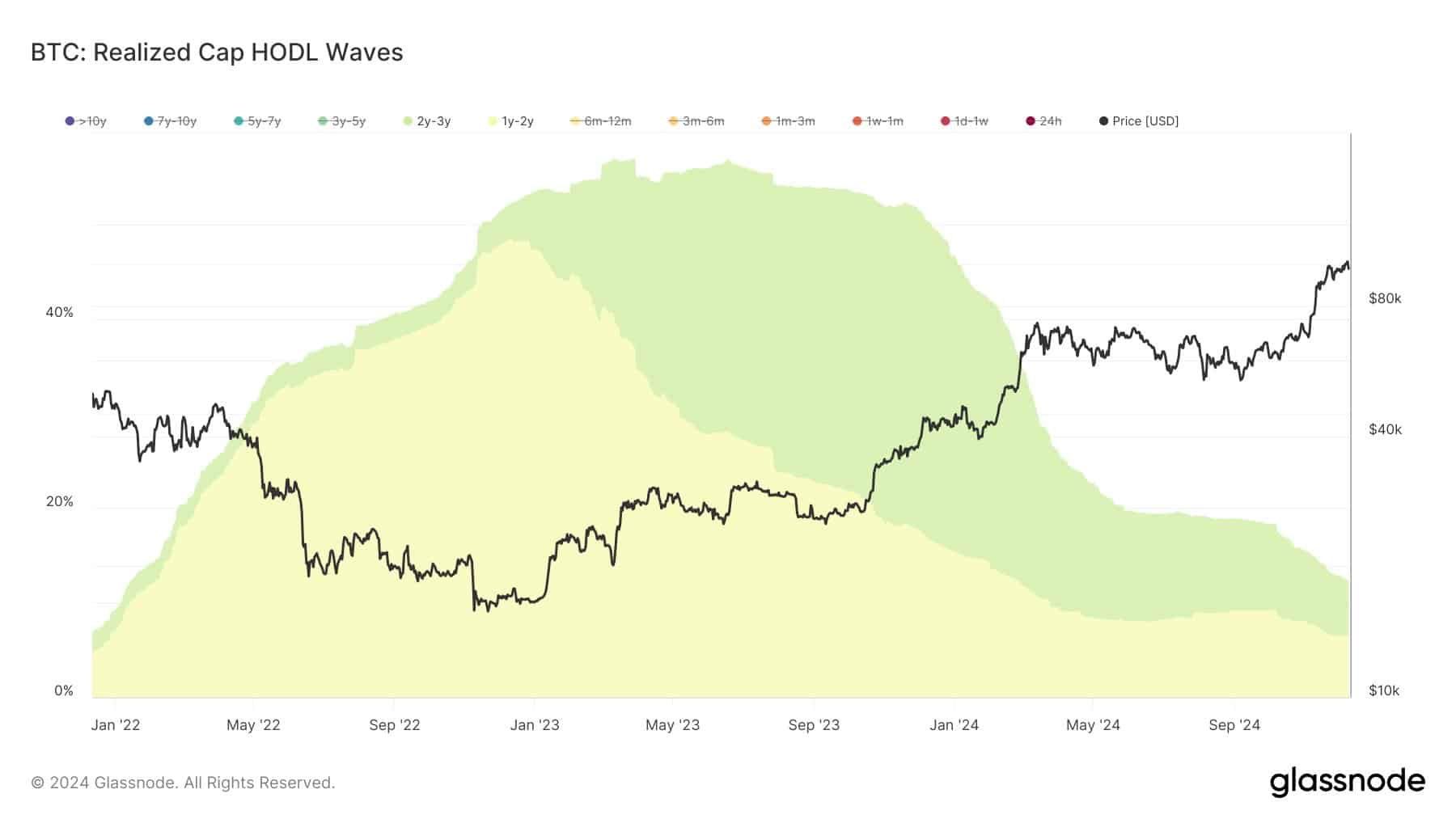

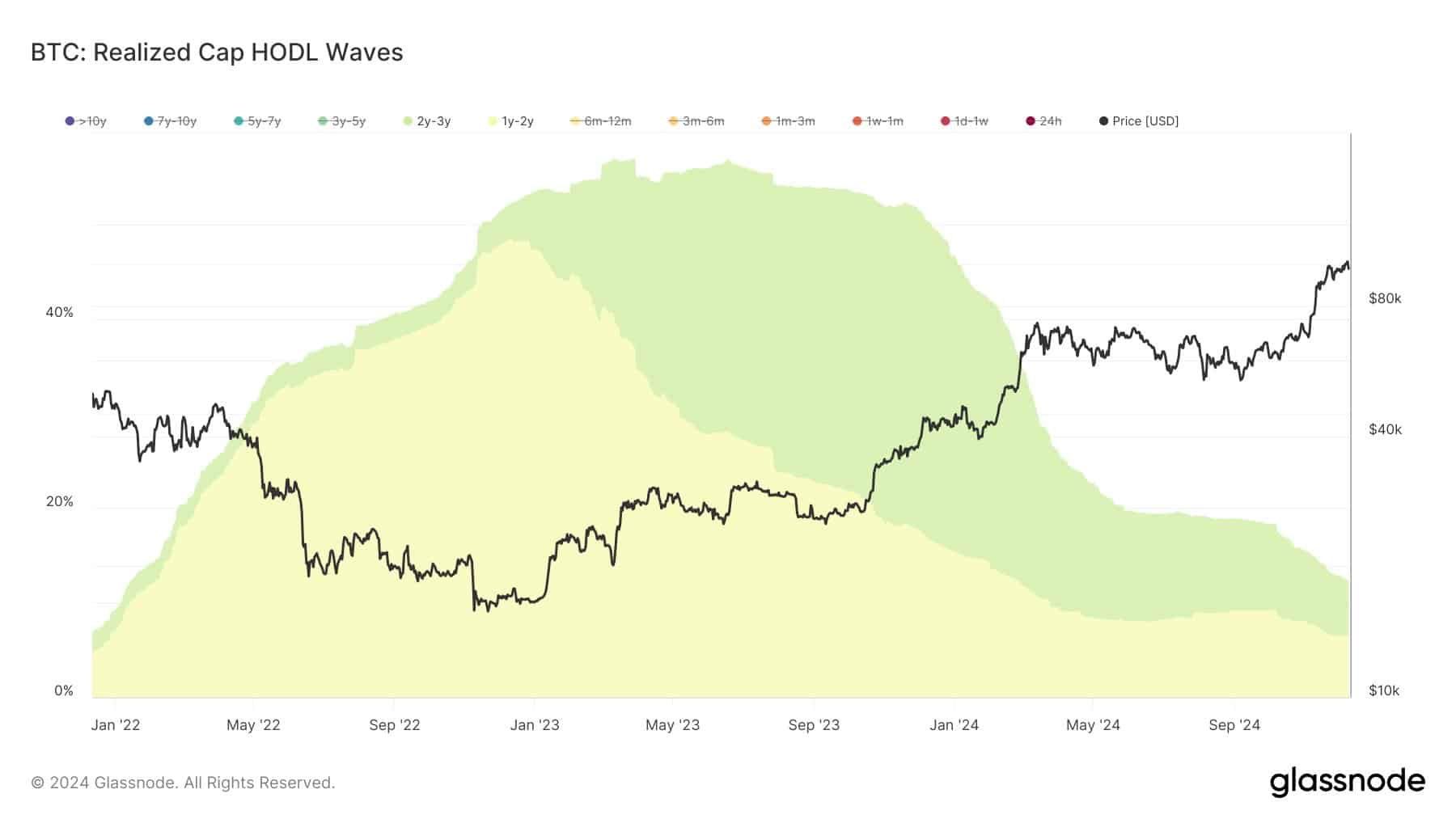

Lengthy-term holders of Bitcoin are dropping curiosity at a sooner price than anticipated.

This development has been noticed throughout distinct cohorts of long-term holders: those that have held BTC for 1–2 years, 2–3 years, and three–5 years, notably after accumulating in the course of the bear market between June and November.

These cohorts have begun considerably downsizing their holdings, as indicated by the current tendencies available in the market chart.

Particularly, the 3-5 yr cohort, which peaked at 15.3%, has since decreased to 13.9%. If promoting stress intensifies, BTC may see additional declines.

Supply: X

Not like earlier market cycles, the introduction of Bitcoin spot ETFs has added a brand new dynamic to the market.

Institutional buyers, who’ve been accumulating BTC over the previous months, at the moment are beginning to promote, with their holdings dropping from 25% to 16%.

Nevertheless, there may be nonetheless potential for a market rally. Since long-term holders haven’t but offered in massive portions, it suggests they might be ready for costs to rise additional earlier than taking income.

Low demand for BTC places stress on value

Latest knowledge from Hyblock exhibits a 50% bid imbalance in 1-2% of the order ebook depth, as indicated by vertical dots on the chart.

This imbalance suggests the market is at present in a promote section, characterised by low demand (fewer patrons) and excessive provide (extra sellers), which places downward stress on Bitcoin’s value.

Supply: X

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Concurrently, knowledge from CryptoQuant reveals a rise within the quantity of BTC accessible on exchanges, with roughly 22,289 BTC being deposited.

This has prompted a gradual rise in Trade Netflow, additional contributing to the rising provide of BTC on exchanges.