Bitcoin: THIS indicator mirrors 2024’s bull run – Will history repeat?

- Bitcoin’s Open Curiosity Delta mimics patterns that preceded previous value surges.

- A dip within the 180-day Delta might sign a market backside or recent accumulation cycle.

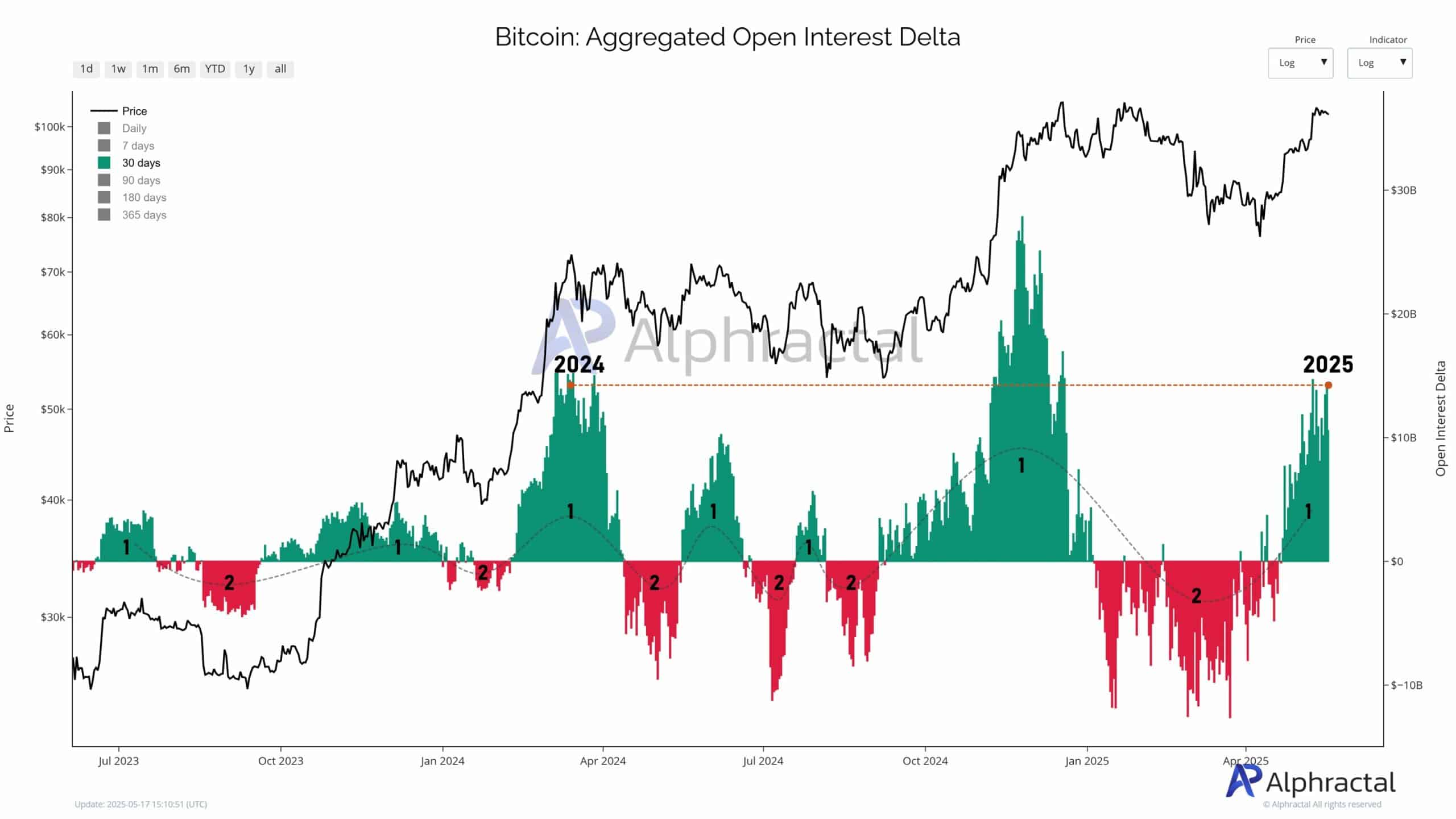

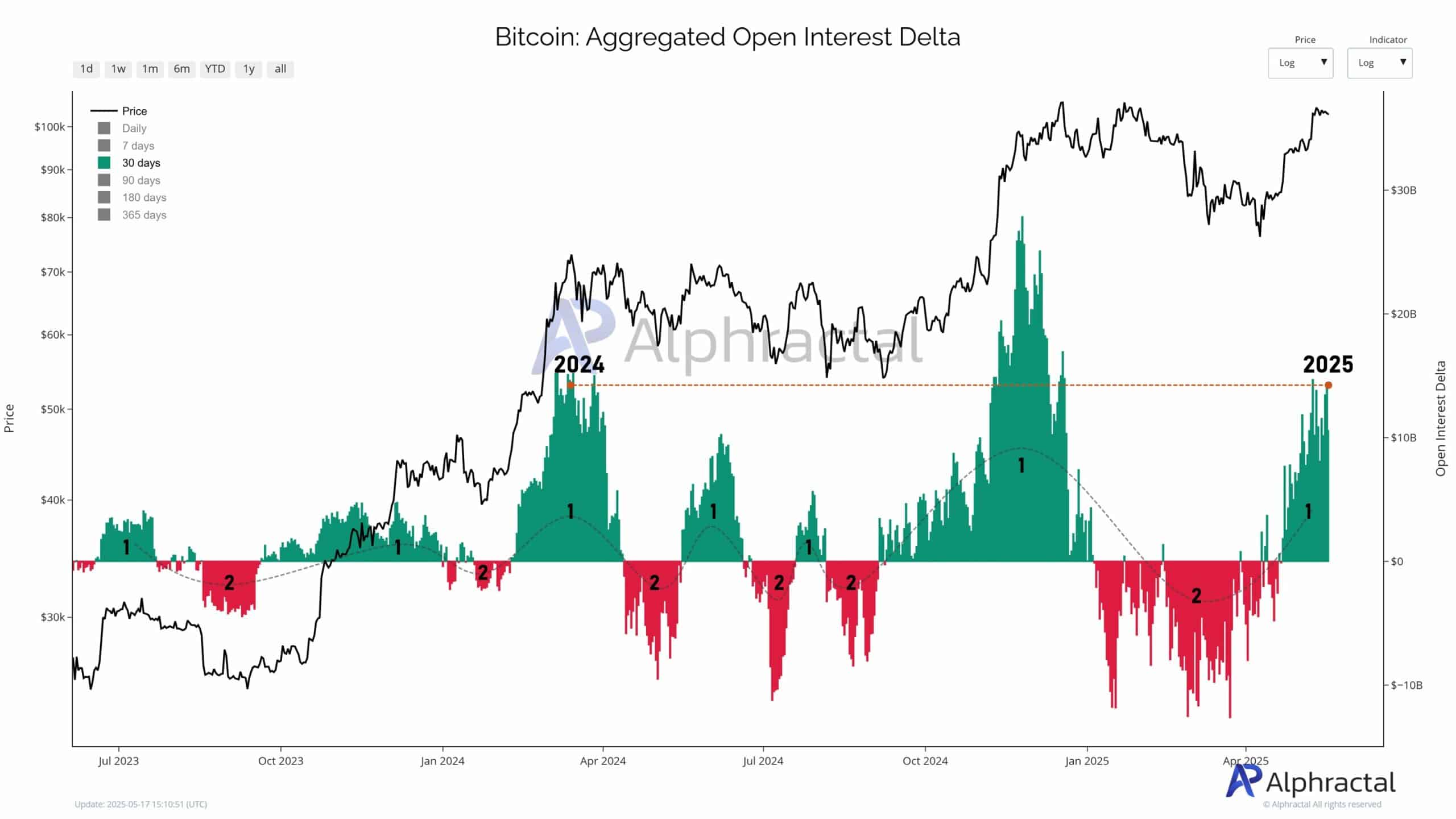

Bitcoin’s [BTC] Open Curiosity Delta exhibited indicators which may really feel acquainted to skilled merchants.

The 30-day consolidated Delta reached ranges not seen since 2024, when Bitcoin jumped above $73K to achieve its all-time excessive.

That second in historical past now appears to be repeating, with the identical sample rising throughout derivatives’ metrics.

Two clear phases are enjoying out

The Open Curiosity (OI) cycle has typically been defined by analysts as having two phases. Section 1 is marked by a fast accumulation of positions—this normally reveals a constructive Delta.

After which Section 2, the place the positions start to unravel, reversing the Delta into being unfavourable. This back-and-forth course of reveals a rhythm of leverage and sentiment.

Supply: Alphractal

On the time of writing, information from Alphractal reveals we could also be getting into one other Section 1. And like in earlier Bitcoin bull runs, the tempo and type of this development are being noticed.

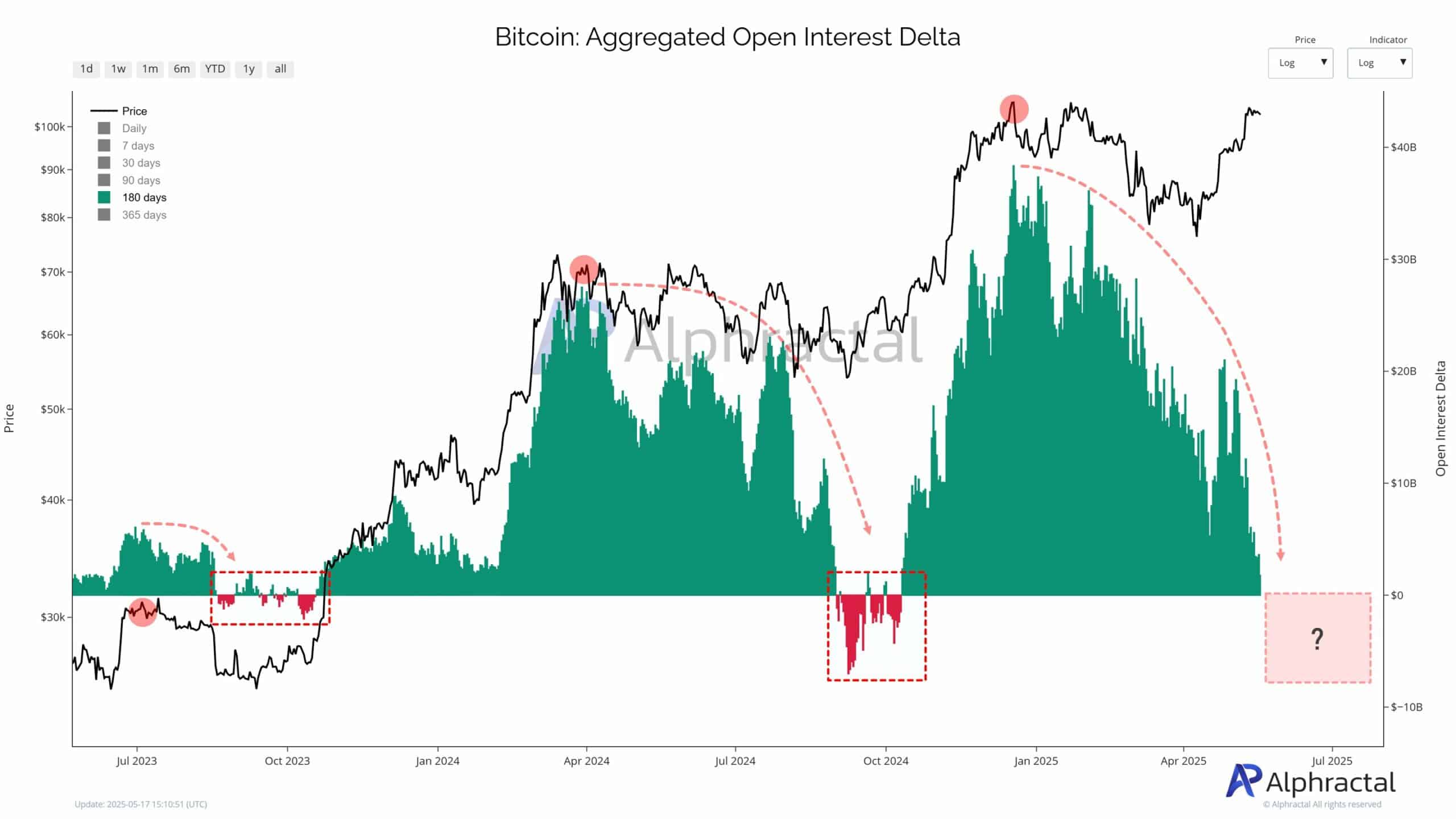

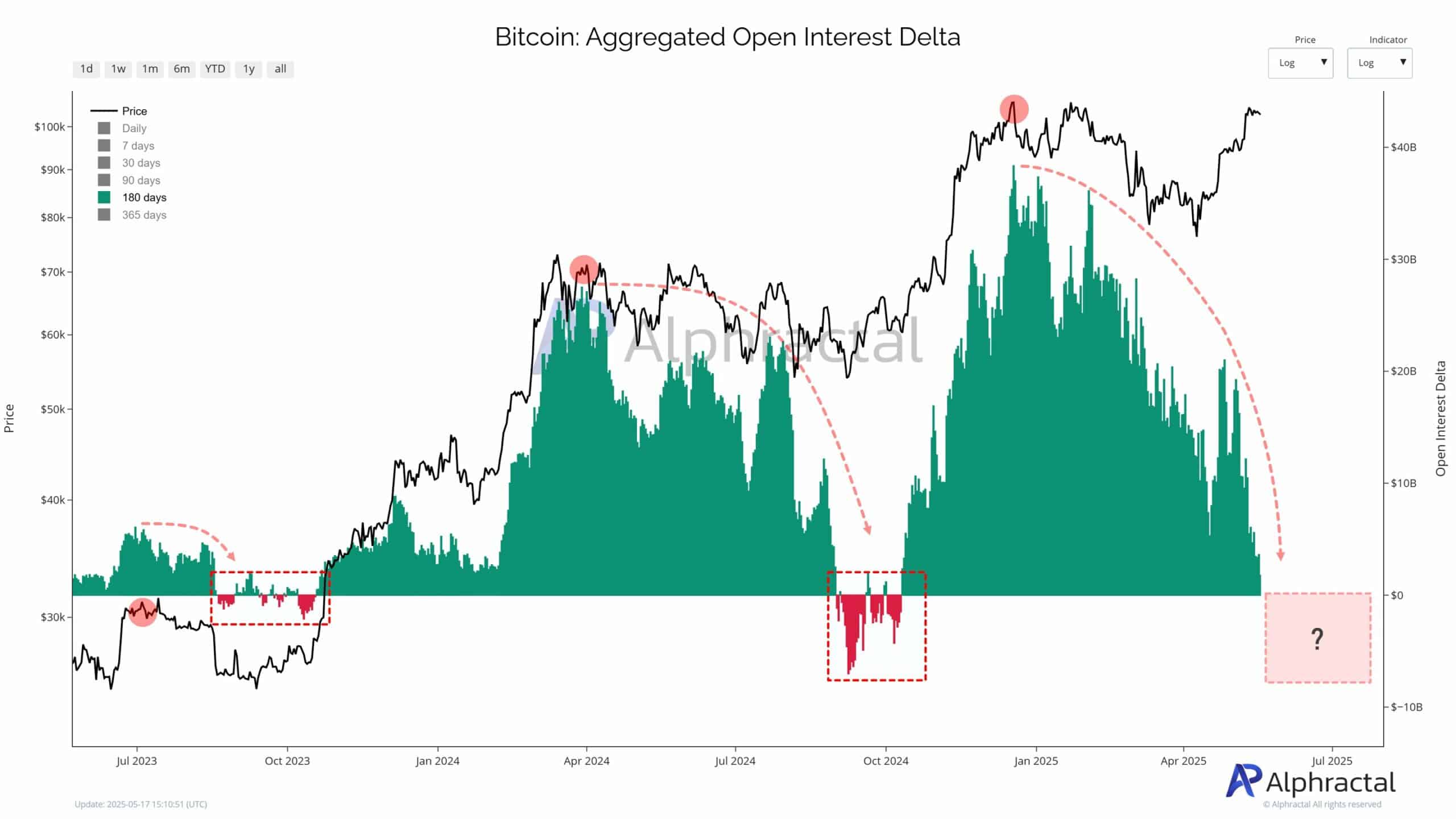

What the 180-day Delta reveals

Trying past the brief time period, the 180-day OI Delta is extra informative.

Previously, sudden drops in Bitcoin Delta foreshadowed huge liquidations. These occasions are inclined to soak by means of over-leveraged lengthy positions. Apparently, they typically coincide with market bottoms.

At press time, the 180-day Delta hovers simply above zero. If it flips purple, it might mark the beginning of one other accumulation section.

This transition is usually the place giant traders start quietly loading up.

Supply: Alphractal

Bitcoin whales are following a well-recognized sample

Over the previous two years, comparable Delta shifts have preceded main Bitcoin rallies, notably in October 2023 and early 2024. Throughout these intervals, aggressive OI spikes signaled robust upward momentum.

Nevertheless, this time, the sample has modified. OI has not surged as sharply, suggesting that enormous gamers are adopting a extra cautious strategy.

This habits aligns with how whales sometimes function—they drive market momentum however withdraw strategically, making their actions vital to look at.