Bitcoin: THIS ratio hints at a possible BTC supply shock – How?

- Binance quantity surged whereas mid-term holders doubled, signaling rising institutional accumulation.

- Crowd curiosity and leverage dropped, highlighting market indecision and weak demand momentum.

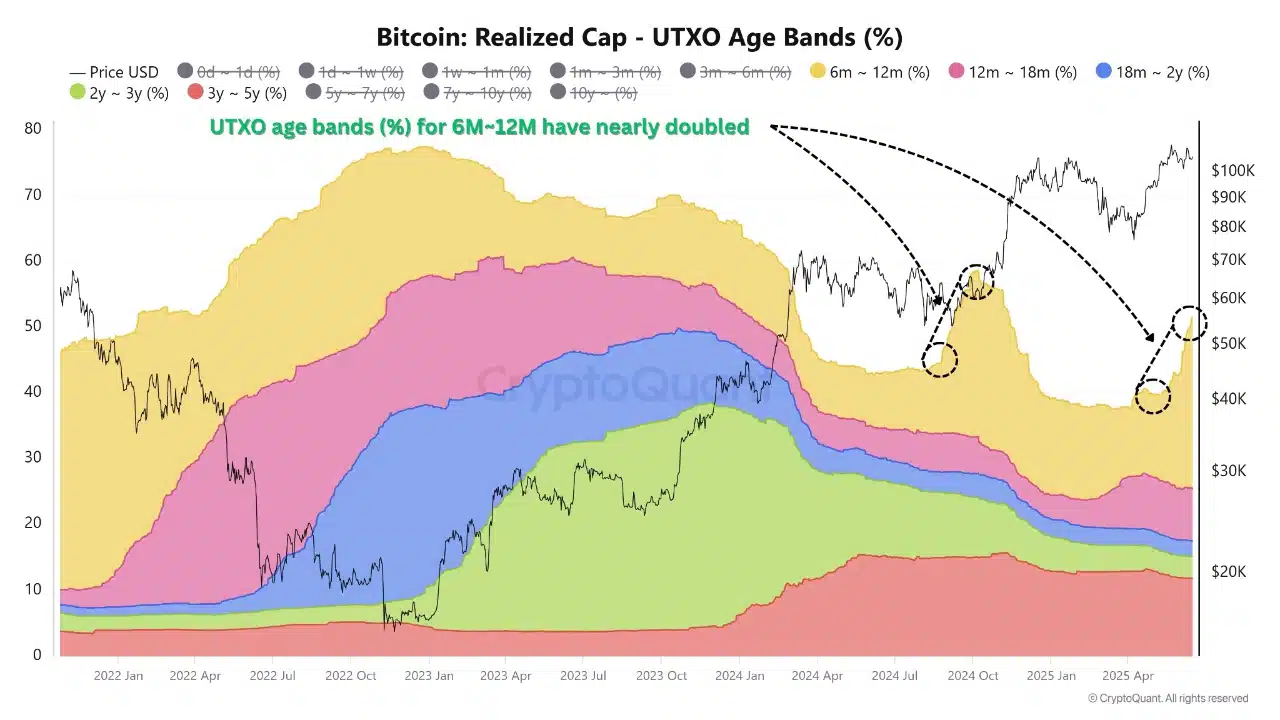

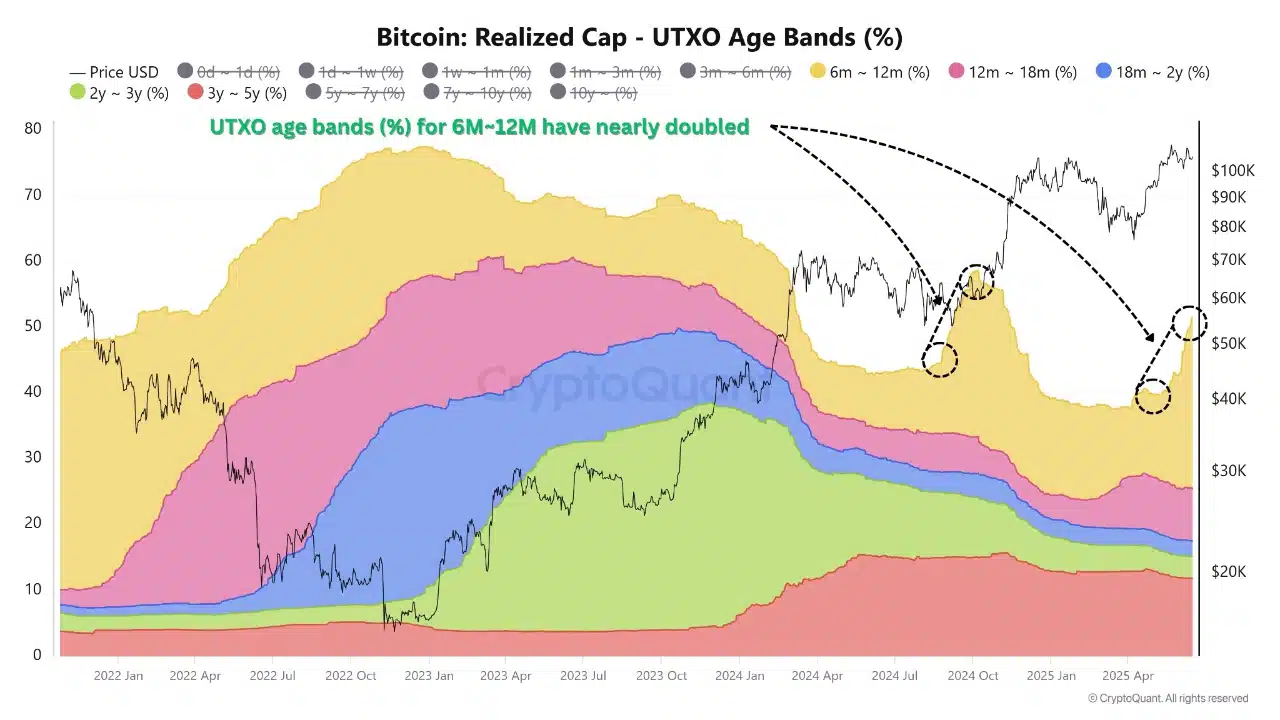

Bitcoin’s [BTC] UTXO band has doubled from 6 million to 12 million in June, indicating rising holder conviction regardless of BTC dropping 1.79% to $104,950, a press time, during the last 24 hours.

This spike exhibits that extra traders are opting to carry by means of volatility quite than take income, lowering accessible provide.

Traditionally, such conduct from mid-term holders—usually thought-about sensible cash—has preceded sturdy rallies. If this development continues, Bitcoin might construct a bullish setup based mostly on accumulation.

Nevertheless, short-term demand stays fragile, and merchants ought to stay cautious till key affirmation indicators return.

Supply: CryptoQuant

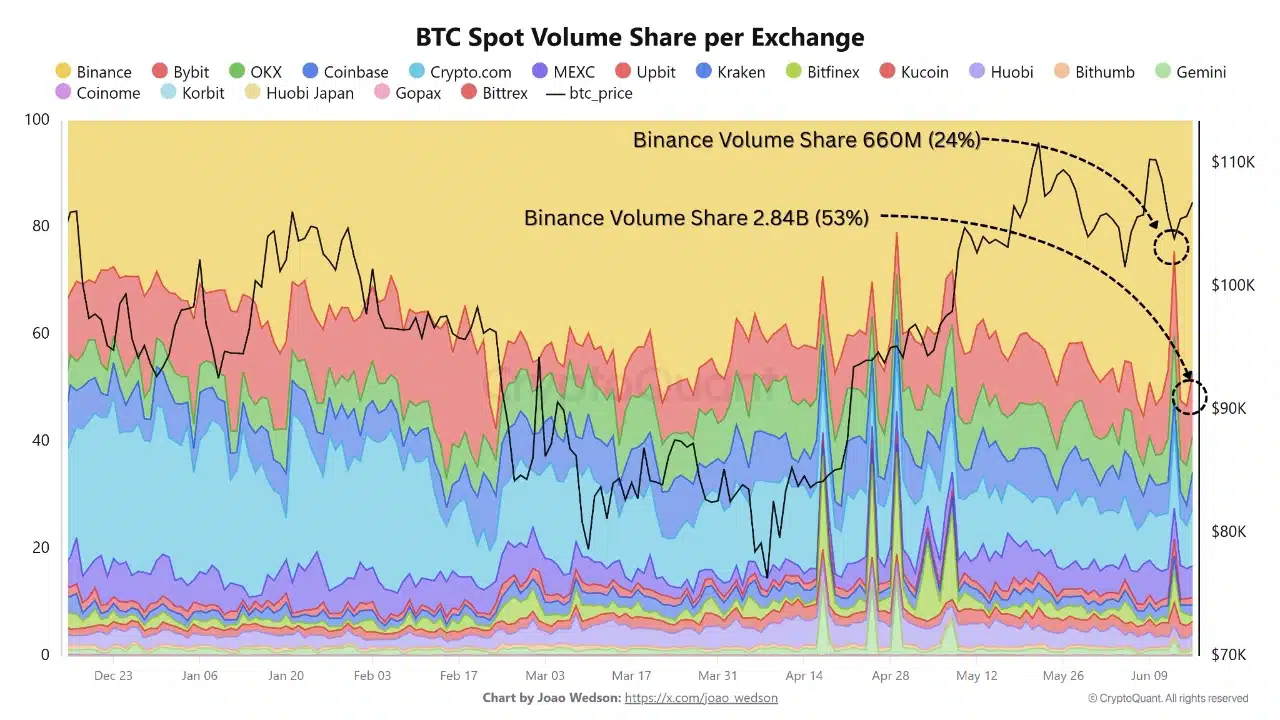

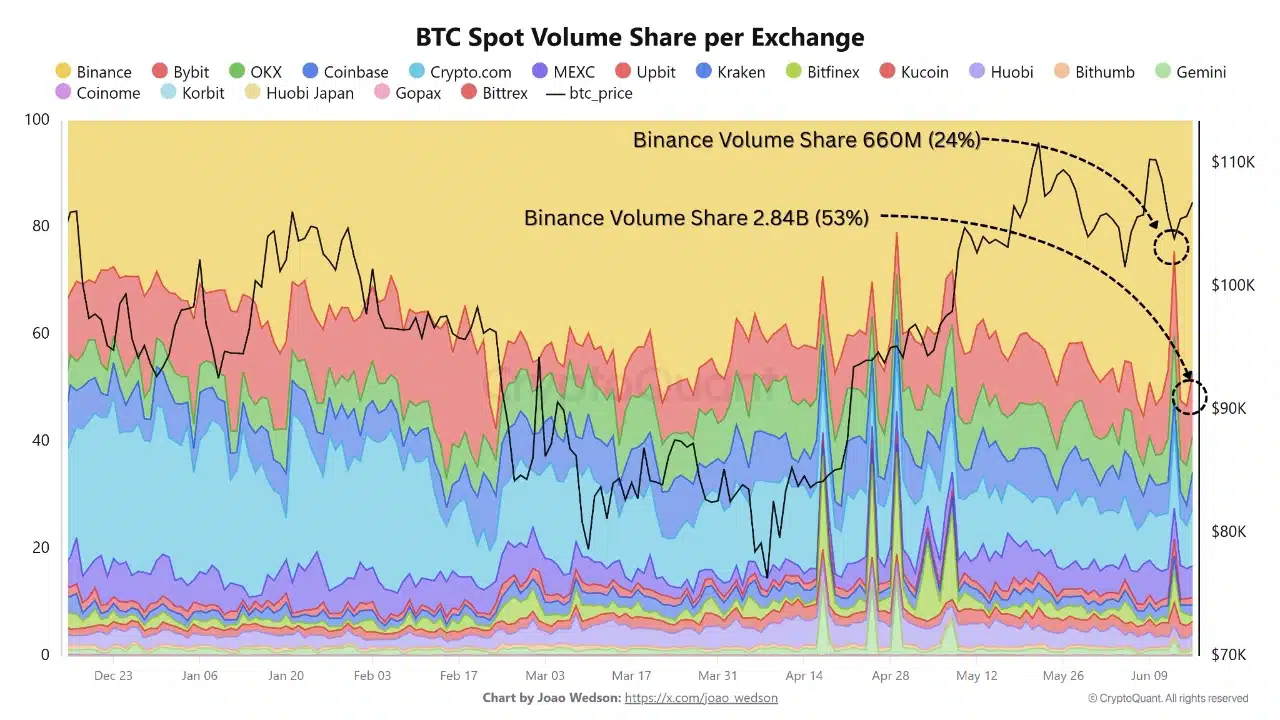

Why is Binance absorbing many of the spot market exercise?

Binance’s share of Bitcoin spot buying and selling quantity has surged from 24% to 53% in simply sooner or later—a dramatic shift, pointing to an enormous inflow of capital.

This spike is probably going pushed by institutional gamers reallocating their exercise, drawn by Binance’s deep liquidity and cost-effective buying and selling construction.

Such a sudden rise in alternate dominance usually indicators an impending high-volatility section, particularly if fueled by coordinated accumulation or strategic positioning forward of main value strikes.

Moreover, this fast consolidation of quantity highlights rising centralization in crypto buying and selling infrastructure.

If sustained, it might have lasting implications for value discovery and market dynamics.

Supply: CryptoQuant

Does a Inventory-to-Move ratio of 580 verify excessive shortage for BTC?

On the time of writing, Bitcoin’s Inventory-to-Move (S/F) ratio surged to 580—a degree effectively above historic averages.

This metric measures the connection between Bitcoin’s circulating provide and its annual issuance, and such a pointy improve usually factors to tightening provide and long-term bullish potential.

Nevertheless, the elevated studying could also be skewed by elements like diminished miner promoting or short-term fluctuations in on-chain exercise.

Whereas a excessive S/F ratio helps the narrative of a looming provide shock, it’s not a standalone sign for value appreciation.

Sustained value progress nonetheless depends upon rising demand and broader market participation.

With out renewed investor curiosity and elevated exercise, elevated S/F ranges alone could fall wanting sparking speedy upside momentum.

Supply: Santiment

BTC social and derivatives metrics present indecision as conviction stalls

BTC’s Social Dominance dropped to 19.88% whereas Binance Funding Fee hovered at a impartial 0.001%, reflecting fading crowd engagement and dealer indecision.

This mixture suggests a low-conviction surroundings, the place neither bulls nor bears are assertively in management.

Traditionally, falling social curiosity paired with flat funding has preceded main volatility as markets await catalysts. The shortage of utmost sentiment or leverage reduces short-term breakout momentum.

Subsequently, and not using a spike in engagement or directional funding, Bitcoin could stay range-bound. If these metrics shift sharply, they might sign the beginning of Bitcoin’s subsequent large transfer.

Supply: Santiment

Detrimental DAA Divergence nonetheless persists regardless of latest value stability

The Worth-DAA Divergence remained detrimental, suggesting that handle exercise has not stored up with latest value actions.

This persistent divergence raises considerations concerning the energy of the present market construction.

Usually, rising handle exercise helps sustainable rallies, whereas divergence usually indicators speculative or hole value motion.

The continued hole implies fewer distinctive customers are transacting on the community, regardless of value hovering above $100K.

Supply: Santiment

Which drive will prevail—conviction or exhaustion?

Bitcoin’s market is at the moment caught between opposing forces: sturdy accumulation by long-term holders and waning curiosity from the broader crowd.

Mid-term UTXO progress and Binance’s rising market share level to growing institutional confidence and long-term conviction.

On the flip facet, detrimental divergence in Every day Lively Addresses (DAA), muted social sentiment, and impartial funding charges expose weak retail engagement.

For BTC to stage a sustainable breakout, alignment between institutional accumulation and retail enthusiasm is important.

Till that stability emerges, Bitcoin stays at a pivotal level—hovering between the potential for a breakout and the danger of market fatigue.